Agentic Payments | Fintech Inside #93

Beyond human clicks: A deep dive into Agentic Payments, the disruption of SaaS pricing, the new infrastructure enabling AI-driven commerce and key players defining how AI will transact in the future.

Hi Insiders, I’m Osborne, an investor in early stage startups.

Welcome to the 93rd edition of Fintech Inside. Fintech Inside is the front page of Fintech in emerging markets.

Just a year ago, the idea of machines autonomously creating valuable output, let alone transacting, felt distant. Yet, AI is rapidly evolving from chatbots analyzing information to 'agents' actually doing things. Imagine an AI agent handling that complex orchestration autonomously.

But this leap raises a fundamental question: how do these agents pay for the services they book or the goods they order? This need has sparked a wave of activity from the biggest names in payments – Visa, Mastercard, Stripe, PayPal, Razorpay – all launching initiatives around Agentic Payments.

Is this the dawn of truly autonomous commerce, or just sophisticated new plumbing for existing rails? This week, I explore the emerging infrastructure, the disruption to business models, and the real potential behind the buzz.

As usual, there’s also a beautiful song recommendation at the end, if you’d like to listen to a song in the background while you read this. Do share your recommendations with me too :)

Thank you for supporting me and sticking around. Enjoy another great week in fintech!

🤔 One Big Thought

Agentic payments | The AI agents are coming… for your wallet

In the 1970s-1980s, expecting flying cars by 2020s was considered science fiction. Today there are car makers Alef and Xpeng who are actually building flying cars. Every generation keeps redefining what "science fiction" means to them and that pushes our collective imaginations and ambitions.

We're living through a period of exploring our definition of science fiction - thanks to GenAI. We're reimagining what it means to create, consume and thrive. We're reimagining business models and revenue models. We're reimagining our role, not to get too philosophical.

Even a short 12 months ago, we would have never imagined machines creating things for us autonomously. Today, 25-30% of all code at Google and Microsoft is writing entirely by AI. I write all my code using AI.

These AI "agents," as they're increasingly called, promise a future where tasks from simple to complex, from managing household supplies to orchestrating sophisticated business processes – are all handled autonomously.

If you're 25+, you'll relate to this example: think about the challenge many of us face managing our elderly parents' healthcare needs – ensuring they eat and stay healthy, tracking doctor appointments, ensuring follow-ups, ordering prescription refills, and handling payments for consultations or pharmacy bills.

Today, this involves constant calendar reminders, phone calls to clinics, coordinating transport, trips to the pharmacy, and manually paying bills via UPI or cards after receiving them. It's time-consuming, stressful, and prone to missed appointments or delayed refills. If only I had an EA just to manage my parents needs and their health.

Now, imagine telling/prompting your AI agent: "Manage Mom's cardiology care with Dr. Sharma at Apollo. Ensure she has her monthly check-up scheduled, remind her one day before via a call, book an uber cab if needed, book pathology tests from Orange Health based on prescription, track her vitals from her smartwatch, ensure her prescriptions for Metformin and Lipitor are refilled 3 days before they run out via Welcome Medical by calling them, and handle payments using my linked ICICI credit card, staying within a INR 10,000 monthly budget for consultations, tests and meds. Alert me if any vital reading is concerning or if Dr. Sharma recommends a change in treatment". *wake up, Osborne!* Ah! what a dream! Snap back to reality.

This AI Agent doesn't just remind you; it acts for your. It proactively schedules, coordinates transport, monitors vitals, checks pharmacy inventory, places refill orders, and – crucially – initiates payments for the consultation fee or the pharmacy bill or the pathology tests, using delegated, secure credentials within the set budget. It operates autonomously based on rules and real-time needs. This shift from human-initiated to agent-initiated commerce requires a new kind of payment infrastructure – Agentic Payments.

Why Now? The Shift to Agent-Centric Commerce

Claude's Model Context Protocol framework of building the "Type-C - universal charging point" equivalent of the Agentic world, seems to be igniting a lot of this discussion and experimentation.

We're still in the very early days of building a true, universal, autonomous agent. There are so many considerations of user interfaces, data structures, systems, proprietary access and other aspects of the internet we've come to know and love that we'll need to get right before we have such universal agents.

The underlying agentic framework is maturing rapidly though. Most large tech companies are experimenting with their vision for such agents, but that's not the topic for today's discussion, so will skip it. However, our current systems are showing their limitations.

Today's APIs and payment flows were largely built with human developers and end-users in mind. They aren't optimised for AI agents communicating and executing complex, multi-step tasks autonomously. These agents require programmatic, secure, and context-aware access to financial rails.

For a long time I've held the view that the payments form factor will evolve based on the evolution of our points of consumption. We've seen it evolve from coins to cash to plastic cards to now our mobile phones. Our payment flows will continue to evolve as our points of consumption evolve. My initial hypothesis was that the payments flow for live commerce was broken, the payments flow for renewing subscriptions on our TV is broken. That thesis was only partially wrong - seems I got the direction right, but not the use case.

In an agentic future, our point of consumption is evolving yet again. And that's creating a need for the payments form factor to evolve once again. Except this time, along with the form factor evolving, our business model is evolving as well.

The Business Model Switch: Pricing in an Agentic World

The most significant catalyst for agentic payments is the fundamental disruption occurring in software business models - especially the traditional SaaS per-seat pricing model becoming increasingly untenable.

Why the shift? SaaS sprawl creates unused 'shelfware', data silos across different tools reduce overall efficiency, and the significant compute power needed for sophisticated AI features puts pressure on margins. Most critically, if AI agents start performing tasks previously done by humans, the very notion of charging "per seat" or "per user" seems to break down.

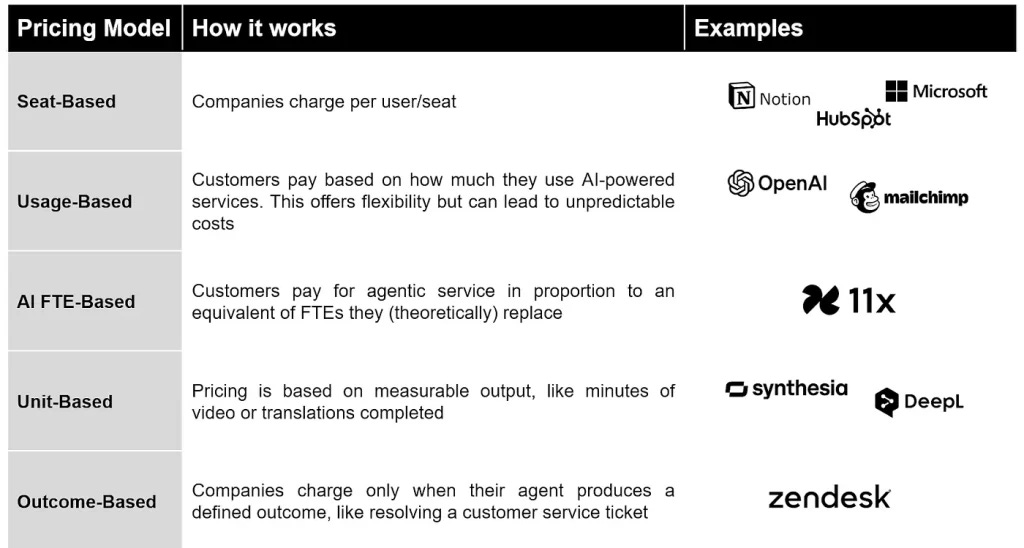

This necessitates a move towards pricing models that better align cost with the actual value delivered. We're seeing the rise of alternatives moving away from the traditional seat-based approach:

Usage-based: Pay per API call, compute time.

Outcome-based: Pay when a specific result is achieved.

AI FTE-Based: Pay based on the equivalent human full-time employees the AI replaces.

Unit-Based: Pay per unit of output created.

However, implementing these new models isn't simple. Measuring outcomes accurately, establishing clear attribution (did the AI really complete the task?), and providing budget predictability for customers are major challenges.

This is where Agentic Payments seems to fit in – they provide the underlying infrastructure needed to measure, track, and settle value based on usage or outcomes, programmatically and reliably.

Enter the Players: The Payments Giants Respond

Recognizing this paradigm shift, the major payment networks and processors have started unveiling their strategies - all within the last 6 months:

Visa's Intelligent Commerce: Chat-based shopping. Visa wants to enable agents to "find and buy" securely. Focuses on "AI-Ready Cards" using tokenization for secure agent transactions, backed by their fraud prevention expertise and partnerships.

Mastercard Agent Pay: Introduced "Agentic Tokens," extending existing tokenization products. Collaborations with Microsoft and IBM target both consumer and B2B use cases, aiming for seamless payment integration into conversational AI platforms.

Stripe Agent Toolkit: Offers developers an SDK to integrate Stripe functionality (including Issuing for virtual cards) into agent workflows. Stripe has gone the extra mile and solved for "usage-based pricing" by including tools for metered billing based on agent usage.

Coinbase Agentkit: Giving AI agents crypto wallets for on-chain interactions, enabling stablecoin payments and monetization, designed to work with any AI framework or wallet.

PayPal Agent Toolkit: Provides an SDK connecting AI frameworks (using the MCP standard) to PayPal's APIs for tasks like invoicing, subscriptions, and payments, enabling agents to manage commerce workflows.

Razorpay MCP Server: An early move from India, establishing a server based on MCP to standardize how agents could potentially interact with its payment gateway APIs in the future.

There are several more platforms, including early stage startups like Prava and others addressing agentic payments in their own way.

Several common threads run through the above initiatives:

Tokenization as Infrastructure: Securely representing payment credentials for machine use is the foundational layer.

Security & Trust: Agent verification, user controls (limits, permissions), and robust fraud detection are critical. The "Know-Your-Agent" (KYA) challenge remains a significant hurdle – establishing the identity, authority, and legal standing of an autonomous agent.

Developer Enablement: Providing developer SDKs and clear documentation is the MO most of these platforms are going for to build adoption by those building the agents.

Ecosystem Collaboration: Given these are early experiments - a sort "throw them at the wall and see what sticks" approach, all are going for partnerships and collaboration across AI labs, frameworks, cloud providers, and payment networks.

The Billing Infrastructure Gap: While payment execution is being addressed, the infrastructure to easily support complex outcome-based billing driven by AI agents is still nascent.

Like telecom, there are only two models to charge the user - prepaid or postpaid. Depending on the agentic payment, users will be required to add amounts to their prepaid wallet or virtual card for use, else the user will be billed and charged at the end of the period. It seems like we may default to prepaid model to build trust initially, and then graduate to postpaid, once trust is built and the user knows what to expect. This has been our experience in India with digital payments too.

The amazing thing is that with agentic payments, new financial products and services might spawn as well, each with their own problems to solve. These include:

Outcome Insurance: Guaranteeing agent performance or insuring against errors.

Agent Credit Systems: Financing agent actions in a postpaid model.

Cross-Agent Settlement: Infrastructure for agents to transact with each other.

Value Attribution: Reliably proving which agent actions led to specific outcomes.

Crypto's potential rebound? Blockchain's programmable money and instant settlement capabilities seem tailor-made for agent-to-agent transactions. Unlike traditional rails that assume human oversight, crypto smart contracts can autonomously execute complex conditional payments between agents—imagine agents creating escrow contracts or even forming economic alliances without human intermediation.

The Future: Beyond Just Plumbing?

Is Agentic Payments just a feature? Looking at the current offerings, it's easy to see them primarily as enhanced plumbing. They leverage existing tech like tokenization and provide SDKs for what feels like automating existing payment flows, just triggered by AI instead of a human click.

Stripe’s focus on metered billing seems the most immediately practical application for the evolving SaaS landscape.

From an investment opportunity lens, maybe I'm being unimaginative, but it's hard to build conviction in the India opportunity today. If agentic payments is just a feature, as displayed by the major payment giants, then distribution will win and these larger payments companies have solved for distribution and more importantly trust.

Secondly, the AI coding agent use case, the most sophisticated agent framework today has achieved only about 30-35% autonomy! That's it. Most other use cases, similar to the one I mentioned above, are far more complex, with far more "agents" to coordinate with. Any product manager will tell you that the more "agents" you have coordinate with, the more "hops" your agent has to do, increasing the failure rate of your orchestration agent. All this to say that I don't know if autonomous agents are 6 months away or 6 years away. With the pace of AI advancement these days, it's hard to say, but I'm currently leaning toward the longer timeline. And the longer timeline is never a good thing for venture capital allocators with a tight fund timeline.

On the flipside, this "feature" view might be too narrow. The fundamental difference isn't necessarily how the payment moves, but who or what initiates it and based on what context. These new payments infrastructure enable:

An outcome-based economy: Agentic payments along with metered billing provide the mechanism to reliably measure and charge for value delivered by AI, making sophisticated and complex outcome-based pricing feasible.

Autonomous Commerce at Scale: Moving beyond suggestions to automated execution requires payment rails built for machine interaction and control.

Sophisticated B2B Automation: Enabling agents to handle complex financial operations like procurement or treasury management requires programmable, secure money movement.

Crypto's time to shine:

The real innovation gap – and perhaps the space where new, focused companies could emerge – might not be in just executing the payment transaction itself, but in the essential surrounding layers:

Agent Identity & Authorization (KYA): Building the trusted systems to manage agent consent, permissions and liability.

Agent-Native Billing Platforms: Creating flexible engines designed explicitly for complex outcome/usage-based pricing driven by AI performance.

Cross-Platform Orchestration: Enabling seamless interaction and settlement between different agents and payment systems.

Conclusion: The Dawn of Agentic Finance

Incumbents like Visa, Mastercard, Stripe, Razorpay and PayPal have a significant advantage in rolling out these initial toolkits because of their distribution. The underlying shift towards programmatic, agent-driven value exchange however is more than just incremental. It feels foundational.

Think of it like the early internet protocols – simple in concept, but they enabled entirely new ways of communicating and transacting. Agentic Payments could be the financial protocol layer for the coming age of autonomous systems.

While the specific tools launched today might seem like features, building the trusted, secure, and interoperable system for this new agent economy is the real long-term opportunity and challenge.

The question isn't if agentic commerce will grow, but whether its financial backbone will be merely an extension of today's networks, or if it will necessitate new, specialised infrastructure players to address the unique complexities of a world where machines manage money.

Which pricing model do you think will dominate the agent economy—usage-based or outcome-based? And if you're building an AI agent product today, would you develop your own payment integration or partner with an existing provider? Drop your thoughts in the comments or reach out directly.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

🎵 Song on loop

Fintech updates can get boring, so here's an earworm: This week Glorious by Macklemore and Skylar Grey (Youtube / Spotify) got me bobbing my head to their beats and lyrics. Give it a listen!

✨ Call outs

Apollo Global’s 40-slide presentation on how US consumers and businesses are responding to the tariffs. Spoiler: Recession by US Summer.

Matthew Prince, Cloudflare CEO, pitching Cloudflare at Techcrunch Disrupt back in 2010. Technically, Cloudflare is a very complex business, it abstracts away a lot of the tooling, piping and more of the internet for us. But his presentation doesn’t get into any of the technical details, he instead constantly repeats that Cloudflare can be used by clicking just one button. That’s his entire pitch. Love it!

👋🏾 That's all Folks

If you’ve made it this far - thanks! As always, you can always reach me at os@osborne.vc. I’d genuinely appreciate any and all feedback. If you liked what you read, please consider sharing or subscribing.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

See you in the next edition.

What do you think will be the iPhone moment of agentic commerce? It seems everyone and their brother is moving in this space, but my early test with operator were not very conclusive. Until there is a clear use case, I fear it could go the way of the metaverse...

Interesting analysis on agentic payments. I share your view that we will at some point see different business models emerge for agentic payments. In such cases we shouldn’t be surprised if no competitors emerge that don’t have the distribution today, so are not obviously the competitors of the future. But often it’s slowly and then suddenly that competition emerges.