Crypto Regulations | Edition #47 - 5th Dec, 2021

Of crypto regulations, fintech startup acquisitions and all the news round up!

Hi Insiders, Osborne here.

Welcome to the 47th edition of Fintech Inside. Fintech Inside is the front page of Fintech in emerging markets.

We made it to December - the month where everything is now a problem for January!

The Indian Government is expected to introduce, debate and pass a cryptocurrency bill. No one knows the contents of the bill and that's leaving the Indian crypto industry biting their nails. But what does the crypto industry want from the Indian government? To regulate or not? and if regulate then how should crypto be regulated? Today's edition covers what regulations the crypto industry wants.

There's also a round up of the fintech news in India and coverage on fintech startups acquiring fintech startups.

Enjoy another week in Fintech...

If you’re an early-stage fintech startup founder raising equity, I may be able to help - reach out to connect@osborne.vc

🤔 One Big Thought

What do Indian crypto startups want from the Indian government?

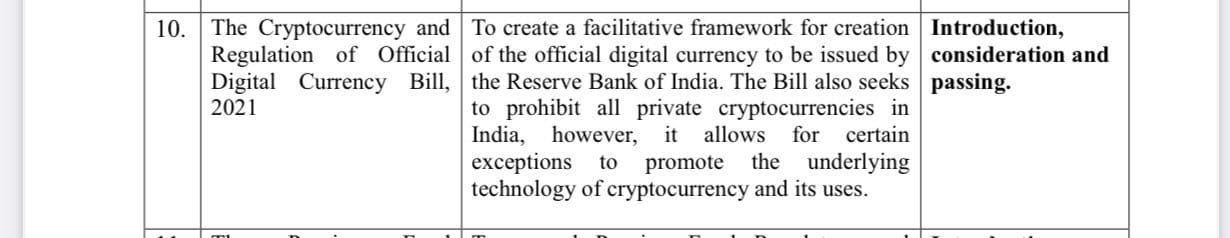

The Indian government announced that the Parliament's Winter Session will be held from 29th Nov, 2021 to 23rd Dec, 2021. As part of the schedule and agenda, under "Bills listed for introduction, consideration and passing" it included "The Cryptocurrency and Regulation of Official Digital Currency Bill, 2021". Unfortunately, it mentioned that the key objective of the "to-be-introduced" bill will be to "prohibit all private cryptocurrencies in India while allowing for certain exceptions that promote the technology of cryptocurrency. Also, creates a framework for digital currency that will be issued by the Reserve Bank of India".

This was a regurgitated "key objective" that unfortunately sent twitter, the global crypto industry (Bitcoin down 17%, Dogecoin down 20% that day) and news channels in a tizzy. There was tons of speculation around what the Indian government was thinking and like every situation, twitter users became experts on crypto and law overnight, including me.

So what do crypto founders want from the Indian government? In one word - regulations. You might be wondering, "Osborne, everyone knows that, but what regulation do they want?". That was my question as well and there's no straight answer to that, unfortunately. None of our Indian crypto startups have anything public (that I could find) on what sort of regulations they want. There's no public information on what have been their submissions or recommendations to the government. As per a MoneyControl interview of Mr. Jayant Sinha, Chairman of the Parliamentary Committee on Finance, it seems even the government is waiting to hear back from crypto founders as to what are their recommendations.

This is not to say that founders in crypto are not doing anything to engage with the government on this front. In fact, crypto companies have formed an industry body - Blockchain and Crypto Assets Council (BACC) as a part of IAMAI, to liaise with the government. There reportedly was a government consultation with founders and stakeholders of various exchanges in mid-Nov, 2021. Here's an interesting coverage of the presentation made by BACC covering the "Challenges and Opportunities". I'm assuming/hoping the Crypto Bill we're expecting, will include recommendations from those consultations.

Unlike crypto bros who say "everything is transparently available on the blockchain, best technology ever!", crypto founders seem to be covert about what they want as regulations. Maybe there's a strategy that I don't see here - please write to me as I really want to understand. In March, 2021, I wrote about the crypto industry's problem with making crypto accessible and the problem seems to be playing out in spades right now.

The closest we come to understanding what the crypto industry wants from regulators is in a document made public in March, 2021 by BACC titled The Case for Regulating the Use of Cryptocurrency in India. The document makes a compelling case for regulations but stops short of talking about what regulations it proposes. Same with this document by Nishith Desai and Associates, an Indian law firm, that goes deep into the legal aspects of the need to regulate crypto-assets.

The one document I could find, that studied the global regulatory landscape, contextualised it for India and made recommendations on what regulations should be made for India, is Regulating Crypto Assets in India by Observer Research Foundation (ORF). In its proposal, ORF says "Like all financial assets, crypto assets pose certain policy risks that must be addressed through a coherent framework that balances the public interest with the need to encourage innovation."

ORF's report proposes the following regulations (abridged version below):

Defining a crypto-asset as "... asset that is created and conveyed using any distributed ledger technology and is not legal tender..."

Adopting a co-regulatory approach where SEBI, RBI, Ministry of Finance and crypto founders, collaborate to regulate the sector.

Making crypto asset custody services and exchange interoperable.

Introducing investor protection norms that are similar to SEBI’s disclosure-based frameworks.

Notifing crypto asset service providers as “Reporting Entities” under the Prevention of Money Laundering Act, 2002.

Introducing a safe harbour such as the one provided under Section 79 of the Information Technology Act, 2000 for all crypto asset service providers

Taxing income from crypto assets as capital gains.

Regulating crypto asset ads through a framework similar to money market mutual funds

Having exchanges and other crypto asset service providers comply with reporting requirement under foreign exchange regulations

Establish minimum security standards

Introducing tax incentives for entities that give relevant and verified information on any other crypto asset service provider acting in contravention of the law.

Prohibiting the listing of crypto assets that have no public address

Now, I don't agree with all the recommendations made here, but it gives a starting point. At least someone did their homework. I urge you to read the full report as it provides a detailed study on the technology, need to regulate and compares global regulations in depth. If you want another perspective on recommendations to regulate crypto in India, here's IndiaTech.org's report. It's not as detailed makes some good proposals.

Mr. Jayant Sinha in the interview mentioned above, aside from showing some serious knowledge about the crypto landscape, claims that there are 15mm crypto accounts holding $6bn in crypto. So there's a lot riding on this bill that's expected to be passed. Mr. Mukesh Ambani also issued an all encompassing statement in support of blockchain tech.

One faction of this industry is against regulation saying it will hinder innovation, especially on the broader web3 front. While another faction wants regulation saying it will build consumer trust. NDTV, a news media company, claimed to have details of the draft bill where it says that the government will not ban but regulate crypto as assets and will appoint SEBI (securities regulator) to regulate the industry. It's still left to be seen what the actual bill will look like.

While we think about regulating crypto over the next couple of weeks, it might be worth remembering that the internet is 30-40 years old and governments are still struggling to regulate it. India is still to pass its data privacy bill! The coming couple of weeks will really set the tone for the future of crypto in India - wagmi.

What did you think of today's post? Have thoughts on crypto regulations? Please write to me at email, Twitter or LinkedIn.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

💼 Work at a Fintech

workatafintech.com: Search from ~180 open positions at 50+ fintech startups in India and South East Asia.

Decentro, a fintech API startup, is hiring for Strategic Partnerships. Apply here.

Inai, a no-code payments startup is hiring a Market Associate and Engineers. Apply here.

Finarkein Analytics, a fintech analytics startup, is hiring a front-end engineer. Apply here.

Work at a Fintech is a community effort by EMVC. If you’re a Fintech who’s hiring I’d like to help. Write to me and I’ll put your requirement here. 2.5K+ people view these open positions.

3️⃣ Fintech Top Three

There were no major events in fintech this week so there are only two top news of the week.

1️⃣ This week that was (round up)

VISA has filed a complaint with the US authorities that the Indian governments promotion of homegrown network RuPay is hurting VISA's business in a key market.

Star Health Insurance's IPO was only 79% subscribed on final day of issue.

CoinDCX, an Indian cryptocurrency exchange, said it plans to launch its IPO soon if regulation permits.

Slice*, an Indian credit card startup, raised $220mm at valuation more than $1bn.

WhatsApp received approval to double its UPI payments offering to 40mm use

Takeaways: There was no specific major event in fintech this week, hence this round up.

VISA seems to be feeling the heat in multiple geographies - first in UK with Amazon announcing it will discontinue accepting VISA credit cards because of high costs and now in India with government backing of homegrown card network RuPay. RuPay accounts for 63% of all debit cards issued in India. VISA's dominance in the global card network sector has been threatened for years now as more countries launch their own networks - China has UnionPay, Russia has Mir, Europe is building European Payments Initiative. Here's a good podcast by Finshots if you want deeper information.

The Star Health Insurance IPO flop was surprising to me. The business is one of the better standalone health insurers in India. Analysts claim it's valuation was too high and that almost 60% of the IPO proceeds were an offer for sale which made investors wary. CoinDCX said it will launch an IPO if regulations permits as a way to gain investor trust in crypto as an asset class. That's a bold move and will be interesting to see how it plays out.

Slice, a Gen Z credit card startup, turned unicorn this week. The startup has been growing significantly and is now the third largest credit card issuer in the country. WhatsApp's payment offering on UPI has been growing slowly (~20+mm users) because of restrictions from the payments body NPCI. It's slowly launching its SMB offering as well and earlier this week launched cab hailing services within the app. WhatsApp's WeChat transformation is slow but deliberate.

2️⃣ Fintech startups acquiring other fintech startups

CRED acquired Happay, an expense management startup, for $180mm in cash and stock. Indiamart acquired a 7.7% stake in M1Exchange, a trade receivables financing startup. Cashfree acquired a majority stake in Telr, a UAE based payments firm.

Takeaways: Amazing to see so many exits for the startup ecosystem in the same year - first with IPO's and now thorugh acquisitions. Even 5 years back exits were just something you'd see as Exit clauses in shareholding agreements. More of this.

CRED's acquisition of Happay is counter-intuitive but makes so much sense though. Happay has access to a ~1mm employees with annual spends of $1bn. But more importantly, Happay's entire payments stack built to manage corporate payments is potentially valuable to CRED. Cashfree's acquisition of Telr seems to be an acquisition of market access. M2P Fintech is growing fast the Middle East and now Cashfree will enter the market with some existing presence.

Looking for the news digest? Read all the week’s fintech news and updates in India and SEA over at This Week in Fintech - India and SEA Edition. You can also find our US, Global and European coverage.

🏷️ Notable Nuggets

Our retrospect on Grab, Southeast Asia’s SuperApp - by Vertex Ventures

Whales Dominate DEXs as High Ethereum Fees Keep Retail Investors at Bay

👋🏾 That's all Folks

If you’ve made it this far - thanks! As always, you can always reach me at connect@osborne.vc. I’d genuinely appreciate any and all feedback. If you liked what you read, please consider sharing or subscribing.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

See you in the next edition.