Are banks winning at fintech? | Edition #36 - 5th Sept, 2021

The incumbents are... winning at Fintech? Read on to understand banks' digital strategies. Details on PayU acquired BillDesk, Jan Dhan Accounts and Account Aggregators.

Hi Insiders, Osborne here.

Welcome to the 36th edition of Fintech Inside. Fintech Inside is the front page of Fintech in emerging markets.

Lately, Indian banks have been crushing it with their digital strategies. Their digital efforts have been translating to increased adoption by users. This week I look at what's happening there and what's the impact on fintech startups.

There's also news on India's largest fintech acquisition (payments is never boring!), India's banked population doubled in 10 years and the data consent infrastructure launched.

Aside: a doge meme that purchased for $ 4mm as an NFT in June, is now valued at $ 225mm after it was fractionalised into 17bn tokens.

Data is beautiful: PhonePe launched Pulse visualising its payments data.

Note: There will be no Fintech Inside next week i.e. 11th Sept, 2021. Will be back with an edition on 18th Sept, 2021. Thanks for your support. If you need to reach me, I’m at connect@osborne.vc.

If you’re an early-stage fintech startup founder raising equity or debt, I may be able to help - reach out to connect@osborne.vc

🤔 One Big Thought

Are Indian Banks winning at Fintech?

Indian banks are increasingly looking like fintech startups themselves. A lot of their public posturing is around "digital", "apps" or "web portals" (ugh, "portals"!). If you read through their shareholder announcements, "digital strategies" definitely finds a mention. It's almost as if banks are touting themselves to be fintechs to ride the fintech wave, in the same way that Apple and other tech companies are positioning themselves to be green companies to attract impact/ESG investors.

In their quest for "customer ownership", banks are competing with other banks, NBFC's, fintech startups and more. They're probably feeling the pressure from all sides, bu they have a trump card - a banking license. They know this and they're using it to their advantage. Any startup that wants to launch a fintech product has to go to a bank/NBFC.

The large banks i.e. SBI and HDFC, have typically taken full ownership over their digital strategy. Other banks i.e. ICICI, Axis, RBL, IDFC First, YES and more have gone the partnership route to grow their reach. But more recently there's been a shift in strategy by HDFC. HDFC is making waves by reportedly partnering with Zeta for its card infrastructure and Paytm for digital banking offerings. It's almost as if this HDFC Bank is unrecognisable!

How are banks winning at their digital strategies? Amazon Pay ICICI Bank credit card crossed two million cardholders. SBM Bank tied up with 30 fintechs to grow deposits. Earlier in Mar, 2021, I reported that "...banks [are] absolutely crushing it in their digital endeavours. ICICI Bank reported its iMobilePay UPI payments app is being used by 1 mn non-ICICI Bank users. Bank of Baroda reported that it has developed an in house neo-banking platform and has already disbursed USD 135 mn in loans since launch in Nov-20. SBI Bank reported that its transactions initiated digitally grew to 67% of total. Lastly, HDFC Bank's SME loan book grew 30% to cross USD 27 bn (INR 2 Tn)".

What are Indian banks focusing on for their digital strategy? Distribution. Simple as that. To build a great fintech startup one needs 1. License, 2. Trust and 3. Distribution. The Holy Trinity! Banks have 1 and 2, all their digital efforts, partnership or otherwise, are designed to optimise for distribution. Even if a fintech thinks they "own" a customer, they're wrong - the financial firm does. Just look how impressive banks and NBFC investor presentations look when it comes to "digitally originated" transactions.

How does this impact fintech startups? Fintech startups rely on these financial firms to build and grow any product. Banks and NBFC's are crucial to India's fintech ecosystem. They don't seem to be playing ball though. Even if banks partner with fintech startups, there's been precedent of banks shutting off those partnerships (for whatever reasons). Fintech startups of course realise this and are acquiring their own licenses now. PhonePe received its insurance brokerage, account aggregator and other licenses. Zerodha received its AMC license. BharatPe (and Centrum) received approval for a Small Finance Bank license. Paytm has had a Payment Bank license, tried acquiring a bank and now wants to convert to a Small Finance bank. Acko has a general insurance license and Navi acquired all its licenses. RBI has all but refrained from issuing new NBFC licenses in the recent past. This is where second order effects come into play. All this basically means licenses will be important, which means large amounts of capital will be required to even start up. Unfortunately, it automatically cuts out founders that are unable to raise large amounts and limits innovation.

What are your thoughts on Indian banks and their digital strategies? Let's discuss it! Please email me at connect@osborne.vc or find me on Twitter or LinkedIn.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

💼 Work at a Fintech

workatafintech.com: Search from ~180 open positions at 50+ fintech startups in India and South East Asia.

Finave, a personal finance startup, is hiring graphic designers. Apply here.

Finarkein Analytics, a workflow orchestration platform, is hiring front end engineers. Apply here.

Setu, a financial infrastructure startup, is hiring for several positions across Engineering, Growth, Partnerships and Strategy. Apply here.

Work at a Fintech is a community effort by EMVC. If you’re a Fintech who’s hiring I’d like to help. Write to me and I’ll put your requirement here. 2.5K+ people view these open positions.

3️⃣ Fintech Top Three

1️⃣ India's biggest fintech acquisition

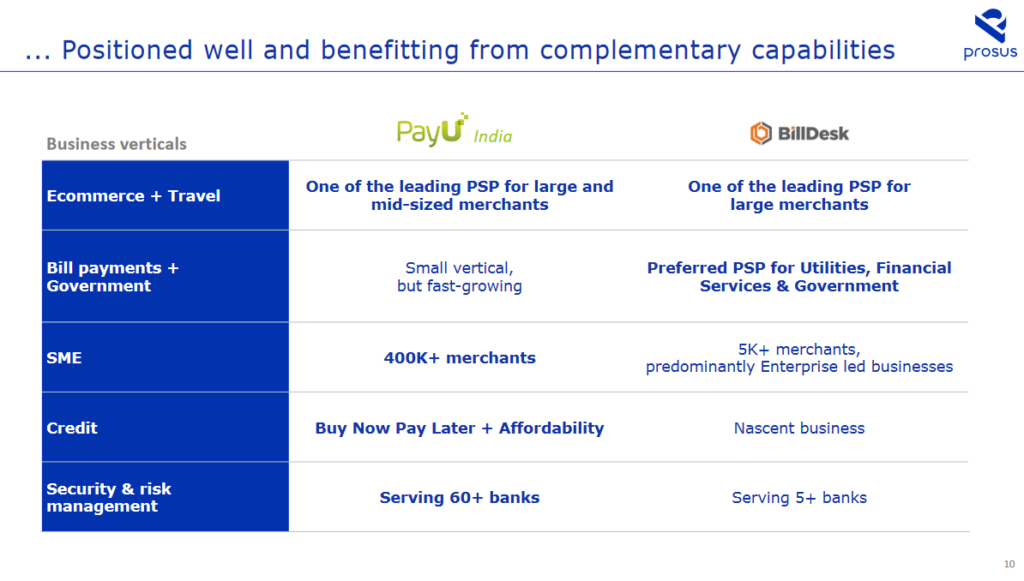

Prosus owned PayU India announced that it will acquire BillDesk for $ 4.7bn, subject to regulatory approvals, and expects to close the deal by Feb, 2022.

Would recommend taking some time to read through this investor presentation for "Project Bolt".

Takeaways: This deal is going to be a steal for Prosus over the next decade, IMHO. The two pieces, PayU India and BillDesk, fit neatly together to form a massive payments behemoth in India processing $ 119bn annually. BillDesk, founded in 2000, is known to power bank payment gateways, has enterprise and government clients as merchants and has 50+% market share for billing transactions. PayU will now own all of that and command 60-70% of the Indian digital payments market.

The most important infrastructure that PayU now gets access to is SI Hub. SI Hub is the recurring payments infrastructure that BillDesk built in conjunction with banks and VISA. Razorpay built a competing recurring product – MandateHQ, with Mastercard. SIHub and MandateHQ are yet to launch. This will be crucial as RBI’s deadline to comply with new payment data storage norms is 31st December, 2021.

Aside from the obvious benefit to PayU, this acquisition along with the fintech IPO's coming up will be a big fillip for the Indian fintech ecosystem. Global investors are taking notice and will continue to deploy larger amounts in India's fintech ecosystem. The notion of lack of depth in the market and liquidity for investors gets quashed and how! Interestingly, the second largest fintech acquisition was also by Prosus owned PayU where it acquired Paysense in 2020 for $185mm.

2️⃣ India's progress in increasing the banked population

India's adult population with a bank account is crossing 85-90% of the total, doubling since 2011. The government announced that as part of its Jan Dhan Yojana to "bank the unbanked" over 430mm "no-frills" bank accounts have been opened since the scheme launched in 2014.

Some additional stats: 85.6% of these accounts are still operational with average deposit of $46 (INR 3,398). ~97% of all accounts are opened with public and regional banks, 67% of all accounts are in rural areas and 55% of all accounts are held by women. These accounts cumulatively held ~$19.6bn in deposits as on 18th Aug, 2021. As on 2018, 66+% of bank accounts held are Jan Dhan accounts.

Takeaways: Banking India is a mammoth task and Jan Dhan Yojana seems to be headed in the right direction. Bank account penetration was key, now comes the tough part - increasing financial literacy, servicing these accounts and increasing usage and deposits. Direct benefits transfer was a big reason for opening these accounts and ~50mm account holders received these benefits with a 5.7% failure rate. In the past, there were reports of Jan Dhan accounts being mis-sold where people were told they would get $68 (INR 5,000) for opening an account, referring to the overdraft facility. During covid in Mar-2020, the government gave women account holders $7 (INR 500) for opening Jan Dhan accounts. It's important to note that most rural people have expenses they pay for in cash, so most of their earnings never get deposited or withdrawn at the start of the month. 52% of respondents to a survey in 2017 by NABARD said they prefer to keep their savings at home. It is tough to ensure usage of these accounts, earning from this user base is even tougher which is why I don't think fintech startups will be able to create a huge dent for this user base in the near term.

3️⃣ India's data consent infrastructure is now live

Account Aggregator infrastructure went live with a public launch this week. "Four major Indian banks—HDFC, ICICI, Axis and IndusInd—are currently live on the account aggregator network, which accounts for around 40% of all bank accounts in India, and other banks like SBI, IDFC First Bank, Federal Bank and Kotak Mahindra Bank are in the process of joining the system". PhonePe just got its in-principle approval and Reliance surrendered its license.

What's an Account Aggregator (AA)? (from the 11th Edition in Nov, 2020) - An AA manages consent digitally. Consent for who has access to one's financial data, the frequency of data access (e.g. monthly), purpose of data access, period of data access (e.g. 3 months or 6 months etc.) and types of data access (transaction history, personal data etc.).

Takeaways: Finally, AA has launched! It's been five years in the making with several delays along the way. In the absence of a data protection bill in India, AA is a welcome infrastructure. We're finally here. Now what? Well, we wait for these banks/fintech startups to create use cases (loans was the one touted at launch) and proliferate AA-based on boarding in their user experience. Users can start creating their AA "handle" by downloading one of the AA apps by Finvu, OneMoney or others. It's important to note that the banks that are live today, are live to become Financial Information Providers (FIP). This is crucial because without data from FIP's you cannot create use cases.

My reservations around this infrastructure remains about pricing and use cases. On pricing there are 3-5 entities in an AA value chain - who earns how much? A financial information provider (FIP) will definitely want to monetise their data. Entities maintaining the infrastructure will want their piece of the pie. Who bears the cost of all this? Of course, this is new public infrastructure and will go through some pricing trials but if we've learned anything from NPCI, it's to not keep core infrastructure free. Use cases are still at idea stages and will need some education on the financial information user (FIU) side of things. Currently, only asset data (banking, mutual fund etc.) is approved by RBI for consent management. The intent is to bring more data types under the ambit of AA.

Random thought: who "owns and maintains" AA? NPCI? iSpirt? RBI? Nandan Nilekani? Banks? Sahamati?

Looking for the news digest? Read all the week’s fintech news and updates in India and SEA over at This Week in Fintech - India and SEA Edition. You can also find our US, Global and European coverage.

🏷️ Notable Nuggets

APAC E-Commerce Customers Embrace Digital Wallets and Buy Now, Pay Later

SEBI is planning regulations for digital gold trading platforms.

Southeast Asia added 70 million online consumers during pandemic

👋🏾 That's all Folks

If you’ve made it this far - thanks! As always, you can always reach me at connect@osborne.vc. I’d genuinely appreciate any and all feedback. If you liked what you read, please consider sharing or subscribing.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

Found a broken link or incorrect information? Report it.

See you in the next edition.

Loved it , Great work and well written in easy language