Big Promise in Tiny Payments | Fintech Inside #94

How UPI micropayments are democratising investment, fueling India's gaming boom and helping startups grow revenue like never before

Hi Insiders, I’m Osborne, an investor in early stage startups.

Welcome to the 94th edition of Fintech Inside. Fintech Inside is the front page of Fintech in emerging markets.

We're witnessing something unprecedented: the financialisation of content and the entertainment-ification of finance. The psychological barriers to both investing and real money gaming have collapsed simultaneously, thanks to UPI making tiny transactions feel like sending a WhatsApp message.

Here's what's wild: India's real money gaming industry now has 200M+ transacting users while our stock markets have 110M unique investors. That's right - more Indians are actively trading on Dream11 than on the NSE.

I'm fascinated by how the same technological enabler - UPI micropayments - is creating two massive parallel economies with completely different regulatory treatment, risk profiles, and social perceptions.

This week, I dive deep into India's micropayment revolution and how it's enabling businesses to earn massive revenue with new business models. The data tells a story that most people aren't paying attention to, and the implications for where Indian household savings flow next are enormous.

As usual, there’s also a beautiful song recommendation at the end, if you’d like to listen to a song in the background while you read this. Do share your recommendations with me too :)

Thank you for supporting me and sticking around. Enjoy another great week in fintech!

Considering angel investing? I get a bunch of fintech founders reaching out to me for investors. I’d be happy to put you in touch. I’m at os@osborne.vc

🤔 One Big Thought

The Big Promise in Tiny Payments

How Tiny Transactions Are Building Massive Markets

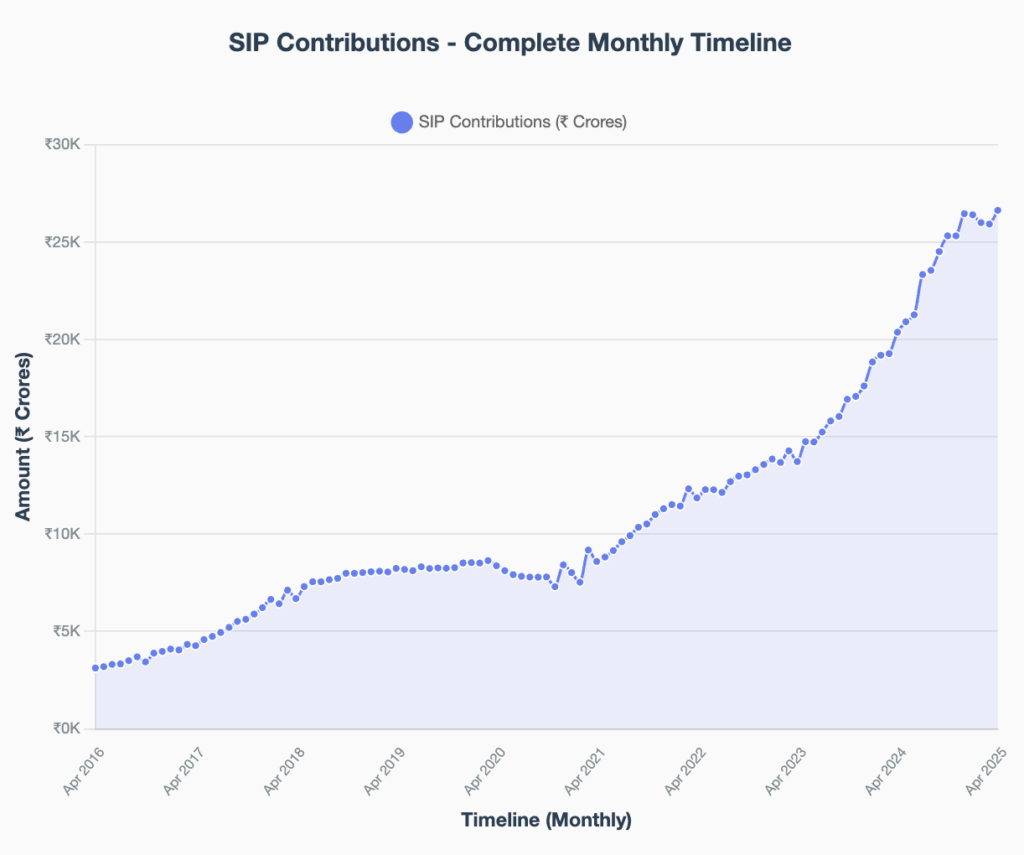

In April 2025, monthly SIP inflows touched INR 26,632cr ($3.1bn). Not even five years ago, that number was INR 8,376cr ($1.1bn). At the same time, India's real money gaming market, valued at $3.7bn in 2024, is projected to reach $9bn by 2029. Not only that, digital product startups seem to have found product market fit and growing revenues like never before.

What do these seemingly unrelated sectors have in common?

They're all being powered by Indians' growing aspiration for convenience and higher household income made possible by UPI.

The hero of this story is UPI, which has fundamentally altered what's financially possible. When transferring INR 10, INR 100 or INR 1,000 becomes as effortless as sending a text message, entirely new behaviours emerge.

This post is about some of those new behaviours, powered by the digital super highway of UPI and it's suite of sub-products.

AD: Speaking of making things simple, today's post is sponsored by Simplehuman

Simplehuman is a browser extension that makes using Gmail a blazing fast. Save time when using Gmail with keyboard shortcuts, follow up reminders, 1 click unsubscribe, and command bar.

Simplehuman is built by my fellow fintech friend Phalgun for folks like you and me to free our time for more productive purposes.

Use code FINTECHINSIDE for a 15% discount on yearly or lifetime plans.

Stocks, SIP's and IPO

The Indian security brokerage market is on a clear growth trajectory. The stock broking industry's revenues was around INR 23,500cr ($2.7bn) in the first half of FY25 which was expected to decline to around INR 20,500cr ($2.4bn) in the second half. That's ~$5.1bn revenue in FY25.

Behind these impressive numbers is a profound democratisation of market access:

NSE registered unique investors reached 110M by Jan 2025, up from 91M a year earlier

The derivatives segments grew 19x in active traders to ~9.6M in 2024 from ~0.5M in 2019

About half of the new investors in 2024 participated in derivatives

The share of mutual funds in Indian household savings grew from 7.6% in FY21 to 8.4% in FY23

What's driving this surge? The friction of entry has collapsed. When I first started investing in stocks over a decade ago, the process was cumbersome - requiring significant paperwork, wet signatures, minimum investment amounts, high fees and complicated payment mechanisms. Today it's a 5 minute onboarding process - thanks to digitisation, Digio and UPI. Costs of onboarding and friction of participation have gone down dramatically.

The UPI-powered IPO application process tells a similar story. Back in 2019, one time mandate for UPI was launched and applied to the IPO process. This meant, you could apply for an IPO using UPI to set up a one time mandate, and your funds would be auto debited from your account if you get allocation at IPO. Don't even ask about the IPO application process pre-UPI.

Today UPI is among the most preferred method to subscribe to an IPO and is used in 10-20% of the total IPO value. The retail portion of most IPO's is around that much, if I'm not wrong.

The INR 5 lakh transaction limit for IPO applications via UPI, compared to the INR 1 lakh limit per regular transaction, is high enough to accommodate most retail investors, removing what was once a significant barrier to participating in primary markets.

This "SIP-ification" of savings is becoming a structural feature of our economy. Platforms like Groww, Zerodha, and others have leveraged UPI to make investing accessible to demographics that were previously excluded - not just the affluent in metro cities, but also middle-income individuals from Tier 2 and 3 cities. Uttar Pradesh crossing the 1 crore registered investor mark is testament to this geographic expansion. For the uninformed, an SIP is a Systematic Investment Plan, which allows the user to decide to invest a certain amount each month in a certain mutual fund's scheme.

Today, I watch as friends casually set up INR500 ($6) monthly SIPs through a few taps, with the money automatically moving from their bank account via UPI autopay.

I remember having a conversation with a senior mutual fund executive who told me that they had to work hard to ensure costs were lower than current levels to launch the latest INR 100 ($1.2) SIP. It was all made possible because of these advancements.

The mutual fund industry is getting $3bn a month in guaranteed capital flows and it probably doesn't know what to do with it. Part of this monthly payment flows are made possible by UPI Autopay.

From Investing to Entertainment

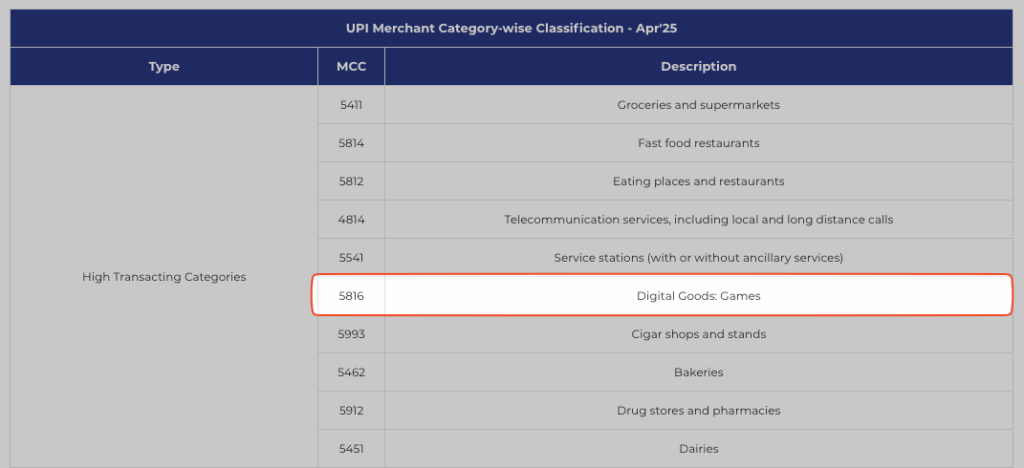

On the other end of the spectrum, India's Real Money Gaming and Fantasy Sports (RMG/FS) sector has exploded on the back of the same micropayment infrastructure, but with a fundamentally different value proposition.

The Indian gaming market, valued at $4.4bn in 2024, is projected to reach $7.6bn by 2028, with a user base of 600M. Within this ecosystem:

Fantasy sports reported revenues of INR 9,100cr ($1bn) in FY24, engaging a massive user base of 220-230M

Companies like Gameskraft saw a 30% YoY revenue increase to INR 3,475cr in FY24

MPL's revenue grew by 22% to INR 1,068cr, while PokerBaazi saw a 55% surge to INR 415cr

RMG leverages the same UPI payments infrastructure for entertainment spending. A typical user makes dozens of small deposits ranging from INR 10 to INR100 for game entries, with each action requiring minimal thought due to the frictionless payment process. The hope for users with real money gaming is that a user wins a game with a large potential cash reward.

The sector's explosive growth hasn't come without challenges. The 28% GST on deposits implemented in October 2023 has significantly altered unit economics. Fantasy sports revenues were projected to decline by 10% in FY25 to INR 8,200cr due to these tax changes. Companies are adapting by adjusting their commission, focusing on segments with higher ARPU like poker and rummy, or diversifying toward casual gaming.

Investing and Fantasy Sports - an Indian dichotomy

Despite the 28% GST addition, revenues are expected to decline just 10% YoY. On similar lines, SEBI (India's securities regulator), introduced a "True to Label" regulation in July, 2024 that was intended to make broking costs fair and standardised for all users. This was supposed to impact the industry as well, but CARE Ratings projected just a 4% decline in revenues.

The reason I'm talking about both these markets is because users are participating in both stock trading and RMG/FS for a windfall gain. The risks are similar, outcomes are similar, yet the real money gaming industry has over ~200M transacting users, vs. the stock trading industry has 110M unique investors i.e. half as many users as the real money gaming industry! Revenue of the two industries will soon catch up too, if not already there.

I keep thinking why that is, especially when the stock markets are regulated, while the RMG/FS industry is not. My current thesis is that users are familiar with RMG/FS - they know who a Virat Kohli is and they watch an IPL match, so, it's easier for them to understand what assets to trade in - everyone thinks they know better. This is not the case with assets in the stock markets.

Secondly, unlike the stock markets open only during a certain trading window, RMG/FS is available 24x7. That allows users massive flexibility in trading.

I could be wrong about these and I'm open to learn if you have differing views.

Beyond Financial Services: Powered by UPI Autopay

This micropayment revolution extends beyond just finance and RMG/FS. Content platforms, commerce, savings and others are increasingly adopting sachet pricing models - letting users pay small amounts for individual articles or limited access rather than full subscriptions.

The magic here though is the Autopay feature. UPI Autopay is a subscription payment platform that's getting platforms to sign up users for recurring payments. Autopay seems to be working because of low transaction values and trust in the UPI platform.

On looking at the data, I was shocked to see that there are ~1.2bn UPI Autopay mandate executions a month. That's ~4-5 transactions per user per month. Unfortunately, success rates are an abysmal 18% - so ~210M Autopay transactions are successful. That's a LOT of money left on the table.

Jar has daily/weekly/monthly UPI Autopay for savings in digital gold. It continues to grow revenues significantly.

Digital Content Monetization: Micropayments have cracked the code for monetizing digital content. Paying ₹5 for a news article, ₹99 for a monthly OTT plan (Netflix adopted UPI AutoPay in 2021), or tipping a creator a few rupees is now frictionless.

Astrotalk, an online astrology platform, leverages the same infrastructure to enable consultations priced as low as INR 10 per minute. Their revenue skyrocketed by 130% YoY to INR 651cr ($76M) in FY24, demonstrating how micropayments can transform even traditional services into scalable digital businesses.

FRND is a social discovery app for "Bharat" uses virtual coins bought via UPI for interactions, grossing INR 74cr ($9M) in FY24 revenue. Dream11 with 200M+ users, it saw revenues of INR 6,384cr (~$800M) in FY23 and turned profitable. Probo an opinion trading saw its revenue skyrocket 32x to INR 86cr ($11M) in FY23 and an astounding INR 459cr ($54M) in FY24, with INR 92cr ($11M) in net profit. Zupee a casual gaming startup doubled its revenue to INR 832cr in FY23 and became profitable in FY24 at INR 146cr ($17M) with INR 1,123cr ($131M) in revenue.

Industry reports even predict Indians will spend more on online gaming than on films by 2025.

Kuku FM, an audio content platform, Pratilipi, another content platform and many others like them listed in the tweet below, are breaking the revenue chasm. From my conversations with friends in the industry, I'm told some of these apps employ dark patterns and/or have low MAUs. Unfortunately, I don't know enough about these platforms to do a deep dive, but you get the general gist.

The common thread? When the friction of small transactions disappears, entirely new business models become viable.

The Power of Financial Accessibility

The micropayment and autopay revolution represents more than just a technological shift - it's a fundamental democratisation of financial access. Whether channeled toward wealth building through SIPs or content and entertainment, the ability to move small sums of money effortlessly is reshaping behaviours and business models alike.

UPI is a massive case study - build the rails and people will use it, unlocking economic activity. If only the India stack also included our roads.

What sectors do you think are being and will be transformed next by the micropayment revolution? Drop your thoughts in the comments or reach out directly.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

🎵 Song on loop

Fintech updates can get boring, so here's an earworm: Nostalgia crept in this week. Re-listening to this classic song by Sean Paul We Be Burnin’ (Youtube / Spotify). Enjoy!

✨ Call outs

Incredible data put together by Cole Rotman, investor at DST Global. The data shows people and firms that invested at Series A in companies that are currently valued >$5bn. Just four investors in that list who invested at Series A in 3 companies currently valued at $5bn+. I wrote a blog post about it too.

Insightful conversation with Jared Cohen of Goldman Sachs six months ago, on the the impact of AI on geopolitics. He was fairly prescient when he said that Saudi Arabia/the Middle East will be the ideal place for the US to build its data centers. Recently, the US had a big show in the ME and made billions of dollars in commitments toward building data centers in the region. FYI Goldman Sachs has an under rated youtube channel.

Stumbled upon Taylor Bell’s Youtube Channel, where in this specific episode she breaks down Erehwon’s business model. Erehwon is an ultra luxury supermarket and is fairly unique. Taylor’s videos are generally accessible with her funny style but deep insights on business models.

MobLand is my latest show obsession (available on Hotstar in India). As the name goes, MobLand is about modern day gangs and their rivalry, but made by Guy Ritchie and stars Tom Hardy, Pierce Brosnan, Helen Mirren and more. Excellent show!

👋🏾 That's all Folks

If you’ve made it this far - thanks! As always, you can always reach me at os@osborne.vc. I’d genuinely appreciate any and all feedback. If you liked what you read, please consider sharing or subscribing.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

See you in the next edition.