Bangalore Fintech Happy Hour - Fintech Inside Edition #73 | 15th April, 2023

Register now to attend the Bangalore Fintech Happy Hour presented by Falcon. This edition also has updates on credit on UPI, funding winter and the insurance regulator.

Hi Insiders, I'm Osborne, Principal at Emphasis Ventures (EMVC).

Welcome to the 73rd edition of Fintech Inside. Fintech Inside is the front page of Fintech in emerging markets.

Happy to invite you to our first Fintech Happy Hour of the year - Thur, 27th April, 2023 in Bangalore! So excited to meet all the builders defining finance in India! More details in the edition.

The newsletter also covers more detail on credit line on UPI, the current state of fund raising for fintech founders and all the regulatory updates and innovation by India's insurance regulator.

Raising funding for your early stage fintech startup? reach out to me at os@em.vc

Enjoy another great week in fintech!

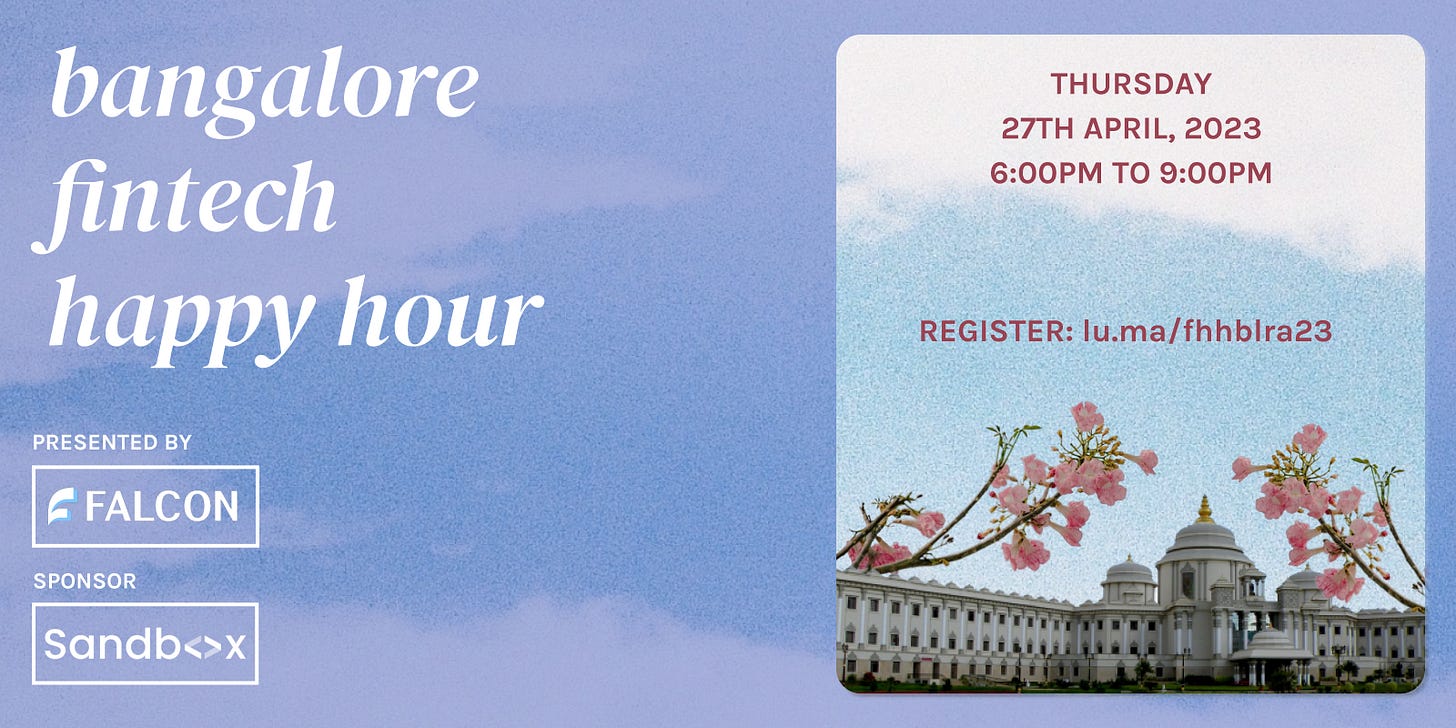

✨ Bangalore Fintech Happy Hour presented by Falcon

Excited to bring back the Fintech Happy Hour! Cannot wait to meet founders, product builders, investors and the broader fintech industry under one roof! Last year we had 180+ people attending the Happy Hour in Bangalore and I hope to see you all again. Please share this with your friends and colleagues in fintech.

When: Thursday, 27th April, 2023, 6PM onward.

Where: Koramangala, Bangalore.

Who: founders, product managers, venture investors, senior executives and others in fintech.

Thanks to our sponsors Falcon and Sandbox by Quicko! More updates coming soon.

3️⃣ Fintech Top Three

1️⃣ Everything is UPI, UPI is everything!

RBI proposed linking bank-issued credit lines to UPI. ICICI Bank launched a credit line on UPI product.

Takeaways:

UPI for everything: Users can now make payments via UPI with a savings/deposit account, prepaid account, overdraft account, RuPay credit cards and now bank-issued credit lines. All roads do lead to UPI.

What's the economics? UPI (debit and credit, but not prepaid) continues to be free to use for users and merchants. When RuPay Credit Cards on UPI was launched, the industry wanted to understand what the economics will look like. 6 months after launch, we're still not sure what the economics of CC on UPI are. This is probably why we have not seen adoption of CC on UPI yet. NPCI introduced a MDR of 1.1% on prepaid on UPI. I wrote on why I believe NPCI should introduce a charge to use UPI back in Edition #66.

Banks continue to win: Visa and Mastercard are still not approved to be integrated with UPI. NBFC issued credit lines are not permitted to be linked with UPI. Banks and RuPay meanwhile enjoy their monopoly. ICICI Bank was too quick to launch its Credit-line on UPI product - 5 days from announcement by RBI to launch. Is this the quickest a bank shipped something?

Credit on UPI could have a delinquency problem: Have said this before in Edition #63, UPI introduced easy and convenience like no other payment method. Though on the flip side, we've seen several UPI frauds take place - Jamtara being a prime example. Bringing credit on UPI will need user awareness built in, to avoid frauds resulting in delinquencies and defaults in credit. Moreover, credit lines don't have the same dispute resolutions and chargebacks that credit lines do.

2️⃣ Best time to build?

Indian startups raised $2.8bn in Q1 2023, a 75% YoY drop from the $11.9bn in Q1 2022. Fintech startups raised $1.2bn during the same period, a 55% YoY drop from $2.6bn in Q1 2022.

Takeaways:

Tough quarter for fund raising: It's not been an easy quarter for founders, especially those in fintech and fund raising. Timelines for fund raises have gone from 2 weeks in 2021 to close to 6-9 months now. It's antithetical because VC's have record dry powder to invest, but we're seeing a 55% YoY drop in fintech startups raising capital.

Observations from my vantage point:

This is objectively a great time to build: The thing the current macro situation is that most large businesses have gone back in their shell because they have a lot to lose and will only focus on what they're good at. Think Facebook and its "Year of Efficiency". Similar trend is happening in India. All large companies will only do what's worked for them and shut all experiments. They're all risk-off now. This opens a big opportunity for risk-on companies (a.k.a. startups) to innovate, experiment and introduce better experiences for users. This is a great time for startups to spend tons of time with users and keep iterating because everyone's fed up of the experience by large incumbents. This is the first time for us in India that large tech companies in sectors can be called "incumbents".

Many product managers and builders are starting up: Some truly great fintech products were launched over the past few years that all of us have come to love. These products were designed, built and launched by stellar folks across our ecosystem to the extent that those products became their identity. These folks seem to now be exhausted of the doing the same thing day in and day out for 3-5 years now. There are so many such people that are quitting those roles and thinking about starting up. This is such a great trend.

Few know what they're truly building: I might get cancelled for this, but I'm going to say it either way - not to berate them, but in the hope that they think, learn and improve - I have vested interests that founders in this sector do well. I see fewer founders know exactly what they're building, why they're building and more importantly for whom they're building. There's a lack of depth in their understanding of user behaviour, market understanding, unique insights and more. It's almost as if the fund raise plan is the credential of the products they launched and business plan will be figured out later. It's almost as if we've forgetting what it's like building in a less-capital environment. Founders, please spend the time with your user and take your time launching - the market is going nowhere, your user is going nowhere.

Fewer VC's know what to invest in in fintech: Starting with myself, us VC's are still debating the white spaces in fintech that make sense to deploy large pools of capital. I tweeted sometime back that "momentum, FOMO, next-big-thing investors have all moved on to other sectors. This is the best time to invest & I'm here for it". Most such VC's have set up monthly "catch ups" with me to understand what's happening in the market and what opportunities are out there. It's not like VC's aren't investing, they just seem to be taking their time.

3️⃣ Lot's brewing at IRDAI (insurance regulator) and the insurance sector

IRDAI, the insurance regulator, claimed that it is in process of reviewing 20 applications for various manufacturing licenses. It approved the life insurance license application of Credit Access Grameen. It plans to launch Bima Sugam, the UPI for insurance platform. Non-life insurance companies are planning to launch a platform to onboard hospitals and manage cashless claims settlement while keeping fraud in check.

Takeaways:

The need for more insurers: India is a country of 1.4bn people but only 57 insurance companies (24 life insurance companies and 28 non-life insurance companies and 5 health insurance companies). The US has a population of 336mm and 276 insurance companies (165 property and casualty insurers, 50 life insurers and 61 health insurers)! Pareto principle probably reigns supreme in US but India desperately needs more insurance companies. Our life insurance penetration (premiums as % of GDP) is 4.2% and non-life insurance penetration is a meager 0.56% as of 2022. The last life insurer was approved in 2011 and now in 2023 - Acko and Credit Access. The last non-life insurer was approved in 2017 and now in 2023 - Kshema general insurance.

We have a long way to go when it comes to insurance penetration and that starts with more insurers and even more intermediaries. The move to approve more insurers (20 in pipeline) is great to hear!

More innovation: Since the new Chairman of IRDAI was appointed last year, there have been a slew of new innovations introduced in the insurance sector including usage based pricing for auto insurance, launch and then seek approval and many more. It's great to see the new approvals to make insurance products more innovative with economic incentives for everyone involved.

Is insurance ready to be UPI-fied? The insurance regulator has been talking about Bima Sugam, a supposed UPI for insurance platform, for some time now. The platform apparently hit a pause some months back but is now back on priority and expected to be operational soon. An entity like NPCI is expected to be set up with insurance companies as shareholders. A quick read of the Bima Sugam platform looks like it will be a marketplace, aggregating products from all insurers but with the ability to execute purchases, claims settlements and more.

Building in the insurance sector? These updates are exciting and I expect to see a lot more from the regulator and startups. I believe there's opportunity across the insurance stack (manufacturing, infra, distribution and more) and users crave a better experience. If you're building a superior insurance experience, I'd be keen to speak to you - I'm at connect@osborne.vc

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

🌏 International

Mastercard launched a tool to help financial institutions simplify cross-border payments. America’s banking giants are expected to reveal $100bn outflow of cash in the days ahead. Clear Street, a “modern infrastructure” for capital markets, raised $270mm at a $2 billion valuation. Visa partnered with a host of firms, including PayPal and Western Union, to launch global P2P payments. The Bank of England opened recruitment for its proposed central bank digital currency. According to a survey of 10,701 US adults ~66% aren't confident current ways to trade, use, and invest in crypto are reliable and safe; 17% have used crypto vs. 16% in 2022. Latitude Financial, an Australia-based personal lender, decided not to pay a ransom to cyber criminals who recently stole millions of customer records. T Rowe tested Avalanche blockchain Subnet. Plaid launched real time payments in the US.

🏷️ Other Notable Nuggets

🎵 Song on loop

Fintech updates can get boring, so here's an earworm: Jee Karda by Kahani (Youtube). Absolute banger for a house mix of Jee Karda.

👋🏾 That's all Folks

If you’ve made it this far - thanks! As always, you can always reach me at connect@osborne.vc. I’d genuinely appreciate any and all feedback. If you liked what you read, please consider sharing or subscribing.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

See you in the next edition.

Hey Osborne 👋

Any articles under Fintech Today where you have deep-dived into Cross Border Payment Space in India? Currently exploring this space - so was keen to understand your thesis on this space.

Thanks!