Inside Finquiry - RBI's open house to engage with the fintech ecosystem | Fintech Inside - 27th Jan, 2026

Plus: Wint Wealth raises $27M; crypto platforms become regulated like financial institutions; and PhonePe gets SEBI nod for IPO

Hi Insiders, I’m Osborne, an investor in early stage startups.

Welcome to the 100th edition of Fintech Inside. Fintech Inside is the front page of Fintech in emerging markets.

A century of editions! When I started this newsletter back in 2020, I didn’t think I’d make it past ten, let alone a hundred. What began as a way to organise my own thinking about fintech has turned into something I genuinely look forward to writing. Thank you for reading, for sharing, for the feedback, and for sticking around through the long posts and the occasional rant. Here’s to the next hundred!

This week’s edition is a little different. The One Big Thought isn’t about a market trend or a company. It’s about something I experienced firsthand. I attended RBI’s open house, Finquiry, in Mumbai last week, and what I saw changed how I think about the regulator. I’m sharing it because I think more founders need to be in that room.

In Top Three this week: Wint Wealth’s Series B signals that online bond platforms have survived the regulatory gauntlet and are now scaling, FIU-IND’s updated AML guidelines are turning crypto platforms into full-fledged regulated financial institutions, and PhonePe got SEBI clearance for its IPO with a target listing in mid-2026.

Thank you for supporting me and sticking around. Enjoy another satisfying week in fintech!

Considering angel investing? I get a bunch of fintech founders reaching out to me for investors. I’d be happy to put you in touch. I’m at os@osborne.vc

🤔 One Big Thought

Inside RBI’s Finquiry: What I Didn’t Expect From India’s Most Powerful Regulator

Last week, I attended RBI’s open house i.e. Finquiry, in Mumbai, partly because I was curious and partly because I’ve always believed fintech innovation and regulation need to work together, not against each other.

I’ve always wanted to contribute to policy making in some way, and I think there needs to be more collaboration between fintech builders and the regulator. So when I saw the open house announced, I figured I’d go see for myself who the people behind India’s most consequential regulator actually are and how they operate.

I went in with no expectations, just curiosity. I left with more respect for what the RBI does and how open they are to learn from the fintech ecosystem. I’m sharing this experience so more founders, operators, and investors show up next time, because we really should.

Walking into RBI felt like entering a temple

Walking into the RBI building felt surreal to me - like entering a religious place. It had a quiet seriousness. It’s a historical building, beautiful circular atrium in the centre, banking counters around this atrium, stunning large columns supporting the roof! So much history in that building. Wish I got to see more of it. Alas, I was handed my entry pass and then I was guided up to the second floor conference room.

I entered the conference room a little late (parking in Mumbai!), just as Mr. Suvendu Pati, the Chief General Manager (CGM) of RBI’s Fintech department, was wrapping up his opening remarks. The topic for the day was Consumer Protection in Financial Services, and the format was fairly straightforward - an opening address by Mr. Pati, followed by remarks from (I missed his name because I was late, but I think..) someone in the Ombudsman department, then an address by the CEO of FACE (the SRO) on new consumer protection standards they’ve introduced, and finally an open Q&A with both online and in-person participants.

There were about 6–8 people from RBI in the room and roughly 30–35 people in person from the fintech ecosystem - founders, product managers, professors, legal teams from banks. The session was scheduled from 3 to 5pm, but it went well past 6pm because the RBI team kept encouraging participants to ask questions and then answering them.

What surprised me about RBI

I didn’t know what to expect going in, but I was pleasantly surprised on multiple fronts.

Firstly, the RBI fintech team, especially Mr. Pati, is sharp, very sharp. What stood out immediately was their command over detail. They quoted regulation names, notification dates, clause numbers, and even international precedents from global regulators, all without checking any notes. Yes, it’s their job to know this stuff, but I’ve seen senior lawyers pause mid-conversation to look up legal references. This was a completely different level of preparation, and no question was treated as “too dumb” to answer.

What made this feel like a real public hearing rather than a “good to have” event was that anyone could raise their hand and anyone could ask whatever they wanted - directly to the CGM of RBI’s Fintech Department. Most answers came directly from the CGM himself, and he didn’t dodge the tough questions. His attitude throughout was what surprised me most - not defensive, not bureaucratic, not dismissive. The tone was essentially: “Help us understand what’s happening on the ground so we can improve this together.”

Their stated objective was clear: address concerns where regulations seem too rigid, and understand what can be done to improve user protection. That kind of openness from a regulator is genuinely rare.

As a side note, I loved that they served the classic government office snacks - coconut water, puff pastry, jeera biscuits, dry fruits, and a chutney sandwich. Standard Mumbai fare. Small detail, nice touch.

One moment that stayed with me

At one point during the Q&A, a founder kept pushing back on the CGM’s explanation of a particular regulation/process. The founder repeated the same point multiple times, refused to accept the CGMs reasoning, and ended up taking a lot of time while everyone in the room grew increasingly uncomfortable. Some folks tried to intervene and move things along.

But the CGM stopped them. He said something to the effect of: “Let’s not encroach on someone else’s time. Let him finish.”

Then he calmly addressed the founder’s concern point by point, continuing until the founder himself had nothing more to add.

I don’t know many senior government officials or frankly, many people in positions of power anywhere, who would handle a situation like that with such patience. He’s the CGM - he had every reason to shut that person and move on. He chose not to. That moment really stayed with me.

The conversation after that changed my mind

After the formal session ended, I stuck around and got talking with a few members of RBI’s fintech team. We discussed increasing the participation from the startup ecosystem, and I mentioned something I strongly believe: senior fintech talent had left the ecosystem.

Founders and CXOs who built the first wave of Indian fintech are now moving into AI, healthcare, and SaaS. One big reason, in my view, is the perception of regulatory overhang or the sense that building in fintech means constantly fighting an uphill battle against regulators and banks.

Now, I brought this up because it’s something I’ve been wanting to do something about for a while. And honestly, I expected a polite dismissal, or at best a “that’s not really our problem” response. Most government folks would typically brush this away and put the onus back on you.

Instead, the RBI team leaned in. They asked questions. They wanted data on talent movement. They asked what RBI could do differently to attract builders back to the ecosystem.

That genuinely surprised me. This is completely not what I expected from the regulators.

It’s easy to hate on things when we don’t know the people behind the organisations. From the outside, RBI looks opaque and intimidating, like a distant authority that can shut down your “little fintech project” overnight if you end up in their crosshairs.

But I didn’t feel that when I met the team. They care a lot about equity in regulations, about consumer protection, and about the spirit of the law rather than just its letter. They seemed open and collaborative, genuinely trying to balance policy with innovation to improve outcomes for everyone.

The biggest letdown: our side

Here’s the uncomfortable part though: the quality of questions from the ecosystem was quite poor.

After the initial consumer protection discussion faded, the Q&A quickly turned into product pitching, “I’m building X, Y regulation is getting in the way” requests, company-specific lobbying, and feature-level complaints. After a point, every startup wanted to position their product or solution as the best or one that should become the gold standard in India. There was very little systems-level thinking happening in the room.

The CGM was gracious about it. He’d mention that founders can send an email to the team with specific product details, but then he’d still take the time to talk through RBI’s thought process around regulations for their specific sector. Very few people, though, asked about the things that actually matter to the whole ecosystem: industry-wide grievance frameworks, fraud liability standards, dispute resolution infrastructure, interoperability challenges, data responsibility, or how to build long-term consumer trust.

We have an opportunity to engage directly with the regulator on issues that matter to everyone, and we largely wasted it on narrow, self-interested questions.

If founders want better regulation, we need to show up with better questions, prepared questions backed by evidence and framed around industry-wide perspectives, not feature requests for our specific products.

So how can we do better next time? Founders - please come prepared with regulations you want to discuss rather than vague complaints about regulations impeding growth. Founders could coordinate before these open houses to identify the top three to five systemic issues affecting multiple players, so the conversation is focused and productive. You could compile some data so questions are grounded in evidence rather than anecdote. The fintech community needs to treat these sessions as what they actually are, a chance to shape policy, not a pitch meeting.

My request to founders

As the fintech ecosystem, we need to do better and actually participate in these open houses. Tell the regulator what you’re doing, engage with them directly. Even if there’s no specific regulation for your product yet, even if you think regulation should exist for your category but doesn’t - you should be in the room. No topic seemed off-topic for them at this forum.

No one had preferential access at Finquiry. Anyone could attend and anyone could speak. That openness exists. We’re just not using it the best we should.

So my one request for 2026 is simple: engage more with RBI. Tell them about your products, your solutions, your ideas. Keep an eye on their social channels for future dates and topics. Show up, and ask better questions.

As an investor, I walked out of Finquiry feeling more optimistic about fintech in India than I have in a while. Not because regulation is becoming easier or because I expect a wave of relaxations. But because my perception about the regulator changed after the open house.

The regulator is clearly willing to have an open channel with the fintech ecosystem. Yes, this was my first time interfacing with a regulator directly like that and maybe things aren’t as simple/optimistic as I’m making it out to be. But there seems to be clear intent from the regulator to engage. I’ll take that.

Unfortunately, at that forum, I didn’t see strong participation from our side. So I’ll end with a plea to founders: please attend and actively participate in these open houses.

Fintech in India won’t grow by avoiding RBI/SEBI. It’ll grow by engaging with them.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

3️⃣ Fintech Top Three

Wint Wealth, an online corporate bond distribution startup, raised INR 250 crore ($27M) in Series B funding.

Impressive growth: WintWealth was among the first startups to launch this corporate bond distribution product. Facilitating ₹8,000cr ($871M). in total bond investments with 300K registered users but most importantly, with zero defaults across its portfolio is very impressive. Good on them for what seems like clear focus on customer trust and success. This is still a small fraction of the $76bn in net new AUM of the mutual fund industry, or the $310bn in net new deposits with banks in 2025. This industry has a long way to go from here, but strong start.

Category creation to formalisation and growth: Most of these online bond platforms launched in 2020/2021, when there was a need for the product but virtually no regulations per se. This was an institutional product with broken experiences. There was some form of real estate fractionalisation as an investment product, but again fraught with poor experiences and no regulation. In 2022, SEBI came along with its Online Bond Platform regulation. When a new regulation comes along, there’s usually a fear that it’ll effectively kill the business model or make it unviable for an early stage startup (no matter how good one’s intentions). Besides, regulations almost always favour large incumbents - thankfully this sector/product didn’t have any incumbents. The BluSmart implosion also could have impacted

growth of passive investment products by these platforms. But this regulatory impact being a net positive is a rarity. The founders and investors in this space correctly decided to continue building, obviously with clear focus on consumer benefit.

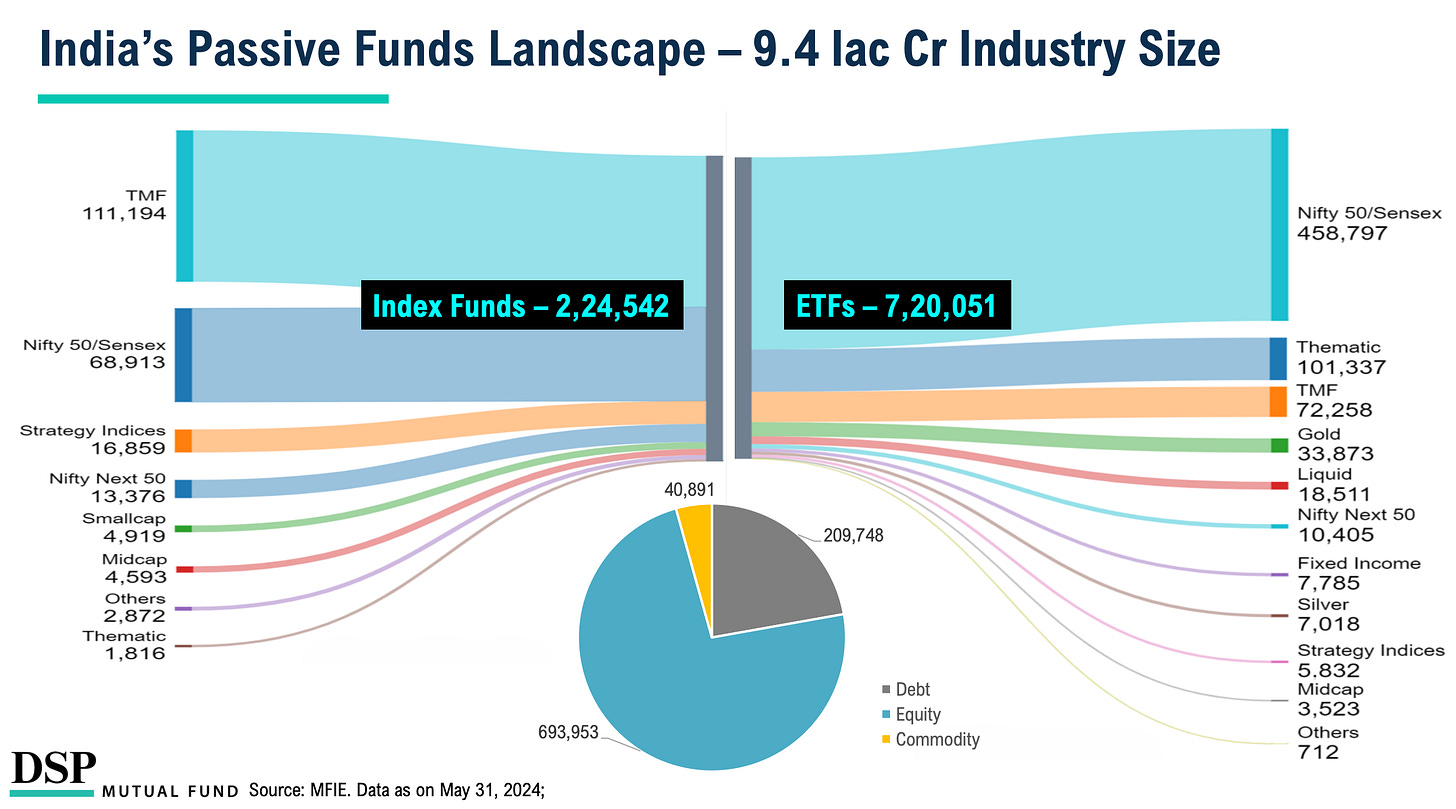

Consumer behaviour shift for good? This is not an apples for apples comparison but a decent proxy for consumer intent, I guess. As of Dec, 2025, 18% of total mutual fund industry AuM is in passive funds, growing 31% YoY, up from 12% of total AuM in 2021. Over the past 12 quarters, there have been an average of 12 new fund offers launched each quarter in the passive space. NFOs were probably a big contributor for the capital growth in passives. 68% of all retail investors in the industry are invested in at least one passive mutual fund. But we’re in sort of a bull market, one where capital in the markets is aplenty - across all asset classes. We may never know how long this bull run will last. But then again, if we avoid the near term view and opt for the long term view, there’s no doubt that passives will continue to grow as percentage of total AuM. Will digital bonds continue to factor in that growth?

Source: DSP Mutual Fund

India’s Financial Intelligence Unit tightened the screws on crypto & virtual digital asset platforms (again)

From “benign neglect” to full-spectrum regulation: India’s relationship with crypto has been a slow march from ambiguity to containment.

2018: RBI’s banking ban (later struck down by the Supreme Court in 2020).

2022: 30% tax + 1% TDS policy signalling without a licensing regime.

2023: VDA service providers formally brought under PMLA and FIU-IND reporting obligations.

2026: The latest AML/CFT guidelines make it explicit - crypto is no longer an “edge case,” it’s a first-class financial risk category.

This update isn’t a philosophical shift. It’s an operational one. The government had already decided crypto would live inside India’s financial surveillance perimeter. Now it’s making sure platforms actually behave like regulated financial institutions.

What actually updated (and why it matters): Three things stand out in the updated regulations to me.

Full fledged registration: VDA platforms now go through a real registration and review process with FIU-IND, including in-person walkthroughs of AML systems, travel rule tooling, sanctions screening, and incident response. This isn’t checkbox compliance anymore.

Implication: fly-by-night exchanges, offshore entities serving Indians quietly, and “we’ll fix compliance later” startups are effectively dead.The travel rule + wallet scrutiny

Transfers to and from unhosted wallets, interactions with foreign VASPs, and use of mixers / privacy tokens are explicitly flagged as higher-risk. Platforms are expected to collect originator–beneficiary data, apply enhanced due diligence, and justify how they monitor cross-chain flows.

Implication: expect more blocked withdrawals, friction for DeFi-native users, and tighter on/off-ramp controls.Governance is being regulated, not just transactions: The rules go deep into: appointing a designated director and principal officer, board-level AML oversight, periodic enterprise-wide risk assessments, independent audits, staff training and escalation protocols. This is basically RBI-style compliance architecture being copy-pasted into crypto. Implication: fixed costs go up materially. Only scaled or well-capitalised players survive.

Other notable changes (that didn’t make the headline list): Identity verification is now important (live selfie, liveness checks, geo-tagging, device/IP fingerprinting, stronger bank verification). High-risk users must go through periodic re-KYC and risk reclassification. STRs are being actively analysed to build fraud typologies, not just filed and forgotten. And offshore platforms are explicitly in scope if they serve Indian users. Cybersecurity is now a regulatory input, not just an IT problem. None of this changes the product surface dramatically for users. But it materially changes the cost structure, legal risk, and operational maturity required to play this game.

Where the opportunity could be (and it’s not just exchanges): At face value, this regulation looks like pure friction. Structurally, it creates a new SaaS market: compliance tooling for crypto — travel rule systems, wallet risk scoring, STR automation, cross-chain monitoring, audit trails. Think “Signzy for crypto,” but chain-aware and regulator-friendly. Longer term, this also quietly lays the groundwork for regulated on-chain payments and stablecoins. If and when RBI formalises a private stablecoin or on-chain settlement regime, only players already inside this AML perimeter will qualify. Net effect: less Coinbase, more “AWS for regulated crypto,” and a small set of too-compliant-to-fail platforms that survive the regulatory grind.

PhonePe obtained regulatory clearance for Initial Public Offering (IPO) targeting mid-2026 listing with 100% offer for sale.

PhonePe’s retail payments scale dwarfs most content and consumer platforms: PhonePe’s scale is staggering with over 650M+ registered users (2x the population of USA) and ~301M monthly active users as of late 2025, and approaching 11M monthly active merchants. It processes hundreds of millions of transactions daily, with annualised TPV in the multiple ₹125–₹150tn+ ($1.5tn+) and consistent leadership in UPI volume at ~45–48% of the ecosystem. That places PhonePe’s throughput on par with or ahead of major global payments companies in sheer payments volume, even if the core UPI rails themselves don’t directly generate revenue. On the financials side, total income grew 33% YoY in FY25 to ₹7,630cr ($833M). Revenue from payment services as a % of total revenue declined from 97.7% in FY23 to 91.3% in FY25 and further to 86.9% in H1FY26.

Revenue diversification is underway but payments still dominate: PhonePe’s monetisation narrative is shifting. Historically, the company made almost all of its income indirectly through payments services and incentives tied to UPI and wallet usage (which itself has near-zero merchant discount revenue). Revenue from payment services as a % of total revenue declined from 98% in FY23 to 91% in FY25 and further to 87% in H1FY26. Revenue from Lending and Insurance Distribution more than doubled to ₹4,530cr ($495M) in H1FY26. With its immense distribution, attaching ancillary financial products, ads and other products is basically playing a conversion game with high margin products. I suspect it’ll be easier for PhonePe to reduce its payments income share in the future. Besides, a company of this size in any other country would have had multiple billions in payments revenue.

The UPI market-cap problem regulation is alive… but effectively deferred: PhonePe’s dominance has raised regulatory eyebrows for years. The National Payments Corporation of India (NPCI) proposed a 30% UPI volume cap on any single third-party app to reduce concentration risk. But enforcement has been delayed repeatedly, most recently pushed out to the end of 2026, with little clarity on if or how it will be applied. In practice, this cap has become a talking point more than an active constraint. That regulatory laxity is not a guaranteed long-term “free pass,” but seem to be unlikely to derail PhonePe’s near-term trajectory.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

🎵 Song on loop

Fintech updates can get boring, so here’s an earworm: Supersonic by Oasis (Youtube / Spotify). This one's been on loop for me lately - loud, confident, and weirdly motivating. Good positive energy for powering through a long week.

✨ Call outs

NSE Passive Funds dashboard: didn’t know this existed, but the NSE has a beautiful dashboard on the passive mutual fund industry. It’s a neat visualisation of the growth of passives. Just wish it had the ability to select time period as a filter.

India in Charts: My friends Rahul and Aaryaman have been on a tear lately - banger after banger with their recent posts. This post - India in Charts, is one such banger. Painfully sourced charts on India that make you stop and think.

👋🏾 That’s all Folks

If you’ve made it this far - thanks! As always, you can always reach me at os@osborne.vc. I’d genuinely appreciate any and all feedback. If you liked what you read, please consider sharing or subscribing.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

See you in the next edition.

Excellent analysis; your point about more founders needing to be in the room truely underscores the value of direct regulatory engagement.