$50bn to zero | Fintech Inside - Edition #61 - 16th May, 2022

Heard about the Terra crash? But don't know what Terra is and how it crashed? Here's your definitive guide to the big Terra crash that brought down the crypto markets.

Hi Insiders, Osborne here.

Welcome to the 61st edition of Fintech Inside. Fintech Inside is the front page of Fintech in emerging markets.

Crypto markets were all abuzz the past week. The project at the center of it all - Terra. The Terra project, intended to decentralise the future of money, crashed, eroding $50bn in value to nearly zero. That had collateral damage on other stablecoins and most parts of the crypto market. All in a matter of days! It happened so fast that I didn't get time to fully understand what happened!

I spent the past week reading pieces by Not Boring, Bloomberg, Milk Road, The Token Dispatch and many others to understand the episode but I was left with many more questions. Matt Levine from Bloomberg and this podcast by Bankless did a great job of simplifying it for me further, but had to still google some aspects.

This edition of Fintech Inside is my attempt at simplifying the entire episode without any of the crypto jargon. You'll find details on the Terra Project, it's various coins, how algorithmic stablecoins work and how the Terra project crashed.

This post is longer than I initially planned for, so I wasn't able to cover Fintech Top Three section for the past week. There was a lot of fintech activity last week and you can read it all in my other newsletter - This Week in Fintech.

Request: Been getting comments that Gmail and other email platforms are throwing my newsletter in Spam. Request you to whitelist this newsletter. Please?

If you're building in fintech or have an idea that you'd like to riff on, I'd love to speak with you. Write to me at connect@osborne.vc.

Enjoy another week in fintech!

🤔 One Big Thought

How to turn $50bn into zero

Standard disclaimers:

This post is for educational purposes only. This is not financial/investment/strategy advice and should not be construed as such.

This is a very high level, 101-style post. If you know about the Terra crash, this post is probably not for you. But I urge you to poke holes in it and let me know what I got wrong. Email me

Starting around 5th May, 2022, Terraform Labs, a crypto project building "the decentralised future of money", saw the price of its coins Luna and Terra crash to $0.0 (from $90) and $0.2 (from $1) respectively, wiping out nearly $50bn in value. All this happened within a week!

As of April, 2022, Terra was the third largest stablecoin by marketcap, after Tether (USDT) at $80bn market cap and USD Coin (USDC) at $51bn market cap. Terra is the only algorithmic stablecoin while USDT and USDC are backed 1:1 by some "asset". Terra was huge, considering it was founded only in 2019 and majority of fund inflows came in only in 2021.

What caused this crash? In short - the 1992 Soros Trade. Wait, what? Crypto wasn't even around in 1992 and what has George Soros got to do with crypto?

History repeats itself: In early 1990, Britain entered the European Exchange Rate Mechanism (ERM), a set of procedures for European countries to manage a country's currency exchange rate relative to other currencies. Britain entered ERM to unify with the European Union and with the hope of maintaining its currency (GBP) at 2.7 above the German currency (DEM). In 1992, Britain had an environment of high inflation and low interest rates and that plan of maintaining GBP at 2.7 above DEM seemed unsound to most, largely because Germany didn't have the same level of inflation as Britain. Enter George Soros and his buddies. George Soros decided to "go big or go home" and took a complex, leveraged position of over a billion dollars to short the GBP while taking positions on other currencies and stocks that would be impacted by the plummeting GBP. The Central Bank offered interest rates in the high teens to attract more people to the Pound but that was unsustainable and this severely impacted the GBP's strength which led to the steep decline in the value of the Pound. George Soros effectively "Broke the Pound". I've oversimplified the whole episode but here's a very detailed coverage by Forbes from that time.

Before I get into the correlation between the Terra/Luna Crash and the Soros Trade, we need to cover some basics.

Terraform Labs, Terra, TerraUSD, Luna, Anchor Protocol:

Terraform Labs: The project designed to build the "decentralised future of money".

Terra Protocol: A layer 1 smart contract blockchain built for stablecoins and decentralised finance. Think, Ethereum but only for finance use cases.

TerraUSD: TerraUSD/UST is the stablecoin native to the Terra Protocol.

Luna: Cryptocurrency native to the Terra Protocol. It is also used for governance of the Terra Protocol.

Anchor Protocol: The lending and borrowing application/platform built on the Terra Protocol.

Supply and demand effects on pricing: (the below rules are not exactly followed this way, but simplified for the purpose of this post)

When supply increases, and demand increases, prices go up.

When supply increases but demand decreases, prices go down.

When supply decreases, but demand increases, prices go up.

When supply decreases and demand decreases, prices go down.

Stablecoin: A cryptocurrency whose value is tied/pegged to the value of another currency, asset or commodity. Stablecoins are characterised by low volatility.

Algorithmic Stablecoin: A stablecoin whose value is tied/pegged algorithmically.

Death Spiral: A situation where the supply of the asset/security increases rapidly, leading to a steep decline in the value of that asset/security. Typically happens for convertible shares.

Bank Run: A situation where a large number of customers of a bank or other financial institution withdraw their deposits simultaneously over concerns of the bank's solvency.

The Earth and Moon in perfect harmony (how the Terra algorithmic stablecoin works): The earth and moon are inter-dependent as they float through space. The Earth's gravity impacts that of the moon and vice versa. Earth would be in imbalance without the moon and similar for the moon without earth.

Similarly, TerraUSD and Luna are designed to be inter-dependent and that's what causes the UST's value to become algorithmically stable. It's not a coincidence that the Terraform Labs' stablecoin system is named after this Earth-Moon harmony - Terra (Latin for Earth) and Luna (Latin for Moon). Terraform Labs has a shockingly simple video explaining how the ecosystem and the stablecoin system works.

Here's breakdown of how the Terra algorithmic stablecoin works:

Again, some basics first:

There are two coins - UST (stablecoin) and Luna (cryptocurrency).

UST always trades at $1 (pegged to the US Dollar). Luna's value is volatile, depending on supply and demand.

The algorithm is designed to guarantee UST at $1. Effectively, you will always be able to buy one UST coin for $1 and with that one UST you can buy $1 worth of Luna. If the price of one Luna coin is $0.2, one UST coin can get you 5 Luna coins. If the price of one Luna coin is $20, one UST coin can get you 0.05 Luna coins.

How Luna and UST make UST stable?

We now know that the algorithm guarantees one UST for $1.

Let's say there's more demand for UST because of the Anchor protocol, this will push up the price of UST to, for example, $1.02.

People can buy $1 worth of Luna and "swap" the Luna for one UST, worth $1, with an instant profit of $0.02 because the value of UST in the open market is $1.02.

But then, as many people swap Luna for UST, there's more supply of UST and this could push the value of UST down to, for example, $0.97.

People will now "swap" their UST for Luna with instant profit of $0.03.

Congratulations! You've just learned what an "arbitrage trade" is!

When enough people "swap" Luna for UST (see Points 2&3), the value of one UST is brought back down to $1 (increasing supply of UST, decreasing the price of UST)

When enough people "swap" their UST for Luna (see Points 4&5), there's a declining supply of UST which increases the price of UST back to the $1 peg.

This arbitrage trading and dance of demand and supply is what helps Terra maintain its peg of $1! Congratulations again! You now know how an algorithmic stablecoin works!

Again, this is a gross oversimplification of the inner workings of the Terra/Luna stablecoin system, but this should give you a pretty solid foundational understanding. For example, you might wonder "what's algorithmic about this? It sounds like these are just market forces maintaining the peg" and you'd be right to think this but it's not important for this post.

Why would people buy or sell UST or Luna? Great question. Two reasons.

Perceived trust in the platform and coins. Terra was touted as the "decentralised future of finance" and became the 3rd largest stablecoin by market value. Too big to fail?

Anchor Protocol. Think of Anchor as a savings bank account. With Anchor, holders of UST could "deposit" their UST coins and receive 20% annual interest rate. You get less than 1% annual interest from the best banks in US and 3-4% from Indian banks. 20% is huge for anyone. 20 percent. Risk-free. No price volatility. Sign me right up!

The folks at Terraform Labs believed that arbitrage trading (high frequency) could pull in enough in fees that they could cover the 20% in interest payouts. Unfortunately, that didn't work, as trading didn't happen at the scale and most users just "deposited" their UST coins because 20% is very attractive in any market condition. Terraform had to honour those interest payouts from reserves and funds raised.

More importantly, the Terra ecosystem didn't really have any other use case or application. All "value" was largely derived from the "perception" of its stablecoin. One can argue that earlier central bank issued currency was pegged to a hard asset like gold but now they can print money at will. While its true that central banks can print money at will, its value is derived from the value of goods and services the country produces. Moreover, over circulation of money can have serious implications on the stability of the country and so the central bank will avoid printing too much money.

The Anchor Protocol wasn't the reason why the stablecoin crashed though. Anchor was just bad financial management. A very sneaky trade actually caused the crash. You guessed it the Soros Trade.

The Crypto Soros Trade (how the UST stablecoin crashed): Corners of the crypto ecosystem have been critical of the 20% interest payouts saying it was not sustainable for the Terra ecosystem (reminds you of the Bank of England in 1992 that offered interest rates in the high-teens to make the Pound attractive). Some traders have been studying this and waited for the opportune moment to strike.

The trade was executed as such: (this section has a few moving parts, so pay close attention. I relied on this Tweet thread for the facts/understanding)

Sometime in March, 2022, Terraform Labs announced it will shift away from the full algorithmic peg to having $1bn in Bitcoin (BTC) assets to defend the UST peg. By end of March, 2022, the Luna Foundation Guard (LFG), the Terra reserve entity formed to support the Terra ecosystem, had its $1bn in BTC.

Then in April, 2022, LFG announced it will be migrating from the 3Pool to 4Pool i.e. a liquidity pool of three stablecoins to a liquidity pool of four stablecoins.

This migration would make the UST vulnerable as the LFG would have its liquid funds (required to defend the peg) locked away in the migration, making the funds unavailable to defend the peg.

During this time, the trader/traders (let's call them "George") set up their trades as such:

George managed to borrow 100,000 BTC for ~$42,000 each. That's a $4.2bn short position against Bitcoin i.e. George bet that the price of Bitcoin will plummet.

At the same time, George built a $1bn UST holding i.e. they owned $1bn in UST.

As the migration from 3Pool to 4Pool began, on 8th May, George start selling their UST in large volumes. This begins to de-peg the UST, bringing down the value of UST to ~$0.972.

From "How the stablecoin works" section above, you would know that when the value of UST goes down, you can defend the peg by swapping Luna for UST.

That's exactly what happened. The LFG started selling its BTC holding to purchase Luna to swap for UST to bring the value of UST to $1. The selling of BTC was happening in large volumes and this simultaneously drove down the price of BTC, which further reduced the value of the LFG reserves.

By now, there was considerable concern among BTC and UST holders. UST holders started withdrawing/selling their deposits as well.

As this happened, George sold their remaining UST holdings (~$650mm) in the open market on Binance, causing panic among UST holders in Anchor which led to panic UST withdrawals. This started a bank run with several billions in withdrawal from Terra which really caused the UST de-peg.

Panic UST withdrawal (bank run) meant there was no one to "swap" Luna for UST. The price of Luna plummeted further (as there was no demand for Luna), which led to more Luna being issued by the algorithm. All this resulted in a death spiral with several trillions of Luna in circulation with a value of close to zero each.

LFG continued its BTC selling, at reducing price, to purchase Luna to swap for UST but it was getting too late to defend the peg.

This trade sounds very complex, largely because it requires an understanding of pricing and market dynamics between multiple assets (BTC, Luna and UST). This also required tons of capital to execute. Meme-ing it with several retail traders would not have worked.

How much did George i.e. the Traders make from this ingenious trade? A cool ~$800mm. But in that process, they brought down an entire stablecoin ecosystem with several people losing their entire life savings.

What happens now? At the time of writing this edition, one week after the crash, the price of UST is at $0.17 (nowhere close to $1), the price of Luna is $0.00027364 (nowhere close to its peak of $115 in April, 2022) with a circulating supply of 6.5 trillion coins. Total value locked in the Terra ecosystem still stands at $530mm and the market cap is ~$4bn.

This crash in the crypto ecosystem is monumental because of its size - $50bn to zero. Nothing of this size has ever happened in the 13 years since the first block was mined on the Bitcoin blockchain.

Obviously, the crash made regulators sit up and take notice. The crash also raises questions about the value of cryptocurrencies and the financialisation of the internet. Terra was built on "perception" and "trust". There was no underlying value.

Some blamed retail Terra investors for not doing enough research on how Terra paid its yield. That's like blaming the common person for not knowing incumbent financial jargon for example claims, loaded premium, floating interest rate, bonds, options and many more. It's unfortunate, because the crypto industry is fraught with its own jargon which most people even in the thick of crypto things are still learning.

The Terra crash is a big learning event for the entire crypto community. There will always be a risk of unknown unknowns. While this crash could have set back the crypto ecosystem by a couple of years, the community is still fairly nascent and just getting started.

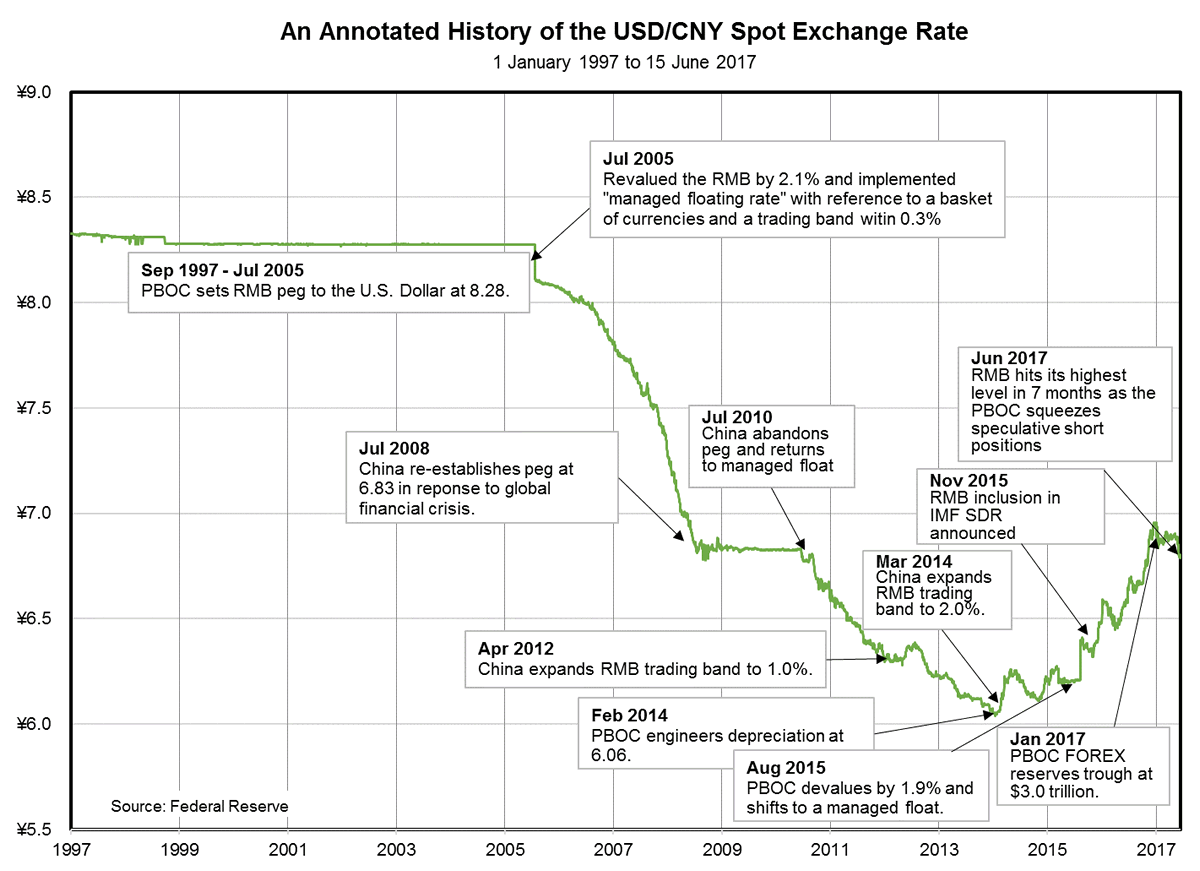

Fun Fact: The Chinese Yuan (CNY) is the OG stablecoin! For long, China did not have a floating exchange rate determined by market forces. Instead, the CNY had a fixed peg of 8.3 to the US Dollar (USD) for over a decade since 1994. Then, in 2005, due to trade partner pressure, the CNY was moved to a "managed float" system that appreciated the CNY to 6.8 to the USD. Over the next few years, there were bouts of "managed pegs" to "fixed pegs" and back. Post 2019, the CNY was allowed to be determined by market forces. This peg to the USD was done largely to make Chinese exports attractive. the CNY exchange rate is still "managed" between 6-7 to the USD by shoring up on dollar reserves. Many other countries "manage" their currencies this way as well. Do Kwon, cofounder of Terra, could learn a thing or two from PBOC!

What did you think of this edition - was it easy to understand? Did I get certain sections wrong? Feedback and brickbats welcome - connect@osborne.vc

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

🌏 International

Looking for the news digest? Read all the week’s fintech news and updates in India and SEA over at This Week in Fintech - India and SEA Edition.

🏷️ Other Notable Nuggets

🎵 Song on loop

Fintech updates can get boring, so here's an earworm: Stumbled upon this unique song called Tomorrow by an artist Chai Lenin (Youtube / Spotify). Don’t want to say too much because the song has some surprising vocals. Have fun!

👋🏾 That's all Folks

If you’ve made it this far - thanks! As always, you can always reach me at connect@osborne.vc. I’d genuinely appreciate any and all feedback. If you liked what you read, please consider sharing or subscribing.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

See you in the next edition.