Launching: Loans by Fintech Inside | Edition #65 - 16th Aug, 2022

In this edition: why credit products are on every startup's roadmap and a breakdown of RBI's recent notification on digital lending.

Hi Insiders, Osborne here.

Welcome to the 65th edition of Fintech Inside. Fintech Inside is the front page of Fintech in emerging markets.

RBI has its way to get me to write my newsletters! 😄

This is a special edition of Fintech Inside that's been months in the works. Today I'm launching something new! Presenting... Loans by Fintech Inside! It's a natural evolution for Fintech Inside!

Read on to learn why every startup is and will get into lending. Lending may be a feature or not, but its certainly on everyone's roadmap.

In this edition, you'll also find details on RBI's recent guidelines on digital lending. Its a whole new RBI world we're living in where some guidelines are to be implemented immediately and others after some deliberation with the government and stakeholders. Read all about it in this edition!

Note: This edition is long to be viewed on email. Please view the same online.

Happy Independence Day, fellow Indians!

RIP Rakesh Jhunjhunwala.

If you’re an early-stage fintech startup founder raising equity or debt, I may be able to help - reach out to connect@osborne.vc

Enjoy another week in fintech!

🤔 One Big Thought

Launching: Loans by Fintech Inside

"Hey, did you hear? That startup is also launching a lending product?"

"What! Them as well?!"

"Yeah, at this point, everything is not fintech. Everything is lending"

You've probably had some version of this conversation with a fellow fintech nerd when a startup announced launching a new credit product. And you're probably thinking "why on this big, beautiful earth is Fintech Inside getting into lending?". Thankfully, I'm not launching any lending on Fintech Inside and never will. Kindly excuse this cringe, click bait-y title.

Why is almost every startup launching a credit product though? The short answer: it's the single most important product in fintech that helps build large businesses in terms of book size and revenue.

The long answer:

Loans are structured products that are tried and tested in the industry.

Pricing is standardised across the lending value chain.

Credit drives transactions and discretionary spending.

Credit products help platforms pass the "toothbrush test".

Regulators have made it tough for fintech startups to earn revenue via other products.

India is really credit-starved.

That's it. That's the post for today. Thank you for taking the time to read this post! See you next time! Kidding!

Seriously though, almost every fintech startup will launch a credit product. More importantly, any platform that has a digital touch point with a consumer, will launch a credit product because of the reasons mentioned above.

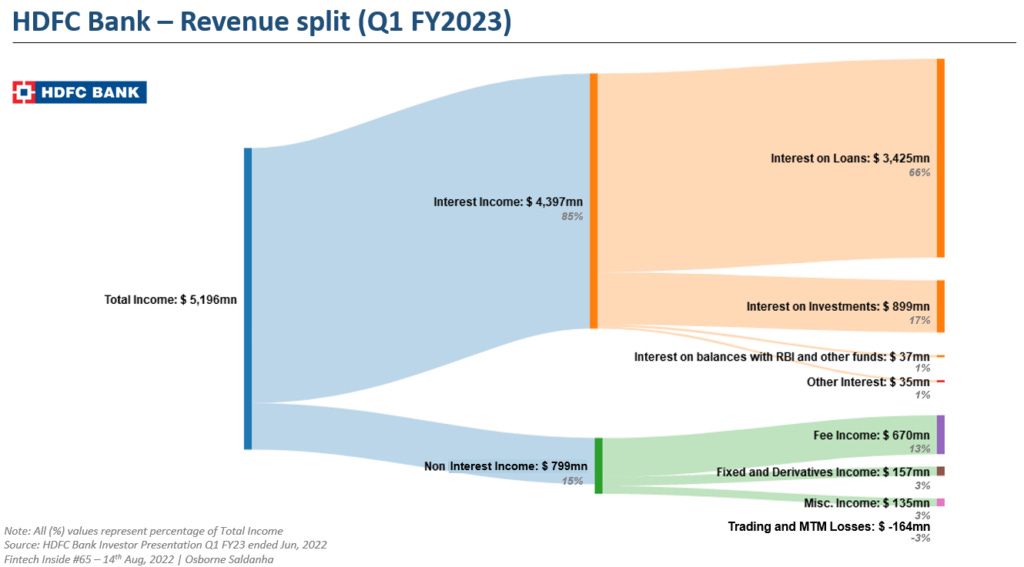

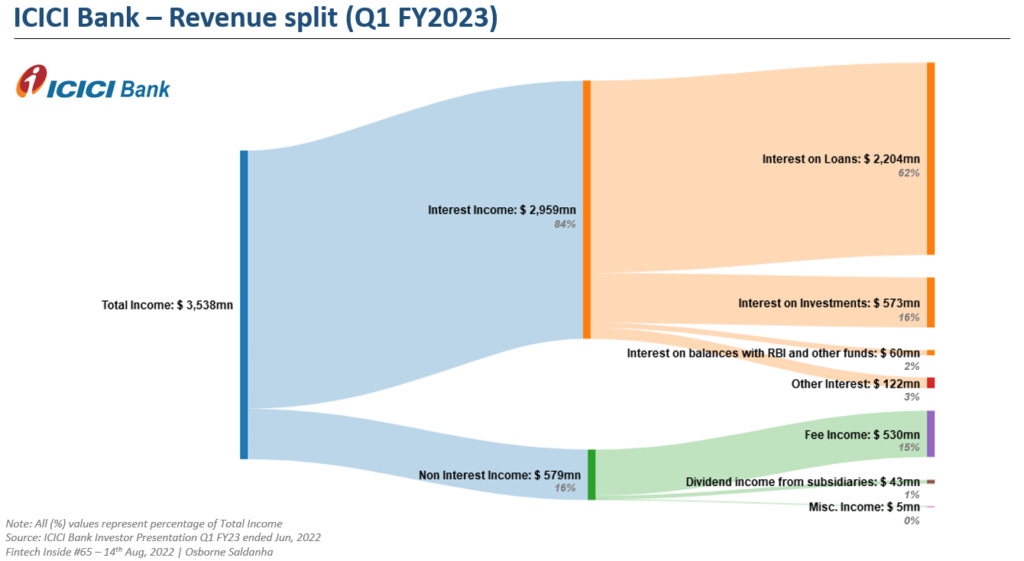

From a revenue perspective, we only need to look at our banks and learn which sources they earn their revenues from. One quick look at their financials helps us learn why lending is so important to build a large fintech or consumer startup.

Why banks? Banks can effectively launch any financial products (lending, insurance, payments, wealth etc.). They have distribution and they have user trust. Understanding where banks focus their attention could give us a clue on what can be innovated on. For the purpose of this exercise, and given the limited time I had, I've pulled together standalone revenue data from 5 of India's larger banks - SBI Bank, HDFC Bank, ICICI Bank, Axis Bank and Kotak Mahindra Bank. I've only used data from their latest quarter (Q1 FY23 ended Jun-22) but their historical numbers broadly conform to the observations below.

For the charts below, you start on the left with total income and as you go right, the revenue sources begin to split. In the charts, focus on the percentages of their income sources. Ignore the absolute numbers (although the absolute numbers for SBI and HDFC are crazy huge!). It's fascinating and surprisingly... standardised!

Note: All USD amounts mentioned in the images are converted from INR at USD 1 = INR 80. This post is not a stock recommendation and should not be construed as any financial advice.

First up, SBI. The split in this quarter is a little skewed because SBI had a loss of $819mn (no biggie!) on sale of investment which reduces the overall non-interest income. (Source for data)

To give you a "Business as Usual" sense of SBI's performance, let's look at the Q4 FY22 (ended Mar-22) revenue split. (Source for data)

Second, we have HDFC Bank. India's largest private sector Bank and second largest bank. (Source for data)

Third, we have ICICI Bank. (Source for data)

Fourth, Kotak Mahindra Bank - the youngest (20 year anniversary next year) among the five banks highlighted. (Source for data)

Fifth and finally, Axis Bank. Axis Bank, unfortunately, didn't share the split of its Interest Income. (source for data)

The private banks (HDFC, ICICI, Kotak and Axis) unfortunately don't share a split of their Fee Income. That would make for quite an analysis!

Some observations on the revenue split:

~85% of a bank's income is interest income i.e. income from lending, investments, deposits with RBI and other sources.

~62-65% of the banks Total Income is from lending. A large portion of this interest income is from a retail portfolio. I've not mentioned it here, but other than HDFC, the other banks' portfolios are ~70-80% secured i.e. secured loans against land, homes, auto, gold etc.

Except SBI, the banks make roughly half a billion dollars in fee income - this is income from loan processing charges, account maintenance fees, credit card MDR, payments and other such income.

~14-15% of the bank's total income is in the form of fees. SBI makes $~1bn, and as mentioned above, the private banks make $~400-500mm per quarter in fees, obviously on a user base of 5-10x that of fintech startups. Fintech startups can only dream!

The most important part to note about Fee Income is:

These banks have *extensive* distribution capabilities - both digital and offline. Just look at the distribution of all the banks (chart below).

The fees are automatically charged to customers and are mandatory. While banks usually upload their respective fee schedules, most users don't even know how to find it, even if they do, it's a litany of fees and charges that may or may not be applicable to their product/service.

Despite the best distribution and a largely opaque fee earning machine, Fee Income forms only 15% of the bank's Total Income. That says a lot!

The whole pitch of fintech startups is to give control back to users and do away with opaque pricing. Fintech startups are increasingly starting to charge processing fees and other charges to users. But I don't think it'll ever get meaningful enough to build a whole business around.

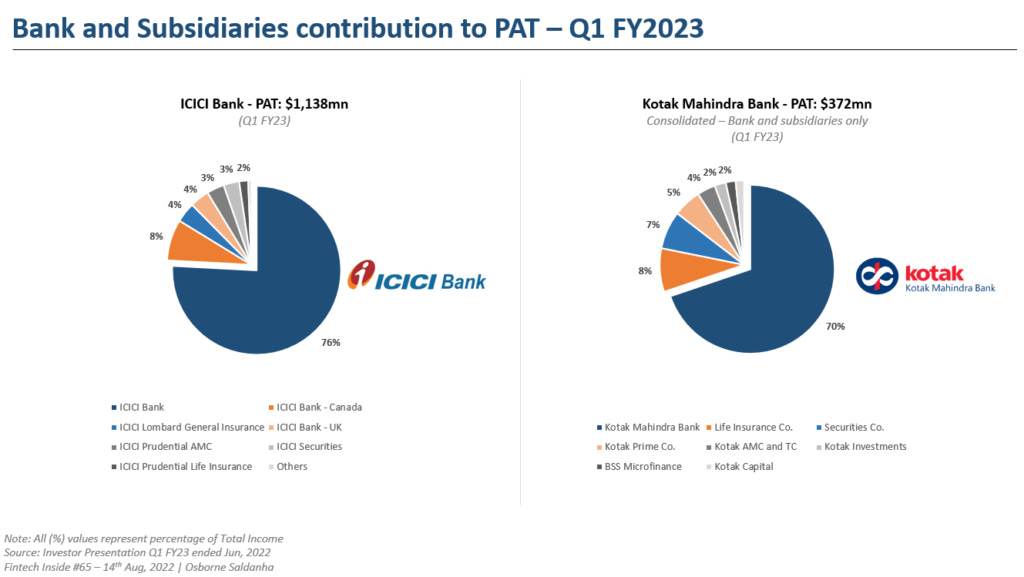

One might argue that banks run several financial businesses and surely the other business lines contribute significantly to the consolidated revenues. I don't know about consolidated revenue and source split (didn't have the patience to compile that data), but the banking business contributes ~70-75% of the consolidated profit after tax (PAT). So the banking (lending) entity is crucial to the bank's consolidated business.

I was only able to compile data from ICICI Bank and Kotak Mahindra Bank but again, largely standard across the industry.

The digital lending guidelines that came out on 10th Aug, 2022 are important in this context. Currently, the guidelines seem to only introduce additional bells and whistles to tighten consumer/borrower protection. The bigger challenge is RBI (India's central bank) tightening its grip on new licenses. Banking licenses are a distant dream, but receiving NBFC and other licenses are a challenge.

This turned out to be a long-ish post to basically say, lending business is crucial to financial services and therefore to fintech startups. There's still a lot of opportunity that banks are too risk averse to capture. Fintech startups and consumer startups are staring at this opportunity.

The next time you hear about a startup getting into the lending business, you know why!

I’d love your feedback and comments on this post. Write to me or reach me on Twitter, LinkedIn or Email at connect@osborne.vc.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

3️⃣ Fintech Top Three

(today’s post became too long. We’ll focus only on one important update from the past week)

1️⃣ RBI's new digital lending guidelines are... tame

RBI, India's central bank, released a notification that it has accepted certain recommendations by the Working Group on Digital Lending. There are certain recommendations (Annex 1) that need to be implemented by regulated entities immediately, there are certain other recommendations (Annex 2) that have been accepted in-principle but need further deliberation and lastly there are recommendations (Annex 3) that require wider engagement with the government and other stakeholders.

Takeaways: I called this notification "tame" because the industry expected much harsher regulations, especially around First Loss Default Guarantee (FLDG). I also say tame because the reputed, legitimate digital lending fintech startups have already had these measures in place. Business as usual for them. Digital lending fintech startups live to see another day!

Secondly, it seems RBI wants to go the "co-branded cards" way for digital lending as well. One partner acts as the customer acquirer only and the other does the lending. RBI clearly recognises the importance of fintech and partnerships but wants to limit activities that can be carried out. Founders, just apply for that license!

Some abbreviations before we dig in:

RE: Regulated Entity e.g. a bank, an NBFC etc.

LSP: a Loan Service Provider. An entity that acts as an agent of the RE and performs functions of originating, supporting with underwriting, collections etc. on behalf of the RE. E.g. your favourite fintech startup that doesn't have an operating license.

DLA: Digital Lending App. This can be the app of the RE or the LSP.

Some key aspects of the notification:

Loan disbursal and repayment should happen between bank account of borrower and lender: This is already status quo for unsecured credit, if I'm not wrong. There was a question of how this will work for secured loans for e.g. a car loan or a loan for a refrigerator where the loan amount is disbursed directly to the merchant. But RBI in its notification has said that exceptions will be made "for disbursals covered exclusively under statutory or regulatory mandate, flow of money between REs for co-lending transactions, and disbursals where loans are mandated for specified end-use as per regulatory guidelines of RBI or of any other regulator". The bigger question in my mind is how this will impact unsecured credit of BNPL or, technically, even credit card transactions. In both these transaction types, the loan amount goes from issuer (lender) bank account to the merchant account directly, not the borrower's account (*cough* PPI-based credit *cough*). One can argue that credit cards have specified regulations and that falls under RBI's "exceptions" but there's nothing for BNPL. Could this be the end of BNPL in India?

The LSP or DLA cannot earn a fee from the borrower: The LSP and DLA must only earn a fee for operations from the lender. This will impact the LSP's cashflows and consequently result in working capital issues, unless the fee payment is automated as opposed to end of month billing by the LSP to the RE. It's unlikely that things will get automated. Secondly, could this mean that LSP's will not be able to earn adequate processing fees or other penalty charges as applicable from the borrower?

Data access/storage: Aside from requiring LSP's and RE's request and access data like account aggregators (specific data requests, consent based permission, etc. etc.), RBI mandated that the DLA can only access need-based data and desist from accessing mobile phone resources such as file and media, contact list, call logs, telephony functions, etc. Restricting mobile data access is a trend generally in the market and apps continue to access this data. It's unclear how this will be enforced though. As part of Annex-2 (in-principle approval with further deliberation), RBI seeks to require LSP's and RE's keep an auditable log of every action that user performs along with their IP address and device information. Logging every user action is a big requirement and I wonder what the ramifications of this could be.

Reporting requirements: RE's will be required to report every single loan item, irrespective of tenor and ticket size, of a borrower, to Credit Information Companies (CIC's). This could mean that if you purchase a small item with credit, it'll show up in your credit report. Be ready for your credit report to be filled with rows and rows of small credit items. The industry was hoping for some way to avoid this issue but it seems RBI wants the borrower to have full knowledge of all credit lines issued to them.

FLDG and securitisation: First Loss Default Guarantee (FLDG) is used by a large part of the fintech sector. But it was a topic RBI refused to acknowledge. In this notification, RBI acknowledges it and talks of bringing about some structure. This is big for for smaller lenders in terms of bulk capital access and cost. The more interesting thing is that RBI mentioned that until there's a proper deliberation and structure in place, RE's will have to adhere to Securitisation rules. This is important! Securitisation is fairly well understood across the industry and has a proper regulatory framework. It could also mean that RBI will be inspired by securitisation rules while thinking about FLDG. This will help give FLDG some legitimacy and bring about standardisation.

Overall: All in, RBI is clearly thinking about borrower protection and wants to avoid the disastrous situation of the unofficial apps that charged user 800+% APR and lead to several suicides. This digital lending notification introduces and formalises a lot of bells and whistles required for this sector to grow.

🌏 International

Coinbase's market share of global spot trading volume among the top 15 crypto exchanges fell from 10.7% in January 2022 to 6.3% in July 2022. Ethereum's third and final proof-of-stake test merge went live on the Goerli test network, a dress rehearsal for the mainnet merge planned for September 2022.

Looking for the news digest? Read all the week’s fintech news and updates in India and SEA over at This Week in Fintech - India and SEA Edition.

🏷️ Other Notable Nuggets

🎵 Song on loop

Fintech updates can get boring, so here's an earworm: This week I was on a weird trip of listening to Gorillaz. Their song Clint Eastwood (Youtube / Spotify) was stuck in my head a little too much this past week. Sending you chill vibes!

👋🏾 That's all Folks

If you’ve made it this far - thanks! As always, you can always reach me at connect@osborne.vc. I’d genuinely appreciate any and all feedback. If you liked what you read, please consider sharing or subscribing.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

See you in the next edition.

Hi Osborne, You just shared the simple retirement stocks basket for every Indian.