The Year That Was - Fintech Inside - Edition #50 - 26th Dec, 2021

Wrapping up a record year for the Indian fintech sector and what to expect in 2022!

Hi Insiders, Osborne here.

Welcome to the 50th edition of Fintech Inside. Fintech Inside is the front page of Fintech in emerging markets.

2021 was a great year for the Indian fintech sector. So many records were broken - investments, acquisitions, IPO's and more. In this edition I kept it light and gave a quick wrap up of the year that was for Indian fintech and what we can expect in 2022.

Note: This will be the last edition of 2021. I will be back with regular programming by 23rd Jan, 2022. See you folks then!

Enjoy another year in Fintech...

If you’re an early-stage fintech startup founder raising equity, I may be able to help - reach out to connect@osborne.vc

🙏 Gratitude

Thank you so much for your support through this year. Fintech Inside started off in Oct, 2020 as a passion project and this past year has been nothing short of a crazy experience for me. Your constant feedback and suggestions to improve has hopefully converted to a significantly better newsletter that adds value to how you think about fintech.

Today, this newsletter has grown significantly with readers across US, LatAm, Africa, Europe, India and SEA. Readers include founders, senior professionals, investors, fintech "enthusiasts" and professionals from the traditional finance sector! I could not have possibly imagined this readership and I'm eternally grateful.

Happy holidays and happy new year to you and those close to you. See you in 2022!

🤔 One Big Thought

2021 - The year that was

There's no denying that fintech startups in India were on a tear this year. Fintech startups raised $9+bn in funding over 360+ deals. For context that's a third of total funding raised by startups in India compared to a fourth in 2020. Fintech investments in 2021 was 3.2x that of 2020.

This mega funding year also minted several unicorns - 12 fintech unicorns and over 40 total unicorns in just 2021. Compare that to 26 total unicorns minted in the past decade! The 12 fintech unicorns are: CRED (credit cards rewards and marketplace), BharatPe (SMB payments and credit), Digit Insurance (insurance), Slice (consumer credit), Mobikwik (payments), Groww (stock trading and investing), Chargebee (recurring payments SaaS), Zeta (banking infrastructure), OfBusiness (SMB credit), CoinDCX (crypto exchange), CoinSwitch Kuber (crypto exchange), Acko (insurance).

BYJU's was not the only one acquiring startups. 2021 was a record year for fintech acquisitions! Starting with the mega acquisition - PayU India acquired BillDesk for $4.7bn. This acquisition was among India's largest and the largest acquisition in the fintech sector. Then there was CRED that acquired Happay for $180mm. By my count, there would be at least 40-50 acquisitions in India this year. History was made when BharatPe, a three-year old payments startup, was given approval to launch a bank! This is rare for Indian banking and more so for Indian fintech.

Most importantly, we saw the first ever IPO's for fintech startups. Paytm and Policybazaar listed on the Indian stock exchanges and that's huge. Their performance post listing has not been the best, but those companies listing is a leap forward for Indian fintech sector. Before this, IPO's were not even thought of as an exit route for investors. It has always been that clause that "needed to be there" in the investment documents. Now, there's precedent and IPO's can be considered a legit exit route.

In my opinion though, the fintech sector's biggest win this year is the grand migration to fintech startups. This includes people from other industries crossing over to fintech and professionals from traditional financial firms "taking the risk" and joining fintech startups. This exodus gives me so much hope for the fintech sector.

What will 2022 look like? We can plan and start building in a direction but we are an iterative species and our plans will keep iterating and getting better. However, based on trends from the past year, I believe we can expect to see more of the following in 2022:

Super app-ification: Paytm and PhonePe have already begun their transformation to Fintech Super Apps. I believe we will see more of that happening in 2022. Startups that have anywhere over 100K users will start offering related financial products to become the one-stop super market for all their user's financial needs.

Licenses will be more valuable: Fintech startups that raise/raised a lot of capital will reduce their dependence on a third party and build their own financial products by owning the license themselves. This license, IMO, will come through acquisitions - which is why capital will be important. Startups/businesses that already have that license will be prime targets.

Contextual financial product launches: Financial products are going to be increasingly embedded within the user flow of a non-fintech app. Imagine MakeMyTrip offering to help you plan for a trip abroad and set up a savings feature to save INR 10,000 a month for that trip. Or even an amazon motor insurance purchase along with that bike helmet purchase. This trend will be enabled thanks to the folks like M2P, building fintech infrastructure.

Innovation in wealth: Provided the current bull run sustains in 2022, we will continue to see a lot of product innovation in the wealth sector. The sector saw it's first set of innovations in 2021 with the likes of WintWealth and Grip Invest launching fixed income products. There was also educational products like Trinkrr and Marketfeed. We're likely to see more products being launched. Crypto products will fuel a large part of this innovation.

Creators will become central to more business models: The covid-fueled creator economy is here to stay and 2022 might just be that breakout year. A lot of fintech business models are creator driven without us thinking of them as creator economy businesses - e.g. Smallcase and others. Either these businesses will start catering to creators as end users or will create platforms for creators to build on top of.

Can things really get better than this? I definitely think so. This 2nd fintech wave has only just begun and is going to outlast the previous one. The fundamentals are very strong for a sustained growth of the sector with or without investment.

What do you think - what does 2022 have in store for the fintech sector? Are there trends I missed out on? Let's discuss it. I'm on email, Twitter or LinkedIn.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

💼 Work at a Fintech

workatafintech.com: Search from ~180 open positions at 50+ fintech startups in India and South East Asia.

Work at a Fintech is a community effort by EMVC. If you’re a Fintech who’s hiring I’d like to help. Write to me and I’ll put your requirement here. 2.5K+ people view these open positions.

PROMOTIONAL FEATURE

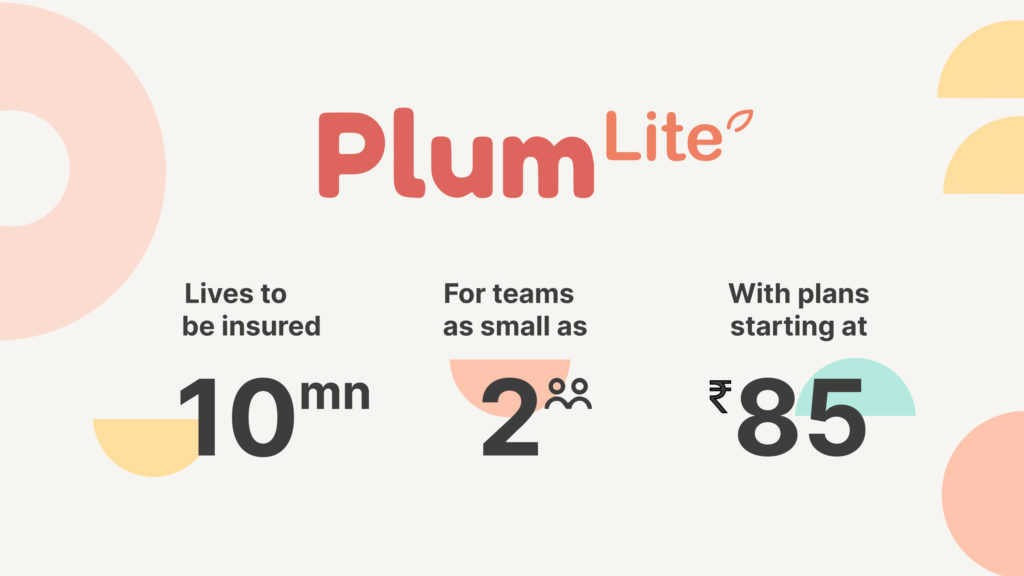

Plum launched Lite, a health benefits membership for early stage startups, SMEs and gig workers

Plum, an employee health insurance platform, announced the launch of Plum-Lite - a comprehensive group health benefits membership exclusively for early stage start-ups, SMEs and gig workers/ freelance consultants. The membership will offer new-age health insurance covers, doctor consultations and Covid19 treatment covers for companies with teams as small as two members and for a premium starting as low as Rs. 85 per month.

The membership covers, health insurance up to INR 5 Lacs, unlimited doctor consultations, weekly wellness sessions, dental and vision checkups, mental wellness consultations and Covid19 treatment claims. It also covers employees, spouse and kids and has a zero human touch point leading to instant activation.

⭐ Top Editions of 2021

Here are the top 5, most read editions that you should not miss out on:

Edition #46 - The Userbase Conundrum: how many users should fintech startups strive for? Read here

Edition #22 - Fintech Business Model Deep Dive - CRED: What makes CRED, CRED? Read here

Edition #29 - Something curious is happening with neo banks: Of neo banks and its challenges. Read here

Edition #42 - Paytm IPO Prospectus Breakdown: deep dive into the Paytm universe. Read here

Edition #47 - What regulations do crypto startups want: what does the sector want from regulators? Read here

Looking for the news digest? Read all the week’s fintech news and updates in India and SEA over at This Week in Fintech - India and SEA Edition. You can also find our US, Global and European coverage.

🏷️ Notable Nuggets

$12.1 bn in cryptocurrencies was stolen between Jan 2011 and Dec 2021 (Report)

House Money: Why our appetite for risk grows with our money.

👋🏾 That's all Folks

If you’ve made it this far - thanks! As always, you can always reach me at connect@osborne.vc. I’d genuinely appreciate any and all feedback. If you liked what you read, please consider sharing or subscribing.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

See you in the next edition.