GDP per capita | Edition #39 - 3rd Oct, 2021

Exploring GDP per capita and its future, Regulatory updates in India and SEA, US Stocks as rewards for credit cards and much more.

Hi Insiders, Osborne here.

Welcome to the 39th edition of Fintech Inside. Fintech Inside is the front page of Fintech in emerging markets.

Ever wondered what GDP really means and how it impacts us? This week I went down a rabbit hole to understand GDP, its components, its downsides and more.

Would you prefer getting rewarded with US stocks for your credit card spends? There's a start up that launched just that. There's also details on the latest regulatory updates from India and SEA.

India: 14 fund raise announcements totaling $441mm (one raised undisclosed amount). Asia (ex. India): 11 fund raise announcements totaling $461mm (two undisclosed).

In other news: Groww released a pretty cool ad. Visa is working on blockchain interoperability hub for crypto payments. GoDaddy launched POS devices. Betterment raised $60mm and claims to have 700K clients.

If you’re an early-stage fintech startup founder raising equity or debt, I may be able to help - reach out to connect@osborne.vc

🤔 One Big Thought

Rabbit Hole: What would India’s GDP per capita be in 2030

Disclaimer: I'm not an economist by any stretch of imagination. It's possible I could be wrong in areas here. Take the piece below with a (massive) pinch of salt. If you already know about GDP, you can give this post a pass.

Recently someone asked me what I thought India's GDP per capita would be in 2030. Wanting to sound smart and with some hesitation, I said USD 5,000! Little did I know, USD 5,000 GDP per Capita effectively meant a total GDP of $6.8tn without accounting for population growth. I was clearly throwing darts in the dark. I've always been intrigued by the GDP metric - what it meant, what constitutes it, what can affects it etc. but I never bothered to truly understand it. This conversation pushed me to go deep. Thankfully, on 15th Sep, 2021, the Reserve Bank of India (RBI) released its Handbook of Statistics on the Indian Economy with tons of data on the Indian economy and its performance. A lot of this post is an attempt to understand GDP using that data. Down the rabbit hole we go!

This is a fintech newsletter, why are we talking about macro economics? As they say, you can optimise what you measure. GDP per capita is that one metric which captures consumption and spending habits in the country. As a reader of this newsletter you are most likely attempting to disrupt finance. It's important to know GDP per capita to understand employment, productivity, spending, wealth growth and more. These factors influence consumer behaviour toward finances, savings, investments, expenditure and more.

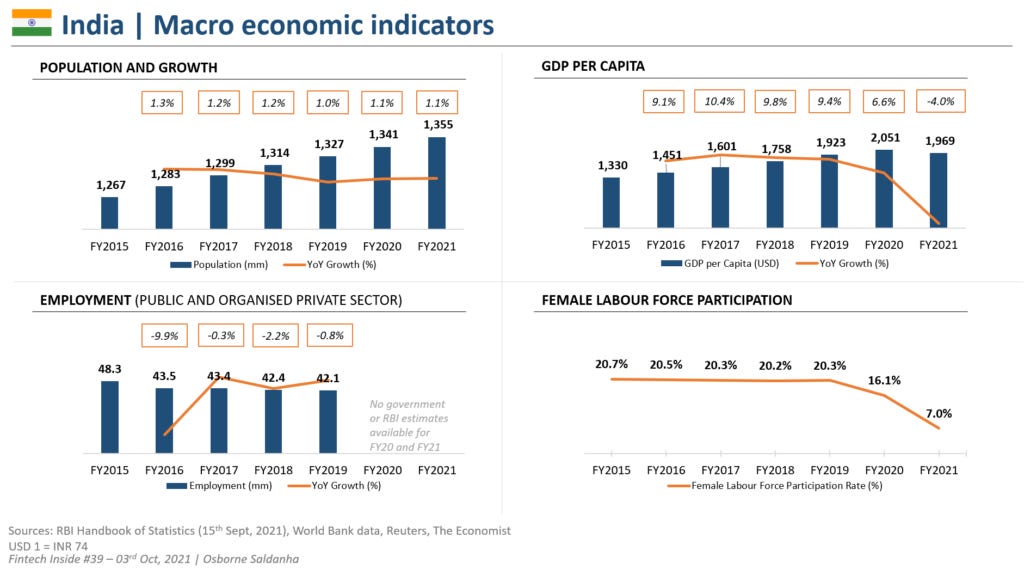

As per these latest numbers by RBI, India is home to 1.34bn people, growing 1.1% YoY. The country's GDP per Capita is $~1,969 in FY21 (Bangladesh - $2,227, Pakistan - $1,221), a number that's been showing slowing growth since FY2017. We could have attributed this degrowth to Covid, but unfortunately, trends show otherwise. Moreover, employment in the country has also been decreasing. Only 42.1 mm Indians are employed in the public and organised private sectors. Yes, 42mm in a country of 1.34bn is a abysmal at best, but that can be attributed to majority individuals being employed in the agriculture sector.

The government discontinued India's employment reports in 2013-2014, but RBI data till that time shows employment in the public sector hasn't been reducing since peak of 19.5mm in FY1997 and current levels are probably similar to those in 1982! What's worse actually is female participation in India's labour force - 7% in 2021. India's female labour force participation rate was 26% in 2005, compared with 30.5% in Bangladesh (2019), 33.7% in Sri Lanka (2019), 20.53% in Pakistan (2020) and 33% in Saudi Arabia!

As mentioned in the Fintech Inside edition in Aug, 21, "out of 250mm households, 48% households have only one income-earning, employed individual. Two thirds of the 250mm households earn less than INR 10,000 ($ 135) per month - at a household level!".

What is GDP and GDP per capita? GDP provides an economic snapshot of the country. GDP is basically the sum of all spends and investments within the border of a country. It accounts for consumer and private sector spending, government spending, investments and FDI in fixed assets in India and net exports. Different countries have different ways of calculating GDP. Methods include expenditures, production or incomes. GDP growth rate captures how fast or slow an economy is growing its spends. The first basic concept of GDP was invented at the end of the 18th century. The modern concept was developed by the American economist Simon Kuznets in 1934 and adopted as the main measure of a country's economy at the Bretton Woods conference in 1944. GDP does not account for sales of used goods, off market transactions, intermediate goods and more.

The GDP value captured the country's economic activity well, but it became difficult to compare countries - countries with higher population would technically have higher GDP. Thus GDP per capita i.e. GDP over population, was coined. It's a finer metric used to compare economic activities of different countries but gives a good indication of the per capita economic activity.

RBI calculates India's GDP in the same way as above (with some finer details) and released the GDP components via the Handbook.

Consumer spending is captured as "Private Final Consumption Expenditure" and accounts for 60% of total GDP. It includes spends on groceries, finished goods, restaurants, haircuts and more.

Government spending i.e. government spending on payroll, infrastructure and more, accounts for 12% of total GDP.

Investment, includes only investments by businesses in fixed asset or capital expenditures. Investment also includes FDI that foreign businesses spend in India. Investment accounts for ~27% of total GDP.

Lastly, net exports i.e. total exports minus total imports. It's another way to capture how much is being produced within India.

Consumer spending (PFCE) is also largely driven by our spends on food, non-food and finished products. ~64% total consumer spending is towards food items i.e. fruits, vegetables, grains, coffee, and finished products i.e. footwear, furniture, electronics and more.

State-wise GDP Per Capita data was even more fascinating. I didn't expect to see states like Goa ($5,891), Sikkim ($5,451), Delhi ($5,084), Chandigarh ($4,460) and Haryana ($3,346) among the top 5 states in India in terms of NNI. A quick look at the map shows you what most of us know - South, West and North India has among the highest Per Capita NNI. The states pulling down India's GDP per Capita are Uttar Pradesh and Bihar - both of which account for 25% of India's population and also the states which have the highest unemployment rates.

Is GDP even the right metric? GDP is not a perfect metric. After all, GDP was formally accepted in a second world war environment. It obviously doesn't fully capture all the innovation of the internet era. For example, earlier the purchase of each music CD would be counted in GDP, now with Spotify and Gaana with just INR 100 ($1.35) a month you can get the entire world's music but dramatically reduces the GDP capture. Yes, we can argue that India's economy is still largely agrarian and not technology driven. However, GDP also only captures consumption, not production or capacity. It also doesn't consider innovation or intellectual property until it is productised and sold. The gains made through technological advances are not adequately captured and only indirectly measured. But, given current economical metrics, GDP is the better one at our disposal which is bound to evolve.

Great, how do we increase GDP per Capita? I've done a few weeks' research online, so I'm obviously qualified to answer this (/s). In my limited view, this may be obvious to most, there are three things we could do immediately.

Increase employment: We need to increase consumer spending. The only long term way to enable people to spend is to employ them. Indians are woefully under-employed. Public sector is clearly not adding any jobs. The burden therefore lies on the private sector. Technology, to some extent, might not allow businesses to create the number of jobs it did in the past. India's entire startup ecosystem might not hire more than a few hundred thousand people. Per India's Economic Survey Report for 2020 reported that 39,000 startups employed 470K people. We'll probably need dramatically more startups in India or bring about serious SMB reforms.

Increase women participation in the workforce: This is potentially the easiest but also the toughest to solve for. 7% female labour force participation rate should be outright unacceptable. I say easy because half the population is women and majority are skilled. I say it's tough because there's the issue of male oriented HR policies and cultural issues. Companies don't hire women for several reasons mentioned in a previous edition. Cultural issues of families not allowing "women of the house" to work or even educated women quitting work to "take care of the family" most times out of force. This is changing but very slowly. Companies like Xiaomi, Ola, Bounce have all-women employees at their factories in India. More of this!

Increase business investment: Private sector spending and bringing in more investment needs to grow in a massive way. Indian startups are raising tons of capital ($3.4bn in Sept, 2021 alone!, $9.3bn in 2020) but very little of that is going towards investment in fixed assets or manufacturing. India lost it's biggest opportunity to grow manufacturing through it's "Make in India" program. How many states do you see compete with incentives to bring investments to their states? Even when Tesla decided to set up a manufacturing unit in India, it seemed like Karnataka didn't have to make any effort. Chinese provinces (states) are known to offer tax breaks, labour incentives and payments and many more - all to attract investments and manufacturing with the result of direct growth in employment. We all long for this mindset from Indian politicians.

Given the above, do I still think India's GDP per Capita will reach $5,000? Obviously not. It's highly speculative to predict any number here - especially with my level of knowledge. Though, I'm hopeful. There's a lot working in India's favour - young population, smartphone penetration, mobile data penetration and more. “Most people overestimate what they can achieve in a year and underestimate what they can achieve in ten years.”

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

💼 Work at a Fintech

workatafintech.com: Search from ~180 open positions at 50+ fintech startups in India and South East Asia.

GoKwik, a one click checkout startup, is hiring for positions across finance, engineering, product management and more. Apply here.

OroPocket, an asset-backed finance startup, is hiring for technology and engineering. Apply here.

Karza, a credit data and KYC API startup, is hiring product managers and business analysts. Apply here.

Work at a Fintech is a community effort by EMVC. If you’re a Fintech who’s hiring I’d like to help. Write to me and I’ll put your requirement here. 2.5K+ people view these open positions.

3️⃣ Fintech Top Three

1️⃣ The regulators are coming

Deputy Governor of RBI, speaking at a fintech event, said fintech startups that offer liquidity services should be regulated like banks. Approved higher net worth cap of INR 1,000Crs (~$130mm) for promoters of publicly listed companies to have differential voting rights. Approved the framework to launch a gold spot exchange and a Social Impact stock exchange.

Takeaways: Addressing an audience at a global fintech event, the deputy governor of RBI said that fintech startups offering deposit or liquidity services should be regulated like banks. This is a first for the RBI referring to regulations for fintech startups and big tech companies. The deputy governor also said that fintech startups should be regulated based on activity rather than entity-based. This is an interesting thought for regulations (not sure if any other country regulates companies this way) and might have been a random statement. While vague, it could signal more regulations for fintech startups, even ones that are not licensed.

SEBI was busy as well this week where it approved a few things at its board meeting. First - Higher net worth cap for promoters of public companies to have differential voting rights. This helps promoters/founders (who typically own <10%) of startups that are listing to have more voting rights. This is a global concept and its great that it's being iterated for India, especially given the spate of startups listing this quarter. Second - the gold spot exchange framework. This is another interesting development. "Gold Spot Exchange" has been offered, unregulated, by literally two companies in India i.e. SafeGold (a startup) and MMTC PAMP (a precious metal refiner). With the new framework, these two companies' offerings will become legit. But what's new is that traditional stock exchanges can also begin offering the same investment product. Another interesting thing is that SEBI has mandated "fungibility", meaning investors can switch their investments to any exchange at any time. Will this be SEBI's way of testing out regulations for a crypto exchange license in the near future?

2️⃣ US Stocks as rewards for credit card spend

INDMoney, an Indian wealth management startup, launched US stocks as rewards for card spends. Users will have to connect their Gmail ID with INDMoney for INDMoney to automatically track card statements. Based on card spends, INDMoney will reward the user with US stocks. It seems the US stock rewarding will also be done for credit score improvement and other "good financial behaviour". Rewards will be typically 1-1.5% of credit card spends.

Takeaways: I like the thought behind the product - lowers the barrier to own US stocks. INDMoney has likely seen a ton of traction for its US stock investing product and seems like it's doubling down on this. First it launched a zero fee, integrated bank account for US stock investing, now it launched a better rewards program (earlier INDCoins program is scrapped it seems). INDMoney is clearly playing the "own stocks of products you use" card here.

A lot of the details here are unclear - will you be allocated stock of any US company or only those of which spends are detected? will rewards be given only when card statements are generated? how will rewards be given when there's no real transfer of money happening? what happens to ownership of the rewarded stocks if the user doesn't want delivery/forgets about it? It's early days for US stock investing for Indians and Indian startups and all these details will be ironed out over time.

3️⃣ SEA Round up

Vietnam's government approved a resolution to create a financial regulatory sandbox. Singapore announced plans to integrate its instant bank transfer platform PayNow with Malaysia's DuitNow. BSP, Philippine central bank, urged policy makers to immediately pass an anti-cybercrime law to protect financial consumers. Central Bank of Malaysia said it will issue digital banking licenses to five entities (out of 29 applicants) in early 2022. Aspire, a South East Asian SMB finance platform, raised $158mm. Ascend, a Thai payments firm, raised $150mm at a $1bn valuation (Thailand's first fintech unicorn).

Takeaways: Fintech investment in SEA is on fire: Aspire raising $158mm and Ascend raising $150mm are huge! Aspire has been crushing it at SMB banking in SEA. Ascend became Thailand's first fintech unicorn. Such large fund raises are not very common yet (especially outside Indonesia) and this could signal an inflection point in SEA.

After announcing an integration with India's UPI, MAS in Singapore is integrating with Malaysia's DuitNow - an instant bank transfer system. Singapore is quickly creating a regional, cross border payments infrastructure for itself and the region. Philippines seems to be following Singapore's lead in combating cyber crime. Last week Singapore said it would launch licenses for cyber security firms, this week Philippine central bank urged law makers to pass an anti-cyber crime law. It's going to be interesting to watch these regulatory moves and how they impact growth of fintech.

Looking for the news digest? Read all the week’s fintech news and updates in India and SEA over at This Week in Fintech - India and SEA Edition. You can also find our US, Global and European coverage.

🏷️ Notable Nuggets

Emerging markets leap forward in digital banking innovation and adoption

The Trillion Dollar Cross-Border Payments Market is Getting a Makeover

Banking-as-a-Service: The $1T Market to Build the Twilio of Embedded Finance

👋🏾 That's all Folks

If you’ve made it this far - thanks! As always, you can always reach me at connect@osborne.vc. I’d genuinely appreciate any and all feedback. If you liked what you read, please consider sharing or subscribing.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

Found a broken link or incorrect information? Report it.

See you in the next edition.