Trade, Tariffs and Finance | Fintech Inside #91 - 07th April, 2025

US tariffs trigger $6tn US market crash and potential trade war as global financial system faces biggest upheaval since 1930. What's next for trade, inflation, and digital currencies?

Hi Insiders, I’m Osborne, an investor in early stage startups.

Welcome to the 90th edition of Fintech Inside. Fintech Inside is the front page of Fintech in emerging markets.

The world of international trade was thrown into turmoil on April 2nd when the US announced sweeping "Reciprocal Tariffs" on imported goods from over 100 countries, with rates ranging from 10% to 54% for China.

The aftermath was immediate: $6 trillion wiped from U.S. markets in just two days, retaliatory tariffs from major economies and uncertainty around global freight movement. These represent the most dramatic tariff hikes since the Smoot-Hawley Act of 1930 - a move that ultimately deepened the Great Depression.

As stock markets plummet and countries scramble to respond, this edition explores how these tariffs might reshape global trade patterns, financial systems, and digital currencies in ways that could permanently alter the economic landscape we've known for the past 60 years. The dust has far from settled.

This is a long edition, buckle up.

Thank you for supporting me and sticking around. Enjoy another great week in fintech!

🤔 One Big Thought

Trade, Tariffs and the World’s Financial System

Disclaimers:

I’m not a global trade expert and don’t fully understand all the first order, second order effects of the recent tariffs imposed. This is an evolving situation, so I could be wrong about certain potential effects.

I’m also not a finance historian. There’s a lot of reference to World War 1 and 2 along with the financial systems put in place then. I’ve tried retelling some of that history to give context for this piece. If you find any factual errors, please notify me about it.

The global trade status quo was thrown in a tizzy last week - that's not something you read everyday or at least in the past 60 years. In case you were living under a rock, here's what happened. In an event on 2nd April the US president introduced new, increased "Reciprocal Tariffs" on goods (not services) imported from all countries that want to sell into the US.

A tariff is a government imposed tax on goods or services imported from another country. The tariffs themselves are not new for any country. All countries have their own tariffs, including in India which is why most imported goods cost so much more in India vs buying from another country. The tariff is a common financial tool used by governments the world over for various purposes including protecting domestic industries/manufacturing, revenue generation or for trade policy negotiation.

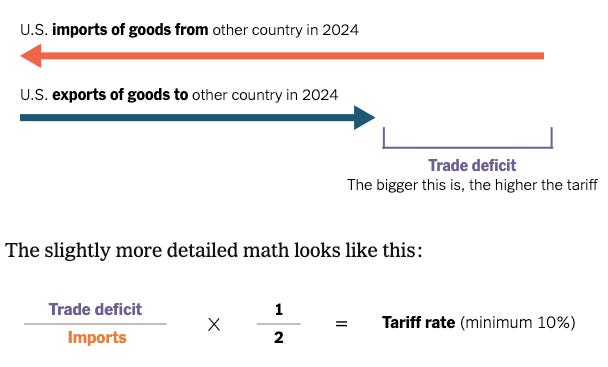

The tariff rate introduced was calculated not just on the respective country's tariff for US produced goods, but also included considerations of US trade deficit with the country, currency differences or any other taxations on the US.

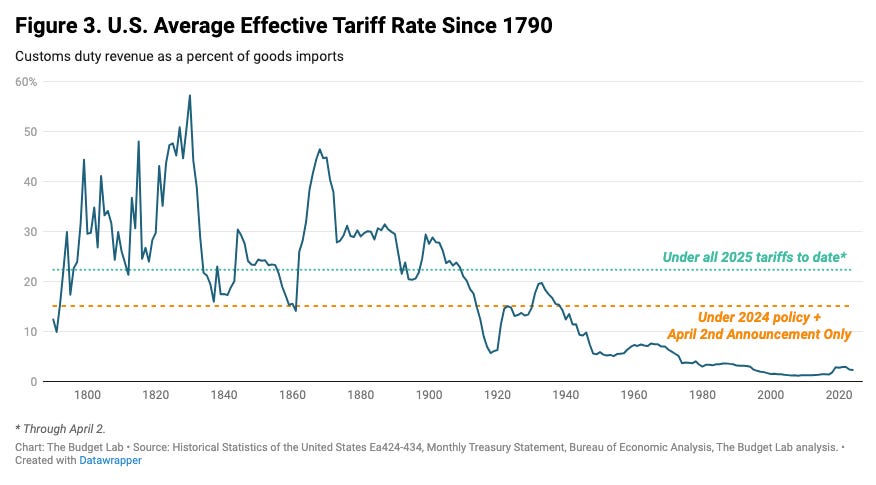

This event was a significant moment in world history because the hike was unprecedented. The US introduced tariffs on more than 100 countries ranging from a minimum 10% to 46% for Vietnam and 54% for goods from China. This is reportedly the most sweeping tariff hike since the Smoot-Hawley Tariff Act, the 1930 law best remembered for triggering a global trade war and deepening the Great Depression. The April 2nd action is the equivalent of a rise in the effective US tariff rate of 11.5%. The average effective US tariff rate after incorporating all 2025 tariffs is now 22.5%, the highest since 1909.

On a lighter note, tariffs were also introduced on Heard and McDonald Islands, a territory south-west of Australia near Antarctica which is only accessible via a seven-day boat trip from Perth, and hasn't been visited by humans in almost a decade but is only inhabited by penguins.

The most exciting time to study game theory: The shockwave of these tariffs were felt the world over.

The US stock markets lost $6trillion in the following two days.

US company stocks that imported from China, Vietnam, Cambodia and others took the most hit.

Stock markets in other countries also plummeted by 6-7%.

China introduced its own 34% Reciprocal Tariffs on goods from US, so did Brazil and others.

Countries like Spain introduced billions of dollars in Aid to soften the blow from this tariff event.

While some countries like Germany are looking at Mexico, Canada and India as "greener pastures" for alternative consumption hubs, some other countries are instead headed to the negotiating table with US.

Before the tariffs were even announced, China, Japan and South Korea held a "Regional Economic Dialogue", the first in five years, to grow trade regionally and jointly respond to Trump's trade tariffs.

Let's not forget, the "Hands-Off" protests across all 50 states in the US - these are not only protests against the tariffs, but also against what they saw as a "hostile takeover" by billionaires, cuts in federal funding for vital programs and assaults on marginalized communities

How will this affect the global trade "equilibrium"?

Trade: Global trade will be in disarray over the next 12 months at minimum. Reorienting trade agreements, the entire global logistics infrastructure, the global financial infrastructure and more - is no joke. There's a ton of moving parts that have a ton of inertia. It's not going to move easily. Furthermore, countries may very well decide it's too much hassle to deal with the US as there's a bit of ego involved, domestic politics in each country and much more at play. Best time to study game theory!

GDP: The US is an important consumption hub: two-thirds bigger than EU consumption, according to World Bank data. So, this tariff on imported goods can meaningfully hurt some nations. Some estimates, suggest that nations could see a 0.5% to 2.5% reduction in GDP over 2025-2027. One recent estimate puts the China GDP reduction at 2.5% within 2025 alone. The tariffs are expected to reduce the US and India GDP's by 30-60 bps each. Per JP Morgan, "according to the IMF, a universal 10% rise in U.S. tariffs, accompanied by retaliation from the euro area and China, could reduce U.S. GDP by 1% and global GDP by roughly 0.5% through 2026. Roughly half of the GDP decline from higher tariffs is attributed to a negative sentiment shock related to rising trade policy uncertainty."

Inflation: Someone has to bear the cost of tariffs. If there's demand despite tariffs, the consumer will have to bear the cost of tariff, if there's no demand because of tariffs, the imports will reduce. If demand sustains, it will increase the cost of the good causing increased inflation in the near term or at least until things settle. According to the Federal Reserve Bank of Boston, "the policy that was proposed during the presidential campaign, an additional 60 percent tariff on imports from China and an additional 10 percent tariff on imports from the rest of the world, could have contributed as much as an additional 2.2 percentage points to core inflation (excluding energy and food)". The Budget Lab at Yale expects inflation to rise and potentially cost the average US household $3,800.

Recession: There's a lot of moving parts to this, but simplified - if inflation sets in, demand goes down and GDP contracts (physics!). That's supposed to look like a recession. JP Morgan increased its probability of a recession in the US by the end of this year. In Jan, 2025, JPM said it thinks there's a 30% probability of a recession, then just before the tariff announcement increased the probability to 40% and as of 4th April, increased it to 60%. Folks on event trading platform Kalshi agree with JP Morgan, suggesting a 66% probability of a recession. S&P Global increased its probability from 25% to 35%. Goldman Sachs similarly went from 20% to 35%, HSBC went to 40% probability and so did all the other global brokerages and research firms.

What's tariffs and trade got to do with the world's financial system? I'm glad you asked.

Our world thrives and progresses because of globalisation. It's the most perfect system we have so far. Goods are produced affordably in places where it can be and then those goods get shipped to places where users consume. Through 80 years of progress, we've fine tuned this most efficient system for users to get the highest quality goods at the best prices while every one in the supply chain makes money and wins. For most of us alive today, we've never known any other system of trade.

This global trade is made possible by the complex interlinkages of the global financial system - banking, payments, lending, insurance and more. And that's exactly where the US inserted itself - right in the center. The Second World War was a pivotal moment in history enabling this global financial system to grow and thrive.

Let's go back in time for this next bit: Oversimplifying but post the First World War in 1918, The UK owed the US large sums, which the UK itself didn't have. UK didn't have the money because France owed UK large sums and France itself didn't have the money. So the Treaty of Versailles was signed as a peace settlement to get Germany to pay large sums in reparations to make France and UK whole for the War. But Germany itself didn't have this capital. Wars I tell you! So Germany borrowed from lenders in the US to pay France, who paid the UK, who ultimately paid the US. But then Germany defaulted on its reparation payments to the US lenders, which snowballed and... you know... led to the Great Depression in 1929.

The irony of it all is that the Smoot-Hawley Tariff Act was introduced in 1930 by Herbert Hoover, the then US President. The tariffs on 20K imported goods were increased by 40-60%, making it one of the highest tariff rates in US history. Almost a century later, here we are. History rhymes, as they say. Herbert Hoover reportedly told US Congress in 1931, "We are now faced with the problem, not of saving Germany or Britain, but of saving ourselves."

Then came Second World War. In order to avoid another Treaty of Versailles causing economic instability and another great depression, the leaders at the time decided it best to organise the world under a new, common economic system. I've skipped through a lot of details of the currency wars of the 1930's caused by the great depression, but moving on. It was important to facilitate global trade using a universally acceptable vehicle. In the past, gold was the standard used, but that was not considered viable in 1944-45 anymore.

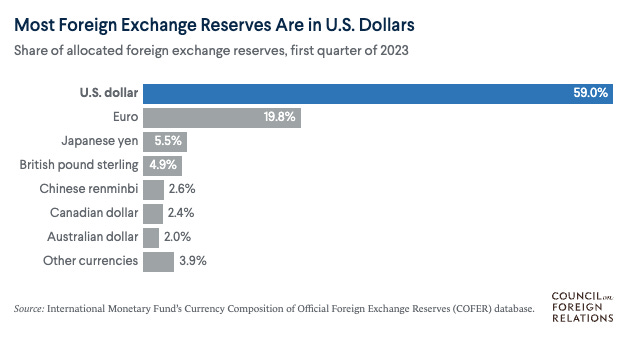

Instead, it was agreed to set up a system of fixed exchange rates using the US Dollar as the reserve currency. This culminated in the Bretton Woods Agreement in 1944. The Bretton Woods system required countries to guarantee convertibility of their currencies into U.S. Dollars to within 1% of fixed parity rates. Only the US Dollar was convertible to gold bullion for foreign governments and central banks at US$35 per troy ounce of fine gold. Why was the US Dollar used for this currency? Among many political and other reasons, post the war, the US held 90% of the world's monetary authorities' gold reserve.

I didn't know this, but the World Bank (1st Jul, 1944) and the International Monetary Fund (27th Dec, 1945) were set up to regulate and enforce the Bretton Woods System on the Allied countries.

The Bretton Woods system was later abolished in 1971 because there was a surplus of US Dollars in the system which caused the US Dollar to be overvalued, resulting in periodic runs on the US Dollar.

Today, the US is the largest importer (14.7%) in the world and the second largest exporter (9.6%). But more importantly, the US Dollar is still the reserve currency of the world. The US Dollar is still widely used for trade, it's the way forex dealers work, and the banking systems are fine tuned towards the US Dollar.

Interestingly, China has the largest US Dollar reserves of any country, three times larger than Japan's reserves.

All this background brings us to the 2020's, where it seems like there's an undercurrent of the world order changing. Rising geopolitical tensions between countries are increasing the fragmentation of the global financial system and pose risks to global trade as we know it today. The economic disruption caused by the pandemic and the war in Ukraine renewed concerns about the downfall of the dollar as the leading reserve currency. Some countries have been stimulating domestic manufacturing and consumption growth. Economic fragmentation and the potential reorganization of global economic and financial activity into separate, non-overlapping blocs seem to be encouraging some countries to use and hold other international and reserve currencies.

This tariff hike specifically, will potentially impact the trade finance (lending) and trade insurance books of global financial institutions. The full extent of this impact is not known, as we're still in a state of flux.

The SWIFT system was used in 2022 to cut Russia out of the global financial system. At BRICS countries (Brazil, Russia, India, China, and South Africa) summit in 2023, Brazilian President Luiz Inácio Lula da Silva asked, “Why can’t we do trade based on our own currencies?”. There have been several attempts in the past to de-dollarise the world order.

This introduces a new protagonist to the story - digital currencies, specifically stable coins. A stable coin is a type of cryptocurrency designed to maintain a stable value relative to a traditional asset, such as a fiat currency, for example the US Dollar, or a commodity like gold. This stability is achieved by pegging the stable coin's value to the underlying asset, which helps reduce the volatility typically associated with other cryptocurrencies like Bitcoin or Ethereum.

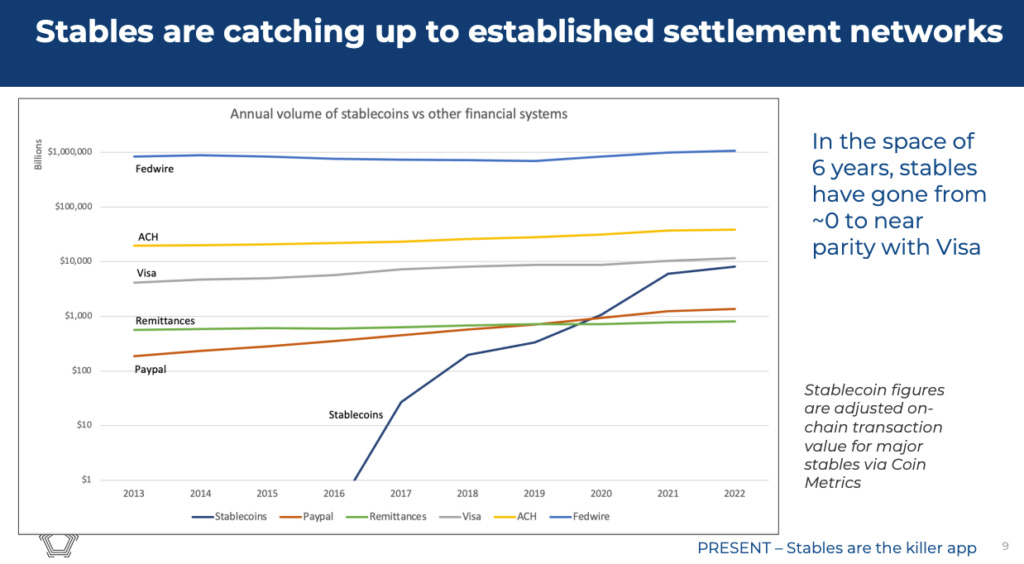

Stable coins, which first appeared in 2014, combines the technological benefits of blockchain - transparency, efficiency, and programmability, with the financial stability needed for widespread adoption. By solving the issue of crypto price volatility, stable coins seem to have unlocked new use cases including global payments for both retail and institutional users.

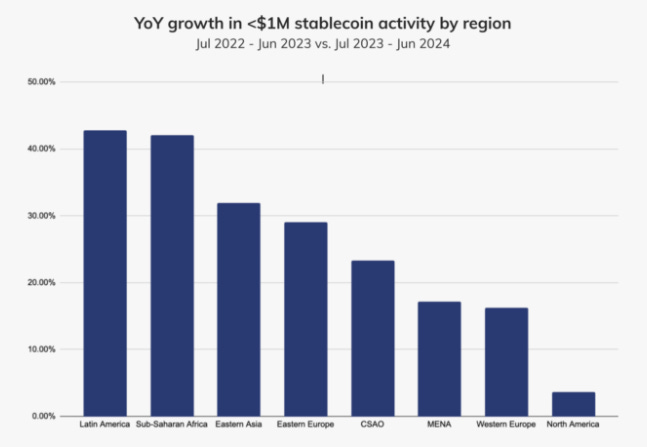

Globally, users have adopted stable coins with arms wide open. Users in Latin America, Africa, Eastern Asia and others are seeing highest stable coin usage activity. Stable coins worth $216bn are currently in circulation.

In fact, stable coins are becoming so popular that transaction volumes of stable coins are reaching parity with Visa!

There are several companies that issue the 92 stable coins in circulation, but the largest are Tether ($145Bn, 67%) and Circle ($61Bn, 28%). Tether issues USDT and Circle issues USDC, both are pegged 1:1 to the US Dollar. That brings 95% of the stable coin market! It doesn't even matter that there are 24 stable coins pegged to various other currencies or commodities.

While 75% of the USD-pegged stable coins are issued outside the US, the reserves are almost entirely invested in US Treasuries.

Several countries have introduced or are in the process of introducing regulations for stable coins, including EU, UK, Hong Kong, Singapore, Japan and Switzerland - all financial hubs. The US introduced its stable coin regulation on 4th Apr, 2025 - allowing stable coins to be used for payments or money transmission and not be treated as securities. If stable coins are indeed the future of global payments, it being pegged to the US Dollar doesn't change much.

Where does India, as an emerging superpower, stand in all of this? There are three aspects related to India's situation in the wake of this tariff hike.

US-India Trade Barriers: As part of the increased Tariffs, India is unlikely to retaliate with Reciprocal Tariffs and most likely will negotiate with US. While the tariffs don't include services, could a negotiation indirectly involve opening up the Indian financial system for US? The US Trade Representative, in Mar, 2025 released a massive 400-page report on trade barriers placed by virtually all countries, specifically called out trade barriers for US companies in India's banking system (Page 206). It cites issues with US banks to expand branch networks, preferential treatment of the government towards LIC, and limitations in participating in UPI and National Common Mobility Card (NCMC). UPI is accessible to licensed banks and apps. However, credit card on UPI is approved for interlinking only for credit cards issued on RuPay, India's homegrown card network, not Visa or Mastercard.

Reduced compliance for UPI Global: India is already on a war footing to take UPI global. It currently has agreements with seven countries including France and Singapore for merchants to accept UPI payments. But it seems the RBI and the Finance Ministry are facing a compliance hurdle for small value transactions. They have reportedly requested the Financial Action Task Force (FATF), to make the Travel Rule "technology-neutral". The Travel Rule is a anti-money laundering rule which requires financial institutions to collect, hold, and transmit information about the sender and receiver of cross-border payments. This rule today is not applicable for payments made via Visa/Mastercard or SWIFT. If UPI is included in this Travel Rule, it'll make UPI easier to use globally. In fact, the Indian government is already hoping for UPI replacing SWIFT.

The launch of Nexus: In 2021, the G20 council released a report to enhance cross-border payments, establishing 11 global targets. In 2023, The Bank for International Settlements (BIS) via its BIS Innovation Hub Singapore Centre, developed the Project Nexus concept, a first-of-its-kind multilateral network connecting multiple domestic instant payment systems. The project initially comprised of the BIS and the central banks of Indonesia, Malaysia, the Philippines, Singapore and Thailand. In Jun, 2024, India's central bank joined the consortium as well. On 26th Mar, 2025, Project Nexus moved out of concept phase and officially launched Nexus Global Payments as a non-profit entity in Singapore. Think of Nexus Global Payments (NGP) as the NPCI-like entity for global instant payments. India's presence as a core member since inception is critical for India to have a say in shaping the future of cross-border instant payments.

We seem to be in a never ending loop of uncertainty since 2020. Hopefully, this time it's different.

What do you think will be the impact of the tariffs? Do you see any opportunities for fintech startups in this confusing period?

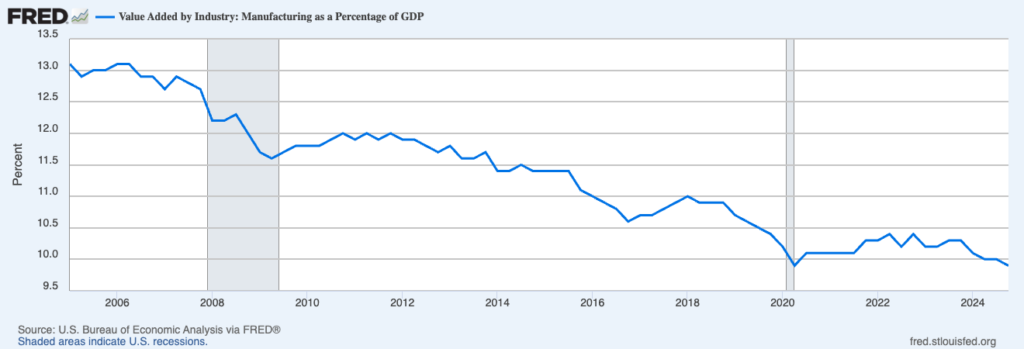

As a bonus, sharing a few interesting charts I found in my research.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

🎵 Song on loop

Fintech updates can get boring, so here's an earworm: Stumbled upon this interesting fusion song - Aigiri Nandini by Brodha V (Spotify / Youtube). It’s a fusion between a spiritual Sanskrit song and english rap. Claude tells me the song is about personal triumph over evil, using Goddess Durga's mythological battle as a metaphor for overcoming one's own challenges and negative forces.

👋🏾 That's all Folks

If you’ve made it this far - thanks! As always, you can always reach me at os@osborne.vc. I’d genuinely appreciate any and all feedback. If you liked what you read, please consider sharing or subscribing.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

See you in the next edition.

Good background context on tariffs, trade Osborne!

I didn't quite get why this situation will elevate use of stable-coins. While improved payment efficiency is understood, won't volatile exchange rates (USD to x) still impact the trade when stablecoins are converted to fiat?