Fragility of Banking | Fintech Inside #72 - 03rd Apr, 2023

Reflecting on the events that led to the collapse of four global banks, a day-by-day timeline of events and the key lessons for fintech startups.

Hi Insiders, I'm Osborne, Principal at Emphasis Ventures (EMVC).

Welcome to the 72nd edition of Fintech Inside. Fintech Inside is the front page of Fintech in emerging markets.

In this edition I reflect on the month that was for the global banking sector and what the lessons for Indian fintech startups. There’s also a full timeline, day-to-day of what transpired and led to the collapse of four global banks. You will find details on how banks work, what happened to each of the banks and my reflections on this month.

Raising funding for your early stage fintech startup? reach out to me connect@osborne.vc

Enjoy another week in fintech!

🤔 One Big Thought

The fragility of the banking sector

Disclaimers:

I'm not an economist or financial expert by any stretch of imagination. This post is intended for educational and entertainment purposes only.

This edition is written to look back and learn at the events in the banking sector over the past month. But it's written more for myself - to make sure I truly understand these events and what caused them. If it helps you learn in the process, that's a big win for me.

There's a lot more I wish I could cover in a newsletter format, but I could not. There are a bunch of concepts that I found fascinating, for example mortgage backed securities, credit default swaps, reserve ratios and much more, that I could not get into details about. However, this post is intended to explain what happened in banking without prior knowledge of those concepts. If you'd like me to cover those concepts, please let me know.

In just a couple of weeks (which felt like an eternity), we've witnessed, almost in real time, four large banks go down - Silvergate Bank ($11bn in assets, US, banker to crypto), Signature Bank ($114bn in assets, US, banker to crypto), Silicon Valley Bank ($212bn in assets, US, banker to startups) and Credit Suisse ($570bn in assets, Switzerland, global systematically important bank).

To safeguard customer deposits, protect the banking system and avoid a global financial crisis, the governments and central banks of US and Switzerland stepped in fairly quickly to backstop the falling banks and find some resolution for each of them.

Silvergate Bank's stock price was down 95% from its record high and announced it is closing and will be returning deposits.

Signature Bank faced record withdrawals because of SVB and the US FDIC stepped in to assure depositors that all deposits will be insured.

Silicon Valley Bank (SVB) depositors were assured by US FDIC that all deposits will be insured and the bank filed for Chapter 11 bankruptcy (meaning SVB can continue operations and restructure its obligations until a suitable buyer is found).

Credit Suisse (CS) was acquired by UBS for $3.2bn in a government brokered deal.

While all four banks made it to the news, the most talked about were SVB and CS - because of their size and because of how they went down.

Before we dig in, here are some numbers on SVB and CS -

SVB: (as on 28th Feb 2023, sources: SVB Mid-Quarter Update Q1 2023, Sign House, SVB Investor Relations)

$15.9bn - market cap just before the collapse.

$7.4bn - revenue for FY22

$1.5bn - profit for FY22

$74.3bn - net value loans disbursed and outstanding.

$169bn - total value of customer deposits held.

$212bn - total value of assets.

$42bn - customer withdrawal requests in 24 hours on 09th Mar, 2023.

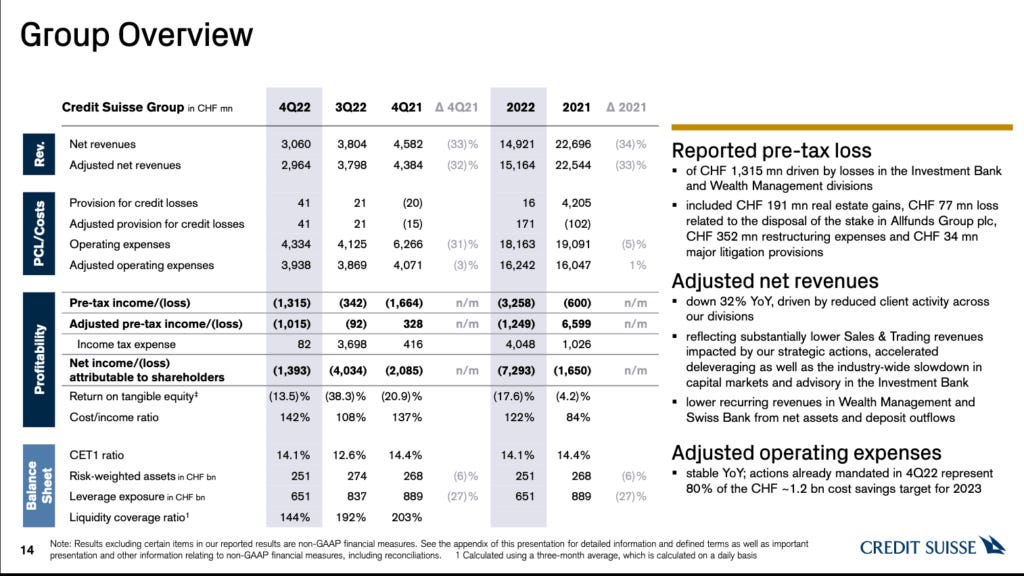

CS: (for the year 2022 unless otherwise stated, Sources: CS Annual Report, Wall Street Journal)

$12bn - market cap at the end of 2022

$3.1-3.2bn - value at which UBS acquired CS on 19th Mar, 2023

$16.2bn - net revenue.

$3.54bn - net loss.

$287bn - net value loans disbursed and outstanding.

$570bn - total value of assets (-30% YoY).

$121bn - customer withdrawals in Q4 2022 (ending 31st Dec, 2022) and $10bn a day for a week before reporting "material weakness" in its financial reporting.

A timeline of bad timing events:

2020: Covid struck and record funds were being injected into the system by governments globally to stimulate our economies. One big beneficiary of lots of capital in the system and near zero interest rates was SVB. Between 2020 to 2022, SVB added (slide 16 of SVB's annual report) $131bn of customer deposits. (Keep this fact for later)

Nov, 2022: FTX, a crypto exchange, collapsed. There was a CoinDesk report highlighting potential leverage and solvency concerns. Heralded as the "Lehman moment" or the "Enron of the 21st century", FTX's collapse brought down the entire crypto market to less than $1tn in total market cap.

Thu, 02nd Mar, 2023: Silvergate Bank notified the exchanges that it will delay filing its annual report for 2022. Unfortunately, post FTX's collapse, Silvergate Bank, the main bank to largely crypto startups and acquirer of Meta's (Facebook) Diem blockchain payment platform, saw massive withdrawals that made it difficult for the bank to maintain cash reserves. The bank's stock price dropped 57.7% in one day!

Wed, 08th Mar, 2023: Silvergate Bank announced that it will voluntarily wind down and liquidate the bank.

Wed, 08th Mar, 2023: SVB announced that it is raising $1.75bn of which General Atlantic committed to invest $500mm. In the announcement, it added, "SVB sold approximately $21 billion of securities, which will result in an after tax loss of approximately $1.8 billion in the first quarter of 2023". This was a fairly standard statement and fairly standard capital raise announcement for a bank. Unfortunately, it was announced the same day as the Silvergate Bank winding down announcement.

Thu, 09th Mar, 2023: Panic ensued. SVB saw $42bn in withdrawal requests. It's stock price dropped 60%. Greg Becker, SVB's CEO, held a 10-minute conference call with customers asking them to "stay calm".

Thu, 09th Mar, 2023: Credit Suisse announced that it would be delaying the release of its Annual Report for 2022 after receiving a call from the US Securities and Exchange Commission (SEC) regarding revisions to its cash flow statements for FY2019 and FY2020.

Fri, 10th Mar, 2023: Californian regulator closed SVB and placed the bank under receivership with US Federal Deposit Insurance Corporation (FDIC).

Sun, 12th Mar, 2023: The US Federal Reserve, Department of Treasury and FDIC issued a joint statement that they approved actions to complete SVB's resolution while fully protecting all deposits and allowing customers to access their deposits from Mon, 13th Mar, 2023. In the same statement, it was announced that Signature Bank, another crypto-friendly bank, was also shut down by the New York regulators and placed under receivership with the FDIC while also protecting all deposits.

Tue, 14th Mar, 2023: Credit Suisse announced that it found "material weaknesses" in its financial reporting process for 2021 and 2022.

Wed, 15th Mar, 2023: In an interview, the Chairman of the Saudi National Bank, which owned 9.9% of Credit Suisse, replied to a question that it would "absolutely not" provide CS with any further financial assistance. This was a fairly standard statement to make, as the Chairman of the Saudi National Bank further explained that investing any more money would result in it holding more than 10% of a global bank which comes with significant regulatory compliances. The bank's stock dropped as low as 30% but ended the day 24% down from open.

Thu, 16th Mar, 2023: The Swiss National Bank announced it would lend $53.7bn (CHF 50bn) to CS to tide with its regulatory issues.

Fri, 17th Mar, 2023: SVB applied for a court-supervised Chapter 11 bankruptcy reorganisation.

Sun, 19th Mar, 2023: UBS announced that it will acquire CS for $3.2bn (CHF 3bn).

Sun, 26th Mar, 2023: SVB was sold to First-Citizen Bank and Trust Company.

In the week ended 22nd Mar, 2022, US commercial banks saw net withdrawals of $125.7bn.

While the pain seems like it's over for now, Deutsche Bank (DB) shares dropped 8.5% by market close on Fri 24th Mar, 2023 and 24% till Friday for the month of Mar, 2023. There are some worries in DB's $42tn derivatives book.

Why did these announcements have to be made almost simultaneously? The announcements from the banks are isolated from each other and coincidental but also needed to be made due to each one's regulatory requirements.

Why does this timeline matter? Fear and panic exposed the fragility of the global banking system. It took centuries (CS) and decades (Silvergate, Signature, SVB) for customers to build trust in each of those banking institutions, but it took mere days for users to lose that trust entirely. This is the first time events like these are happening in our hyper-connected, instant gratification, digital age. Fear and panic spreads digitally even more like wildfire and that's what connected the collapse of these banks. What's incredible to see was the governments and central banks of US and Switzerland acting fairly quickly to avoid a contagion across the global financial system.

In India, we've witnessed similar events in the banking sector and each time, RBI was quick to intervene with a resolution. In Sept, 2018, the asset-liability mismatch at IL&FS, with a combined debt obligation of INR 90,000crs ($11bn), came to light, causing serious fear of a systemic risk in India's financial sector. In Sept, 2018, PMC Bank's financial misreporting of 97% GNPA was revealed, leading to a bank run which was later curtailed by RBI imposing a withdrawal restrictions. In early Mar, 2020, RBI superseded YES Bank's board “owing to serious deterioration in the financial position of the Bank”. This caused a lot of panic and could have cause a bank run but RBI capped withdrawals per account at INR 50,000 ($610).

Before we proceed, a quick refresher: how does a bank work?

A Bank is a lender. It takes customer deposits (liabilities - what the bank owes us) and gives out loans (assets - what borrowers owe the bank). To explain this concept as an example, I deposit $100 with my bank that gives me 4% for keeping money with the bank. The bank, in turn, lends out my deposit to a borrower at 6% interest. At the end of a year, my bank earns $106 ($100 principal + $6 interest income) and gives me $4 (my $100 is still kept with the bank) with a net interest income to the bank of $2. In Edition 65 on 16th Aug, 2022, I wrote about Indian banks have 62-65% of their total income coming from lending alone!

Additionally, it is important to note that banks cannot lend out 100% of my deposits. The bank needs to leave a certain amount (liquidity) of my deposit with them because I have daily expenses or I may have to withdraw cash or any other needs. Maintaining this percentage of cash reserves is extremely crucial in running a bank but more importantly to build trust with users that their money is safe and that they can access their money at any time.

Fun fact (at least to me): financial institutions are the only entities where one can see loans on the asset side, whereas loans are liabilities for all other companies.

What went wrong and what lessons can fintech startups learn?

Too much capital is not always a good thing for businesses:

In SVB's case, it's deposits grew faster than the pace at which it could put those deposits to work. As mentioned above, SVB's deposits grew by $131bn in 3 years but its lending operations couldn't keep pace. As of Feb 2023, SVB had $74bn in average loans and $169bn in deposits (slide #17). What did it do with all that deposit capital? Invested it - in seemingly safe, standard assets that any bank typically invests, instead of lending it. A typical bank would have lent out that money, but SVB was not a typical bank and hadn't seen or dealt with that much capital in its 40-year history.

Lesson: If you're not sure what you're doing, too much capital can be a bad thing. A few founders even admitted to me that raising excess capital was a bad thing for their startup. It made them over hire, over pay, take large office spaces that they closed after 6 months, spend frivolously, focus on non-core products/features and overall created bad habits that led to bloat in the system. There was a general lack of planning that led to it. To be clear, I'm not saying don't raise capital - raise as much as is needed and some buffer, but plan strategically and be crystal clear on how you're going to use it.

Asset Liability Mismatch:

With SVB, their assets (investments) were held in long term, liquid securities that kept reducing in value thanks to the increase in interest rates. They didn't have the capital to maintain their reserve capital required to deal with customer withdrawals (startup cash burn i.e. liabilities) in the near term.

Lesson: We of course know the problem of spending too much capital today in the hope of making revenue at some time in the future. Most startups in the ecosystem built up their costs (liabilities) in the near term with little/no visibility on revenues (assets). More recently, profitability has become a buzzword, but I think focus on revenue is more important, profitability is a function limiting costs which is in the startup's control.

Concentration risk:

Each of the four banks had a concentration to a particular type of customer base. In SVB's case it was startups, in CS's case it was wealthy customers, in Silvergate's case it was crypto. In some sense, their concentration in customer base led to their downfall. It didn't seem like in this concentrated user base, there was any further concentration in users e.g. SVB's top 10 customers held $13bn in deposits i.e. 7.7% of total deposits.

This is a risk factor I didn't consider in my editions on vertical neo banking (Edition #13 Dec 2020) and vertical financial services (Edition #69 Feb 2023). I've only considered this risk factor narrowly for the case of small business lending i.e. my theory is any shocks in the market will first impact small businesses and delinquencies could rise as a consequence. Guess I need to reevaluate my position on this risk factor.

Lesson: It'll be easy for me to say diversify your user base, but I don't have a well formed opinion on how to avoid a concentration risk. If you've thought about this, I'd love to chat.

Communication is important:

Communication with their customers became an important factor for the banks until fear took over and caused a bank run. More importantly, without the messages from the FDIC and Swiss National Bank, who knows what could have happened to the global financial system. In the four banks cases, they were required by regulation to communicate the situation in time - there are pros and cons of that.

Lesson: In times of crises, communicating with key stakeholders could make or break a company. For most of the startups, over-communicating with their trusted shareholders could ease their nerves and give them confidence that the founders know what they're doing. Sending regular updates, communicating important decisions or even preempting a concern could go a long way in building trust in times of crises.

The events of the past month were horrific to go through in real time - all of us were on edge hoping another domino doesn't fall somewhere else. While these events teach us some important lessons, the most important lesson of all is Trust is fragile but in banking and financial services it's even more fragile. To be a successful fintech startup, don't just provide a slick user experience, work to earn your customer's trust.

What did you think of today's edition of Fintech Inside? What are your takeaways from the events in the banking sector this past month? Anything more you'd like me to cover? Keen to hear from you.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

🌏 International

Binance and its CEO Changpeng Zhao have been charged with violating U.S. regulations in federal court - Binance saw net outflows of $2.1bn. Apple launched Pay Later product for US customers. Visa and Mastercard are in talks to separately acquire Pismo, a Brazilian payments and banking platform. Block stated that 44mm of its 51mm users are verified users as of Dec, 2022.

🏷️ Other Notable Nuggets

🎵 Song on loop

Fintech updates can get boring, so here's an earworm: Flowers by Miley Cyrus (Youtube / Spotify). Love the vibe of the song and the subtle digs by Miley.

👋🏾 That's all Folks

If you’ve made it this far - thanks! As always, you can always reach me at connect@osborne.vc. I’d genuinely appreciate any and all feedback. If you liked what you read, please consider sharing or subscribing.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

See you in the next edition.