Circle Payments Network | Fintech Inside #92 - 28th April, 2025

Circle's USDC-Based Network: A Solution for Slow, Expensive International Money Transfers?

Hi Insiders, I’m Osborne, an investor in early stage startups.

Welcome to the 92nd edition of Fintech Inside. Fintech Inside is the front page of Fintech in emerging markets.

Been thinking a lot lately about the plumbing of global finance. We live in this incredibly connected world – instant messages, global e-commerce, video calls across continents. Yet, sending *money* across borders often feels like wading through sludge, stuck on infrastructure built for a pre-internet era. Why the disconnect?

It’s this tangled mess – the global spaghetti of correspondent banks, SWIFT messages, and opaque fees – that holds back businesses and individuals. So, how do we fix it?

This week's edition explores a company stepping up with a potential infrastructure upgrade: the Circle Payments Network (CPN). They're aiming to build new, internet-native rails using stablecoins. Could this finally untangle the knots? Let's dig in.

As usual, there’s also a beautiful song recommendation at the end, if you’d like to listen to a song in the background while you read this. Do share your recommendations with me too :)

Thank you for supporting me and sticking around. Enjoy another great week in fintech!

🤔 One Big Thought

Untangling the Global Spaghetti: Can Circle Fix Cross-Border Payments?

Over the past month, I've had two very diametrically opposite experiences with cross border payments from India.

I was in Sri Lanka recently and made my first International UPI payment. It felt natural/normal - pulled out my phone, scanned the QR code, entered my UPI pin, 15 seconds later the payment was successful and I walked out of the store with my stuff. The problem is that QR acceptance was abysmal in Sri Lanka and banks charge 3% fees for all digital payments, apart from the forex fees. This led me to the insight that for International UPI to work, you need other countries to have a wide spread QR acceptance network - but this is topic for another day.

On the other hand, I wanted to make a transfer to GIFT city for an investment in US. I struggled for 3-4 weeks. First I walked up to my bank branch and told them I wanted to make a transfer to GIFT city, the teller thought I wanted to buy a GIFT card! No jokes! Unfortunately, I had to resort to calling anybody and everybody I knew at my bank, signed physical documents, sent in a physical cheque (which by the time it got delivered to the bank, the forex rate changed, so I had to send it again). But finally, after all of that running around, I managed to get the transfer done.

The pain is real. Anyone want to join my GIFT city remittance survivors support group?

In today's digital world, our global economy has never been more interconnected. Every day, trillions of dollars flow across borders, supporting international trade, supply chains, remittances, and digital commerce.

Businesses source materials from one continent, sell to customers on another, and collaborate with teams scattered across time zones. E-commerce has made global marketplaces accessible from our phones, and communication is instant, virtually free.

There in lies the paradox: while we can instantly stream movies, video chat with colleagues across the world, or order products from thousands of kilometers away, one critical aspect of our global economy remains stubbornly anchored in the past: the infrastructure that moves our money around the world.

Moving money across borders remains frustratingly slow, expensive, and opaque. It's like having a high-speed train network forced to run on decades-old, narrow gauge tracks.

The Broken State of Cross-Border Payments

I know I'm not alone in experiencing the pain of sending money across borders. Anyone who's dealt with international wires knows the pain points all too well.

Despite technological advances in nearly every industry, cross-border payment systems continue to rely on frameworks established in the pre-internet era. The correspondent banking system that underpins international wire transfers emerged in the 1970s, designed for a world that bears little resemblance to our digital-first, global economy.

The consequences of this outdated infrastructure are felt by businesses and individuals worldwide:

The Plumbing: At the heart of the old system lies "Correspondent Banking". Banks hold accounts with each other in different countries – Nostro ("our" money held by them) and Vostro ("your" money held by us). To actually move money, they send instructions back and forth using SWIFT, a secure messaging system. SWIFT standardises the message (codes, language etc.), transfers the message, audits the messages, but doesn't move the money itself. A typical cross-border payment relies on and passes through 3-5 financial institutions, each adding their own fees and potential delays.

Banker's Hours: Global commerce operates 24/7, but the banking system largely doesn't. Time zone differences and bank holidays create frustrating bottlenecks in the SWIFT message chains and settlement processes.

Eye-Watering Fees: All those hops cost money. Sending money internationally is expensive. The global average cost of sending $200 was 6.65% and doesn't include forex conversion rates. This is painful for small businesses and individuals sending remittances home.

Settlement Limbo: Forget real-time, because of the messaging delays and reliance on Nostro/Vostro reconciliation, traditional cross-border payments can take days, sometimes even longer, to actually settle. This uncertainty wreaks havoc on cash flow planning for businesses and leaves individuals waiting anxiously for critical funds.

The Black Box Effect: All of the above lead to the eternal question - where is the money? Often, neither the sender nor the receiver have clear visibility into the payment's journey through the correspondent banking maze. Good luck getting anyone in the banking system to

As per RBI, "South Asia continues to offer the lowest remittance transaction costs worldwide, with an average of 5.8 percent for sending $200 (Migration and Development Brief 40, June 2024). This rate represents 80 basis point reduction from the global average of 6.4 percent in the same period. However, it still exceeds the Sustainable Development Goals (SDG) target of a three percent ceiling, underscoring a critical area for improvement."

Think about an importer waiting days for a payment to clear, potentially missing supplier discounts or delaying production. Or imagine a freelancer losing a significant chunk of their earnings to FX fees and wire charges. Or a family reliant on remittances seeing the value eroded before it even reaches them. This isn't just friction; it's a tax on global economic progress.

The Innovation Landscape: Startups (and Incumbents) Chip Away

Naturally, where there's friction, there's innovation. The fintech sector has recognised these problems, leading to a wave of startups developing solutions to improve aspects of cross-border payments. They can be categorised broadly into three kinds:

Forex Specialists: Companies focused on providing better FX rates and faster transfers for specific corridors (e.g., Wise, Remitly, Niyo).

Blockchain & Crypto Solutions: Using cryptocurrencies or stablecoins for faster, cheaper settlement, though often facing regulatory hurdles and volatility concerns.

B2B Payment Platforms: Building rails specifically for business payments, streamlining invoicing and reconciliation.

Globally, startups have begun to chip away at the market share of incumbents and they're starting to take notice.

Back in March 2020, Visa announced it was piloting settling transactions directly in USDC over the Ethereum blockchain, partnering with Crypto.com and using Anchorage Bank as a custodian.

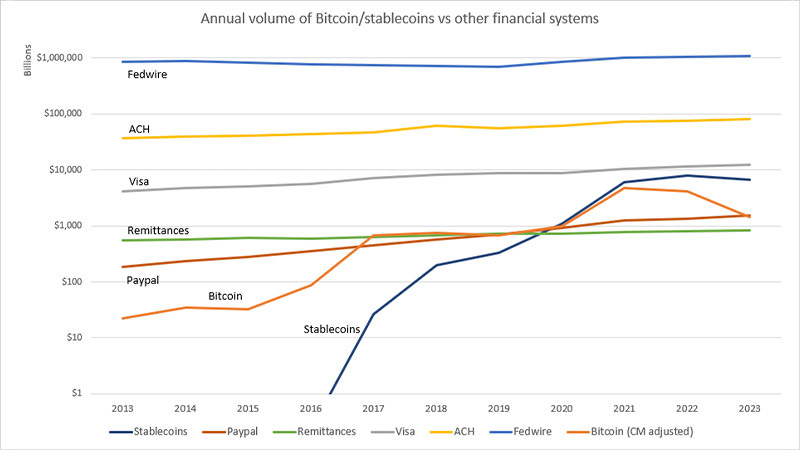

In 2023, Paypal announced the launch of its stablecoin PYUSD. This past week, it announced offering a 3.7% yield on PYUSD holdings and a rewards program, attempting to make its stablecoin more attractive to end users. Just last week, it was reported that the total stablecoin transaction value crossed past Visa's but Visa believes that's not true if you remove bots and other use cases of stabelcoin transactions. It even released a dashboard to make sense of stablecoin data.

Stripe is not far behind either.

As mentioned above, UPI has its own ambitions for international payments. I've covered it in some detail in the previous edition #91. Alipay is another major payments institution and the world is sleeping on its global expansion network. We all are disregarding just how widespread Alipay acceptance is across Asia, Africa and Europe for over 900M Chinese users of Alipay.

In that same previous edition of Fintech Inside, I also covered Nexus Network that the central banks of Singapore, Malaysia, India and others in SEA are building. Now, a few digital asset providers in US have come together to build the Lynq network.

This is a major signal – incumbents acknowledging the need to improve cross border payment rails and potentially use stablecoin as a vehicle to address it.

Circle Payments Network: A New Coordination Layer?

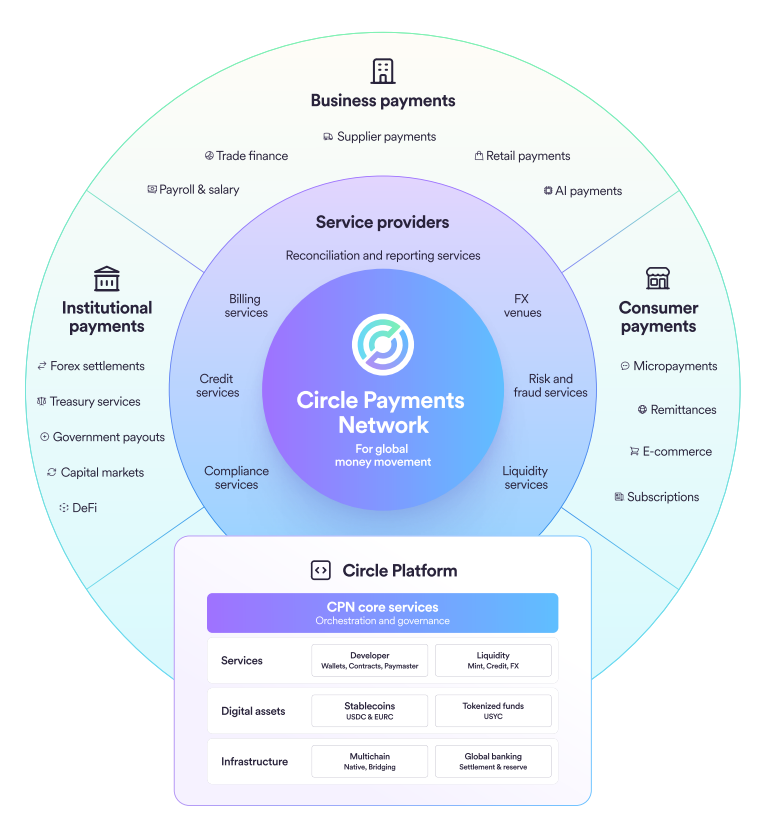

Enter Circle Payments Network (CPN). Circle, the second largest issuer of USD-backed stablecoin after Tether, announced the launch of CPN to serve as a new protocol layer in a comprehensive, open, and internet-based settlement system, with regulated payment stablecoins like USDC and EURC at its core.

Instead of just building another payment app or focusing on a single niche, CPN aims to be a foundational coordination layer connecting existing financial institutions in a new way. Conceived as a network, CPN enables banks, payment service providers, and digital asset-native financial institutions to connect directly with each other through a trusted counterparty framework.

Circle wants you to think of CPN less as a direct payment rail and more as an intelligent, compliant switchboard for global money movement, built for the internet age, leveraging stablecoins. It seems to want to get rid of the entire correspondent banking system we've all come to know and hate.

Here’s what makes it interesting, IMO:

Stablecoin Core: CPN leverages regulated, fiat-backed stablecoins like USDC (USD-backed) and EURC (EUR-backed) as the primary settlement asset. This offers the speed and global nature of digital assets combined with the stability required for institutional finance.

Compliance by design: From the ground up, CPN seems to be designed with compliance and governance at its core. CPN wans to upgrading stablecoins within regulatory frameworks, including robust AML/CFT standards and KYC/KYB checks for participating institutions.

Near-Instant Settlement: By reducing intermediaries and using blockchain rails for the value transfer leg, CPN facilitates near real-time settlement across borders, 24/7/365.

Lower Costs: Fewer intermediaries inherently mean lower transaction costs compared to the multi-hop correspondent banking system involving Nostro/Vostro accounts and SWIFT fees.

Programmability: Built on blockchain principles, CPN opens the door to programmable payments and smart contract integration, enabling new use cases beyond simple transfers (think automated escrow, conditional payments, etc.).

Importantly, similar to Visa, CPN does not seem to want to move funds directly; rather, it wants to serve as a marketplace of financial institutions and acts as a coordination protocol that orchestrates global money movement and the seamless exchange of information.

How CPN Works

Imagine a US business needing to pay a supplier in Mexico:

The US business initiates the payment via their bank or payment provider (the Originating Financial Institution - OFI).

The OFI, connected to CPN, converts the USD to USDC (or uses existing USDC) - crypto on-ramp.

CPN facilitates discovery and connection with a suitable partner institution in Mexico (the Beneficiary Financial Institution - BFI). This involves checks on compliance, capabilities, and FX rates if needed.

The USDC is transferred almost instantly over supported blockchain networks to the BFI.

The BFI receives the USDC, converts it to Mexican Pesos, if required (crypto off-ramp), and credits the supplier's local account.

The key is that CPN orchestrates this flow, ensuring compliance data is shared appropriately (like FATF Travel Rule info), FX can be handled efficiently (potentially via integrated venues), and settlement occurs rapidly between trusted, vetted institutions, potentially reducing the need for multiple SWIFT messages and Nostro/Vostro hops.

This model benefits:

Businesses: Faster supplier payments, quicker receipt of international sales, improved treasury management, reduced working capital requirements, and simplified operations.

Individuals: More value reaching recipients and less uncertainty about when funds will arrive. Potential for low-cost micropayments.

Financial Institutions: Access to modern, efficient, global payment rails; new product opportunities; reduced operational complexity for cross-border transactions.

The Future Outlook: Towards the Finternet?

CPN is an interesting solution to modernising out global financial networks and making it truly internet-native. CPN seems to be the practical implementation of the "Finternet" – a concept explored by folks at the Bank for International Settlements (BIS). The Finternet envisions multiple, interconnected financial ecosystems, much like the internet itself, designed to be user-centric, interoperable, and leveraging technologies like tokenization and unified ledgers.

I've long held the belief that nothing will shake Visa or Mastercard from its duopoly position. They're just so well rooted into the banking system. The wave of nationalistic protectionism globally is one reason that stronghold could be weakened, but CPN makes for a compelling reason as well.

Even SWIFT is so engrained in the process for cross border payments among banking systems, that it seems tough to even think that CPN will kill SWIFT. Banks today are incentivised to keep things status quo, they lose all incentive and control by working with CPN. However, Standard Chartered, Deutsche Bank and others are pilot partners with CPN on this network. Let's see how it works.

Further, CPN works in countries where there are existing stablecoin/crypto regulations. Most countries globally are cautiously adoption stablecoins and introducing regulations, with the big exception of India. India has stifled growth in the market by introducing prohibitive tax and requiring approvals from the Financial Intelligence Unit to operate a crypto/stablecoin platform.

Growing adoption for CPN is not going to be easy - there're so many moving parts, entities and systems to integrate. It's a gargantuan undertaking, IMO.

It's perhaps more accurate to see CPN as an alternative set of rails designed for the digital asset age, potentially complementing or competing with traditional systems depending on the use case. It could significantly disrupt traditional B2B cross-border settlement and remittance corridors currently dominated by the old correspondent banking model.

The journey requires network adoption, continued regulatory clarity, and seamless integration. But CPN, and the broader move towards stablecoin-based settlement and the Finternet vision, present a compelling picture of a future where moving value globally is as easy as sending an email. It’s definitely one to watch.

What do you think? Is CPN the missing piece, or just another layer in a complex puzzle? Let me know your thoughts.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

🎵 Song on loop

Fintech updates can get boring, so here's an earworm: Discovered only recently that Billie Eilish’s brother Finneas has his own solo tracks. This one - For Cryin’ out Loud (Youtube / Spotify) makes for easy listening and you’ll very quickly find yourself singing the lyrics during the day. The trumpets and saxophone are added benefits.

✨ Call outs

Video interview of Fred Wilson and Brad Burnham, founders of Union Square Ventures, reflecting on the last 20 years of their journey with USV. Excellent excellent interview of the two legends - no fluff, just straight insights, strategy and grit.

The Studio on Apple TV (trailer). I love Seth Rogen and he’s really knocked it out of the park with the Studio. Funny, easy watch but visibly made with a lot of love for the movies and music.

Video on Why Going To Space Costs So Much. In the process of explaining why rockets need to be reusable, this video goes into a lot of detail about the business model of space - the revenue, costs, margins, logistics and so much more.

👋🏾 That's all Folks

If you’ve made it this far - thanks! As always, you can always reach me at os@osborne.vc. I’d genuinely appreciate any and all feedback. If you liked what you read, please consider sharing or subscribing.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

See you in the next edition.

Really insightful read on Circle Payments Network and how it’s shaping the future of fintech! The way payment infrastructure is evolving reminds me of how regulatory frameworks like the ISP License in India are also driving innovation in connectivity and financial inclusion. Excited to see how such ecosystems continue to overlap and create new opportunities.

Visit For More Information: https://www.registrationwala.com/isp-license