Policybazaar IPO Prospectus Breakdown | Edition #43 - 31st Oct, 2021

Policybazaar's IPO prospectus breakdown, Fintech startups raising record funding, Tokenisation product launches and SEA news and updates round up.

Hi Insiders, Osborne here.

Welcome to the 43rd edition of Fintech Inside. Fintech Inside is the front page of Fintech in emerging markets.

PB Fintech, holding company of Policybazaar and Paisabazaar, is launching its IPO on 1st Nov, 2021. Didn't find the time to read its IPO prospectus? Well, look no further - here's your definitive breakdown of the company's IPO prospectus.

India's funding environment for fintech's has been on a tear recently. This week alone records were broken. All the details in today's edition. Payment companies in India launched tokenisation products. Lastly, find a round up of the week's news and updates from SEA.

Note: There will not be an edition of Fintech Inside next week on account of Diwali. Will resume regular programming on 14th Nov, 2021. Enjoy a joyous festive week if you celebrate!

If you’re an early-stage fintech startup founder raising equity or debt, I may be able to help - reach out to connect@osborne.vc

🤔 One Big Thought

IPO Prospectus Breakdown | Policybazaar - the pioneer of digital insurance distribution

PB Fintech, the parent company of Policybazaar and Paisabazaar, received approval to list on the Indian stock exchanges. It's IPO goes live tomorrow i.e. 1st Nov, 2021, where PB Fintech will look to raise ~$760mm of which $507mm will be fresh issue. At listing, PB Fintech will be the only listed "insurance" sector startup and the sixth company in the "insurance" sector to be listed, after ICICI Lombard, ICICI Prudential, HDFC Life Insurance, SBI Life Insurance and New India Assurance. Here's the Red Herring Prospectus (RHP) breakdown of PB Fintech - a company that's only gone from strength to strength over the years.

Disclaimer: This post is purely intended for educational purposes. It is not investment advice and should not be construed as such. Please consult your investment advisor for such things. Further, this post is me cherry picking sections of the Red Herring Prospectus (RHP). Please read the RHP for full context. I am not directly or indirectly a shareholder of PB Fintech.

Standard definitions: $1 = INR 74 (constant prices). FY is the fiscal year ended 31st March of the respective year. YoY is Year on Year.

Policybazaar is among the first insurtech startups to launch in India and truly breakout to become what it is today. Insurance and wealth have typically been "push" products where the user doesn't really see the need for it (until they need it) and is therefore very hard to sell. It's also a product that sees interaction about once a year - at the time of sale or renewal. Building a startup in a sector plagued with daunting regulations, complicated product design, fraught with misselling and many more problems, could have been mistaken for a fools game.

Policybazaar started out in 2008 to simplify insurance and make pricing transparent. At that time, India's general insurance penetration was 0.6% with $6.2bn (INR 30K Cr at USD 1 = INR 48.45) in annual gross written premium. Moreover, in 2007 IRDAI finally lifted insurance pricing tariffs, effectively opening up the industry. India has come a long way since then with general insurance penetration is at ~0.9% with annual gross written premium of $26.5bn. Life insurance penetration has dropped from 4.0% in 2008 to 3.2% in 2021.

Policybazaar has played a pivotal role in upgrading India's insurance industry to what it is today. As insurance customers, today we'll not settle for anything less than an interface with transparent pricing, full feature comparison, no/limited jargon and more. Policybazaar is the one to push that envelope along with others on the way. Even today, it's among the most recognisable brands for insurance - 126mm unique people visit its platform annually. PB Fintech has raised over $400mm till date with 60-64% of the money still in the bank (as per the Management). It has spent cumulatively $140mm to build the brands of Policybazaar and Paisabazaar. The company looks to list at a valuation of $6.15bn.

What does PB Fintech do? Yes, I realise that so far I've talked a lot about Policybazaar. Policybazaar alone is not the entire company. PB Fintech owns and operates two core brands:

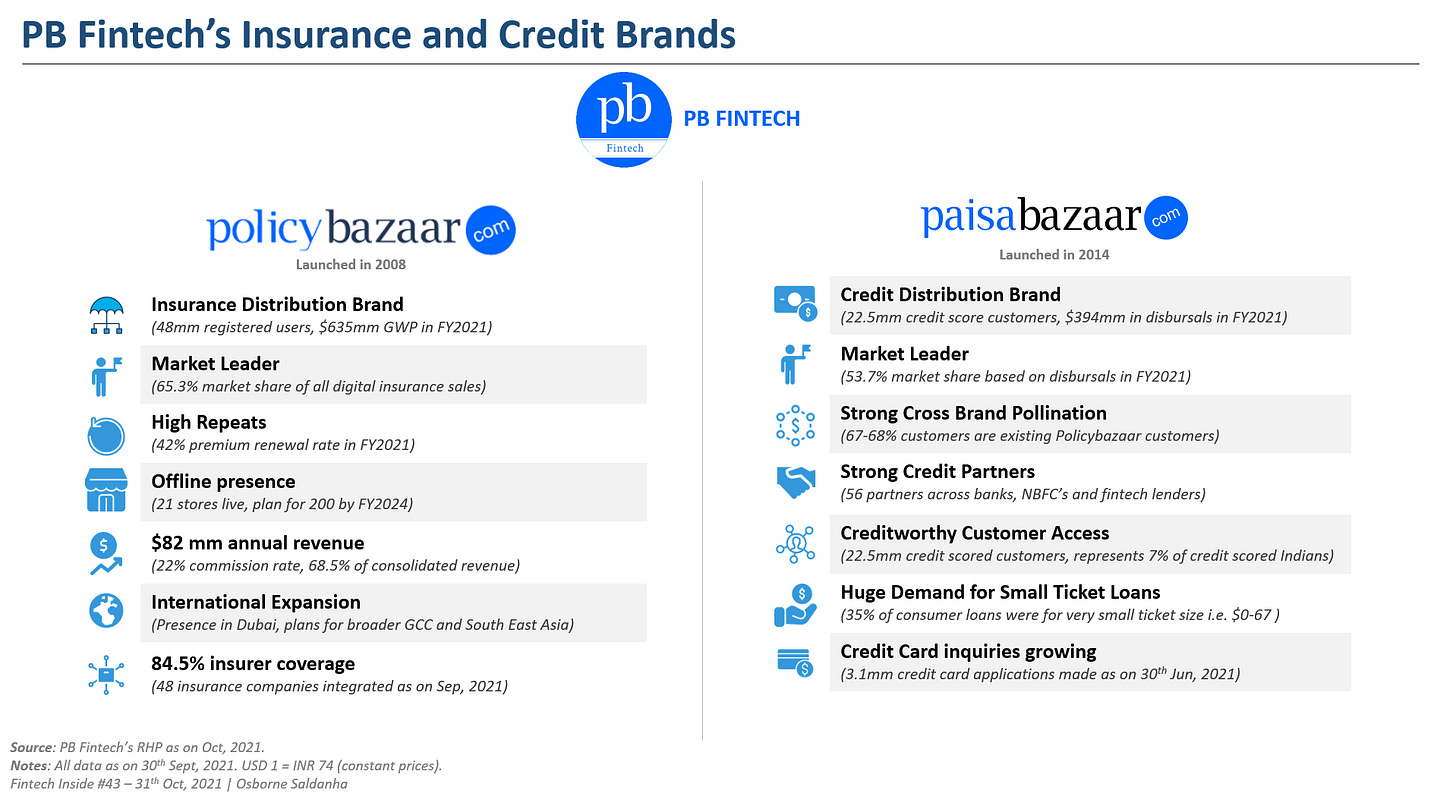

Policybazaar - the insurance distribution brand: Policybazaar is the brand where users can compare and purchase all types of insurance products. It is India's largest digital insurance marketplace with 93.4% market share (among insurance distributors) in terms of number of policies sold. Moreover, it has a 65.3% market share of all digital insurance sales in India. In FY2021, Policybazaar had 126mm unique visitors, 48m registered customers and 19mm insurance policies sold. In FY2021, Policybazaar originated $635mm in gross premiums (58% new premium) for its insurer partners. Policybazaar earns a commission for insurance distribution and had $82mm in revenue in FY2021, accounting for 68.5% of PB Fintech's total operating revenue.

Paisabazaar - the credit distribution brand: With Paisabazaar, users can compare and apply for all sorts of credit products including small ticket unsecured loans, credit cards, home loans, small business loans and more. Launched in 2014, Paisabazaar, as claimed by PB Fintech, is India's largest consumer credit marketplace with 53.7% market share, based on disbursals in FY2021. Paisabazaar offers free credit score access, with ~22.5mm customers having accessed their credit scores as on 30th Jun, 2021. 67-68% of disbursals were made to existing customers, largely sourced through Policybazaar. Credit score access works as customer acquisition strategy for the platform. In FY2021, it facilitated $394mm in total disbursals, whereas as on 30th Jun, 2021 it facilitated $133mm in total disbursals. The management has not reported separate revenues for Paisabazaar.

Interestingly, PB Fintech has already opened 21 physical stores in Tier 2 & 3 towns and plans to open up to 200 stores across India by 2024. It says these stores will act as "Experience Centers" and give customers a local physical presence to resolve any queries or service requests. This is a big departure from the online-only approach it's had so far and indicates that PB Fintech concedes that market expansion and distribution will only happen if one's present offline.

PB Fintech expanded to Dubai and the broader GCC region and plans to enter South East Asia at some point. It's been in Dubai since 2019 and is currently earning meager revenue of $1+mm in FY2021.

Policybazaar so far operated with a "Web Aggregator" license as per IRDAI but received its broker license in Jun, 2021. With a broker license, Policybazaar can "represent" its customers and handle claims process along with servicing them offline through Point of Sale Person (POSP).

What's the market size? India's insurance industry is expected to grow at 17.8% CAGR from $102bn in FY2020 to $520bn by FY2030. From FY2020 to FY2030, Life insurance is expected to grow at 18.8%, health at 15.3% and non-life insurance at 13.5% CAGR. In the Fintech Business Model Deep Dive on Digit Insurance, I discussed the insurance penetration levels in India - sum assured as a % of GDP is lowest in the world at 25% (China - 95%, USA - 265%). India mortality protection gap as a percentage of protection was at 83.0% in 2019, one of highest in the world, despite Indian households being disproportionately dependent on a single income earner. Furthermore, In 2018, India's health expenditure was the lowest globally at $73 per capita (China $501, USA - $1,111) resulting in 63% of health expenses being met out of pocket. As on FY2020, India's premium via online channels was only 1% of total industry premium (China - 5.5%, USA - 13.3%).

India's consumer credit market stood at $486bn as on FY2021, expected to grow to $1,055bn by FY2030 representing an 8% CAGR. Personal loans, home loans, credit cards and other consumer durable loans are expected to make up a chunk of the consumer credit sector. In terms of credit outstanding to GDP ratio, personal loan penetration stood at 3.3% in FY2021. Credit card market is expected to grow at 29.7% p.a. to reach $016bn in disbursal by FY2030 from $10bn in FY2021. India had very low housing credit penetration in terms of the outstanding housing loan as % of GDP, which stands at only 11.4% in FY2021 (China - 41.2%, USA - 57.8%). Lastly, there are only 300mm people in India with a credit score i.e. 22% of the population.

How was PB Fintech's financial performance? In FY2021, PB Fintech made cumulative income of $129mm - 63% from insurance biz. It's cumulative revenue grew 12% YoY from $116mm in FY2020. Insurance biz is ~60%, other operating revenue accounts for 30% and 10% from other income.

Employee expenses and advertising expenses account for the major chunk of expenses i.e. 96.3% of total income in FY2021 vs. 113% in FY2020 and 141% in FY2019. PB Fintech makes a contribution profit, in FY2021, contribution profit was $47.7mm (39.8% of total income).

PB Fintech has so far not made a profit with total losses of $20mm in FY2021 ($41mm in FY2020 and $46mm in FY2019). An important indicator of improved performance is that its premium per advisor: $190K in FY2021, $115K in FY2020 and $85K in FY2019. The big jump in premium per advisor between FY2020 to FY2021 was on account of 1,900 people being laid off during covid in FY2021.

Who is PB Fintech competing with? Technically, PB Fintech's Policybazaar is competing with insurers and other agent-driven insurance distribution startups. Insurers are starting to double down on their own digital channels. In fact, In March, 2021 Policybazaar had 52 insurer partners, and that number dropped to 48 as on Sept, 2021. So, insurers are dropping off. HDFC Ergo delisted it's entire product offering from Policybazaar post Sept, 2021 and other insurers are also following suit.

Throughout the RHP and even in the analyst call, PB Fintech emphasized consistently that its brands are its biggest competitive moats. Even Paisabazaar depends heavily on the Policybazaar brand evidenced by the fact that 67-68% of disbursals being sourced through Policybazaar.

What does the future look like for PB Fintech? PB Fintech believes its strengths lie in its brand, repeat usage and growth flywheel, its capital efficient business model and its "founders' clarity of purpose". PB Fintech plans to double down on its brand recognition to maintain its leadership position for both business verticals.

PB Fintech's plans include (a) deepening its India presence - largely on the back of offline store expansion, (b) replicating its success in the corporate and SMB segments, (c) continued investment in brand and technology, (d) strategic investments - started off with acquisition of DocPrime and Visit Health. and lastly (e) international expansion.

Maintaining its leadership position will pose the biggest challenge for PB Fintech as competition is increasingly going direct to consumer. PB Fintech has ample capital to tackle any challenges in the short term. Besides, India's digital insurance market is only 1% done, literally. The market has a long way to go with much more disruption ahead of it, aside from the market having enough depth to accommodate multiple Policybazaar's.

What was your takeaway from this IPO Prospectus breakdown? Have an interesting story about PB Fintech? Share it with me on email, Twitter or LinkedIn.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

💼 Work at a Fintech

workatafintech.com: Search from ~180 open positions at 50+ fintech startups in India and South East Asia.

Zimyo, a human resources SaaS startup, is hiring product managers. Apply here.

BharatX, an embedded finance startup, is hiring for several positions including Head of Risk Operations, Founding Engineers and more. Apply here.

Glide Invest, a wealth management startup, is hiring a backend developer. Apply here.

Work at a Fintech is a community effort by EMVC. If you’re a Fintech who’s hiring I’d like to help. Write to me and I’ll put your requirement here. 2.5K+ people view these open positions.

3️⃣ Fintech Top Three

1️⃣ Largest weekly funding announced by Indian fintech startups

16 Indian fintech startups announced raising a cumulative $800+mm in funding this week. 3 fintech startups raised $100+mm. 5 raised $10-100mm and 8 startups raised <$10mm. Groww raised $251mm, Acko raised $225mm and Paytm Insurance raised $122mm. You can find the full list of fintech fund raise announcements here.

Takeaways: Not sure if this is a rush to announce fund raises before Diwali but $800+mm in a week is a first for me. This is also important, as the $800mm is not 80-90% fund raise of one startup. 6 startups announced raising $40+mm! What's more, there was no concentration of sectors where capital was deployed. This week startups from sectors including wealth, insurance, fintech infrastructure, taxation, banking, SMB and consumer finance, payments and more raised funding.

From the several investors that I speak to, fintech startups will only continue to dominate Indian startup funding. Many more startups are yet to announce their fund raises. Indian fintech is witnessing a huge second wave (first was in 2016/2017 when payments and credit were grabbing millions in funding). Will we soon see fintech startups cumulative announce raising a billion dollars in a week? I sure hope so, and I'll be here for that.

2️⃣ Card tokenisation products launched in India

Razorpay launched TokenHQ and PayU launched Token Hub. TokenHQ and Token Hub are both tokenisation products by the two largest payment platforms in India. Both these products are multi-card network tokenisation where Razorpay offers tokenisation for VISA, Mastercard and RuPay and PayU offers it with VISA and Mastercard. Tokenisation will be available to all existing merchants of both companies.

What's tokenisation and why launch these products? As per RBI, "Tokenisation refers to replacement of actual card details with an unique alternate code called the “token”, which shall be unique for a combination of card, token requestor and device". In Jan, 2019, RBI introduced tokenisation for card transactions and then in Sept, 2021 RBI permitted tokenisation for card-on-file transactions as well. In Mar, 2021, RBI also, more importantly, disallowed payment aggregators and merchants from storing card data on file. Basically, RBI wants to improve security of card transactions by not allowing entities to store card data which could get stolen in case of a data breach.

Takeaways: The deadline for entities to comply with RBI's tokenisation regulations is 31st December, 2021. From 1st Jan, 2022, all entities except card issuers and card networks, will not be able to store card data. Any card data stored will have to be purged. This will not change anything at the consumer end, other than the additional factor of authentication as required. Most of the tokenisation will happen at the backend which is where TokenHQ and Token Hub come in. Like we're currently witnessing with recurring payments in India, there will be a couple of weeks of payment issues when the tokenisation deadline expires.

3️⃣ South East Asia Round up

Kakao Pay, South Korea's largest payments company, to list on the Seoul exchanges to raise $1.3bn at top of range.

Nium launched a global platform for Crypto-as-a-Service.

Swiss fintech companies are increasingly opening up offices in Singapore for access to South East Asia.

Partior, a blockchain based settlement and clearing platform, piloted SGD and USD settlements in near real time with participating banks.

OJK, Indonesia's central bank, released a digital banking blueprint. "The blueprint outlines working principles in five areas—data governance, technology, risk management, collaboration, and institutional arrangements.". Link to Blueprint in Bahasa

DBS Bank became the first South East Asian bank to join the Hedera Governing Council.

Takeaways: Kakao Pay, part of Kakao Corp and South Korea's largest payments platform is going public just a few months after its sister company Kakao Bank went public. If you've been following this newsletter, you would know that Kakao Bank's IPO was 1,700 times oversubscribed and even on listing, it's stock price surged 79%. Will we see an encore from Kakao Pay as well? We'll have to wait till 5th Nov when IPO subscription closes.

South East Asian countries are also attempting to be the crypto and fintech innovation hub in the eastern hemisphere. Nium, a Singaporean fintech startup launching a "crypto-as-a-service" product is testament. Further, Partior, formed by DBS, J.P. Morgan and Temasek in Singapore launched a clearing platform built on the blockchain to facilitate cross border payments. Piloting its SGD-USD payment rails is big progress. DBS is also now part of the Hedera Governing council which has developed the "only public decentralized distributed ledger that utilizes the fast, fair, and secure hashgraph consensus mechanism." It claims to be better than blockchain technology. Interestingly, India's Tata Group, Wipro and IIT Madras are founding members of the Hedera Council.

Looking for the news digest? Read all the week’s fintech news and updates in India and SEA over at This Week in Fintech - India and SEA Edition. You can also find our US, Global and European coverage.

🏷️ Notable Nuggets

Coinbase Strategy Teardown: How Coinbase Grew Into The King Midas Of Crypto

Finance apps dominate Play Store and App Store – but have surprisingly low ratings

What is a DAO? All you need to know about a Decentralised Autonomous Organisation

👋🏾 That's all Folks

If you’ve made it this far - thanks! As always, you can always reach me at connect@osborne.vc. I’d genuinely appreciate any and all feedback. If you liked what you read, please consider sharing or subscribing.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

See you in the next edition.