BNPL in India | Fintech Inside #90 - 31st Mar, 2025

How traditional banks hijacked the BNPL revolution in India with EMI innovations, reshaping the consumer credit landscape while fintech startups search for new opportunities.

Hi Insiders, I’m Osborne, an investor in early stage startups.

Welcome to the 90th edition of Fintech Inside. Fintech Inside is the front page of Fintech in emerging markets.

While the BNPL model scaled globally, it failed to even find product market fit While global markets embraced Buy Now Pay Later as the future of consumer credit, India's finance sector played by different rules. Traditional banks launched EMI innovations that resonated deeply with Indian consumers, creating a credit landscape unlike any other market.

Credit cards, once considered outdated by fintech enthusiasts, transformed into India's preferred credit delivery mechanism. Banks strategically repurposed these plastic cards into flexible payment tools, effectively capturing the market that BNPL conquered elsewhere.

This unexpected evolution reveals crucial insights about Indian consumer behavior, regulatory impacts, and market dynamics. As default rates rise and unit economics shift, both incumbents and startups must navigate a complex landscape where legacy products continue to dominate.

The battle for India's trillion-dollar consumer credit market is far from over, with innovative vertical-specific models emerging as potential disruptors.

Eid Mubarak to my friends who celebrate and happy end of financial year to those who celebrate!

Thank you for supporting me and sticking around. Enjoy another great week in fintech!

🤔 One Big Thought

Beyond BNPL: Why Credit Cards Won and the Opportunity for Fintech Startups

Beyond BNPL: Why Credit Cards Won and the Opportunity for Fintech Startups

Evolution of Consumer Credit in India: Pre-2020's, before Covid, credit cards were not as prevalent in India. In general, the consumer credit ecosystem was broken - offline onboarding, tight risk policies, incessant calling to pay back and many other terrible practices. This was the opportunity identified by most fintech startups - the opportunity to satiate Indians' credit appetite. This started the consumer credit revolution. In those days (early to mid 2010s), 4 in 5 users acquired were new to credit.

Lending to New to Credit users is risky - they don't have a credit history and you can't accurately predict their repayment behaviour. With unsecured loans, the loan amount is deposited in the user's bank account and the lender cannot track end use of that money, as a way to underwrite downside risk protection. That's a fancy way of saying, without knowing what the user is spending the loan amount on, the lender cannot estimate the probability of the loan becoming delinquent.

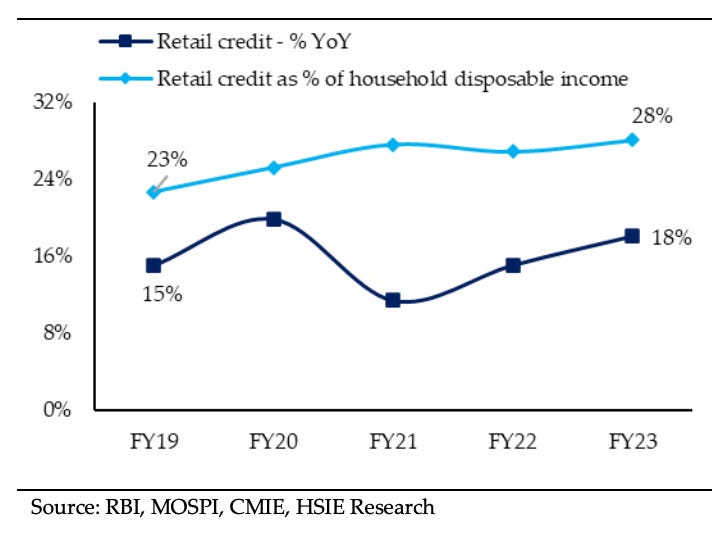

Other than the supply side just wanting to track the end use, from a demand perspective, India is a growing economy with increasing disposable income to spend on consumption. Add our ambition as a young nation and sprinkle a bit of Instagram-fueled FOMO and we have the perfect mix for a credit driven consumption growth. If you understand credit well, you'll know, credit-driven growth is not a bad thing.

The best way to track end use of consumption credit is the humble yet powerful credit card. The end use of a credit card is regulated and can be tracked. The product is a standard credit line which can be drawn down by the user as per need. For example, INR 50,000 approved credit line and the user can draw down/spend up to that amount during the billing period. But the main kicker is from a supply side (lender) perspective, the user never really gets access to the loan amount. This loan amount gets disbursed directly to the merchant at the time of sale.

Credit card economics: The credit card company has multiple sources of revenue, broadly categorised as Interest Income and Fee Income. All income earned by charging the user an interest on the outstanding and unpaid debt is interest income. All fees charged including joining fees, annual maintenance fees, merchant payment acceptance fees, late payment fees, penalties etc. are accounted as fee income. From a card company perspective, at least basis the one public company data we have available, Interest Income and Fee Income are roughly 50:50% revenue split.

From a user perspective, this credit card product is a sweet deal. We can spend upto our credit limit in a given billing period and we're given 20-45 days "interest free" to repay back that loan. At the end of the 45 day period, if we don't pay back the loan, only then we're charged an interest on the outstanding loan amount. This interest rate ranges from 2.5-4.0% per month, annualised this ranges from 25% to 50%. It's like having "working capital" for a month without any financial cost. Credit card companies also earn via their extensive rewards programs and cobranded partnerships, but that's not the crux of today's topic so I'm not getting into it.

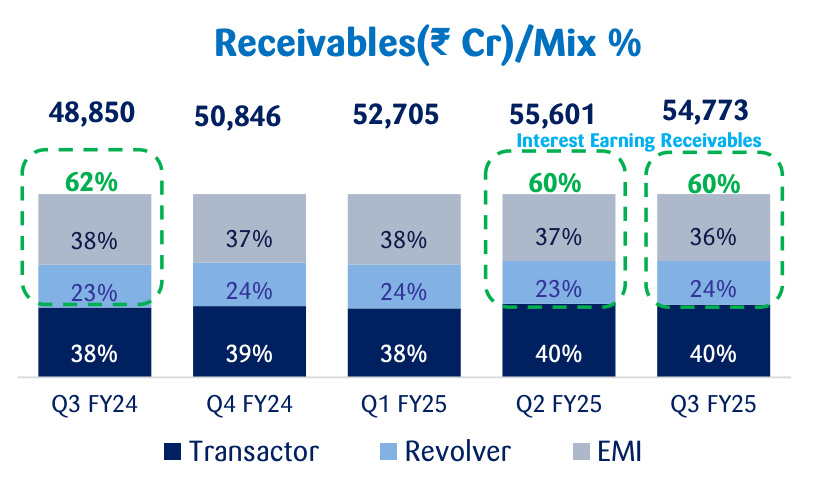

If you pay 100% of your credit card billed amount before the due date, the credit card company earns nothing on you and you're labelled a "Transactor" by them. If you pay anything less than the entire billed amount, you're a "Revolver" and the CC company earns interest income. This is important classification for later in the post.

Limitations for fintech startups in building credit card products: Now, credit cards in India can only be issued by a bank, unless you're SBI Card which is an NBFC. This automatically sets fintech startups outside the credit card market - except Slice, after the acquisition of North East Small Finance Bank. Some startups tried to build a significantly better credit card by using the Fixed Loss Default Guarantee (FLDG) model to take on the loss risk of a bank, so the bank would be willing to co-issue a credit card. There have been several startups including OneCard, Scapia, Kodo, Uni Cards, Eazydiner, Slice and others who built credit card products for their specific use cases.

But this model soon came under RBI's radar and it introduced the Digital Lending Guidelines, the Default Loss Guarantee guidelines and the Credit and Debit card co-branding guidelines.

You can go through the details of the guidelines, but by and large the RBI stepped in and made the "co-issuance" partnerships obsolete, then it made co-branded partnerships basically a customer acquisition model (non-bank/fintech partner only acquires the user and shares none of the upside/downside) and the default loss guarantee guideline made lending partnerships tough to execute, with limited to no incentives for the fintech partner.

Enter Buy Now Pay Later

This is where Buy Now Pay Later (BNPL) comes in. BNPL globally is different from the BNPL we know in India.

BNPL globally charges a higher merchant discount rate (MDR) to the merchant, than a regular credit card and the user gets no further charges. For example, if I'm purchasing a smartphone worth $200 (INR 17K), as a user, I have the flexibility to choose the option to Pay in 4 or Pay in 6 (pay in four months or six months) and I'm maybe charged a one time processing fee. For a regular credit card transaction, the merchant would have been charged 3% of the $200 as MDR, but in this BNPL product use case, the merchant will be charged ~5% (depending on the product this MDR can range between 3-10%).

In this case, the "interest" income of 5% when annualised is 10-15% (depending on Pay in 4 or Pay in 6). Seems to work in countries where bank interest rates aren't as high. However, BNPL loss rates (NPA) are high at 5-7%, similar to most other unsecured credit products, so this interest income should be able to absorb the loss rate after accounting for interest costs as well, to be gross profitable.

BNPL in India: Fintech startups in India tried various flavours of the BNPL product, but it didn't take off because regulation made it increasingly tough to do so. Aside from regulation, there are two main reasons why BNPL didn't work in India.

First reason: ICICI Bank. ICICI Bank was the first to launch an Equated Monthly Instalments (EMI) product back in the early 2000's and since then, most of the industry adopted the product as a substitute for low credit card penetration in the country. EMI is basically a fixed amount paid by the user on a monthly basis for the duration of EMI chosen. The fixed amount is calculated as principal and interest of the entire tenor divided by the number of months.

Then came the other innovation "No Cost EMI" - the closest we came to the global equivalent BNPL product. In No Cost EMI, the lender partners with the OEM to get some discount (for increasing sales and getting full amount on day zero, as opposed to a 60-90 day working cap cycle) on the product value which is then passed on to the user to "subvent" the interest cost. For example, for a $200 smartphone, Bajaj Finance would partner with Xiaomi to get a 10% discount on the value of the smartphone, so Xiaomi got $180, the user pays the $50 over 4 months (total $200). The lender made $20 "interest" income on this transaction.

There are a ton of nuances which I'm not getting into here, but there are motivations why the merchant or the OEM will want to get into such arrangements, there are difficulties of making these arrangements work at scale, there are only certain product types with large enough margins to absorb such discounts, MDRs etc. But that's not the point of today's post.

The other reason why BNPL didn't take off in India is because credit card companies are starting to look a lot like BNPL companies. The Affirm of India is SBI Card, HDFCs Credit Card and others similarly.

SBI Card has 36% of its loan book in EMI (Indian BNPL) product, 40% are Transactor and 24% are Revolver.

As shown in the image, SBI Card earns no interest income on ~40% of its loan book. A meagre 25% is Revolver, this either means, SBI Card is not taking enough risk with issuing cards or SBI Card's users are financially savvy and know to pay the amount in time. But it seems there's a third option that most users are choosing - EMI. Users proactively choosing to convert their spends to EMI seems to show that they'd rather pay interest on their spends over 4-6 months, than pay back the entire amount within the 45 day period.

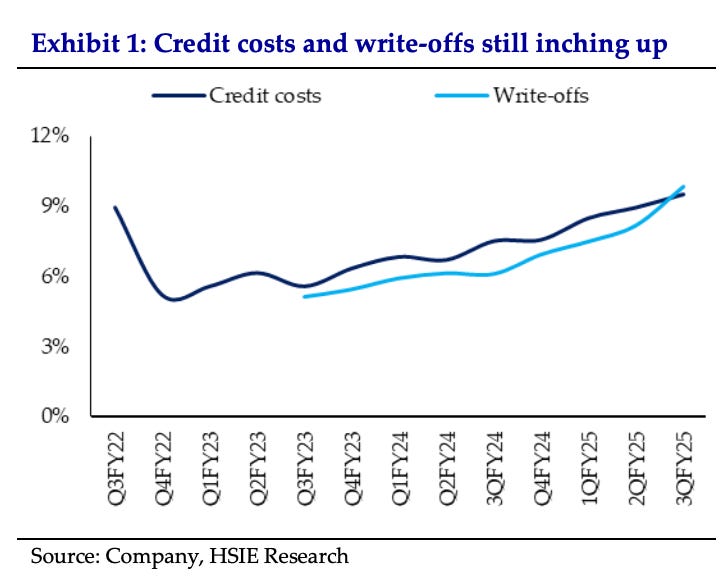

This is directly resulting in increasing default rates for SBI Card where the default rate is higher than its interest cost, making it's entire unit economics go for a toss.

Leaving aside the rising default rate, it's clear that the credit card is the form factor for BNPL in India. However, given that credit cards are a bank-only remit, fintech startups are starting to get innovative.

What's the opportunity for fintech startups here?

Vertical credit cards seem to be the way out for fintech startups in India. While the economics and model of a co-branded credit card are far from exciting to spend any time on, startups can target users for a vertical-specific use case to layer on other products specific to that vertical.

For example, startups like Scapia, a travel specific credit card product, are launching co-branded credit cards. Along with the core CC proposition, Scapia offers visa services, flight and train bookings, forex and other ancillary travel related product and services.

Similarly, EazyDiner has a restaurant/eating out specific credit card, cobranded with a bank. The Card is beautifully integrated with their premium offering and higher rewards and discounts than any other provider in the market. It seems to work in their favour with users spending more on EazyDiner cards than otherwise.

Closing thoughts: the future of vertical credit cards

In my opinion, vertical credit cards will likely capture significant market share. I think other companies have tried launching such cards in the past, but not layered on ancillary products and services. Furthermore, I think now is the right time from a consumer demand perspective too. Travel, healthcare, education, fashion/eommerce sectors present immediate opportunities for specialized credit products.

These vertical cards will evolve beyond basic credit functionality to include sector-specific benefits, personalized rewards, and integrated services. The most successful players will combine credit access with comprehensive vertical solutions.

For fintech founders, the regulatory landscape favours bank partnerships over direct issuance. Building domain expertise in specific verticals will create defensible positions against horizontal competitors.

What vertical would best serve your spending habits? Would you choose specialized benefits over general rewards programs? The next wave of credit innovation may depend on these changing consumer preferences.

For those of us tracking this space, monitoring co-branded partnership announcements and regulatory updates could be useful in building better strategies.

Are you thinking of building such a solution? Let's talk.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

🎵 Song on loop

Fintech updates can get boring, so here's an earworm: Remember Rabbi Shergill? He recently performed at Italy’s oldest jazz club - the Biella Jazz Club. He did a jazz cover of his famous song Bulla Ki Jana (YouTube / Spotify). It’s a soulful rendition.

🫡 Call outs

I’ve been binging on the latest videos from two smaller YouTube channels below. They have presentations and insights by absolute legends from India and US markets. Personally, learned a lot from these videos on how to think and evaluate.

United Way Chennai (YouTube Channel): Watch these presentations by Prashant Jain, Ex-CIO of HDFC AMC and Neelkanth Mishra, Chief Economist, Axis Bank.

Upfront Ventures (YouTube Channel): Watch these interviews of Pat Grady, Partner at Sequoia (one of my favourite VC investors); Bill Gurley and Brad Gerstner; Blake Scholl, Founder of Boom Supersonic and Dara Khosrowshahi, CEO of Uber.

👋🏾 That's all Folks

If you’ve made it this far - thanks! As always, you can always reach me at os@osborne.vc. I’d genuinely appreciate any and all feedback. If you liked what you read, please consider sharing or subscribing.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

See you in the next edition.

No Match to the insights we get here, Thank you