Amul DAO | Fintech Inside - Edition #49 - 19th Dec, 2021

gm Insiders, Osborne here.

Welcome to the 49th edition of Fintech Inside. Fintech Inside is the front page of Fintech in emerging markets.

I've been excited about this week's edition for a while. Web3 and crypto concepts have been alien to me for sometime and today's edition taken a stab at understanding one of those concepts - DAO's. DAO's are Decentralised Autonomous Organisations and I try to explain what I know about them using a familiar Indian brand - Amul.

Writing this edition took longer than usual and is longer than the usual edition. Because of the email form factor, I've had to sacrifice some of the other sections of the newsletter. So you will not find a Fintech Top Three and Work at a Fintech section. Will make up for it in the coming edition.

Thank you for all your support so far.

Enjoy another week in Fintech...

If you’re an early-stage fintech startup founder raising equity, I may be able to help - reach out to connect@osborne.vc

🤔 One Big Thought

Amul - The OG DAO

Disclaimers:

This post is for educational purposes only. This is not financial/investment/strategy advice and should not be construed as such.

This is a very high level, 101-style post. If you know your web3, this post is probably not for you. But I urge you to poke holes in it and let me know what I got wrong.

Amul is used only for illustration purposes as it is a household Indian brand. I have no affiliations with Amul or any of its brands. I don't even consume any of its products.

Wondering what on earth is a DAO? Been hearing a lot about web3, crypto and DeFi? NFT's were all the craze lately - did you get on that hype train? Or are you still scratching your head about all those terms? I'm mostly talking about myself here - I'm the one scratching my head. I didn't understand a lot about how this brave new world of web3 works and why it's fundamentally different from how we live our lives today. In fact, in Mar, 2021, I wrote that the crypto industry faces a problem of too much jargon being thrown around and expecting everyone to "just get it" without doing any 101.

I've spent the last few months going deep into web3 and DeFi, trying to understand it from a first principles basis. This post is the start of an explainer series intended to improve my understanding of web3 ("learning in public") and in the process help more folks "get it" along with me. For this post, I chose to write about DAO's as DAO's encapsulate a large chunk of web3 concepts.

Buckle up!

Web3 is the latest evolution of the internet (web1: read only, web2: read, write) enabling direct ownership (web3: read, write, own). Direct ownership of assets, content, entities and more. Blockchain technology is enabling this evolution to web3 with finance/financial concepts embedded as a core tenet, by design. This aspect of web3 is like nothing we've ever seen before and is what's making us scratch our heads. It sort of reminds me of the early internet (1980's) - some people, including David Letterman, just didn't "get it" and that's fine for the majority of people. Not us though, the ones building and investing in the internet and finance. We may not get it either, but we cannot look away from it or be willfully ignorant about it.

The internet is witnessing its Amul moment! To understand that statement, lets first understand what is Amul.

What is Amul? Amul is an Indian dairy products brand that's owned by its milk farmers. Not one entity or shareholder but 16.6mm milk farmers! It was founded in 1946 as a co-operative society of milk farmers who were fed up of the unfair and manipulative trade practices of trade cartels and middlemen. The co-operative society model initially launched in a few villages and soon rolled out across Gujarat and the rest of India because of its success. This structure allowed milk farmers to take control back in their hands and own the entire supply chain ensuring they didn't lose out on income rightfully owed to them.

How does Amul operate? Amul's milk farmers at the village level govern the brands operations. Milk farmers organise themselves to form Village Co-op Societies where all milk is collected and processed. Multiple Village Co-op Societies organise to form District Unions that processes the milk to various dairy products. These District Unions then organise to form State Federations who further distribute the dairy products to customer retail points. At each level in this three-tier organisation, leaders from among the milk farmers are elected to safeguard the milk farmers interests.

The Amul brand managed by Gujarat Co-operative Milk Marketing Federation Ltd. (GCMMF) as the apex marketing body of these federations. Reports suggest that GCMMF keep 20% of all income and the rest is distributed downstream till the end milk farmer.

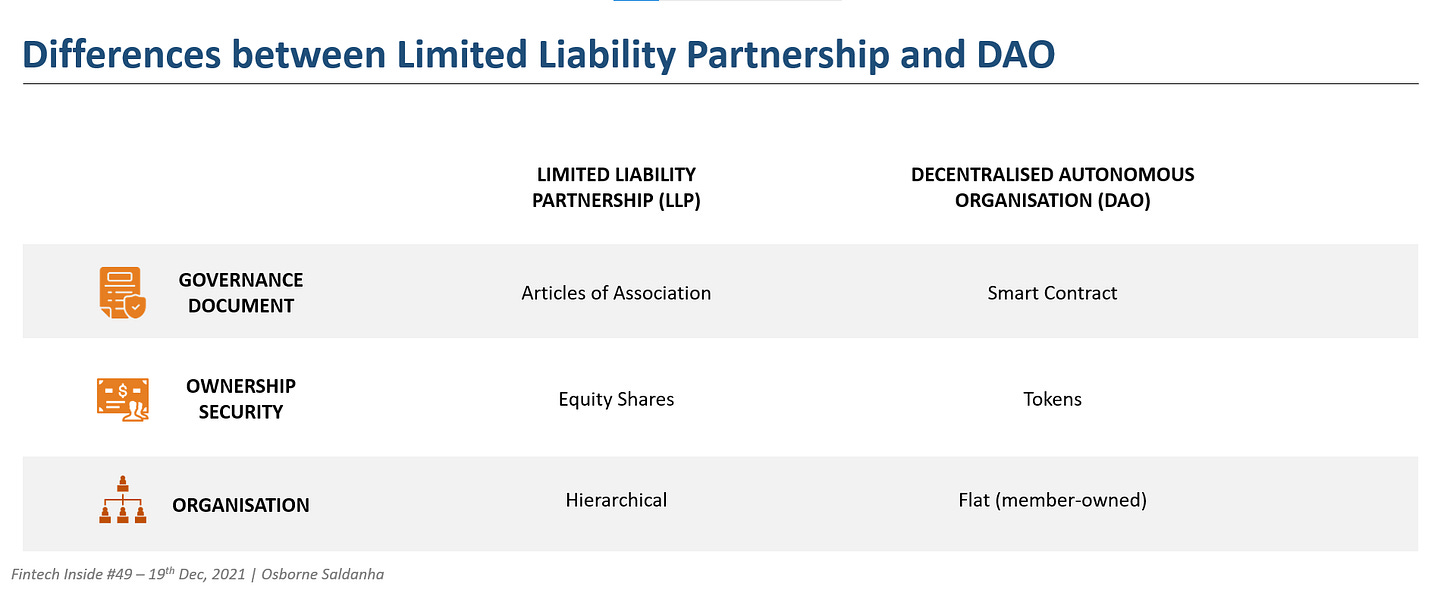

What's a DAO? DAO is an acronym for a Decentralised Autonomous Organisation. DAO's are internet-native organizations collectively owned and managed by their members. In the Indian context, think of a DAO as a Private Limited (Pvt. Ltd.) company, a Limited Liability Partnership (LLP) or such other entity structures. And just like those structures have a Charter Document or in India an Articles of Association (AoA) and Memorandum of Association (MoA) that govern how a LLP/Pvt Ltd. function, a DAO has a Smart Contract that's essentially chunks of code that automatically execute whenever a set of criteria are met. Smart contracts govern the DAO and all administrative actions are executed by this smart contract. Smart contracts are initially defined by the founders of the DAO.

Saying you're excited about a DAO is like saying one's excited about a Private Limited company - it makes no sense. But as with any entity, DAO's need a purpose or product or service. That's what makes it interesting. This purpose or product or service is what brings interest from members. Members own the DAO by either buying tokens of a DAO or they're "airdropped" these tokens based on participation. Think of tokens as equity shares. Members with tokens can make new governance proposals and vote on how the DAO is governed. Smart contracts can only be amended through a public voting process (e.g. on Snapshot.org) by token holders.

DAOs are fully autonomous and transparent. As they are built on open-source blockchains, anyone can view their code. Anyone can also audit their built-in treasuries, as the blockchain records all financial transactions. The Ethereum Foundation originally intended for DAO's to be non-profit style orgs that do not distribute dividends.

What are the principles of a DAO? DAO's were introduced as a concept in 2014 by the Ethereum Foundation. The founding principles are:

No central governing entity: DAO's are intended to be completely flat entities. Founders only provide direction, but the members truly propose, vote and govern the organisation. DAO's can further be organised into departments for specific functions. e.g. Bankless, a community for web3 and crypto, has Guilds (departments) for marketing, writing and others. These members, guilds and the DAO has full ownership over its own roadmap and evolution.

Self-regulating/democratic governance: Anyone anywhere in the world can join a DAO. This form of an entity makes it truly borderless. Moreover, anyone can make new governance proposals and watch it become part of the fabric of that DAO. DAO's then by design become self-regulating entities.

Addresses the principal-agent dilemma: DAO's are autonomous entities that rely on smart contracts for governance. All actions of the DAO are executed by this smart contract and only members can propose and amend the same. This, in a big way, addresses the Principal-Agent dilemma of traditional entity structures where the authorised representative (Agent) could potentially act contrary to the best interests of a person or group (Principal). Automation via smart contracts helps address this.

Community: Community is a big part of the functioning of a DAO, at least today. We've seen examples of ConstitutionDAO which raised $47mm from 4,000+ members to make a bid for a copy of the US constitution. Even the folks that bought Bored Ape Yacht Club NFT's, although not a DAO, identify other buyers as part of a community. There are some 2,000+ DAO's today and you can check out their membership here on DeepDAO or Snapshot.

Transparent and radically public: Everything a DAO does is available on the public blockchain for anyone to audit or verify. Any member can check the DAO's activity before deciding to participate or purchase tokens. Traditional organizations require trust in the people behind it — especially on behalf of investors — with DAOs, only the code needs to be trusted. Trusting that code is easier to do as it’s publicly available and can be extensively tested before launch.

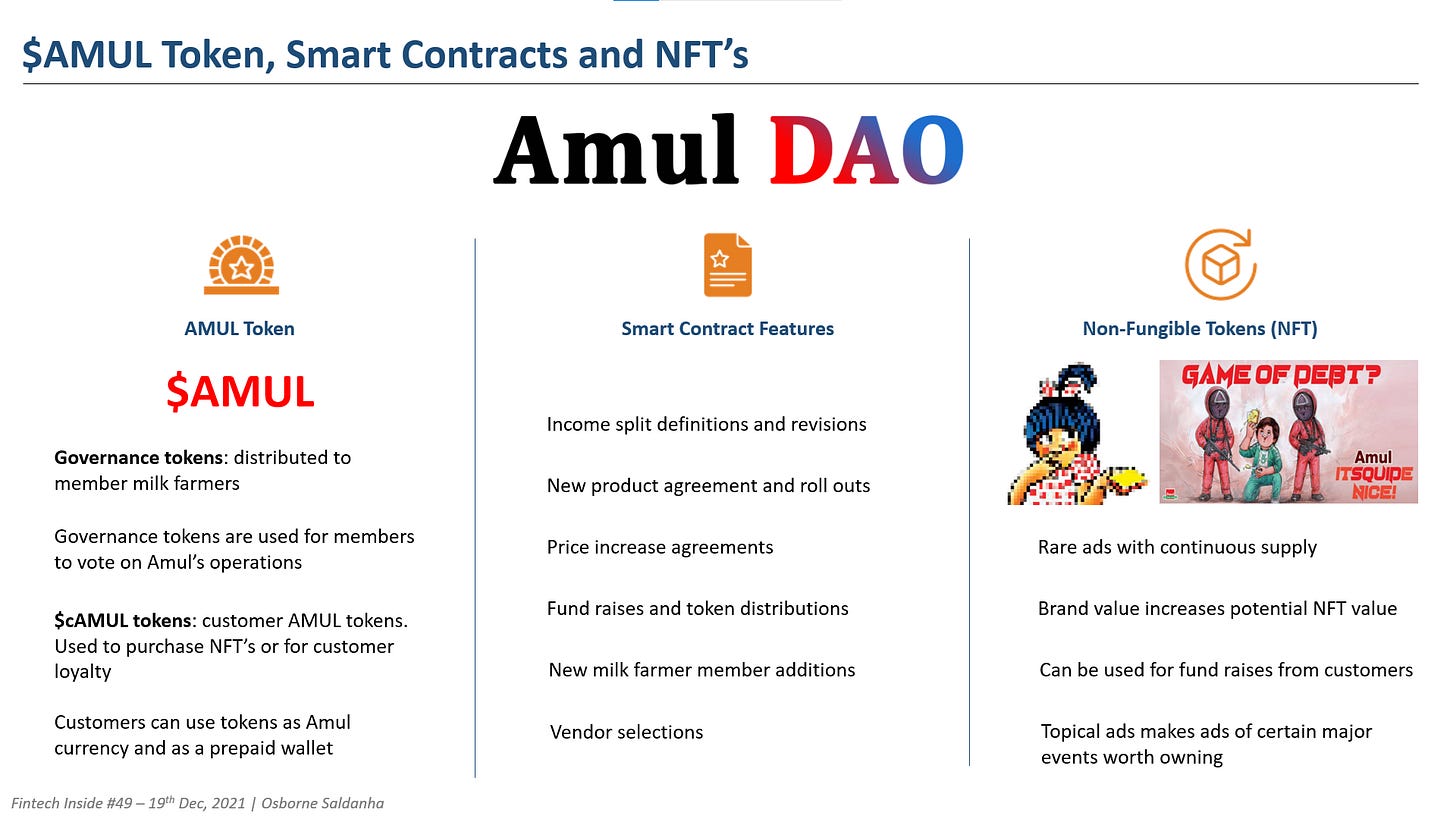

How would an Amul DAO work? Amul DAO is essentially bringing Amul's operations to the internet-age. Milk farmers own $AMUL governance tokens to define the roadmap of the brand and govern the administrative aspects of the brand. Owners of $AMUL tokens can participate in income sharing which will be defined by the smart contract. The Amul DAO smart contract will have rules for revenue sharing, price increases/decreases, fund raises (new token distributions), new members, new product introductions, input purchases, vendor selection and many more.

At some point, Amul stores could accept payments via a prepaid wallet with $AMUL tokens. Specialised tokens, $cAMUL ($AMUL customer tokens) could be issued to loyal customers to participate in unique ways e.g. define the launch of a new flavour for a flavoured milk. Those tokens could be made tradable too. There's a lot that can be done from a tokenomics perspective with a brand like Amul.

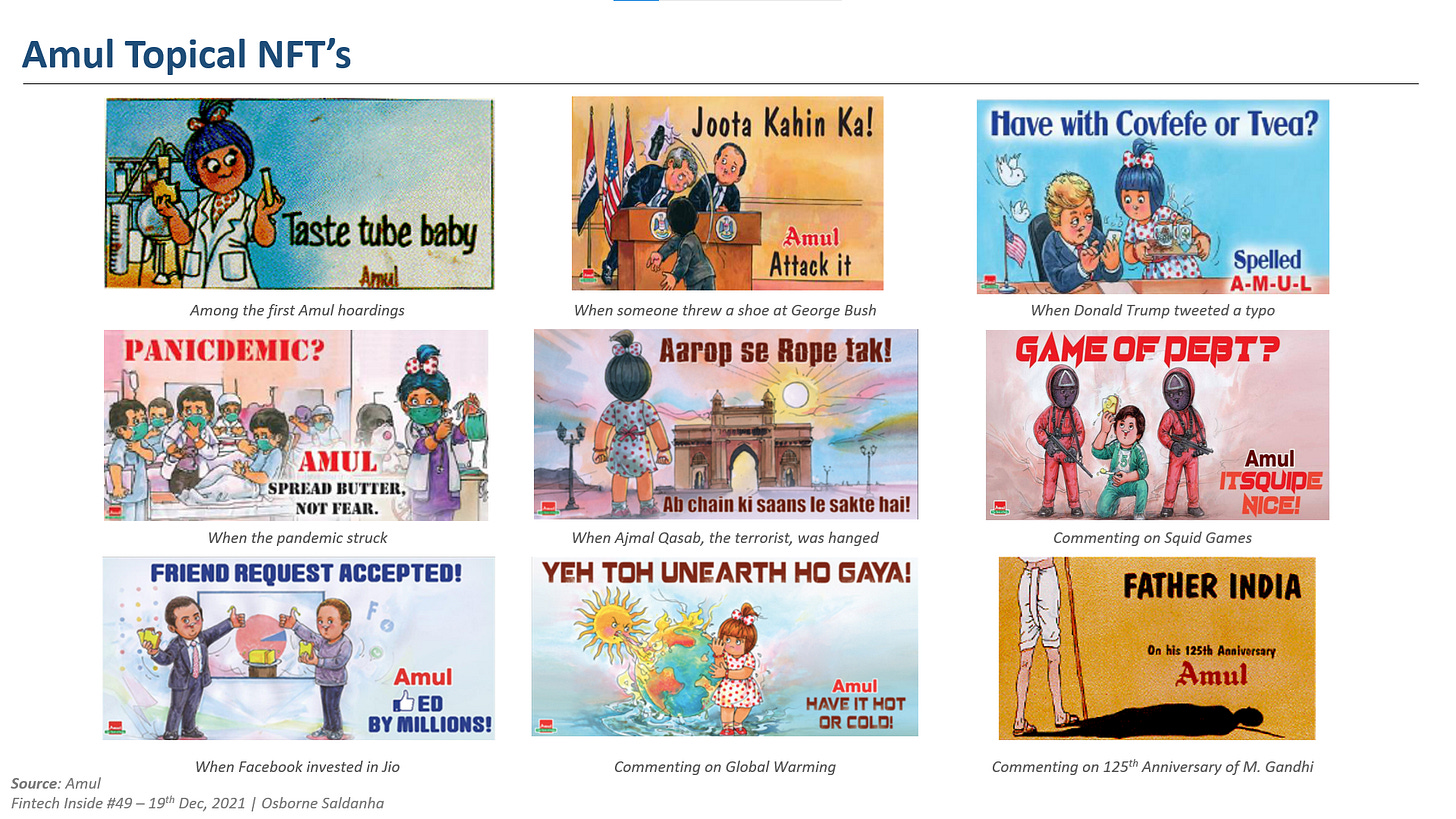

Amul DAO could even raise money by minting NFT's for each of it's "Topical ads". Customers could purchase some of these very valuable works of art that have become a part of the fabric of Amul and India. I'd definitely buy those NFT's! NFT, Non-Fungible Token, is a digit asset that a) represents ownership, b) is unique and only one of it exists and c) cannot be traded (like currency) but can be bought and sold.

What are the downsides? DAO's are still a very early concept. The entire crypto community is constantly iterating to achieve their version of an optimum DAO. But there are obvious downsides that need to be addressed in the process.

Doesn't work for offline settings: DAO's are internet-native organisations. For smart contracts to function autonomously, there needs to be end-to-end data capture and tracking. In the Amul DAO example, the smart contract will need to know how much milk was deposited by each member farmer to ensure accurate income sharing. The smart contract will also need to get access to data on product quality.

Communication and Collaboration breakdown: Members or token holders can vote on how the DAO functions. But us humans are still figuring out how to communicate and collaborate better. DAO's probably work in a small setting, but how things break as DAO's scale, is unclear. Near Puducherry, India, Auroville, an experimental, international, democratic community free of government, money and religion, with its own treaty with the Government of India, sometimes takes years to decide whether they want to build a road within their land or if they should allow a petrol pump to set up shop.

Dispute resolution: Tech is designed by humans but a DAO is governed by its smart contract. What happens if things go wrong? Who do you file a complaint against? Who do you arrest? the smart contract? It's still unclear. There is no regulation governing DAO's, so how do you resolve disputes? Again, in Amul DAO, if a customer gets spoiled milk, who should they complain to? Courts don't recognise DAO's or its smart contracts - will they hold up in a court of law? Will the founders then put the blame on the community or the smart contract? Aragon, a DAO infrastructure company, has its own dispute resolution framework - Aragon Court and its in very early stages.

Some people still need managers: As a species we're still learning how to organise ourselves. Everyone wants to be part of a community to get a sense of belonging. And as part of that organisation, there will always be leaders and followers. We've seen during covid and work from home set ups, not everyone could cope with working from home and in independence. Most people just need people to tell them what to do and follow up with them. DAO's today largely have people that are self-driven. What about those who aren't self-driven?

Security Challenges: DAO's live in code and where there's code there's a hacker. Blockchain technology by itself might be impenetrable but there are other aspects that can be hacked. TheDAO, the first ever DAO launched in Apr, 2016, was hacked - days after a vulnerability was reported in the DAO's smart contract and the vulnerability was scheduled to be fixed. The hacker made away with $60mm in ETH. These systems will always be a target.

Code breaks in unexpected ways: DAO's are reliant on smart contracts to be autonomous. But the reality is that code breaks in unexpected ways. There's always a risk of "unknown unknowns". Yes, blockchain is public and composability is a big feature which will help to improve on past work but that doesn't solve for code behaving in unexpected ways for different use cases. We've seen how Twitter's image-cropping algorithm became problematic when it cropped out non-white people from images.

What will the future of DAO's look like? It's tough to say. I do believe that DAO's will co-exist with LLP's or Pvt. Ltd. companies. DAO's will be used to address specific situations or types of missions. Problems will exist, it's not like LLP's are perfect entity structures, and we'll need more dreamers to iterate and improve on what we know as DAO's today. Even for a DAO, I think it will need a hybrid governance structure of Code + Humans - i.e. maybe the administrative work by the smart contract and others through humans. The biggest issue that DAO's will need to address is dispute resolution. Dispute resolution is an incredibly complex issue that has no straight answer, there's limited precedent as well and law always looks for precedent.

DAO's present a big opportunity, the opportunity itself is still an unknown unknown. We're only starting to see some direction of the different use cases DAO's are being use for and we'll continue to see more evolution. Many years ago, Marc Andreessen, famous VC, said that "Software is eating the world". Ten years later, software has taken a big first bite, but the pie is still very large. If anything, software is eating the world.... but slowly. Similarly, I don't think DAO's and web3 will change our lives dramatically in the short term, but when it does, and it will, the impact will be much larger than anything we've seen so far.

Additional Reading:

What is a decentralized autonomous organization, and how does a DAO work?

CoinMarketCap's Alexandria (Investopedia for crypto)

What did you think of today's edition? Did I miss out on certain aspects of a DAO or got them entirely wrong? Which other Indian brand would you like to see as a DAO? Please write to me at email, Twitter or LinkedIn.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

💼 Work at a Fintech

workatafintech.com: Search from ~180 open positions at 50+ fintech startups in India and South East Asia.

Work at a Fintech is a community effort by EMVC. If you’re a Fintech who’s hiring I’d like to help. Write to me and I’ll put your requirement here. 2.5K+ people view these open positions.

Looking for the news digest? Read all the week’s fintech news and updates in India and SEA over at This Week in Fintech - India and SEA Edition. You can also find our US, Global and European coverage.

🏷️ Notable Nuggets

The Original HDFC (must read on the origins of HDFC Bank)

How to go from being a super hot company to lucky to get acquired in less than 24 months

👋🏾 That's all Folks

If you’ve made it this far - thanks! As always, you can always reach me at connect@osborne.vc. I’d genuinely appreciate any and all feedback. If you liked what you read, please consider sharing or subscribing.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

See you in the next edition.