May the force be with you | Fintech Inside - Edition #60 - 09th May, 2022

All about a trend in the VC funding cycle. This edition covers what's happening in the market, why it's happening, how it will impact startups and what founders can do.

Hi Insiders, Osborne here.

Welcome to the 60th edition of Fintech Inside. Fintech Inside is the front page of Fintech in emerging markets.

From doing only zoom calls to meetings in person, coupled with travel, I was a little disoriented this past month. My publishing schedule this past month was a mess and I will return to my usual publishing cadence. Thanks for bearing with me.

In April, I organised two fintech meet ups - one in Bangalore and another one in Delhi NCR. Meeting the local fintech communities was exhilarating and I hope to organise meet ups in other cities too!

Lately, I've been noticing a market trend among startups - that of a change in market sentiment. There are indications of an end of the 2021 funding party. This edition covers what's happening in the market, why it's happening, how it will impact startups and what founders can do.

The past week was slow in terms of a fintech news cycle, so there's not much else in this edition.

In other news, India minted its 100th Unicorn! No surprise that it was a fintech startup! Deepak Abbot wrote this excellent piece on the unicorns analysing them by revenue, city, profitability and other metrics.

Request: Been getting comments that Gmail and other email platforms are throwing my newsletter in Spam. Request you to whitelist this newsletter. Please?

If you're building in fintech or have an idea that you'd like to riff on, I'd love to speak with you. Write to me at connect@osborne.vc.

Enjoy another week in fintech!

🤔 One Big Thought

May the force be with you

2021 was a year of historically high amounts being deployed into venture startups - ~$643bn globally! Indian startups as well raised record breaking amounts of $29bn! In 2021 it was common to see deals being closed in a few days (literally) and founders getting the capital and valuation they demanded. It was, effectively, as they call it, a founders market. Lately, there have been indications that that party might not last too long.

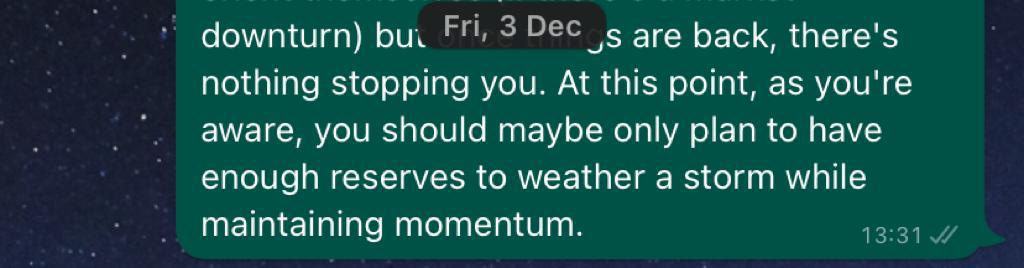

On 3rd Dec, 2021, I sent the above text to a founder friend congratulating them about their fund raise and suggesting to have enough reserves to weather a potential market downturn. Since then, I mentioned this to every founder I spoke to in our our portfolio or otherwise. This post is about what I'm seeing in the venture market in India and what I've been telling founders I meet. I'm certainly no economist or financial expert to know what's causing what and why the economy might take a turn for the worse. You've been cautioned: take this post

"Err... wait a minute. What are you talking about?" Since a couple of months, I've been noticing the pace of investing slowing. There are indications that the market is flipping from a founders market to an investors market. What are these indications:

For growth stage companies, they don't seem to be getting the valuations they seek. Even the exceptional ones are finding it tough.

For early stage companies, traction is being questioned, founders aren't getting the amounts the seek and investments are taking longer to close.

I must admit, early stage is a mixed bag - some founders are being chased and deals are still getting closed quickly (maybe not in days) and most others struggle.

“Why is all of this happening?” I can speculate but that would be irresponsible of me. You can read more about global supply chain issues, interest rate hikes, inflation, wars, localisation and more. Choose your lesser evil!

“How will this impact fintech and my startup?” This section assumes a funding winter and a market downturn. Read accordingly.

Startups that have built trust with their users over the years will have a better time weathering this period. Those that have spent money to acquire non-loyal users will see a mass exodus and real numbers will start showing up. Early stage companies will likely take frustratingly longer to find product market fit.

Regulators will be ever more stringent with license holders as it will focus solely on consumer protection and trust in the institutions. It will be difficult to get new licenses or acquire existing ones.

Payment companies might see a reduction in payment volumes as consumption might drop. Lending startups might see increased demand but will need to be even more stringent on approval rates. Lending companies might see a decline in supply of capital from larger financial institutions. This will lead to limited disbursal rates.

This period is "non-season" time for the insurance sector, so not sure how this will impact insurance startups. Wealth management startups might see big drawdowns. In the 54th Edition where I did a deep dive on Jar, I predicted that users might continue to hold their investments/savings in gold. Time will tell if that prediction holds.

For startups building financial infrastructure, there might be declining demand from companies where fintech products are non-core to the business model. Companies selling to businesses will have longer sales cycles and longer payment cycles. For B2B startups, expect that customers will not honour agreement commitments.

“As a founder, what should I do?” Conserve cash. If only life were that easy! Conserving cash is the single most important thing you could do. Make sure you have cash to cover at minimum 12 months of burn. Don't rely on VC funding - ever. Avoid seeking instant gratification on products and constantly speak to your most loyal customers to iteratively improve product. Strengthen your business by cutting non-core spends/businesses and double down on what you're good at. Taking care of your teams will become increasingly important as morale will be low (again).

As a founder, you should not be scared by price dips because of market sentiment as long as you have full conviction in your business.

Especially for early stage startup founders:

If you've raised funding recently - great! Be prudent with your costs.

If you're fund raising right now, close it as soon as you can. If you have only a few months of cash and fund raising is tough, explore strategic opportunities.

If you're just going to begin fund raising, go in assuming it's going to be tough to close or at all.

“Thanks for ruining my week, Osborne!” It is not my intention to sound the warning bells but I'd rather founders be prepared. What's the worst if there's no downturn? You'll do well and have a strong business with stronger cash flows. Nothing to lose, IMO.

The best businesses will come out of this period unscathed. Those that provide true value to consumers will bubble up from all the noise of the past year. Founders and senior management will have to become "war-time leaders" to do what must be done for the business.

It is important to note that, some of the world's largest tech businesses today e.g. Slack, Uber, Facebook, Amazon, LinkedIn and more, were born out of periods of recession or changing market sentiment. All is not lost. This is potentially the best time to start up.

Every single VC fund in India has recently raised their latest funds and needs to deploy it within the next 2-3 years. These funds, totaling billions, will go to founders focused on building structurally sound businesses with an eye on business metrics of users, retention, revenue and costs. Valuation could not be less important and deal timelines may be longer.

Given I invest at early stages, picking great founders has always been paramount. Nothing changes for me and I will continue to invest in the best founders starting up. Honestly, I couldn't be more excited to back founders starting up in fintech. Massively bullish on fintech for this decade!

What are your thoughts on the changing market sentiment? Are there sections of this you disagree with? Write to me and let's discuss this. Email: connect@osborne.vc.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

3️⃣ Fintech Top Three

There was no material fintech development from the past week worth discussing. Did I miss something? Email me

🌏 International

Looking for the news digest? Read all the week’s fintech news and updates in India and SEA over at This Week in Fintech - India and SEA Edition.

🏷️ Other Notable Nuggets

Global Financial Sustainability Report: The Rapid Growth of Fintech

The Tale of a Crypto Executive Who Wasn’t Who He Said He Was

🎵 Song on loop

Fintech updates can get boring, so here's an earworm: When Chai Met Toast is such an underrated Indian band. Listening to their music is very soothing. Slight Mumford and Sons vibe. Hope you have a soothing week with this beautiful song Khoj (Passing By) (Spotify / Youtube)

👋🏾 That's all Folks

If you’ve made it this far - thanks! As always, you can always reach me at connect@osborne.vc. I’d genuinely appreciate any and all feedback. If you liked what you read, please consider sharing or subscribing.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

See you in the next edition.