Payment Platform NPS | Edition #44 - 14th November, 2021

Payments companies compared on NPS. BharatPe equity for Merchants, Singapore Fintech Festival and Crypto news round up. All that and much more inside.

Hi Insiders, Osborne here.

Welcome to the 44th edition of Fintech Inside. Fintech Inside is the front page of Fintech in emerging markets.

This week we have a guest post covering what consumers really think of India's largest payment platforms.

We also have details on BharatPe incentivising its merchant network, a round up of the Singapore Fintech Festival and lastly a round up of the crypto and DeFi news from Asia.

In other news: If you're looking for a very basic introduction to crypto/DeFi/web3, spend about 20mins listening to a very crisp explainer podcast by India Fintech Diaries.

Also, the Indian government released stats on the retail inflation in India (which is at ~4.5%). If you continue to find yourself wondering what on earth is inflation, how it impacts you and in what context it should matter to you, then look no further. NPR released an absolutely excellent, story-style, Halloween-themed, 13-min explainer on Inflation. I guarantee you will not regret listening to this one.

Please enjoy another week in fintech.

If you’re an early-stage fintech startup founder raising equity, I may be able to help - reach out to connect@osborne.vc

🤔 One Big Thought

Indian Payments Giants and Consumer Satisfaction

Editor's Note: Today we have a guest post by Nirant Kasliwal and Sahil Sorathiya. Nirant and Sahil are excellent at data crunching and have done some incredible work in the past. Follow them or reach out to them for any comments or questions on the analysis.

Paytm just concluded India’s largest IPO which saw 1.89x oversubscription. Before investing, I analyzed almost 100K PlayStore reviews to understand the business better. I use PhonePe as a reference because they’re also both wallets, and offer other similar features like UPI payments, bill payments, recharges & insurance.

To begin with the official UPI data, I learnt that PhonePe is 3x the market share of Paytm in UPI.

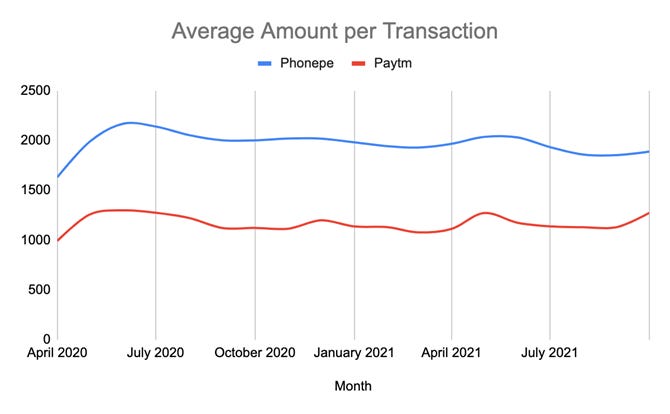

PhonePe is not just a leader by market share, users spend 1.5-2x more per transaction on average via PhonePe UPI when compared to Paytm.

But when it comes to NPS via App Reviews, it tells a different story. The Paytm app NPS continues to be close to 40 while PhonePe has really paid for their hyper-growth in absolute numbers of UPI transactions via lower NPS. Paytm’s NPS also takes a hit during the UPI growth phase (see Sep 2020, Jan-Feb 2021) but is very well cushioned by it’s large user base and the more stable wallet experience.

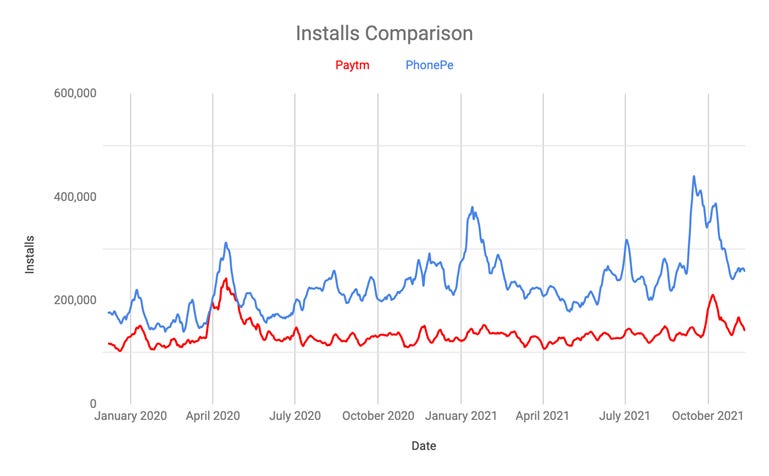

Let’s take a look at when did this growth happen? You’ll notice that both apps grow almost similarly in the pre-COVID months and first lockdown. It’s almost immediately after Sep 2020 that PhonePe really pulls ahead and takes its first Reviews-NPS hit. We see another burst of new users come in on PhonePe during Jan-Feb 2021 as Lockdown 2 eased in the country.

As we’d expect, a higher Reviews-NPS is an outcome of Day30 retention: When Paytm’s NPS peaks in Jan-Feb-March 2021, their Day 30 retention also peaks dramatically before falling back to earlier value. This is also the trend we see in their NPS: A peak and then rapid correction. PhonePe’s D30 retention has improved dramatically in the last 3 months. We see both: Paytm’s fall, and PhonePe’s rise in Reviews-NPS - but with a lag.

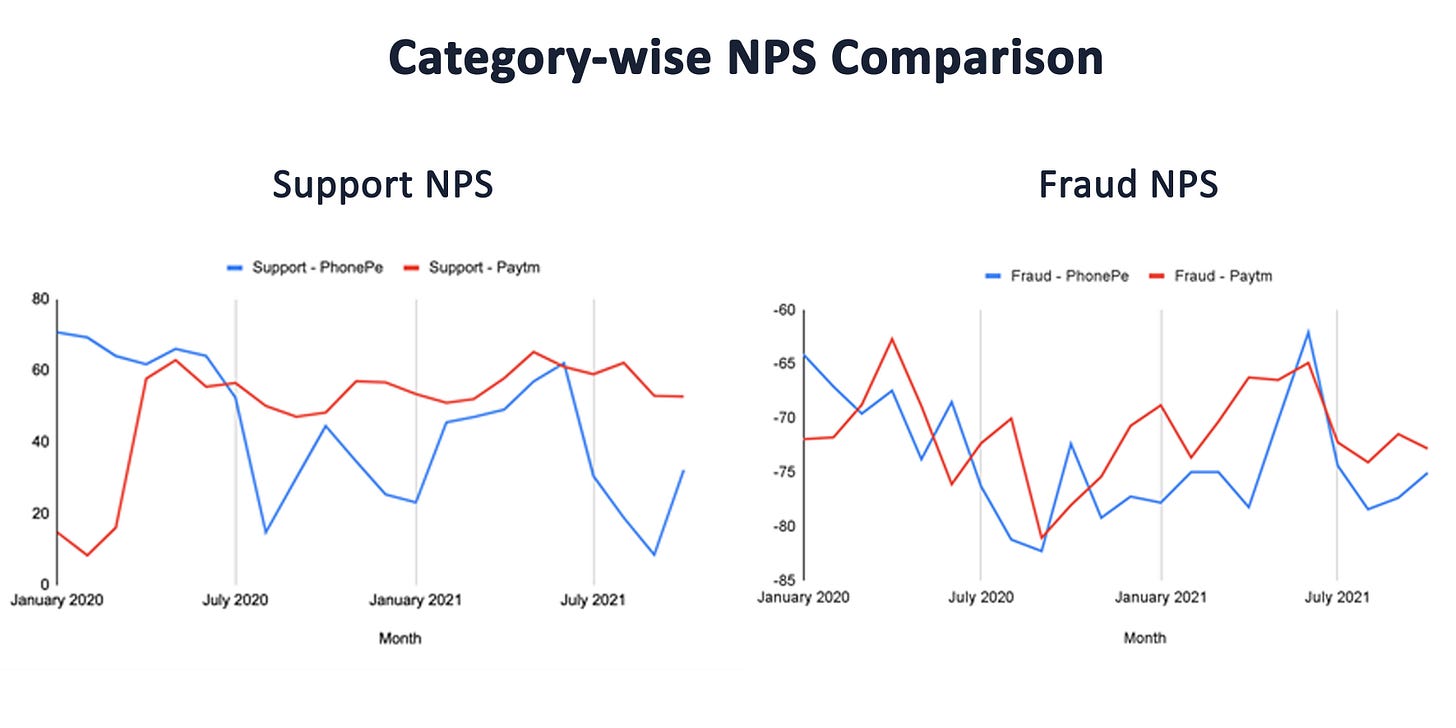

Digging deeper into Reviews, it’s clear that Paytm pulls ahead in keeping it’s customers happy in two of the biggest categories: support and fraud complaints. Despite it’s extremely large user base, Paytm has a better NPS on Fraud and Support both compared to PhonePe.

Notice that support is such a big contributor of the overall reviews - it is highly correlated with overall App NPS itself. Support is the point where it is winning against PhonePe by a meaningful margin.

Next, let’s look at a specific use case of a payment app: Bills & Recharges. Paytm pulls ahead by a very good margin after COVID, but PhonePe’s NPS drops. New user growth dipped in July-August 2020 probably because users were trying both apps for the first time, and dragging NPS down.

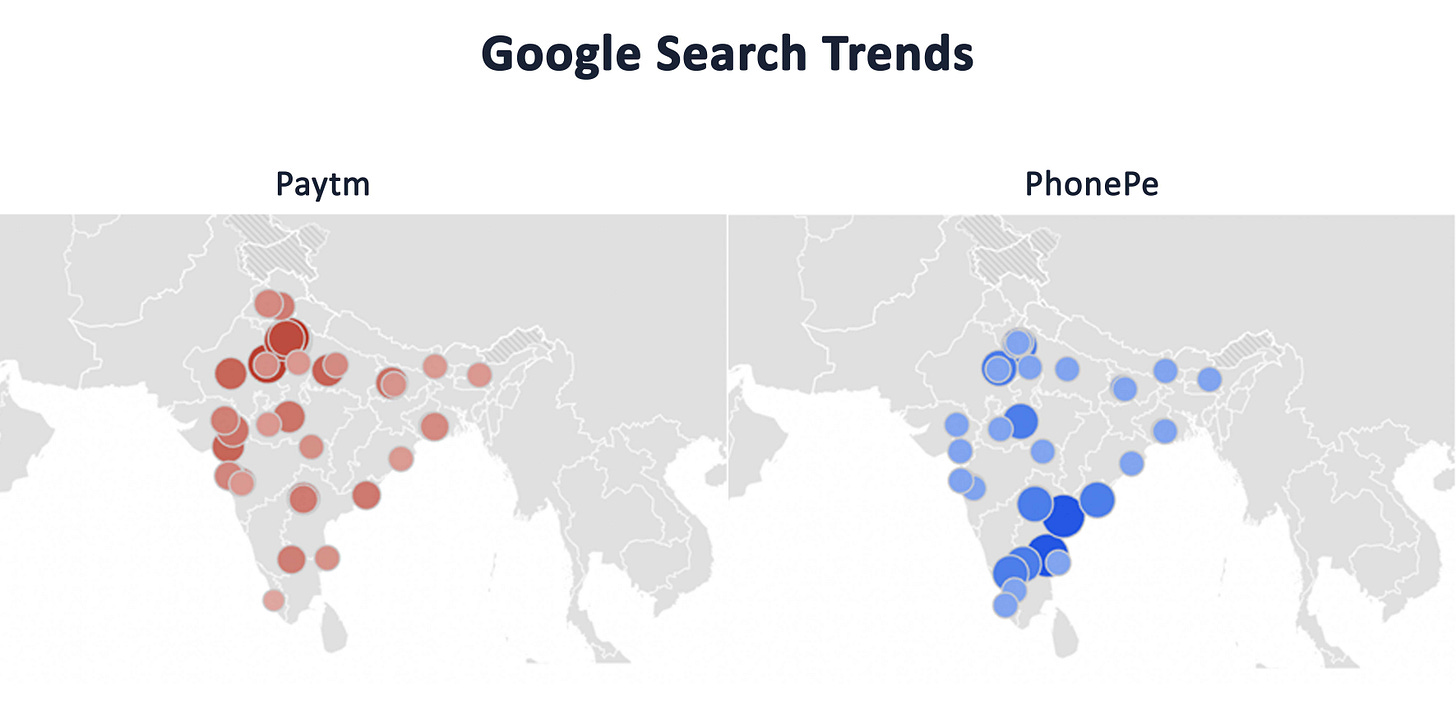

From UPI data, you can tell that UPI is way bigger in Southern states of India specially Karnataka, Telangana, and Tamil Nadu. I decided to compare the search volume by cities for Paytm vs. PhonePe. The top 5 cities for Paytm search queries are Ghaziabad, Noida, New Delhi, Surat and Gurgaon. The top 5 cities for PhonePe are Tirupati, Mysore, Visakhapatnam, Bengaluru and Bhubaneswar.

At first glance, it looks like PhonePe might be winning the UPI war for now. But PayTm is not out of the UPI race, as a payments bank - it owns the UPI rails to reduce failure rates. Even more important, NPCI’s 30% market share ceiling might be PhonePe’s loss and Paytm’s gain. There are still millions of users who’ve installed Paytm but not PhonePe.

Disclosure: Previous consulting clients of the authors for similar insights include a large Indian fintech company. They continue to provide this analysis with greater control and granularity on request.

All images by Nirant Kasliwal and Sahil Sorathiya.

What did you think of this analysis? Would you like seeing more such analysis for other sectors within the Fintech ecosystem? You can reach me via email, Twitter or LinkedIn.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

💼 Work at a Fintech

workatafintech.com: Search from ~180 open positions at 50+ fintech startups in India and South East Asia.

Setu, a fintech infrastructure startup, is hiring a person for Growth (Whatsapp Banking Partnerships). Apply here.

Card91*, a card infrastructure startup, is hiring a Sales Manager. Apply here.

GoKwik, a one-click checkout startup, is hiring a Product Manager. Apply here.

Not on Work at a Fintech but interesting opportunity with Swaypay. Swaypay is hiring a Director of Engineering.

Work at a Fintech is a community effort by EMVC. If you’re a Fintech who’s hiring I’d like to help. Write to me and I’ll put your requirement here. 2.5K+ people view these open positions.

3️⃣ Fintech Top Three

1️⃣ BharatPe is incentivising its network with equity

BharatPe will create a $100mn equity pool for its merchant partners which will be allotted to eligible merchants over the course of the next four years. The company believes its MSP pool be worth close to $1 billion by the time it goes public. The company is also looking to double its merchant base to 14 million by March 2023.

Takeaways: I like this update. It's impressive that BharatPe is thinking about building a loyal merchant network with equity. Most businesses have always thought only of employees as "owners" of the business, where employees get access to ESOP's. But merchants/supply side are equally important.

The first I heard of any company offering equity to non-employees was Airbnb, where it made a special plan to allocate equity to its home owners at the time of IPO. I don't know what are the challenges with Indian companies setting up such structures, but would be cool to see a marketplace provide equity/ownership to its supply partners.

What this BharatPe merchant equity pool also does is expand the capital markets participation market by default. It'll be amazing to see rural merchants discovering they have stocks, getting intrigued by the markets and then further participating in it.

However, the challenge to all this is the "equity/ownership" mindset among Indians. Ask any employee today in India if they prefer a higher upfront salary or higher ESOP allocation - the answer, in chorus, will be the former. I hope this changes.

2️⃣ Singapore Fintech Festival announcements round up

Singapore and Philippines linked their instant bank transfer systems for a cross border QR payments system.

Singapore rolled out e-GIRO, it's direct debits payments system, which will reduce processing time from the previous GIRO system.

Singapore launched a national program for artificial intelligence in finance.

Singapore's Infocomm Media Development Authority (IMDA) and MAS (central bank) completed the world’s first cross-border digital trade financing pilot.

Takeaways: Singapore is a tiny country with big ambitions. For any company that wants access to literally the entire Asian market, Singapore is the base location. Every other country in the region knows this and so does Singapore.

Despite this, Singapore is not complacent. Not even close to being complacent. Ambitious Singapore wants to be the financial capital of world's eastern hemisphere and with all its focus on web3, crypto, and traditional finance, it's "future-proofing" its position in the global financial markets.

These updates from Singapore, via the Singapore Fintech Festival, show that Singapore is progressive, innovative and collaborative. It's even putting money where its mouth is by investing capital in artificial intelligence, fraud analytics, centralised databases and many more initiatives. It's almost as if the Monetary Authority of Singapore (central bank) is functioning like a startup - move fast, break things, improve it and reiterate. Huge props to MAS!

3️⃣ SEA Crypto and DeFi updates highlight

Mastercard partnered with cryptocurrency exchanges Amber Group, Bitkub, and CoinJar to launch payment cards, to let users worldwide convert digital tokens into traditional fiat currency.

DBS Digital Exchange (DDEx) reported $600mm in digital assets under custody, 3x from the previous month. This is 2 months of 24x7 trading. It recorded trading volumes surpassing the total trading volume of the first eight months of the year by 40%.

Indonesia religious council said that crypto trading is forbidden for Muslims.

KasikornBank, a Thai bank, through its investment vehicles, invested in the Pantera Capital's blockchain funds.

Huobi, a Chinese cryptocurrency exchange, is restructuring to Gibraltar, for global customers after Beijing crackdown.

Hybe, a South Korean K-pop management agency, partnered with Dunamu, a crypto exchange, to create a US platform for NFTs, including of BTS members.

Takeaways: What a cocktail of exciting, impressive and weird updates from the world of web3. Read on:

The exciting: Mastercard launching a payment card for crypto to fiat conversion on the fly is cool. It's partnered with crypto exchanges in South Korea, Taiwan, Hong Kong, Thailand and Australia for this. And of course, there had to be news of K-Pop NFT's. At this point, if there's an artist without an NFT, are they really an artist?

The impressive: DBS's digital exchange (DDEx) has been on a tear in the two months since it launched 24x7 trading - $600mm in digital assets under custody, 3x from the previous month.

If you've been reading my other newsletter, This Week in Fintech, you'd probably know by now that Thailand's Banks are for some reason making big moves in crypto. Kasikornbank launched Kasikorn X (KX), a DeFi Incubator, and Coral, an NFT Marketplace and it invested in Pantera Capital. Siam Commercial Bank, the oldest bank and one owned by the Thailand's King, acquired a majority of crypto exchange Bitkub for $536mm, . Kungsri (Thailand's fifth largest bank) led the $41mm round of Zipmex, a Thai digital asset exchange. This is not being reported about enough.

The weird: What's the Indonesian religious council doing in web3? Well, crypto-trading is now deemed "haram". The country with the world's largest Muslim population will now not be trading in crypto. Also, ever since China banned crypto platforms, the exchanges there have been running amok to find a solution. Huobi is now restructuring to Gibraltar to continue serving customers globally. It's also shutting shop in Singapore.

Looking for the news digest? Read all the week’s fintech news and updates in India and SEA over at This Week in Fintech - India and SEA Edition. You can also find our US, Global and European coverage.

🏷️ Notable Nuggets

A silent revolution is underway in Hong Kong’s fintech industry

What Indian Payment Indicators Are Telling Us About Spending.

Profile of CryptoPunks, an NFT project which has reached $1.5B in lifetime sales.

Philippine digital banks target $140bn retail deposit market.

👋🏾 That's all Folks

If you’ve made it this far - thanks! As always, you can always reach me at connect@osborne.vc. I’d genuinely appreciate any and all feedback. If you liked what you read, please consider sharing or subscribing.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

See you in the next edition.

Banking for 800mn Rural Population

Mahagram is rural fintech company building scalable solution for the growth market of India.

https://mahagram.in/

Esops to Tsops, now Msops how about CSops - stock options for customer any use cases in India or US would be happy to learn and adopt !