Payments exciting again? | Fintech Inside #89 - 24th Mar, 2025

Exploring the key developments making India's payments industry attractive for investors and entrepreneurs again

Hi Insiders, I’m Osborne, an investor in early stage startups.

Welcome to the 89th edition of Fintech Inside. Fintech Inside is the front page of Fintech in emerging markets.

After five years of relative stagnation, India's payments sector is showing signs of being exciting again. In this edition, I examine how the payments industry is now entering a new phase of excitement.

This phase seems to be driven by changing regulatory landscapes, potential MDR introductions, and intensifying competition among payment gateways.

Having witnessed the sector evolve from card payments to cash-on-delivery to digital wallets and finally to UPI, we stand at another inflection point that could redefine how payment companies generate value in the world's fastest-growing digital payments market.

Thank you for supporting me and sticking around. Enjoy another great week in fintech!

🤔 One Big Thought

The Pendulum Swings | Is the Indian payments sector getting exciting again?

India's payments industry has been the most innovative and exciting industry globally, over the last 15-20 years or so. We've been through several global-first innovations that were contextual for India's requirements. At each of those times, nobody from the industry thought any of the innovations will become as mainstay as they have now become.

The Indian travel industry (starting with MakeMyTrip) was, I think, the first to build and adopt online payments back in the early 2000's because of the nature of the business. Card based payments worked best for this sector, but there simply was no distribution of debit or credit cards. That's when direct debit (netbanking) was then introduced. RBI's Real Time Gross Settlement (RTGS) and National Electronic Funds Transfer (NEFT) proved crucial for net banking to work well.

Then came the Ecommerce industry boom - with Flipkart launching "cash on delivery". This was complex to execute from a payment gateway perspective, because of the offline cash handling aspect and managing success rates. This innovation got a lot of users to trust buying online. As ecommerce started to deliver on expectations, certain aspects started becoming baseline expectations including growing trust in ecommerce platform, digital payment going through successfully, delivery within 1-2 days, product is received as per expectations.

That's when prepaid wallet payment, driven by Paytm, started to take off, especially via its exclusive partnership with Uber. Prepaid wallets were ideal for merchants and users in multiple ways: downside risk limited to amount in the wallet, no 2FA for amounts debited from the wallet, easy refunds, easy QR payments and much more.

Just when we thought nothing could get better than prepaid wallets, demonetisation happened, and it was UPI's time to shine. Since UPI's launch, India's economy has never been the same. It's made spending significantly easier with high trust, which brought in 350M Indians to get comfortable with spending digitally.

None of this is to forget the massive acquisitions, consolidations and more that happened in this sector. PayU acquiring CitrusPay for $130M in 2018 (largest ever in fintech, at the time), then PayU going on to acquire many companies including - Wibmo, Paysense ($180M, 2020) and the more recent Mindgate ($100M, 2025). Razorpay (Ezetap, Curlec, Poshvine, TERA Finlabs, Opfin, Thirdwatch and more) and Pinelabs (Setu, Qwikcilver, Fave, Saluto and more) have similarly not been shy of acquiring companies for large sums.

It is important to note that, as of today, the largest payment gateways in India are not legacy companies or non-Indian companies. They are primarily tech-first companies and all founded within 2000's (except Pine Labs).

Over the past five years, India's payments sector helped the rest of the economy innovate and grow but the sector itself started going through a phase of relative stagnation. Recent developments suggest we might be witnessing a change in this space. Let's explore what made payments boring and why the sector is regaining its spark - from product and investment perspective.

Why was India's payments industry getting boring?

(Before some folks start hating on me, I must caveat - boring is not a bad thing. It means that things are working just fine and that's a good thing.)

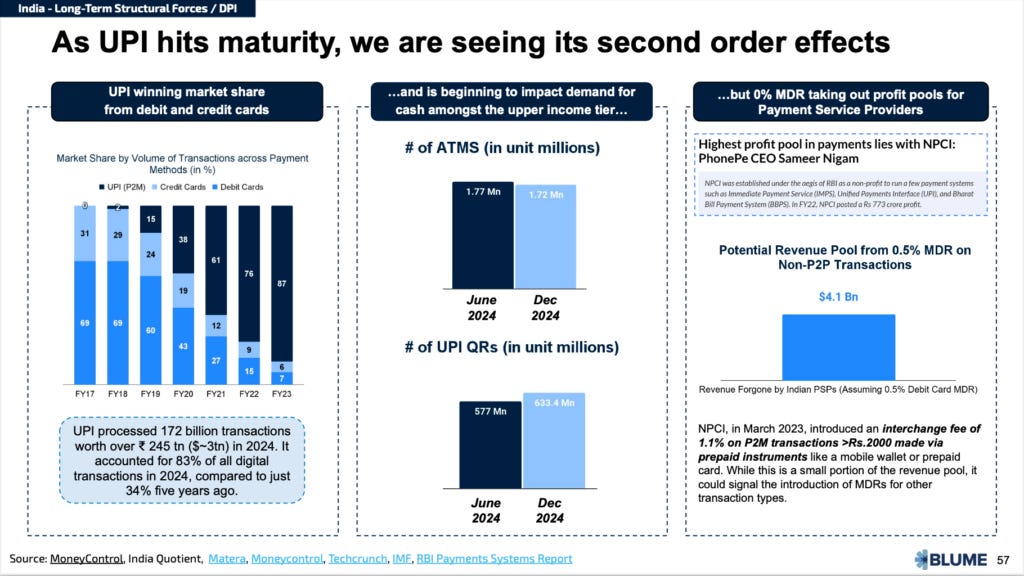

UPI made the sector boring: How can you make an instant and free product better? UPI revolutionized India's payment landscape by standardizing transactions across platforms. This standardization created a level playing field where differentiation became increasingly difficult for payment companies. The protocol's universal adoption reduced unique selling propositions among payment platforms, making the sector predictable and homogeneous.

Tech startups lead the market: As mentioned, the Indian payment industry does not have legacy businesses with regulatory moats. Startups including Razorpay, Paytm, Mobikwik, PineLabs and more are competing in this sector. PhonePe and GooglePay entered this market to grow UPI's distribution but had large pools of capital to sustain. A new entrant like Stripe has found it tough to even set up base in the country. A new startup was not be able to compete on product or distribution or license, unless it had a ton of capital backing, even then a positive outcome was tough.

Limited revenue upside (given UPI was free): The zero-MDR (Merchant Discount Rate) policy on UPI transactions eliminated direct revenue streams for payment processors and put pressure on other modes of payment. Payment companies were forced to explore alternative monetization strategies like value-added services and cross-selling financial products. Most startups struggled to achieve profitability with the core payments business alone. Having no revenue model, made UPI a "big boys" game, as mentioned in the previous point.

Government and regulators were focussed on building infra: The RBI, by itself and via NPCI, is building payments infrastructure for the country. This is both a new thing and a not so new thing. It's also a good thing and not so good thing. NEFT and RTGS were built and maintained by RBI. UPI was built by NPCI, a retail payments umbrella body, as a subsidiary of RBI. Payments needs a central, neutral infrastructure. But now, RBI is building a cloud platform for the financial industry too. Unfortunately, it's regulations had become too prescriptive and exclusionary (from participating entities perspective). If regulators and the government build everything, what role do the private markets have? Also, if infrastructure is built by RBI and role of private markets is to acquire users and grow usage without the business model to make it sustainable, why will private markets participate in this industry? The focus remained on expanding digital payments reach and transaction volumes rather than creating profitable business models. This approach succeeded in driving adoption but limited business model innovation in the sector. The trend of regulators and government building infrastructure is potentially not going to change though.

But recent developments seem to suggest change is eminent. India's payments sector is getting exciting again:

The World vs Juspay: The recent news of Razorpay, Cashfree and PhonePe opting out of Juspay's orchestrator platform, is important in my opinion. Juspay's orchestrator product was crucial infrastructure that makes sense for large enterprise customers. The payment gateways (PG) opting out of Juspay, while surprising, suggests that they'd rather go after those enterprises directly without being dependent on Juspay's benevolence to direct traffic to the PG. The PG's claimed that Juspay, after getting its own PG license, was going after the same customers. All this seems to suggest some openings in the payment industry, which could create an opportunity for a new platform. This orchestrator is a crucial and highly complex infrastructure with clear merchant need. However, the existing PG's have started to get into each others territories.

RBI gave new license approvals: Since RBI updated the payment gateway license requirements to Payment Aggregator (PA) license, RBI approved licenses of 23 PAs (existing and new) and 46 others are still in process. That's a lot of PAs to operate in the country. This could shake things up. It's not like RBI will approve all 46 in pipeline, and it's also not guaranteed that 40-50 PA's will create any dent in the top 4-5 PAs. There will continue to be a concentration but I believe a new company could have a fighting chance as things are changing in the Indian payments industry.

UPI MDR may become a reality: I argued in Edition #66 that UPI should not be free but relented that the government will ensure that UPI remains free - there are many incentives to keep it that way. That seems to be changing and I didn't expect it to happen so soon. The government is reportedly considering a proposal to charge a fee for UPI usage. Prepaid instruments using UPI charge a 1.1% fee and NPCI is introduced a fee for credit card on UPI usage too. If MDR is introduced on UPI payments, there's suddenly a viable revenue model, which makes building and innovating in the industry viable again. Some business models may get disrupted and UPI will not be thought of as a customer acquisition cost center.

Government UPI incentive is not incentivising: India's Ministry of Finance offered incentives to the payment industry to keep UPI free of cost to the merchant. The incentive outlay was INR 2,600cr ($315M) in FY23, then INR 2,000cr ($240M) in FY24 and initially INR 437cr ($51M) in FY25, but now increased to INR 1,500cr ($175M). Unfortunately, the payments industry doesn't think it's fair to have an incentive payout of $175M to process $3tn in annual payments value. That's an assumed MDR of 0.0058%! It seems banks and payment companies have still not received any incentive payout for any of the preceding years. UPI needs a business model, not a handout.

UPI is a single point of failure: UPI is growing in importance. The Government and RBI seem to push it for every use case - credit, IPO subscription, international payments, subscription payments - you name it, you'll get a UPI rail for it. This is not a bad thing. From my conversations with friends in the ecommerce and payments industry, it seems UPI is about 20-25% of their total payment value. Cash on delivery still reigns supreme at 40-60%. The more digital apps like Probo, Dream11, Frnd, KukuFM and more are almost entirely UPI. With this latest incentive plan, the government is pushing to grow UPI usage even in low value (<INR 2K) transactions - effectively to get rid of cash transactions for low values. The motivation could also be to grow indirect taxation as they recently increased the minimum salary threshold for direct tax. But the main point here is that making UPI the primary digital spending protocol creates a single point of failure for the country. UPI is already the most used mode of digital payment. Thanks to the sheer volume of transactions, UPI has had concerns on scalability - with technical declines (TD) reducing from 8% in 2016 to <1% on average in 2024. Moreover, let's not forget the ransomware attack on C-Edge Technologies in 2024. C-Edge, a JV between TATA Consultancy Services (TCS) and SBI Bank, is the UPI technology infra provider for more than 300 small banks. When this ransomware attack happened, users of those small banks could not use their UPI. NPCI was able to isolate the issue and restore services, but that's service downtime for at least a few million users. Mindgate is a similar technology provider that processes ~50% of UPI's volumes via its technology through HDFC Bank, YES Bank, SBI Bank and many more. Again, this is critical infrastructure and UPI is at its core. I think, there will come a time of diversification away from UPI but I can't imagine what that will be.

RBI's CBDC push: RBI's been pushing its "e-Rupee", a central bank digital currency (CBDC), via banks and now via retail payments companies, including CRED, Mobikwik and others. In pilot phase the CBDC grew to 1M transactions per day in 2023 (?!), but then sharply declined to 100-200K per day in 2024. The RBI seems to be facing pressure on the global stage with every other central bank figuring out its own CBDC strategy. There's something to be figured out here.

India's becoming global citizens: Indians are increasingly travelling abroad and Indian businesses are increasingly selling in other markets. Payments infrastructure to address both use cases is a growing need. UPI going international and stable coins potentially becoming a thing is another changing vector that is making this sector exciting again.

The Indian payments sector stands at a critical juncture where regulatory support, market evolution, and business model innovations are converging. With MDR discussions progressing and new license holders entering the market, we may witness a new era of growth and innovation. The focus seems to be shifting from mere adoption to sustainable business models.

As India continues its digital payment journey, the sector appears poised for renewed investor interest and entrepreneurial activity. The next few years could redefine how payment companies operate and generate value in the world's fastest-growing digital payments market.

What's your view on the evolving payments landscape in India? I'd love to hear your thoughts.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

🎵 Song on loop

Fintech updates can get boring, so here's an earworm: House of the Rising Sun by Mumford and Sons Live (Youtube). The whole live set is beautiful, there’s solos played, the singing - all of which come together so well. It’ll make you want to pick up an instrument and play your tune. Thanks to Saranya Gopinath for sharing her excellent taste in music!

🫡 Call outs

The Painted Stork by Ambika Pande. This is a fantastic newsletter that goes deep on the Indian payments sector. Each newsletter is detailed and insightful. Worth spending time in educating oneself about the intricacies of the sector.

Pejman Nozad’s interview on the Divot podcast. I didn’t know much about Pejman until I heard this interview. Turns out he’s been on several lists as the world’s best seed investor. But that’s not what makes him special. He’s Iranian born, wanted to become a footballer, went to US, became a rug seller and hustled his way to investing in category-defining startups. So much packed in that interview. Do watch!

👋🏾 That's all Folks

If you’ve made it this far - thanks! As always, you can always reach me at os@osborne.vc. I’d genuinely appreciate any and all feedback. If you liked what you read, please consider sharing or subscribing.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

See you in the next edition.