Should UPI be free? | Fintech Inside - Edition #66 - 11th Sept, 2022

UPI is always in the news - usually it's for breaking some record or the other. This time, it was in the news for something else - MDR. Should UPI be free? I explore.

Hi Insiders, I'm Osborne, Principal at Emphasis Ventures (EMVC).

Welcome to the 66th edition of Fintech Inside. Fintech Inside is the front page of Fintech in emerging markets.

ANNOUNCEMENT: Fintech Happy Hour is coming to Mumbai! After Bangalore and Delhi, I'm super happy to bring this community meet up to my home city! The Fintech Happy Hour will be on Thursday, 22nd Sept, 2022. If you're attending the Global Fintech Fest in Mumbai, this will be an easy walk for you to truly network with the fintech community. Register now!

Fintech twitter has been a bit heated lately, debating whether UPI should be free or not. In today's edition, I try to look at UPI's history, its contribution to the Indian economy and if it should be free to use or not.

This post is slightly long to read on email. You might want to view it online.

If you’re an early-stage fintech startup founder raising equity or debt, I may be able to help - reach out to connect@osborne.vc

Enjoy another week in fintech!

✨ Fintech Happy Hour

After successful Fintech Happy Hours in Bangalore and Delhi, I’m excited to host the next Fintech Happy Hour! This time we meet in my home city - MUMBAI!

If you’re attending the Global Fintech Fest happening in BKC, Mumbai, this will be an easy walk to meet, network, learn and have a fund time with the city’s fintech community!

Mumbai is the financial capital of the country and HQ to several fintech startups. My city has a thriving fintech ecosystem and I can’t wait to get everyone in the same room!

Save the date for Thursday, 22nd September, 2022.

Would you like to sponsor the Fintech Happy Hour in Mumbai? Write to me at connect@osborne.vc

🤔 One Big Thought

Should UPI be free?

Recently, the Reserve Bank of India (RBI) released a discussion paper seeking comments on charges in India's Payment Systems. The paper, which I recommend you read, details all of India's payment systems including RTGS (Real Time Gross Settlement), NEFT (National Electronic Fund Transfer), IMPS (Immediate Payment Service), UPI (Unified Payments Interface) and all others. In addition to explaining how each system works, the RBI also explained payment flows and expenses. The RBI often releases discussion papers and seeks comments from industry participants and the public. This is not new.

A few days later, India's Ministry of Finance released a statement "There is no consideration in government to levy any charges for UPI services. The concerns of the service providers for cost recovery have to be met through other means."

This resulted in vehement debates across the fintech community - some want UPI to continue to remain free while some others think it should be charged. Should UPI be free?

TL;DR

I believe P2M (Peer to Merchant) transactions should have charges/fees. RBI already runs a regulatory sandbox, test out various pricing mechanisms and identify the optimal framework that achieves its stated objectives, whatever shape or form it takes.

I don't believe charges/fees will ever be levied on UPI payments. Once you go free, you just cannot go back.

First, some history on UPI: The RBI and the Indian Banks Association formed National Payments Corporate of India (NPCI) as a non-profit organisation (section 8 entity under Companies Act, 2013) to operate India's retail payment systems. NPCI began operations in 2009 and took over the National Financial Switch (NFS) to build retail payments and ATM networks. Initially, there were ten promoter banks of NPCI i.e. State Bank of India, Punjab National Bank, Canara Bank, Bank of Baroda, Union Bank of India, Bank of India, ICICI Bank, HDFC Bank, Citibank and HSBC. Over the years, more banks, payment gateways and other financial entities were allowed to participate in the shareholding of NPCI.

It is important to note that NPCI is not a regulatory body and it is not a government organisation. As per NPCI, the goal of launching UPI was "Prior to 2016, India used a number of different systems to transfer money between banks. The traditional forms included RTGS, IMPS and NEFT. With the plethora of systems, rules and growing paper burden, there was a need for a unified system that could automate and standardise India’s payment platforms."

Most fintech folks that were around in 2013/2014 (hey yo!) would remember the prepaid wallet and its popularity - the instrument which brought Paytm, Freecharge, Mobikwik and many others to the fore. Users flocked to these wallet startups for its convenience and ubiquity. Banks started feeling the heat. This was the first time non-banking entities were attracting users in droves but more importantly, banks couldn't own the transaction data that were taking place within the wallet, and therefore banks couldn't earn anything from it.

There were two main reasons for launching NPCI and later UPI: 1. Banks needed to regain control of users and payment data. 2. Keep foreign entities from getting backdoor access to Indian financial systems. (I don't quite believe in the second reason).

When UPI launched, only banks were allowed to integrate with UPI and issue UPI handles. Third party payment companies couldn't directly issue UPI accounts. This helped banks achieve their goal of regaining control of users and infra and own transaction data.

Great so banks won! What's the harm? That's yes and no. Yes, banks won because they became central to the entire payments system and payment takes place within the bank account. Yes, banks won because they continue to earn revenue from UPI (subvented by the government). But no, banks didn't win because customers don't think of their bank when making UPI payments. Customers think of PhonePe, Google Pay, Paytm and (surprisingly) Cred - the top four UPI apps by payment value. Yes Bank's "apps" come in 5th among top UPI apps. Those Top 4 apps account for 95% of total UPI payments by value. Other than Paytm, which owns a payment banking license and is thus a regulated entity, none of the others earn any direct revenue from UPI, that I know of.

There's absolutely no harm in this - not a regulated entity/bank, why should anyone care whether you make money? It gets complex when these non-banks are the sole reason why UPI has become ubiquitous. That's where I don't think it's as easy as saying - UPI should be free.

Wait, wasn't UPI free all along? No, UPI had MDRs (merchant discount rate) at the time of conceptualisation. It was minimal but there was a percentage take rate. It just so happened that UPI was launched the same year of demonetisation in India. To deal with demonetisation, and as a "temporary measure", RBI mandated that no charges shall be levied by banks and PPI issuers for transactions of value less than INR 1,000 ($12.5) across UPI, IMPS, NEFT and USSD.

Then in 2019, the Ministry of Finance in its budget for the next year, stated that RuPay and UPI payments will be made free to use for both users and merchants starting 1st January, 2020. NPCI in Feb, 2020 agreed to make UPI and RuPay free retrospectively and temporarily from 01st Jan, 2020 to 30th April, 2020. In March, 2020, some banks intended to start charging for UPI beyond 20 transactions per month. That plan never reached fruition because of COVID-19.

It is worth noting that, since April, 2021, the government decided to foot the bill of RuPay and UPI as an incentive scheme for one year. The incentive scheme was paid out to acquiring banks at a price set by the government. The total incentive paid out to banks and other stakeholders (as decided by NPCI) - INR 1,300 Cr ($162.5mm), total UPI value processed in FY22 (Apr, 21 to Mar, 22) - INR 84tn ($~1tn). That's less than 2 basis points MDR, only counting UPI value, while the incentive was for RuPay as well.

These entities knew what they were getting into when launching UPI payments. Why should they be given a handout? As you can see above, UPI was never intended to be free - even as a public utility. Circumstantially, UPI was made free, "temporarily", several times. There are several entities facilitating the smooth functioning of UPI - NPCI, Banks, Third Party Apps Providers (TPAP i.e. PhonePe, Google Pay etc.). Without any of these entities, it's unclear whether UPI would reach the scale and ubiquity it has achieved till date.

No one's asking for a handout anyway. Obviously NPCI is central and needed in this whole equation. Banks are needed because the payment is going to and from the bank account. Banks are not needed for issuing (user acquisition) or acquiring (merchant acquisition). That's where TPAP's are important and needed. TPAP's, IMO, have played a key role in building trust/confidence among users, acquiring merchants and growing UPI.

We don't have to look too far to see that banks would not have accelerated UPI's growth the way TPAP's have. Credit cards are still available to only 35-40mm unique credit card users (80mm credit cards outstanding), debit cards are an add on with new bank accounts opened, especially Jan Dhan accounts, and have grown to 928mm debit cards outstanding. The most important of these stats, is the number of POS devices in the country - only 6.8mm. Yes, you can argue that POS devices have a high rental amount and ATM's are expensive to install, but everywhere you go, you still don't see a bank UPI QR code - it's still one by PhonePe, Paytm, BharatPe, or Google Pay.

Ok, so why should UPI be charged? Other payment instruments are free. NEFT, RTGS and IMPS payments have various charges levied by banks for payment initiated offline. Banks levy anywhere from INR 2.5 to INR 100 + GST for different payment values and payment mode.

I believe charges should be levied on UPI for the following reasons:

For digital payments between a merchant and a user, there are several entities that make that digital payment possible. Without those entities, you're back to using cash. These entities should be compensated accordingly but most importantly because there are costs involved in making that transaction possible. Moving back to cash is not an alternative.

When I tweeted in favour of introducing charges on UPI, someone replied (and later deleted) asking if I would pay INR 1 additional on a INR 100 cash payment to a merchant. Except, cash payment is not the same as a digital payment. Firstly, in that cash transaction, there is no other entity making the transaction possible. Secondly, I'm not advocating for users paying over and above the cost of good or service. Lastly, 1% MDR is prohibitively high and something I'm not advocating for either.

If the participating entities don't have a way to earn a revenue from payments, they have no incentive to accelerate its growth. They have no incentive to improve security and privacy. They have no incentive to maintain the stability of existing systems and product. They have no incentive to innovate and improve the existing product.

The top 10 remitter banks (account where money is debited) see avg. UPI success rate of 92.8% (top 50 is 88.7%). These top 10 remitter banks still see avg. Technical Declines (TD - declines due to technical failure at bank or NPCI's end) of 1% (top 50 is 2.8%). That's still high at the scale of UPI.

UPI 2.0 and recurring UPI payments has been in conversation since UPI launched. Yet, till date, recurring UPI transactions see a very low success rate (<75%).

We're all aware of UPI frauds that happen but it's poorly documented. Just because we have no statistics on frauds on UPI, doesn't mean it didn't happen. There is a UPI chargeback facility but fraud is not covered.

Compliance costs of third party payment apps will likely rise as RBI proposed to issue guidelines on Cyber Resilience and Payment Security Controls for Payment System Operators (e.g. PhonePe, Google Pay and others).

The main reason why I think UPI should have MDR is that all entities should be able to compete equally. Thanks to UPI's low/no MDR circumstance, early stage, homegrown startups have not been able to build or innovate in UPI. There's just no business model without MDR.

One can argue that this is not a playing field for startups, let the banks do their job. But we've clearly seen, each bank accounts for less than 1.5% of UPI transactions by value. One can also argue that we can leave it up to India's large conglomerates. Here too, in a list of 70 UPI apps, only Jio and Tata feature, processing $14.6mm and $2.2mm in value per month, respectively. Who else is left to build and grow UPI? Obviously, we're left with large international tech companies that have the capital to absorb these losses.

UPI is a net positive for productivity of the Indian economy. If we introduce MDR, people will stop using UPI and all gains will vanish!

Absolutely, going digital is a huge productivity boost for the economy. Optimising for digital payments is important and should be the focus. However, cash will never exit the system - that's a pipe dream.

Saying that the introduction of MDR will decelerate the growth of UPI and digital payments is an assumption. We don't know if that is true.

In the past we have seen that MDR on debit and credit cards was passed onto customers over and above the cost of the good or service. RBI came down heavily against that practice and went so far to cap MDR of debit cards to <1%. Today, accepting debit cards is common practice. It's a cost of doing business and accepting payments digitally. Of course there's still negotiation between parties on price, but the regulator doesn't interfere as long as it's not above the cap.

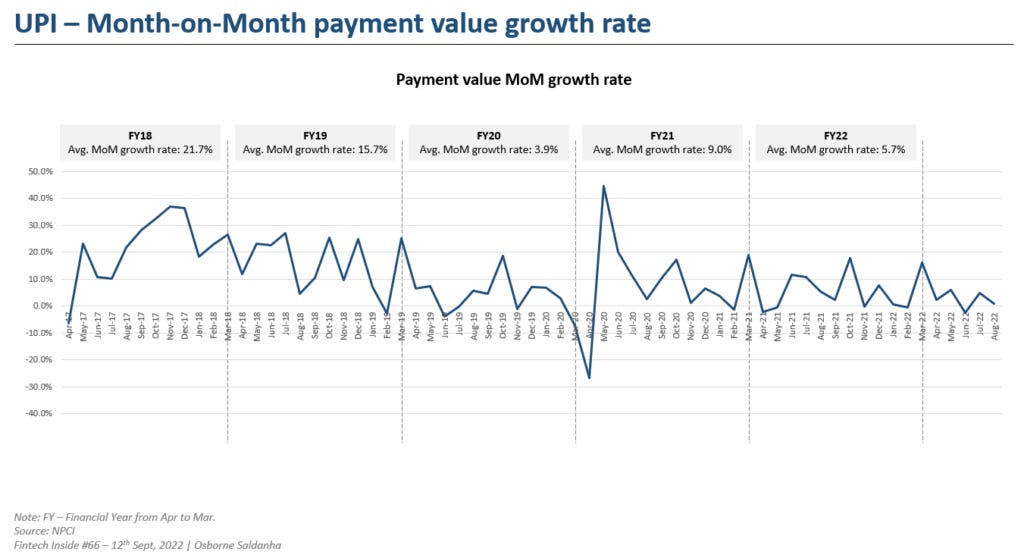

What's most fascinating is, during the zero MDR regime, UPI's growth has actually decelerated. There are several arguments to explain this but it could very well be that zero MDR has not necessarily played a role in UPI's growth.

How should UPI be charged? The only possible answer to this is having a data driven and evidence based approach to UPI MDR. There are several opinions out there:

Deepak Abbot, founder of IndiaGold, believes it should be 0.1% for transaction value above INR 500 ($6.25) for P2M transactions. 0% MDR for transactions less than that.

Someone else believes large merchants should pay for UPI.

I have a rather extreme opinion on MDR for UPI. Merchants should pay for UPI but it should be capped at a standard, low MDR across the board - for example 0.1% MDR for all payment values and all merchant sizes. When MDR is different for values and sizes, perverse incentives are created and merchants start creatively gaming the system.

How to go about implementing MDR? The RBI's regulatory sandbox is a great place to start. It already runs experiments on solutions for retail payments. It could also experiment different MDR's based on RBI's objectives, which it outlines for every category. As Madhu, cofounder of M2P*, also puts it "We should do Pilots at different price to undrstnd different strata, posturing should move to data led decisions..."

What do you think? Should UPI be free to use?

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

🌏 International

UBS Bank terminated its $1.4bn acquisition of WealthFront and said it will instead buy $69.7mm of convertible notes. Binance stopped supporting USDC, the world's second largest stablecoin and plans to convert user's USDC to BUSD (Binance's own stablecoin). Poolin, one of the world's biggest bitcoin mining pools, suspended withdrawals from its wallet service, citing liquidity issues, but says users' assets are safe.

Looking for the news digest? Read all the week’s fintech news and updates in India and SEA over at This Week in Fintech - India and SEA Edition.

🏷️ Other Notable Nuggets

How is the fintech sector in India poised for exponential growth?

Pix revolution: how instant payment put Brazil at the forefront of global financial innovation

👋🏾 That's all Folks

If you’ve made it this far - thanks! As always, you can always reach me at connect@osborne.vc. I’d genuinely appreciate any and all feedback. If you liked what you read, please consider sharing or subscribing.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

See you in the next edition.