Trends and insights from 23 largest financial firms | #99 - 18th Aug, 2025

Why India's financial giants are choosing opposite strategies in the face of identical market pressures—and which approach will dominate the next cycle.

Hi Insiders, I’m Osborne, an investor in early stage startups.

Welcome to the 99th edition of Fintech Inside. Fintech Inside is the front page of Fintech in emerging markets. Almost at 100 editions!

This is a special edition. I've spent the past few weeks diving deep into something that's been nagging at me since earnings season wrapped up.

India's financial services companies just reported Q1 FY26 results, and beneath the usual metrics lies a story most people were missing. While everyone focuses on individual company performance, I kept seeing the same pattern repeat across 23 different institutions - from mega banks to insurers to listed fintech companies.

Credit stress is forcing uncomfortable decisions. Technology is delivering real productivity gains. But most importantly, companies are making radically different strategic bets in response to identical market conditions.

The implications for where Indian household savings flow next, and which business models survive the current cycle, are enormous.

In this edition, I break down what I found across all 23 companies and why this strategic split might be an important trend shaping India's financial sector.

Thank you for supporting me and sticking around. Enjoy another great week in fintech!

Considering angel investing? I get a bunch of fintech founders reaching out to me for investors. I’d be happy to put you in touch. I’m at os@osborne.vc

🤔 One Big Thought

Trends and Insights Report - Q1 FY26: The Great Divide

Why India's financial giants are choosing opposite strategies driven by credit stress

India's financial services sector just revealed a defining moment. After analysing the Q1 FY26 performance of 23 largest financial companies across sectors, one pattern dominates: institutions are making radically different strategic bets in response to similar market pressures.

The catalyst? Widespread credit deterioration that's forcing uncomfortable choices.

Banks and NBFCs are reporting customers with 3+ active loans becoming the norm, not the exception. Commercial vehicle financing faces structural headwinds. Even home loans show stress amid brutal pricing competition. The numbers tell the story - Kotak Bank's PAT fell 7% YoY while net interest margins compressed 37 basis points.

This credit stress is creating two distinct responses:

The Defensive Play: Established institutions are pulling back. Multiple banks are reducing unsecured portfolios, tightening underwriting, and prioritising margin preservation. The message is clear - protect what you have.

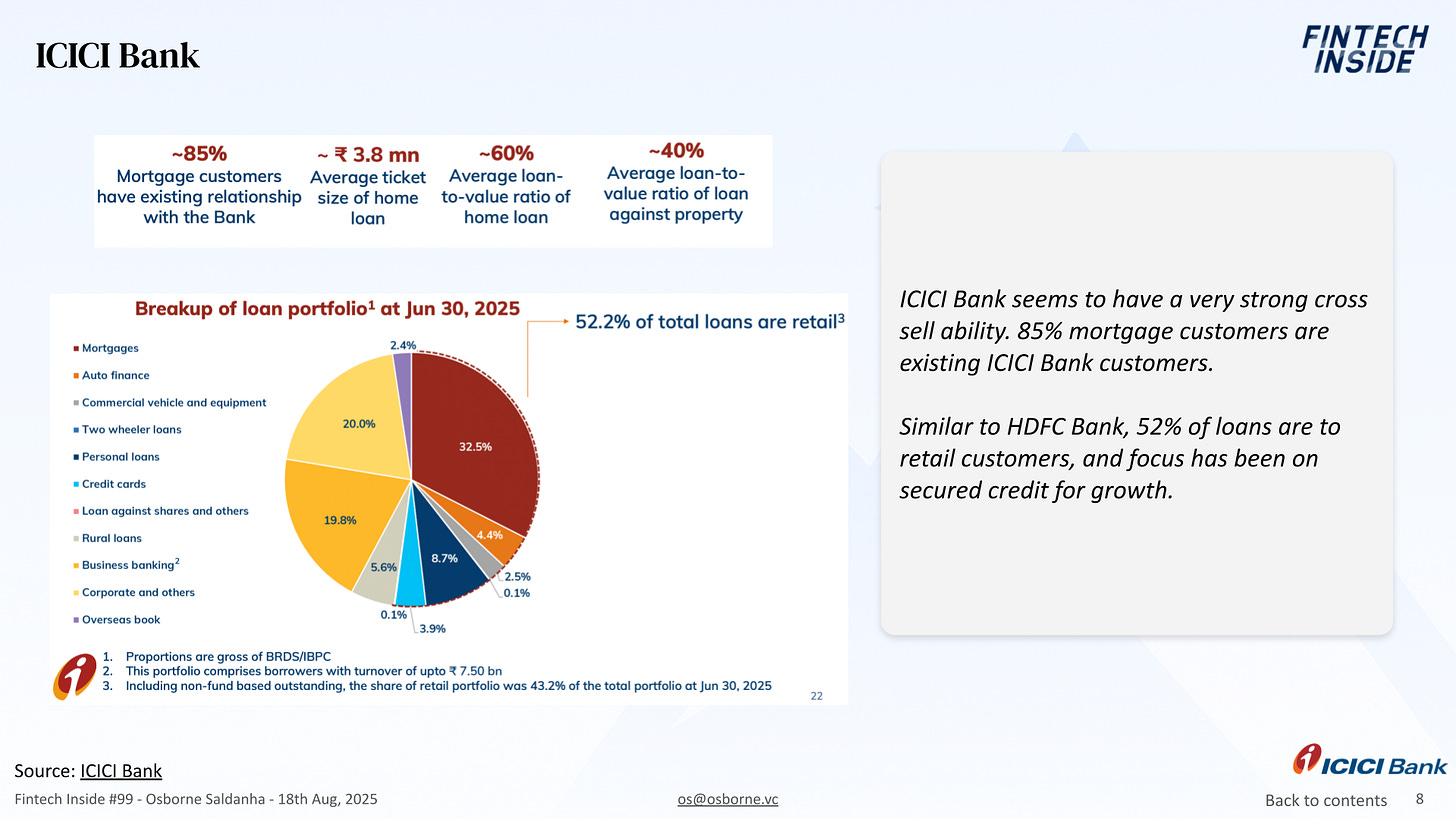

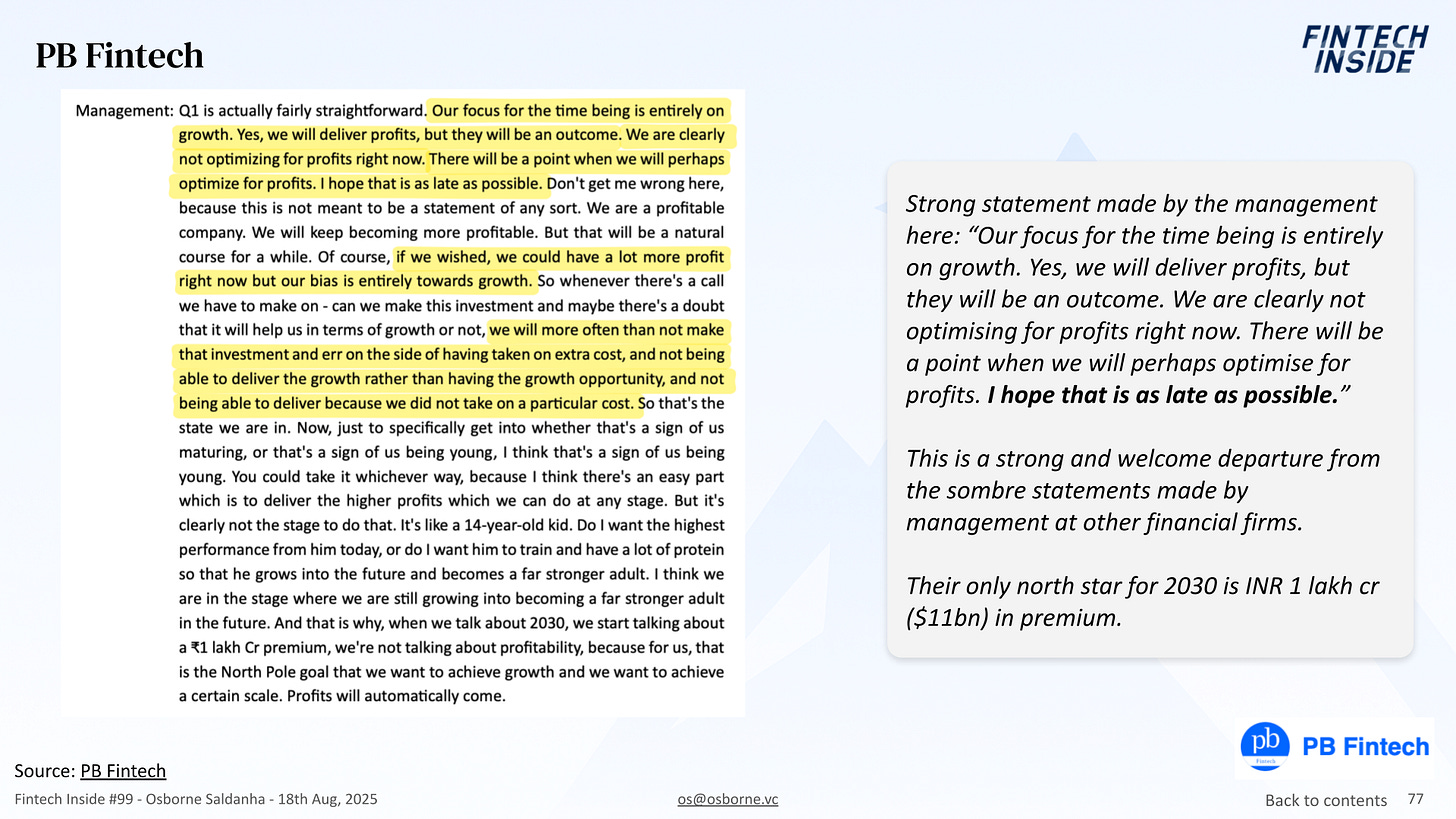

The Aggressive Expansion: Growth-stage companies are doing the opposite. PB Fintech's management stated they're "clearly not optimising for profits right now" while targeting ₹1 lakh crore ($11bn) premiums annually by 2030. Paytm achieved profitability but immediately signalled continued aggressive investment in merchant payments and international expansion.

Meanwhile, technology deployment is accelerating across both camps. ICICI Lombard cut headcount by 22% while boosting productivity 78% through digital consolidation. SBI deployed GenAI across 10+ use cases, processing $4bn in loans during Q1 via YONO. Bajaj Finance is quick to redeploy 150 employees to build out the firm’s AI strategy. At the same time Paytm wants to become an AI first company for all customer facing products.

Oddly, other than the above mentioned firms, there’s no mention of a concrete AI strategy or roll out from any of the other firms. It’s mid-2025!

The implications extend beyond individual companies. This strategic divergence is reshaping capital allocation across India's financial system, with profound consequences for where household savings flow next.

I've documented the complete analysis across all 23 companies, across 82 slides, including the specific strategies each is pursuing, management statements of bullishness or bearishness and what this means for customers, investors and general market watchers.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

🎵 Song on loop

Fintech updates can get boring, so here's an earworm: This week I’d been binging on my third favourite band. This song casually crept in except it wasn’t from the same band. This song is She’s Not Gone Yet but She’s Leaving by The Fratellis (Youtube / Spotify). The sound and vocals are exactly like my third fav band - grunge-y, high pitched and fun. Can you guess which band I’m referring to?

✨ Call outs

[REPORT] SVB released its State of the Markets report for H1 2025 and it’s a data-packed read. It gives a very detailed review of the current state of the VC ecosystem and startup financing trends. Definitely worth your time.

[VIDEO] I’ve been learning a lot about nuclear energy lately so learning about the design choice for the massive “exhaust” from the nuclear facility seemed like a nice thread to pull on. Not knowing what to expect, the video surprised me in its simplicity, puns and general wonder for the unknown using a slice of pizza as a metaphor.

[VIDEO] Another weirdly fascinating video the algorithm sent my way, was this new “light-field” display concept video. It breaks down a new kind of display technology for the AR glasses future being built out of Switzerland. The technology is complex and still in prototype stage but the implications could be massive if miniaturised and if energy requirements are met.

👋🏾 That's all Folks

If you’ve made it this far - thanks! As always, you can always reach me at os@osborne.vc. I’d genuinely appreciate any and all feedback. If you liked what you read, please consider sharing or subscribing.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

See you in the next edition.