Slice launched its UPI powered ATM | Fintech Inside #97

This week's edition: Slice's historic bank launch, India's booming IPOs, and the RBI report that proves the system is built to last.

Hi Insiders, I’m Osborne, an investor in early stage startups.

Welcome to the 97th edition of Fintech Inside. Fintech Inside is the front page of Fintech in emerging markets. So close to the 100th Edition!

While the world economy navigates headwinds and uncertainty, India's financial ecosystem seems to be defying gravity. The evidence from this week is overwhelming, and it points to a market that is not just stable, but aggressively building the future.

In our Top Three this week, I explore three pillars of this strength:

The Rule-Breaker: Slice did what many thought was impossible, launching a physical bank branch and becoming the youngest founder-led bank in India. It's a story of grit, pivots, and finally taking on the incumbents on their own turf.

The Thriving Market: Forget the global IPO slump. I analysed data from 274 IPO’s over the past 5 years. The insights show Indian IPOs have delivered returns of up to 436% since 2020, creating a vibrant public market that's the envy of the world.

The Resilient Foundation: I summarise the key findings from the RBI's Financial Stability Report, which confirms that India's banks are the strongest they've been in a decade, insulating our economy from global shocks.

From a single startup's audacious move to the confidence of an entire nation's capital markets, the message is clear: India is the bright spot. Here’s the deep dive.

Thank you for supporting me and sticking around. Enjoy another great week in fintech!

Considering angel investing? I get a bunch of fintech founders reaching out to me for investors. I’d be happy to put you in touch. I’m at os@osborne.vc

3️⃣ Fintech Top Three

1️⃣ Slice enters the big leagues as it opens its first branch

slice launched an UPI-based credit card and opened India's first UPI-powered physical bank branch and ATM in Bengaluru.

Takeaways:

Historical moment for Indian fintech: I barely saw any excitement about this on social media but this launch is historical in many ways, for slice and the broader ecosystem. For slice, this is its first branch as a small finance bank. This is the first branch to be powered by UPI. This is the beginning of a change in consumer banking in India. For the broader ecosystem, this is India's first new consumer bank launched in India post covid. This is the first time a fintech startup, by itself and not as a consortium, was approved to acquire a small finance bank in India. Rajan Bajaj is the youngest founder a bank in India today. None of these are a small feat by any measure.

slice is not new to financial services: Founded in 2016, slice is no stranger to pivots, regulatory action, funding crunch and more. That company has dealt with many blows over the years since founding and still managed to emerge and run a stellar business, finding opportunity where few ventured when it was unpopular. Until RBI regulation in 2022, slice was the 2nd largest "issuer" of BNPL cards in India. It had an NBFC license since 2018/2019 and always operated with that license along with off-book loan facilitation as well. Over the years, it raised $340M+ in equity and debt. Other than Blume Ventures, it does not have a single "top tier" Indian venture fund as an investor.

Bank license opens a new whole world for slice: A banking license is coveted, largely because of two reasons a) it's not easily attainable, not even Sachin Bansal or Vijay Shekhar Sharma are able to get one. and more importantly b) you can launch a whole host of financial products without much dependence on others for capital or product integrations. Being able to capture customer deposits is a big moat that literally no other fintech startup can do. This means slice now competes with incumbent banks, not just fintech startups. Consumer deposits are the lowest cost of capital, allowing the lender to offer competitive interest rate loans. Slice will take some time to get there, but it's a huge moat, compared to others. If early product launches are any indicator, Slice could capture an increasingly younger user base away from incumbent banks. It's "not-your-father's-bank" website, app and branches are opinionated and unique.

Unfortunately not much is written about the company's financial performance and Rajan has been a bit media shy. But Slice was last known to have ~$100M in revenue (FY23) and close to profitable.

I'm very excited for this new phase for fintech in India which will involve more fin than tech, finally capable of truly taking on incumbent institutions.

2️⃣ India IPO performance shows India’s capital markets is thriving, how long will it last?

I recently listened to the All In Podcast where Thomas Laffont of Coatue Management was talking about US public market performance. He said the companies that went public (excluding SPACs) in US in 2021, were trading 40% down, on average, within one year of going public and currently 50% down, on average. That's terrible performance and it's probably what's driving poor investor confidence in the US public markets.

So I evaluated data on IPO performance in India. Of the 274 Indian companies that went public in the last five years (2020-2024) they've returned, on average, 69-100%. 2020 was an outlier year, with companies returning 436% till date! That's the complete opposite performance of the US, as noted by Thomas Laffont.

Takeaways:

Number of companies going public is increasing: Since 2020, the number of companies going public grow 5.8x from 16 in 2020 to 93 in 2024 - the most we've seen in over a decade! The market response to companies going public is driving more companies' confidence to go public - diametrically opposite to that of the US markets. Public markets already have a strong pipeline of companies expected to go public over the next couple of years - driven by strong business turnaround by private companies and investor appetite to subscribe to these businesses.

Success rates: of the companies that went public in each year, 2/3rds are still trading above issue price. This is a very strong performance indicator. 52% delivered positive returns on both listing day and long-term. Success rates for each year are:

2020 - 94%

2021 - 67%

2022 - 67%

2023 - 67%

2024 - 58%

Average and median returns: Depending on the vintage year, average and median return performance till Jun, 2025 is off the charts.

2020 - avg is 436%, median is 117% (NIFTY50 - 136%)

2021 - avg is 98%, median is 58% (NIFTY50 - 62%)

2022 - avg is 96%, median is 34% (NIFTY50 - 57%)

2023 - avg is 58%, median is 35% (NIFTY50 - 30%)

2024 - avg. is 25%, median is 11%. (NIFTY50 - 4%)

I'm no public markets expert, so it's hard to pin point what's driving this increasing investor confidence: these IPOs were probably well priced at issue and listing, signalled by strong investor demand and oversubscribed IPOs. There could also be the fact that there's been general strong performance in India's benchmarks. Indian corporate performance is also the strongest we've ever seen - growing 7.2% YoY in FY25 among listed, non-financial services companies, compared to 4.7% YoY in FY24. Lastly, general frenzy in the markets, driven by general price appreciation or the fact that margin trading facilities have grown from less than $1bn in 2020 to $10bn today!

There's a lot happening in India's public markets that's diametrically opposite to global markets. And with a strong, healthy pipeline of companies expected to go public over the next two years, we can only expect it to get even more exciting. But with consumer spending reducing, while deposits growing, who knows till when this IPO party will last.

3️⃣ RBI Financial Stability Report - India continues to be the bright spot in the global economies

RBI released it's semi-annual Financial Stability Report. The report is full of deep research, data and insights on India's financial stability. It's a lot to read and analyse, so allow me summarise the most important points for you.

Takeaways:

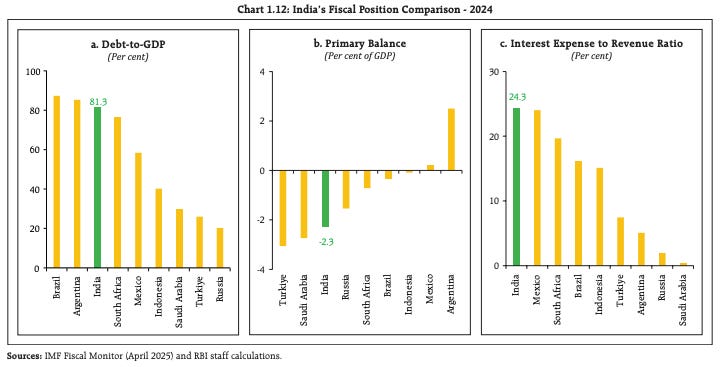

Global markets are not doing so well: The global economic outlook has weakened, with major international agencies (IMF, OECD, World Bank) downgrading growth forecasts. This is primarily driven by a cocktail of global issues including trade tensions and elevated geopolitical risks. These external shocks unfortunately can exacerbate existing intrinsic economic vulnerabilities. Soaring public debt, stretched asset valuations and stalled disinflation are increasing risks of global financial instability.

India is doing relatively better: India remains the fastest-growing major economy, with real GDP projected to grow at a steady 6.5% in FY26. Growth is underpinned by strong domestic demand, insulating the economy from the worst of the global headwinds. Domestic inflation steadily declined, reaching a six-year low of 2.8% in May 2025. The Current Account Deficit (CAD) is eminently manageable at 0.6% of GDP, supported by strong services exports. Financial markets have shown resilience supported by RBI's liquidity measures.

India's financial system is the most resilient it's ever been:

Scheduled Commercial Banks (SCBs) - Strongest in Over a Decade: The Capital to Risk-Weighted Assets Ratio (CRAR) for SCBs reached a record high of 17.3% in March 2025. Asset quality has shown remarkable improvement. The Gross NPA (GNPA) ratio fell to 2.3%, and the Net NPA (NNPA) ratio stood at just 0.5%. Banks continue to report strong earnings and profitability, although a slight moderation in Net Interest Margin (NIM) is noted due to rising deposit costs. Even under a severe stress scenario, the system-level CRAR is projected to remain at 14.2%, well above the regulatory minimum of 9%. Importantly, no single bank is projected to breach the minimum capital requirement.

Non-Banking Financial Companies (NBFCs) - Healthy but with Pockets of Vulnerability: The NBFC sector remains healthy with strong capital buffers and robust interest margins. Overall credit growth has accelerated to 20.7%. Delinquency levels have improved, though some stress is visible in the microfinance portfolio. Under a high-risk stress scenario, 15 middle-layer NBFCs might breach the minimum CRAR of 15%, highlighting a specific area for monitoring.

Systemic Risk, Interconnectedness, and Key Risks: The RBI surveyed folks from the financial ecosystem on systemic risks. They seem to have high confidence in the Indian financial system's stability but decreasing confidence in the global system (as mentioned above). The RBI believes bi-directional exposures among financial entities will continue to grow. While this fosters efficiency, it's also a potential for risk transmission. The inter-bank market is dominated by PSBs. A critical RBI finding is that the system is resilient to contagion. According to the RBI's stress test, a hypothetical failure of the largest bank, NBFC, or HFC would not cause a domino effect leading to the failure of any other bank.

Regulatory developments and outlook: RBI's key priority is fraud prevention. Introducing the .bank.in domain and rules for telecom service providers to curb digital payment fraud are initiatives in that direction. The RBI also issued updated directions for Digital Lending, Project Finance, and revised the Liquidity Coverage Ratio (LCR) framework to account for the speed of digital withdrawals. There's a proactive stance taken by RBI to shield the Indian economy from domestic and global shocks.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

🎵 Song on loop

Fintech updates can get boring, so here's an earworm: Remember Seven Nation Army by the brother-sister duo White Stripes? Happened to listen to this beautiful soul/jazz rendition of the song while in Goa. This is "Remasterisée" version, by Ben L'Oncle Soul (Spotify / Youtube).

✨ Call outs

[Report] The Rainmaker Group’s Rain Gauge Private Markets report. The report is the best report I’ve come across with data on private matured startups and their performance comparisons with public market comps. I’m sure you’ll learn something new from that report. If you have more time, do check out their public markets report too.

👋🏾 That's all Folks

If you’ve made it this far - thanks! As always, you can always reach me at os@osborne.vc. I’d genuinely appreciate any and all feedback. If you liked what you read, please consider sharing or subscribing.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

See you in the next edition.