Paytm IPO Prospectus Breakdown | Edition #42 - 24th Oct, 2021

Covering a deep dive into the Paytm universe ahead of its IPO. Also details on Visa and Mastercard's BNPL plans, regulator cracking the whip and the recurring payments fiasco.

Hi Insiders, Osborne here.

Welcome to the 42nd edition of Fintech Inside. Fintech Inside is the front page of Fintech in emerging markets.

Paytm received approval from the regulators to list on the Indian stock exchanges. This week I breakdown Paytm's Draft Red Herring Prospectus (DRHP) a.k.a. IPO prospectus, and look at the business, product offerings, financial performance and a lot more.

There's also news on VISA and Mastercard's BNPL plans, the regulator banning RIA's from advising on gold and Indian recurring payments fiasco. There's also some bonus coverage.

CRED announced its fund raise at a $4bn valuation. Tons of coverage of SEA fintech startups as well. Let's dive right in.

Note: today’s edition is lengthy. You might want to view it on a browser.

If you’re an early-stage fintech startup founder raising equity or debt, I may be able to help - reach out to connect@osborne.vc

🤔 One Big Thought

IPO Prospectus Breakdown | Paytm - India's Financial Super App

On Friday, 22nd Oct, 2021, SEBI (India's securities regulator) granted Paytm the approval to list its shares on the Indian stock exchanges. The proposed $2.2bn IPO will be India's largest IPO ever. Paytm was reportedly seeking a $25-30bn valuation, even though its pre-IPO placement was unsuccessful because of valuation differences. The company expected to receive approvals in time for a Diwali listing (early-Nov) but will now be looking at a mid-Nov listing timeline. Here's the draft IPO prospectus breakdown of this pioneering, loved and often controversial payments company.

Disclaimer: This post is purely intended for educational purposes. It is not investment advice and should not be construed as such. Please consult your investment advisor for such things. Further, this post is me cherry picking sections of the DRHP. Please read the DRHP for full context. I am not directly or indirectly a shareholder of Paytm.

Standard definitions: $1 = INR 74 (constant prices). FY is the fiscal year ended 31st March of the respective year. YoY is Year on Year.

From value added service provider, to phone recharge app, to prepaid wallet app, to digital payments platform, to commerce platform, to payment bank, to now everything financial services super app, Paytm has come a looong way. Founded in 2000 and launching its payments platform in 2009, Paytm has constantly evolved/pivoted to become the most recognisable mobile payments brand in India. Paytm at its peak, dominated India's consumer payments landscape, thanks in a large way for making QR code payments ubiquitous in India. Pre-UPI, the entire country was plastered with only Paytm's QR code. Then with UPI's launch in 2016, Paytm lost its prepaid wallet dominance to platforms like PhonePe, BharatPe and GooglePay that offered instant transfers from bank accounts.

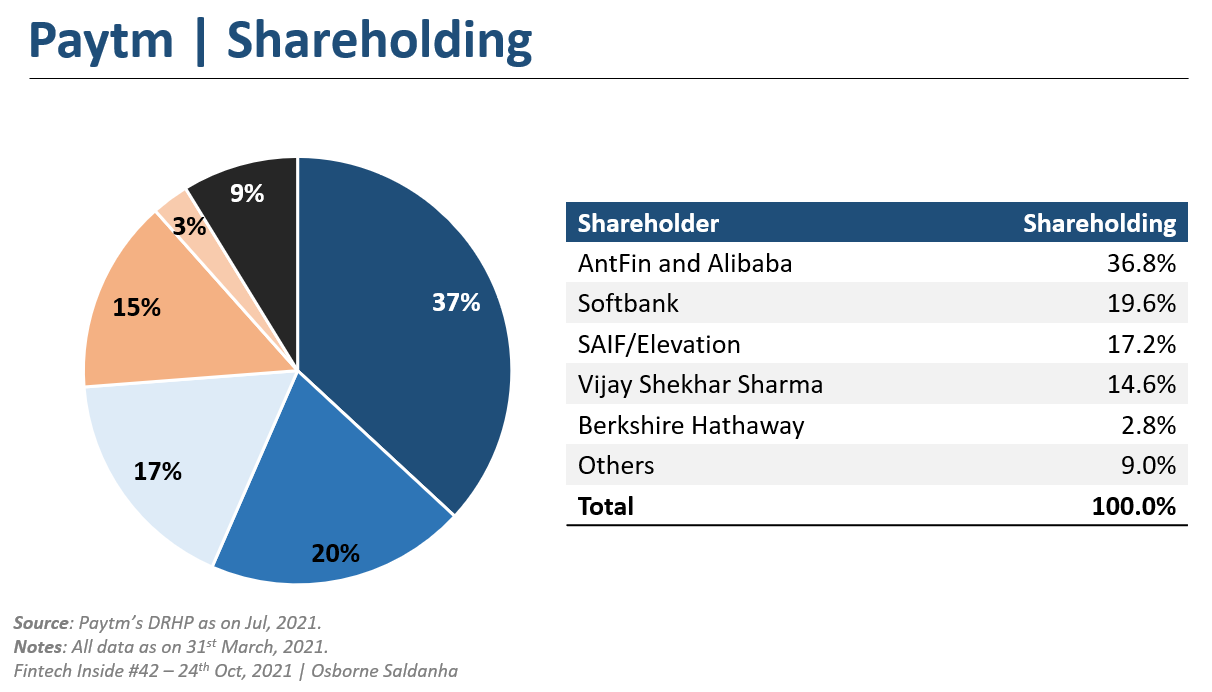

Paytm still claims to be India's largest payments company with a 40% market share of overall payments transaction volume and 65-70% market share of the wallet payments transactions volume. Paytm continues to make its presence felt by getting into related financial services, at one point wanting to acquire an Indian bank but later denying it. The company has so far raised $3.54bn in funding (including $300mm from Berkshire Hathaway, its only investment in India yet) and was last valued at $15.6bn.

What does Paytm do again? Paytm calls itself a Super App with 3 core verticals.

Digital Payment Services: Paytm has a massive suite of digital payments offering for consumers (e.g. wallet, bill payments, recharges, money transfer and more), merchants (e.g. QR payments, soundbox, payment gateway, POS devices and more) and enterprises (e.g. vendor and employee payouts, channel partner incentives, utility bill payments and more. As on FY21, Paytm processed $54.5bn in GMV (excludes P2P transfers).

Commerce and Cloud Services: Paytm's commerce offering includes travel ticketing, event and entertainment ticketing, advertising, gaming, Android "mini-app" store and a full ecommerce platform through Paytm Mall. Under Cloud services, Paytm offers loyalty management, billing and ledger management, online storefront, CRM and others. It also offers "Paytm AI (PAI Cloud)" which is its fraud prevention, customer engagement and analytics suite. Paytm calls it a "Cloud" offering, but its really a SaaS offering. As on FY21, Paytm processed $573mm of Commerce GMV.

Financial Services: This is where Paytm's financial super app comes becomes whole. It offers deposit accounts through its payment bank, loans for consumers and merchants, attachment insurance products and wealth and investment products. Other than loans, Paytm offers financial products through its own group companies. As its a payment bank it can only facilitate loan products in partnership with other platforms. As on FY21, Paytm has 64mm deposit accounts and $702mm in deposits, 11.3mm unique insurance customers and combined AuM of $702mm across mutual funds, gold and stock broking.

Paytm has 333mm customers and 21mm merchants across its ecosystem. It also has "operations in Canada, Singapore, UAE, Malaysia, Tanzania, Uganda and Bangladesh, among others". In 2017 it launched bill payments in Canada and in 2018 it partnered with Softbank to launch PayPay in Japan. As on FY21 it had 8,623 on roll employees (3,989 for sales, 2,550 for tech and product). The most fascinating part (IMO) of the entire IPO prospectus, is that the Paytm brand alone is valued at $6.3bn, making "Paytm" the most valuable payments brand!

What's the market size in which Paytm operates? Paytm operates in two very large markets - commerce and financial services. As pointed out in the MobiKwik IPO prospectus breakdown, the market size is only growing.

Payments Digitisation: India is projected to have 1bn internet users (70% of population) by FY26. Digital payments is going to evolve to serve these 1bn users and new payment methods are changing the way people transact. In FY21, the digital payments market size was $~20tn and is expected to grow at a ~17% CAGR to $~40-50tn by FY26. Mobile payments market size is also expected to grow 5x from $608bn in FY21 to $~3tn in FY26.

Increasing Merchant Digital Payment Adoption: Between FY21 to FY26, India's SMB merchants are expected to grow by 5% from 65mm to 80-85mm. During the same period, digitally enabled merchants are expected to grow 9% from 45mm (69% of total) to 70mm (84% of total) and merchants using QR for payments is expected to grow 12% from 30-35mm (49% of total) to 55-60mm (69% of total).

Commerce: Paytm operates across ticketing, retail, gaming and advertising in Commerce. Retail is the largest market at $41bn in FY21, expected to grow at a 28-31% CAGR to $140-160bn in FY26. Travel ticketing comes in second at $36bn market size, expected to grow at a ~9% CAGR to $60bn by FY26. Online gaming, entertainment ticketing, grocery and others are $3-9bn in market size growing significantly till FY26.

Financial Services: Each vertical within financial services is large driven by under penetration, presenting an opportunity. BNPL market is expected to grow 5x from $15-20bn in FY21 to $90-100bn by FY26. 63mm SMB's employ 110mm people but only 20% of the credit demand is met by formal sector. Insurance penetration stands at 3.8% compared to global average of 7.2%. Non-life insurance market is expected to grow at 15% CAGR to reach $50-60bn by FY26. Investors in stocks and mutual funds are expected to 2x to 80mm by FY26 and total investment in the sector is expected to grow 2.6x to $1.2tn by FY26.

Paytm is hoping for growth coming on the back of digital GDP growth, pace of digitisation, digital payments and under penetration. The same was detailed out in Edition #41 so I'm not repeating it here, for brevity.

How was Paytm's financial performance? Paytm's total annual income stood at $431mm for FY21 representing a 10% YoY degrowth from $478mm in FY20. Revenue from Payments and Financial Services vertical made up 66% of the total income, with YoY growth of 11% and 12% for FY20-21 and FY19-20 respectively. Revenue from Commerce and Cloud verticals have significantly reduced between FY19-21 from $208mm in FY19 to $94mm in FY21.

Total expenses stood at $646mm in FY21, reducing 21-22% yearly between FY19-21. In FY21, payment processing expenses represented 40% of total expenses, employee expenses was 25% of total expenses and marketing expenses was 11% of total expenses. Paytm has significantly reduced its marketing expenses from $461mm in FY19 to $72mm in FY21 contributing massively to its overall loss margin.

Paytm was profitable at a contribution margin level: FY21 contribution margin was 12.9% from -7.2% in FY20 and -61.8% in FY19. At a consolidated level, all in, Paytm was not profitable with -$203mm in total comprehensive loss as on FY21, reducing from -$398mm in FY20 and -$572mm in FY19.

Who is Paytm competing with? Each of Paytm's business verticals faces fierce competition. The Paytm ecosystem is wide ranging and competes with several very large, vertical-focused businesses. Paytm thinks that its Apple-like ecosystem will keep customers loyal with significant value add.

In fact Paytm thinks the biggest risk to its business is if it's not able to continue to acquire new customers and merchants. It is relying heavily on its (complex) customer and merchant growth flywheel.

What does the future look like for Paytm? Of the $2.2bn being raised via IPO, $1.1bn will be via fresh issue and the rest will be existing shareholders selling. Paytm intends to use 52% if the IPO proceeds to grow the existing Paytm ecosystem (marketing spends, merchant acquisition etc.). 24% of the IPO proceeds will be used for new business initiatives on commerce and financial services and the rest of the IPO proceeds for general corporate expenses.

Given that most of Paytm's financial services (insurance, wealth etc.) products were launched only post 2017, growth of this business vertical will be a major growth driver for Paytm in the future. The commerce piece is a little confusing to me because that vertical has played an increasingly smaller role in Paytm's growth. It only feeds consumers with more reasons to come back to the Paytm app.

Back in 2017, I had an opportunity to invest in Paytm at a $~6bn valuation. At that time, I didn't think there was any upside and had never seen a startup grow significantly beyond that valuation and Paytm's losses were unlike any I'd seen back then. Clearly I was foolish, as Paytm will be valued at 3-5x that at IPO with more potential upside at this scale. If you read my CRED deep dive, you'd know I have immense respect for the senior management at Paytm and those that have moved on to start their own businesses. Paytm has played a pivotal role in Indian fintech in many aspects and its amazing to see it will soon list on the Indian stock exchanges.

What was your takeaway from this IPO Prospectus breakdown? Have an interesting story about Paytm? Share it with me on email, Twitter or LinkedIn.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

💼 Work at a Fintech

workatafintech.com: Search from ~180 open positions at 50+ fintech startups in India and South East Asia.

Voodlee, a wealth management startup, is hiring Android Developers. Apply here.

OneStack, a neo banking startup, is hiring technical leads, partnership managers and more. Apply here.

Inai, a no-code/low-code SMB payments startup, is hiring back end and devops engineers and more. Apply here.

Work at a Fintech is a community effort by EMVC. If you’re a Fintech who’s hiring I’d like to help. Write to me and I’ll put your requirement here. 2.5K+ people view these open positions.

3️⃣ Fintech Top Three

1️⃣ VISA and Mastercard plan to bring BNPL-as-a-service to India

VISA and Mastercard are working to launch BNPL rails on their networks by the end of March, 2022. Both card networks already have BNPL/installment programs live in various countries globally.

Takeaways: Do you think VISA and Mastercard (V/MC) will ever get disrupted? I can't seem to think of any circumstance where that's a reality. We thought UPI would do the trick but V/MC only grew stronger. The V/MC network effects are just too strong. Moreover, other payment methods are free, meaning banks don't make any money, which incentivises banks to use platforms that make money for them - enter V/MC. Credit card, as a payment method, is the highest revenue earner for everyone in the payments value chain. Next time you make a payment, pause and look at the order in which you're shown payment options - top most earns the most revenue. BNPL poses an even higher revenue potential.

BNPL is a merchant and bank network game. Anyone with the largest network at both ends wins. V/MC are doubling down on their network effects by pushing another credit product down the pipe. It works beautifully for them. It's also the reason why they wanted to acquire Plaid (data network) and are now building a crypto network (payment networks of the future). The more products they push down the pipe, the more value it adds to everyone in the network and V/MC become even more central to the entire value chain.

However, V/MC are currently live in credit card dense countries - US, UK and Australia. India will be the first (per surface level research that I've done) low credit card penetration country that these networks will launch in. Why this matters? It's not clear how this BNPL/installment-as-a-service platform will work without cards in the picture. VISA lays out how the transaction will work pre-purchase, during purchase and post-purchase - but they all require a card. Lastly, this "credit network" is what India's Open Credit Enablement Network (OCEN) was supposed to do but that's yet to see the light of day.

2️⃣ Registered Investment Advisors banned from advising on unregulated financial products

SEBI (India's securities regulator) put out a notification for Registered Investment Advisors (RIA), barring them from advising or "providing a platform for buying/ selling/ dealing in unregulated products including digital gold".

Takeaways: It's surprising that SEBI has singled out digital gold in its notification. It could either be that digital gold has gained a lot of traction with users and so it's important enough or it could also be that SEBI was given the mandate to regulate the gold spot exchange and so it's doing this. This notification is also surprising as SEBI recently approved the framework to launch a gold spot exchange (as mentioned in Edition #39). With the Gold Spot Exchange, digital gold will become a regulated product. It's possible SEBI wants to curb digital gold's growth until all entities are compliant with the new framework.

There are 1,320 RIA's in India. Entities like Groww, Paytm and others who are RIA's and offer digital gold purchases will be impacted over the next 3-6 months or till the gold spot exchange goes live. Wealth products or investment products are typically monthly, quarterly or one time purchase products. Digital Gold made it a more frequent use case which in turn increased transactions, retention and other metrics for these platforms. This notification is being construed to include cryptocurrencies and will also include the newer fixed income products being offered by WintWealth, GripInvest and others. These platforms are not RIA's themselves but depend on RIA's for distribution. The notification will have adverse impact on these platforms at least for some time.

3️⃣ India's recurring payments fiasco

It's been 23 days (as on the date of writing this) since RBI's recurring payments framework deadline came into effect and recurring payment failures have only been mounting. The RBI first approved automatic, recurring, payment auto debits on card for card-not-present transactions in Aug, 2019 with a whole framework in place. In Dec, 2020, RBI increased the limit of recurring payments without the need for Additional Factor of Authentication (AFA) from INR 2,000 ($27) to INR 5,000 ($67.5). Lastly, in Mar, 2021, RBI extended the deadline to comply with the recurring payment framework from 31st Mar, 2021 to 30th Sept, 2021.

Takeaways: Who's to blame here? RBI, payment platforms, card networks or merchants? Bloomberg columnist Andy Mukherjee thinks it's RBI's fault and RBI should have implemented a penalty or fine approach to ensure compliance. Most people also think RBI's at fault.

Please donate to India's Internet Freedom Foundation if you can

RBI extended the deadline and sort of gave ample time to comply. Moreover, the push for recurring payments on card framework was a push from the industry. Sure you can also blame Covid to have caused delays from the industry but the regulation has been in place for 2 years now. As with most things, we waited until the 11th hour. It seems merchants, non-regulated entities, were the non-compliant ones here, and it was the responsibility of the merchant acquirer (Pine Labs, HDFC Bank etc.) to ensure these merchants are compliant. The real issue comes for international merchants with no local entity but with users in India - how do these merchants comply with India's recurring payments framework? It's clear this is going to be a problem for a couple more weeks. Hang in there, founders!

🎁 Bonus: HSBC has a new business vertical

HSBC in UK launched Banking as a Service business vertical and partnered with Oracle's NetSuite. HSBC's corporate banking solutions will be integrated in NetSuite's Cloud ERP. With this integration, NetSuite will embed automated banking features into its accounting software for businesses.

Takeaways: Impressive move by two incumbents that I did not see coming. NetSuite has 27,000 enterprise customers globally. Apparently, HSBC is the first partner for NetSuite's ambition to offer embedded banking services. It's looking to partner with more such banks to automatically send and receive money, "automate accounts payable, accounts receivable and reconciliation processes, making it fast and simple to pay bills, send invoices, get paid and gain full cash flow visibility, all from within a unified system."

This is the first time a major ERP provider has embedded banking services in its accounting platform. It's impressive that a major bank has decided to take this route too. There are many such partnerships in India between SMB accounting startups and banks but these partnerships are still superficial i.e. high level products are offered. We can only hope that product offerings go deeper to offer innovative capabilities to SMB's.

Looking for the news digest? Read all the week’s fintech news and updates in India and SEA over at This Week in Fintech - India and SEA Edition. You can also find our US, Global and European coverage.

🏷️ Notable Nuggets

Southeast Asia Startup Ecosystem 2.0 by Golden Gate Ventures (Summary)

The Most Popular Digital Bank in Almost Every Country in the World

👋🏾 That's all Folks

If you’ve made it this far - thanks! As always, you can always reach me at connect@osborne.vc. I’d genuinely appreciate any and all feedback. If you liked what you read, please consider sharing or subscribing.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

See you in the next edition.

Nice writeup sir