No country for fintech startups? | Fintech Inside - Edition #64 - 27th June, 2022

In this edition: RBI's notification on prepaid instruments and its impact on users and the broader fintech ecosystem. Bonus: what will the future of fintech look like?

Hi Insiders, Osborne here.

Welcome to the 64th edition of Fintech Inside. Fintech Inside is the front page of Fintech in emerging markets.

Last week, the RBI released a notification warning against loading prepaid payment instruments (PPI) with credit lines. This one notification sent a jolt across the fintech industry with widespread ramifications. It is estimated that 10-20mm users will be impacted.

Like you, I had a ton of questions: Which fintech startups are impacted? Why would RBI take such a drastic step? Was this expected? Were these fintech startups operating illegally? What's next for fintech in India? All that in this week's edition of Fintech Inside!

Like what you read? please share this edition with a friend.

If you’re an early-stage fintech startup founder raising equity or debt, I may be able to help - reach out to connect@osborne.vc

Enjoy another week in fintech!

🤔 One Big Thought

No country for fintech startups?

The Reserve Bank of India released a notification, warning prepaid payment instrument (PPI) issuers against loading prepaid wallet accounts with credit lines. In it's notification, the RBI cited paragraph 7.5 of its Master Direction on PPI's, stating "PPI's shall be permitted to be loaded/reloaded by cash, debit to a bank account, credit and debit cards, PPI's (as permitted from time to time) and other payment instruments issued by regulated entities in India and shall be in INR only". Several fintech startups have written to the RBI seeking six months to comply with the notification. There was some confusion as the notification was addressed to non-bank PPI's only, but if the spirit of the notification is to be interpreted, this notification will apply to all PPI's - bank or non-bank, IMO.

Just like that, in one fell swoop, a decent chunk of fintech startups were impacted. It is estimated that 10-20 mm customers are affected with a combined credit outstanding of INR 3500-6000cr ($450-800mm). Outstanding book-wise that might not sound large, but customers impacted-wise this is big.

Just like you, I have a ton of questions. Which fintech startups are impacted? Why would RBI take such a drastic step? Was this expected? Were these fintech startups operating illegally? What's next for fintech in India?

To understand the impact of this notification, it's important to understand what these fintech startups did.

First Principles to the rescue! I'm simplifying here, but there are three types of accounts to hold funds - debit, credit and prepaid. Any funds you receive or pay with, are from one of these types.

Debit account is your typical bank account with no limits.

Prepaid account is a temporary wallet account with some limits on funds held.

Credit account is your credit card or BNPL account with limits and charges.

Unsecured loans (without any collateral) typically get disbursed into a debit account or credit account. If it gets disbursed to your debit account, its a "Personal loan" and if "gets disbursed" to your credit account it's a "credit card" or BNPL account. The "gets disbursed" is in quotes because you, the borrower, only get a credit limit and the funds only theoretically get disbursed your credit account, the funds actually get disbursed directly to the merchant.

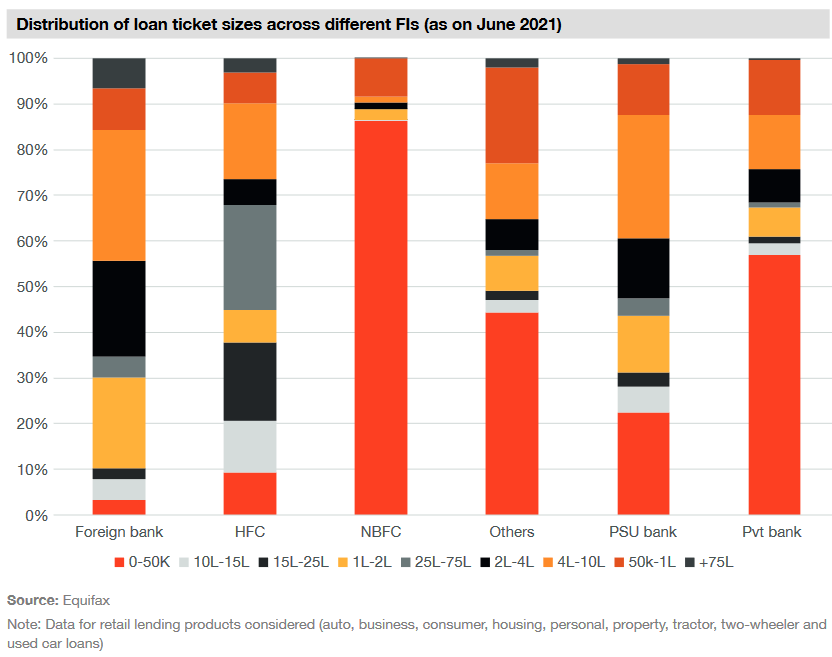

Most lenders prefer giving secured loans (with collateral) e.g. auto loans, home loans, gold loans and more. All have to disburse personal loans for 2 reasons - 1. it's risky because the lender doesn't know the "use of funds", but 2. it commands higher interest rates, which increases the "average" net interest margins of the overall loan portfolio.

How do you counter the above risk while maintaining a high interest rate? Besides getting control of the debit account, which only a bank can do, the other way to cap your risk, is to get control of the credit account i.e. a credit card or BNPL account. The credit account doesn't give the borrower free money, instead the borrower can only "spend" from the account at merchant stores. That's great control for a bank - you can predict the "use of funds". This is potentially the main reason why RBI allowed linking credit cards with UPI, in addition to the several others I've mentioned in edition 63 of Fintech Inside.

Here lies the curve ball: In India, only banks are allowed to issue credit cards, effectively giving access to this "credit account" only to banks, in addition to owning the debit account. In April, 2022, RBI hinted at the possibility of selectively and specifically approving NBFC's (non-banks) to issue credit cards. Leaving aside this "possibility" to become a reality, for any entity to partner with a bank to launch a card or co-branded card is easily a 6-9 month process and comes with "bank grade" scrutiny. Its simply not viable to innovate, iterate and improve faster. The process and scrutiny are important, the timeline - painful.

So what did fintech startups do? They innovated and found a regulatory arbitrage for faster time to market for challenger cards. Fintech startups used the prepaid account as a quasi-credit account. How?

At sign up, issue a prepaid account to the user. Link the account to a card network and issue a prepaid card number.

Issue a personal loan to the user with a credit limit linked to the prepaid account.

When the user makes a transaction using the card at a merchant store e.g. INR 100, process a "just in time" credit transaction. i.e. load INR 100 from the lender to the prepaid account and automatically transfer INR 100 to the merchant.

Deduct INR 100 from the credit limit of user.

Voila! You have a functioning quasi-credit card!

The entire dummy transaction above, gets completed in seconds! This is broadly how some BNPL startups and all challenger credit card startups have functioned. In the case of BNPL startups, the card network linking is not necessary.

If you noticed in the dummy transaction, the prepaid account was loaded with a credit line. And that's where RBI gut-punched fintech startups (reference the RBI notification above).

Why, RBI? Why? There are many theories out there as to why RBI did this. My theory:

Credit instrument being used as a payment instrument - a big no no: RBI seems to want to restrict the use of a payment instrument (prepaid account) for the purpose of credit. PPI licenses were not issued with credit in mind. Regulatory requirements and compliance for PPI license holders is less than those for an NBFC or banking license. RBI probably wants fintech startups to avoid any miscommunication to users that could arise from this subtle nuance. This could have made RBI hesitant as it wants to build better safeguards for consumer protection and limit any systemic risks.

Limited user awareness/education: This reason is loosely tied to the one above. Users also seem to be mistaking this "card" as a payment instrument and are sometimes caught unaware when they see a credit line in their credit scores. For this, I agree, fintech startups could do better to make the user more aware. Nobody wants to be caught off guard - not fintech startups, not banks, not RBI, not users.

Global outcry/fear of BNPL: BNPL globally has been getting a bad rap lately. Unfortunately, this seems to have spilled over to Indian fintech BNPL startups. However, it needs to be clarified that the operating model of Indian BNPL startups is different from the global models. RBI probably wants to restrict its growth before anything untoward happens.

Curb systemic risks? I'm speculating here as I don't have data to back it up. Only a handful of banks partner with startups in any meaningful way. Unsecured personal loans by these banks are a small percentage of their overall loans outstanding portfolio. I'm not sure if there are any systemic risks. Thinking aloud, maybe if something were to go awry in one corner of the credit market, RBI wants to restrict the damage or loss of trust to the whole credit market.

Iron out regulations in anticipation for credit cards on UPI: This is far fetched, but RBI probably has a better idea for fintech startups to innovate - credit cards on UPI. In anticipation of the proposed CC on UPI, RBI probably wants to tighten regulations for the launch.

Along with RBI's notification came the deluge of comments against "malpractices" of fintech startups. Majority of the criticism was that "Fintech startups don't care about regulation". This could not be farther from the truth. Speak to any founder or product manager in a fintech startup, aside from an air of fear in their voice, you will see how deeply they care about regulation. I will not be surprised if they know all the regulations better than their holy scriptures (I joke, partially). But that's not all, fintech startups partner with banks and NBFC's who themselves make the fintech startup go through extensive regulatory and compliance checks. The process is exhaustive to the extent that banks and NBFC's approve each screen that the user sees, including the font size!

However, I don't mean to generalise - there are some lending apps that charge very high interest rates, that employ dark patterns and that don't care about consent. The majority of fintech startups that have raised any amount of capital are unfortunately getting a bad reputation. These fintech startups realise there's a lot at stake including their own reputations and wouldn't mess with partners or regulators.

What's the impact? Immediate impact is the shutting down of challenger credit cards and BNPL's that used PPI licenses. Fintech startups that were built around this are massively impacted - they probably only have options of launching personal loans or co-branded cards. The most important category to be impacted is the end borrower - suddenly their access to credit is shut. In the near term, banks position as the epicenter of financial services is further cemented. We will probably see more fintech startup participation in regulatory consultations.

The future of retail unsecured credit will go the UPI route (cardless form factor) but my worry is that young startups will not stand a chance to play a role in innovation and competition. We don't need to look too far to see that not a single startup was able to compete or play any role in the growth of UPI.

All this brings me to my main question: what is a winning business model for fintech in India? There's little or no money to be made in payments. There's not a lot to do in consumer credit now. SME credit is tough (hey, Brex!). The platform makes trailing income by selling regular mutual funds. Innovating in the insurance sector requires another post altogether. Crypto is being taxed all around. Indians don't pay subscription for anything. You can forget about a banking license. Any license is tough to come by even if you have all the capital in the world. So, really, what does a fintech startup do?

This is a question many to-be-founders are potentially asking themselves right now. Anyone interested in fintech, will probably think twice before taking the plunge. The real blow is to the smaller fintech startup i.e. one that doesn't have the capital, or the regulatory reach. Innovation and competition are at stake. Honestly, I've been thinking about the above question for the past week and I haven't been able to find a clear answer to the path forward yet. This is a very grim outlook.

"You of all people are supposed to be optimistic about fintech, Osborne": Yes! Absolutely, I still am. I still think India has a long way to go when it comes to access, simplicity and transparency of financial services. Even after investing in this sector for close to a decade, I still feel we're only scratching the surface. My underlying thesis still holds true. I will still write this newsletter week on week sharing my theses, optimism and learning on fintech.

Going forward, banks will have to drastically improve the way they work and how they partner with startups. Fintech startups need to improve the way they engage with the regulators and regulated partners. There are no clear tailwinds that I can think of yet but I know the macros will identify and propel the tailwinds. There are headwinds and that's what's always made it fun to build and invest in India. In the long term, this might look like a minor hiccup. The one thing I'm absolutely confident about is our ability to innovate. After all, necessity is the mother of invention.

What do you think are the tailwinds for India's fintech sector? What products should Indian fintech startups focus on or build? Write to me or reach me on Twitter, LinkedIn or Email at connect@osborne.vc.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

🌏 International

The total value of all cryptocurrencies is down $2tn to ~$800bn. Bank of Israel is conducting experiments to make its CBDC anonymous and said that DeFi smart contracts may need some oversight. Klarna lashed out against a Barclays research on BNPL calling for merchants to reconsider BNPL at checkout. Solana launched a crypto mobile phone.

Looking for the news digest? Read all the week’s fintech news and updates in India and SEA over at This Week in Fintech - India and SEA Edition.

👋🏾 That's all Folks

If you’ve made it this far - thanks! As always, you can always reach me at connect@osborne.vc. I’d genuinely appreciate any and all feedback. If you liked what you read, please consider sharing or subscribing.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

See you in the next edition.

well written!