Fintech Inside #25 - 20th Mar, 2021 | Creator Payments

In this Edition we have a guest post discussing Payments Stack for Creators. There's also - Incumbents winning at Fintech, Industry effort to increase MF distribution and a Fintech Fellowship

Hi Insiders, Osborne here.

Welcome to the 25th edition of Fintech Inside. Fintech Inside is the front page of Fintech in emerging markets.

This week I have a guest post from Prince Jain, Consultant at Mastercard, where he discusses payments products for the creator economy.

There's also news on incumbents winning at Fintech, AMC industry launching a training platform and a Fintech launched a fellowship product.

Globally: Stripe raised USD 600 mn at a mammoth USD 95 bn valuation. Trustly (Swedish payments) and eToro (European social trading) are expected to IPO at USD 11 bn valuation each. Austria got its first unicorn in BitPanda (crypto exchange) and Israel's first new bank launched in 40 years.

Personal Update: Excited to share that I've joined EMVC's investment team. EMVC is a global venture fund that invests in early stage startups in Fintech & related sectors. If you're an early stage Fintech (even idea stage) startup, I'd love to chat with you. My email is os@em.vc. We're also hiring an intern.

🤔 One Big Thought

Creator Economy: The Payments Opportunity

Note: This is an abridged cross-post from Prince Jain's latest Unit Economics newsletter. Prince publishes insightful ideas in Fintech and I urge you to read and subscribe to his newsletter too.

People have always had passions. Be it writing, painting, playing an instrument, running, or following a random ball for hours. But few put it out to the world and made a living off it.But the last decade has forced millions to rethink this. Platforms and businesses have emerged centered around independent content creators and curators. In the early stages, and this is not long ago, monetization for creators would primarily come from advertising. That is, the scale of your network and the reach of your content mattered most. This was the first stage of the internet creator economy.

Few years on, creators have access to more resources and platforms. From teaching to newsletters, merchandise to fan engagement – platforms today are building a differentiated service for each part of the creator’s business lifecycle. Creators are not only reliant on scale today, but also on differentiation of what they are creating – even if, they have only 1000 true fans. This implies that advertisements aside, creators get to monetize their content through users directly. Therefore, for payment providers, it becomes crucial to recognise the change and to understand the specific & evolving payment needs of this 50M+ strong creator economy.

So, how would creators like their payments?

A. Borderless Payments: Creators, today, have audiences that are truly borderless. For a top Iranian tutor sharing video lessons on Physics, there is likely to be as much demand from those in India and Japan as it would be from Iranians. Unless served on a platform such as Teachable, these lessons face a big monetization issue.Making standalone creator endeavours seamless should be a top priority for payments companies focusing on this domain, and making acceptance of payments across borders easy would be a big leap towards that.

B. Customization in Modes of Acceptance: Creators monetize their content and popularity in more ways than one: advertising, sponsoring content, tips and donations, product placement, digital content and merchandise sales, live and virtual events, and paid subscriptions cover most of such methods. Increasingly then for platforms, to discourage disintermediation of their creators, it should become important to provide the convenience of all these methods under one roof.

C. Loyalty of Subscribers: Card-on-file or subscription services are suited to retain customers. But there remain many conventional payment methods of attaining loyalty that creators remain little exposed to. Amcouple of them, which I imagine would be interesting, are 1. Reward Points or cashbacks and, 2. Virtual credit cards. Such payment options would help independent creators recognise higher long-term loyalty from their users.

D. Single View of Multiple Platforms: Going back to the point made earlier, creators today build audiences on multiple platforms. For one, this helps them diversify their sources of earnings. Now, if creators accept payments on more than one platform, there is value in providing the users the same payment methods. Not only does it reduce friction for the user, but it also reduces complexity. I imagine that the most convenient route may be offering a payment option that is tied to the user, is easily shareable on platforms through simple links, and offers a single dashboard view of the revenue statistics arranged by members and by platforms.

Few Final Thoughts: This article was a small thought experiment on how payments can evolve for creators. With the growth that creator platforms are seeing today, it is not tough to imagine the high value one could bring by assembling and offering a creator-specific payments stack. This would likely include the option to offer tiered pricing, accept donations, offer discount codes, issue virtual cards, accept in multiple currencies, and offer a single-view dashboard. We must note that, today, we stand at the infancy of creator content monetization, but with platform sophistication, we should expect content to be treated like SKUs, and payments to be linked to the platform and user-specific metrics. For what it could end up be becoming, it is intriguing to imagine the possibilities.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

💼 Fintech's Hiring

RupiFi, an embedded SME finance startup, is hiring for UX, Growth and Risk profiles. You can reach out to the founder Anubhav Jain on LinkedIn to apply.

If you’re a Fintech who’s hiring I’d like to help. Write to me and I’ll put your requirement here.

3️⃣ Fintech Top Three

1️⃣ The Incumbents seem to be... winning at Fintech!

This week alone there was news of four banks absolutely crushing it in their digital endeavours. ICICI Bank reported its iMobilePay UPI payments app is being used by 1 mn non-ICICI Bank users. Bank of Baroda reported that it has developed an in house neo-banking platform and has already disbursed USD 135 mn in loans since launch in Nov-20. SBI Bank reported that its transactions initiated digitally grew to 67% of total. Lastly, HDFC Bank's SME loan book grew 30% to cross USD 27 bn (INR 2 Tn).

Takeaway: The biggest advantages banks have are 1. License, 2. Distribution and 3. Trust. The Holy Trinity! Each of these three are tough for any Fintech company to get. Banks know this and they're using it to their advantage. Fintech companies have limited choice but to partner with an incumbent. But the incumbent has the choice to go solo. Sure, this has been changing - banks are partnering with Fintech companies but it's rather slow.

2️⃣ Mutual Fund Companies partnered to launch expertmfd.com

Several asset management companies (AMC) and the National Stock Exchange partnered to launch expertmfd.com. This platform will look to acquire and train new mutual fund distributors (agents) and handhold them through out the registration and certification process. These AMC's are targeting to induct 50,000 new distributors in the next 3 years.

Takeaway: All these years of digital mutual fund distribution by wealth Fintech companies and AMC's had to still take matters in their own hands? Why build a platform to train offline agents? Sure, market expansion has always been the target, but isn't that what wealth Fintech companies have been doing? Further, distributors no longer earn upfront commissions only trailing commissions, so why will individuals want to join this platform? I'm genuinely curious about this update and I may not have a solid takeaway here, but I really want to know the thought process for such a collective effort by the entire industry. Please write to me (Email) if you have thoughts on this?

3️⃣ Decentro launched a Fintech Fellowship Program

Decentro, a banking API startup, announced the launch of a "Fintech Fellowship Program" for young graduates or final year students. The 2.5 month fellowship will give 3 individuals or teams an opportunity to 1. build their ideas using Decentro's API's 2. a monthly grant of INR 50K (USD 690), 3. Mentorship by Decentro's team. If interested, you can apply here. Decentro raised seed funding in 2020 by YC and other investors.

Takeaway: I like this idea. It's great packaging but it's amazing that the team at Decentro is thinking of approaching this uniquely. It's a win-win situation for Decentro (crowdsource use cases, engage tech talent early etc.) and for the individuals/teams (practical experience). It's the right kind of innovation we need to see in the industry. Here's hoping more Fintech and tech companies think of these sorts of innovative programs. I genuinely hope this fellowship program finds success.

🇮🇳 India

- 📰 Market Updates:

Paytm Payments Bank received approval to launch UPI-based IPO subscription. Upstox, a Fintech stock broker, was announced as the official title sponsor for IPL 2021. Decentro, a Fintech API startup, announced Fintech Fellowship Program

CRED is in talks with investors to raise USD 200 mn at USD 2 bn valuation. Rupeek, a gold loan startup, kicked off Series E round with USD 33 Mn tranche led by GGV.

Helios Capital and Rakesh Jhunjhunwala's firm applies for Mutual Fund license. WhatsApp hired Amazon Pay's Manesh Mahatme to lead India payments.

Govt. allows private provident funds to invest in domestic VCs, infrastructure funds. ICICI Bank claimed that 1 mn users of other banks are using iMobilePay - ICICI's mobile payments app.

Bank of Baroda claims to have built an inhouse digital loan management system that disbursed INR 1,000 Cr (USD 135 mn) in loans to 125K borrowers. SBI's digital transactions are as high as 67%. HDFC Bank's SME loan book grew 30% to cross INR 2 Tn (USD 27 Bn)

Carlyle to sell 4% in SBI Cards for INR 3,900 Cr (USD 527 mn). PNB Bank incorporated a new NBFC subsidiary to launch a credit card program. International Air Transport Association (IATA) partnered with Standard Chartered for EasyPay facility for its travel agents.

Indian hedge funds and VC funds queue up to set up an AIF in Gujrat's GIFT City. Rajasthan Government announced a medical insurance scheme for households.

- 🚀 Product Launches:

Axis Bank rolled out a range of wearable devices for contacless payment transactions. Leading Mutual Fund Companies have joined hands to launch expertmfd.com to train and induct 50,000 agents to distribute Mutual Funds.

NPCI launched Unified Payments Interface dispute resolution within the BHIM (gov-owned) app.

CRED and DotPe partnered to launch CRED Payments while ordering food using DotPe.

- 📝 Regulatory Updates:

- RBI (Central Bank): Asked banks to implement image-based Cheque Truncation System in all branches by 30th Sept-21. Imposed an INR 2 Cr penalty on SBI for non-compliance.

- SEBI (securities): Proposed to streamline IPO process via UPI. Amended qualification norms for portfolio managers, investment advisers and research analysts.

- 💰 Funding Announcements:

FUNDING: Magma General Insurance (insurance). YAP (Fitech API). Transak (fiat-to-crypto). BimaPlan (insurance). Leap Finance (education finance). PolicyBazaar (insurance distribution).

ACQUISITIONS: CashRich acquried WealthApp.

🌏 Asia

- 📰 Market Updates:

Wise appointed Grab’s co-founder to its board. Batumbu, Indonesian subsidiary of SME lender Validus, received approved for digital financing license.

DBS closed a trade financing transaction valued in excess of USD 40,000 on AntChain’s Trusple blockchain platform. Bank of Thailand revealed plans to focus on retail digital currency. OCBC rolled out facial verification for ATM transactions in Singapore.

BangNiTou, a robo-adviser service backed by Vanguard and Ant Group, reached 1 million users. TONIK Bank officially launched in Philippines.

Ripple appointed a former executive at Uber, as managing director of its Southeast Asian operations.

- 💰 Funding Announcements:

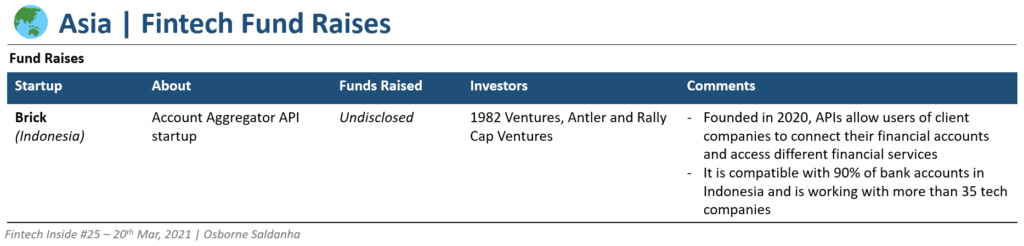

Funding: Brick (Indonesia, Fintech API)

👋🏾 That's all Folks

If you’ve made it this far - thanks! As always, you can always reach me at connect@osborne.vc. I’d genuinely appreciate any and all feedback. If you liked what you read, please consider sharing or subscribing.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

Found a broken link or incorrect information? Report it.

See you in the next edition.