Fintech Inside #9 - 7th Nov, 2020 | Gold Loans

This edition explores India's gold loan market and startups disrupting the sector. It also covers WhatsApp Payments, UPI's 30% volume cap, ANT Financial's IPO, Monthly payments for insurance and more.

Hi Insiders, Osborne here.

Welcome to the ninth edition of Fintech Inside. Fintech Inside is the front page of Fintech in emerging markets.

This past week was dominated by the US elections and ANT Financial's IPO. Towards the end of the week, NPCI dropped its bitterseet bomb on us. But if you weren't able to keep up with other Fintech news - don't worry, I gotcha.

In this edition I explore the gold loan market in India and startups that are disrupting it (only three that I could track!). I also cover WhatsApp Payments launch, NPCI introducing bureaucracy in UPI, monthly payments driving growth of health insurance and other important news.

Globally, Indonesia fell into recession for the first time in 22 years! The country's GDP fell -3.49%. UK's FCA introduced another opt-in six-month "loan holiday" for borrowers of all loans. Lots more updates. You can get all details at https://fintechinside.club as well.

Diving in

One Big Thought 🤔

India's Lending Underdog - Gold Loans

Since lock downs began and moratoriums were announced on all loans, we've all been fretting over the performance of lenders (NBFC's and Fintech's). All lenders stopped disbursal and focused on collections to avoid bad debts. All except gold lenders. As soon as lock down restrictions were lifted, gold loan NBFC's were making brisk business. Rising price of gold during the pandemic also meant higher loan values to households. Tightening of criteria for unsecured loans played a huge role in driving up the demand for gold loans. RBI as well increased the Loan To Value (LTV) ratio on gold loans from 75% to 90%. The gold loan business model is truly unique to India.

Gold Market: As per World Gold Council estimates, India has 23,000-25,000 tons of gold reserves - largely sitting idle in households a.k.a. unproductive use for future financial security. India's yearly gold demand is 700-800 tons (75% jewelry) and this accounts for 23-25% of global gold demand - second largest in the world after China. The total gold reserves in India could be valued at USD 1 trillion! RBI even had a plan to buy gold from households without asking for its source to increase its own reserves.

Gold Loans: In the organised market, Indians borrow USD ~40 bn a year against their gold. This borrowing is largely done at NBFC's and some at Banks. Only 35% of the gold loan market is organised leaving significant room for disruption. These incumbent lenders have taken the branch-led user acquisition model to provide trust, safety and security for users. Now that that's done, this market is ripe for disruption. The two largest gold loan NBFC's outperformed every other lender this Covid period - Muthoot's total loan assets grew 29% YoY between April to Sept, 2020 while Manappuram's gold loan AuM grew 18% during the same period.

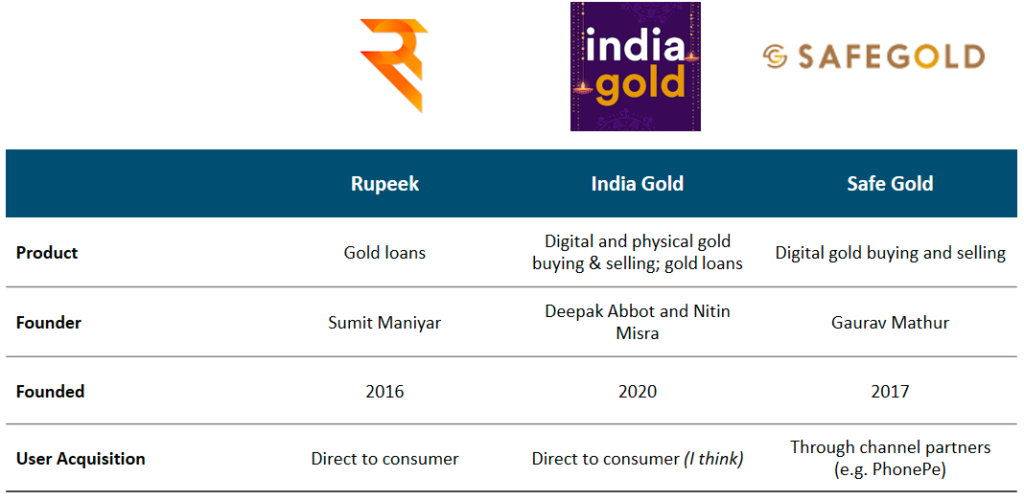

Where are the startups?: That's the billion dollar question. Very few startups are looking at disrupting India's fascination with the yellow metal. I have been able to track only three startups as below. Rupeek started with lending - offering borrower convenience with doorstep services. Safe Gold started up next - offering digital gold buying and selling. The latest entrant is India Gold - offering everything there is to offer against gold - digital and physical gold buying and selling along with loans. All three are approaching the market with vastly different approach and its likely that all will succeed. Obviously, I'm rooting for all three.

Correction: India Gold is building a gold backed open credit network, as per the founders.

My guess is that most Fintech's so far, approached the "Financial Services" problem with "distribution" in mind to solve for. And we've seen that everyone build the digital layer, improved UI for ease of access but left the product as is. There was limited innovation on the product and pricing front. To disrupt the gold market requires a much more nuanced approach to innovate the entire rails bottom up. The wave of innovating on pricing and product is just starting and its probably started in the gold space.

If you're starting up in the gold sector or would like to riff about the same, please reach out by scheduling a meeting.

Fintech's Hiring 💼

If you’re a Fintech who’s hiring I’d like to help. Write to me and I’ll put your requirement here.

Fintech Fast Five 🖐🏼

Enter the 800 pound gorilla - WhatsApp Pay:

WhatsApp finally received approval from NPCI to roll out UPI payments in India. This is momentous - at least in theory. NPCI has approved WhatsApp's roll out in a phased manner. The first phase will allow WhatsApp to have 20 mn users live on UPI - that's 7% of WhatsApp's total India Monthly Active Users. It will also be going live with five banks - Jio Payments Bank, SBI, HDFC, ICICI and Axis Bank

Takeaway: I've been on the WhatsApp Payments pilot for over a year now and the WhatsApp payments experience is probably the best I've had among all UPI apps. While WhatsApp payments might do well in P2P payments (this sort of wipes out Google Pay's entire premise), I'm less bullish on their P2M payments. WhatsApp recently announced business features but very few small businesses actually know how to use the various offerings. WhatsApp has always left it up to users to figure out the various features and use cases. Business will require a little hand holding.UPI, meet Bureaucracy:

NPCI, the pseudo-government body that built UPI, announced a cap of 30% on share of volume any Third Party App (TPA) can have on the UPI network starting Jan-2021. This market limit of 30% will be calculated on last 3 months volume and apps that exceed the same will have 2 years to reduce its market share.

Takeaway: Does it get more ridiculous than this? UPI is a rocketship, why clip its wings already? Let's for a minute try and see the arguments from NPCI's perspective - maybe it feels WhatsApp pay may become really large and hence monopolistic. But there's already a cap of 20 mn users. Maybe NPCI feels there is a risk of system failure - the cap is put on the TPA's not the Payment service providers (PSP's) which actually face the problem of system failures.

My issue with this doesn't stop there. How is a TPA going to limit a consumer from paying using their app if the cap is breached? Putting a cap means failure rates might increase - if I prefer using PhonePe but PhonePe has to limit to 30% of total volume how will PhonePe stop me from using it? Amit Bhor (CPO at CapitalFloat) had the best response to this announcementThe World's Largest IPO that never was:

This past week, ANT Financial had to suspend its much awaited IPO after Founder Jack Ma was called in for questioning by the Chinese regulator. This suspension took the world by surprise because tons of money (USD 3 tn) was already in the works to subscribe to this IPO. What's interesting is that not many people, even in China, knew why it happened. Later, media reported that a new regulation caused the suspension.

Takeaway: Never mess with your regulator. I only joke, but its unfortunately, the reality. This is true even in India. Very few companies will ever speak out against a regulator or its policies. But now that the world's largest IPO is probably delayed until April-2021, we will have to find a new topic to keep up this odd bull run.Monthly payments for medical insurance to the rescue:

Earlier this week, PolicyBazaar, India's insurance policy aggregator, claimed that since IRDAI permitted Health Insurance premiums to be paid on monthly or quarterly or half-yearly basis, more consumers are opting for monthly payments. As much as 45% of monthly payers are first time insurance buyers and 40% take premiums between INR 25 lacs to 1 Cr.

Takeaway: I find this update especially exciting. We all know of the woefully low insurance penetration in India. One of the main reasons for that is affordability and making it easier to afford it will drive up health insurance coverage. This will hopefully also reduce the 55 mn Indians that get pushed into poverty because of out of pocket medical expenses.TransferWise has a new competitor - HSBC:

HSBC yesterday launched Global Money Account - a global money transfer solution for its customers in 20 countries. The account will have its own mobile app with banking features - hold, manage & send funds. Users can transfer money in real-time, in various currencies to HSBC users in 20 markets for FREE. This solution will compete with the likes of Transferwise and Revolut

Takeaway: A global bank is probably the best positioned to launch such a service. In fact HSBC was one of the banking partners of TransferWise. Banks should have had these services in the first place but the experience is still painful. However, a Founder-led service will be more agile, fast to market, innovative in its approach. Having the HSBC machinery run this service will surely face some hiccups along the way. Take for instance ICICI Bank's attempt at neo banking ICICI Bank Mine - zero innovation.

India 🇮🇳

Market Updates: 📰

UPI crossed 2 bn transactions in Oct-2020 and PhonePe accounted for 41% of them. Aditya Puri joined Carlyle PE fund as advisor. CredAble claims to have disbursed USD 333 mn to small businesses. FamPay to hold a virtual festival - FamJam for its users. BankBazaar revenues dip 27% YoY. Axis Bank goes live on Account Aggregator framework as a Information Provider.

Regulatory Updates: 📝

SEBI put out an advisory to all market participants on use of SaaS for regulation and compliance. RBI introduced guidelines for Banks to co lend with NBFC's in priority sector.

Product Launches: 🚀

BankOpen launched UPI Auto Pay feature for small businesses. Paytm launched a Credit Card with SBI and VISA. Antworks launched P2P micro lending program in Kolkata. Shashank Joshi (Money on Mobile) launched a neo bank mBnk. SaveIN launched a neo bank. ICICI Bank launched millenial neo bank.

Funding Announcements: 💰

Fedo- health insurance underwriting SaaS (USD 1 mn), LivFin - small business finance (USD 5 mn), Mobikwik - financial product aggregator (USD 7 mn)

South East Asia 🌏

Market Updates: 📰

VISA launched financial literacy app in Malaysia. Digital yuan sees 4+ mn transactions totalling USD 299 mn. Singlife launched blockchain based life insurance in Philippines. VISA launched digital payments with NextTech Group.

Indonesiafalls (GDP -3.49%) into recession for the first time in 22 years. Japanese drugmaker partnered with Ping An to design new drugs with data. Cermati hit with hack of 2.9 mn users personal data.

Regulatory Updates: 📝

Hong Kong regulator introduced licenses for crypt-asset trading platforms.

Funding Announcements: 💰

Lucy - Singaporean women focussed neo bank (USD 366K). Statrys - HK small business money transfer (USD 5 mn). BeforePay - Australian salary advance (USD 2.8 mn). MathWallet- HK crypt-asset trading (USD 7.8 mn). Osome - Singapore business services automation (USD 3 mn). MioTec - ESG SaaS (undisclosed). 40 shortlisted Fintechs for MAS Singapore Fintech Festival.

Europe 🇪🇺

Market Updates: 📰

EToro launched client protection insurance scheme against insolvency. UK's Financial regulator (FCA) announced a six-month, opt in, loan holiday. VISA Ireland launched loyalty program for small businesses. To The Moon, UK-based telco, launched its first tariffs with integrated crypto-wallet.

Funding Announcements: 💰

Denmark's Nets to merge with Italy's Nexi (USD 10 bn). Charm - London social impact inevsting (EUR 300K). AnaCap acquired 60% of CarrefourPay (USD 300 mn). GoCardless - UK direct debit (likely to raise USD 100 mn). VividMoney - German challenger bank (USD 17.6 mn).

That's all Folks 👋🏾

If you’ve made it this far - thanks! As always, you can always reach me at connect@osborne.vc. I’d genuinely appreciate any and all feedback. If you liked what you read, please consider sharing or subscribing.

Found a broken link or incorrect information? Report it.

See you in the next edition.