Fintech Inside #4 - 3rd Oct, 2020 | Shareholder Value

Hi, Osborne here.

Welcome to the fourth edition of Fintech Inside. Fintech Inside is the front page of Fintech in emerging markets.

This week was slightly muted for Fintech. Not many fundings were announced but quite a few market updates. South Korea’s payments platform, Kakao Pay, filed its IPO documents and is seeking a valuation of USD 8.5 bn.

The founder of Coinbase, US-based crypto exchange, announced that the company will be solely focused on profit-making and not indulge in politics. The question here is should businesses focus only on shareholder value?

Diving in

One Big Thought

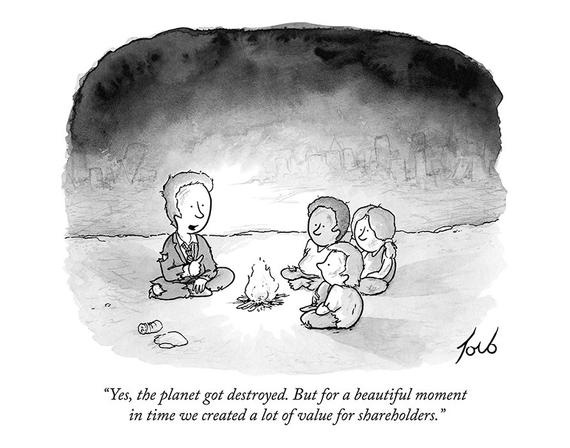

Should businesses focus solely on shareholder value?

Earlier this week, the Founder of Coinbase, a US-based crypto exchange, made an announcement discouraging its staff from thinking about politics and encouraging them to focus on the company’s mission. This caused quite a controversy that divided Silicon Valley. Now, here’s the challenge in my mind - businesses have a real impact in our everyday lives. Should a business, then, not take a stand on how politics or policies or other things impact our society or environment?

Traditionally, businesses have always focussed on increasing shareholder value. That’s true capitalism - increase wealth whatever the costs, free markets will take care of it. However, those costs have resulted in a huge wealth gap among others. In recent times, we’re realising that sharheolder value is not the only value to be created. Societal and Environmental value must also be created. There are inherent benefits in creating all round value - afterall, if there are no humans left on earth what’s the point of shareholder value?

Now, you can very well say, in US one can take such a stand without repurcussions, and that’s true. In India, for example, it can be detrimental for a business to take a stand. Similarly in Indonesia, Philippines and so on. Sometimes, businesses also feel that taking such a stand will deter prospective customers - doubt there’s any evidence of that. However, it is also true that business put out front page interviews if and when a new regulation is introduced that will adversely impact the business. What this tells me is that businesses will take a stand when it’s convenient.

Just this past week, in India we had a horrifying event of a rape victim succumbing to her injuries. The cops, in order to avoid any controversies, created a controversy by creamating the victim’s body themselves, while keeping the family away from the whole scene. Only a handfull of business leaders voiced their opinion on this matter. We continued our daily lives. Women continue get raped.

What’s the takeaway from all this? You decide. As a business leader, can you ignore the society you’re building for? Can you ignore the environment you’re building in? Can you solely focus on growing your business at any costs? What are those costs?

Fintech’s Hiring

If you’re a Fintech who’s hiring I’d like to help. Write to me and I’ll put your requirement here.

India

Market Updates:

ChqBook, a loan aggregator service for small merchants, has launched digital ledger, lending and insurance services for small merchants Read More

PaytmMoney, Indian wealth management app from the Paytm stable, has launched stock broking for all users (was earlier limited to few users), targets 1 mn users in first year. It currently has 220K users Read More

India’s Government-backed COVID-19 emergency loan scheme for small businesses was only 42% utilised. The scheme was to be disbursed to applicants via government-owned banks Read More

PineLabs, Indian point-of-sale payments platform, has allotted USD 14 mn ESOP’s to additional employees Read More

PhonePe, Walmart-owned payments platform in India, distributes 500,000 insurance policies since launch 5 months ago. Majority of the buyers were first-time insurance buyers from Tier 2 & 3 cities Read More

Flipkart, Walmart-owned ecommerce business, has partnered with Bajaj Allianz to launch cyber insurance Read More

India’s Unified Payments Interface (UPI), a bank to bank payments protocol, continues to grow in usage registering 1.8 bn transactions in Sept-2020 Read More

Funding Announcements:

Smallcases, Indian stock investment platform, announced a fund raise of USD 14 mn from DSP Group along with existing investors Sequoia, Blume and others Read More

Home First Finance, an affordable housing finance platform, has raised USD 95 mn from Warburg Pincus. Since inception, the company claims to have sanctioned loans to 50,000 borrowers Read More

South East Asia

Market Updates:

KuCoin, Singapore-based cryptocurrency exchange, announced that it’s hot wallets were hacked with minimum damaged pegged at USD 150 mn Read More

ANTGroup launched its digital banking platform, ANT Bank, in Hong Kong weeks after filing IPO documents Read More

PPro, UK-based payments company, launched in Indonesia through partnership with local payments firms OVO and Doku Read More

Timo Plus, Vietnam’s first online-only bank has relaunched with a new partner Viet Capital Bank, replacing VPBank Read More

BigPay, AirAsia Group’s Fintech platform, launched it’s first offering in Singapore. BigPay will offer its customers a mobile money app with prepaid VISA card Read More

Volopay, a Singaporean corporate expense tracking platform, has partnered with NIUM, a Singaporean fintech API platform to offer an improved corporate card product Read More

Singapore’s Banking regulator - MAS, has directed Wirecard to cease operations in the country Read More

Shopee, South East Asian Ecommerce platform, announced a five-year partnership with VISA enabling Shopee’s small business sellers to digitise their operations and use VISA as the payment acceptance method Read More

Funding Announcement:

PayMongo, an API-based payments acceptance platform in Philippines, has announced a fund raise of USD 12 mn from Stripe Read More

Kakao Pay, South Korean Kakao Corp’s mobile payments platform, is set to list on the South Korean stock exchanges at a valuation of USD 8.5 bn. KakaoPay claims to have 34 mn users Read More

RootAnt, Singaporean Banking-as-a-Service platform, has raised USD 1.46 mn led by Linear Capital and KZM Group Read More

Castles Technology, Taiwanese payments major, has acquired Spire Payments, UK-based electronic funds transfer at POS platform Read More

Europe

Market Updates:

GG Insurance, UK-based gaming insurance provider, has expanded to US Read More

SimpliBiz, UK-based compliance SaaS for advisors, has partnered with Wealthify, UK based investment advisory SaaS to provide to enable Wealthify for all all SimpliBiz advisors Read More

Paysera, Lithuanian gold trading platform, announced trading in physical gold as well as units of gold digitally Read More

Spare Bank1 Østlandet, a Norwegian bank has exported its AR app to Japan. The app teaches children about personal finance Read More

N26, European challenger bank, has hired Adrienne Gormley as COO. Interestingly, Gormley held several leadership positions at Dropbox before this Read More

Judopay, UK-based payments platform, has announced partnership with Mastercard for touch-less payments Read More

Memo Bank, a French small business challenger bank, has unveiled three new plans for new customers. The plans are EUR 49 for 20 transactions/month, EUR 149 for 200 transactions/month and EUR 399 for unlimited transactions/month Read More

Samsung Pay in Germany has partnered with Solaris Bank, a German API-only bank, to allow Samsung Pay users to link an account with almost any bank enabling contactless payments powered by VISA virtual debit card Read More

Funding Announcements:

RipJar, UK-based data intelligence platform for anti money laundering and fraud prevention, announced a fund raise of USD 31 mn Read More

Mozzeno, a Belgian P2P lender, has announced a fund raise of USD 3.3 mn from existing investors. Mozzeno claims to have facilitated 2000 loans with total disbursement of EUR 15 mn Read More

Bitpanda, Italian digital assets and precious metals trading platform, has announced EUR 44.5 mn Series A round (largest Series A in Europe). The investment was raised from Peter Thiel’s Valar Capital Read More

Finom, small business challenger bank, has announced a fund raise of USD 12 mn from several European funds including Target Global (Germany), Cogito Capital (Poland), Entree Capital (Israel), Avala Capital (Germany), Tal Capital (USA) and AdFirst Ventures (EU) Read More

GIC (Singaporean Investment firm) and MassMutual (US Life insurance co.) have agreed to acquire Blackstone’s 36% shareholding in Rothesay Life, UK-based annuity provider. The deal is valued at USD 7.4 bn Read More

October, a French small business lender, has announced a USD 300 mn fund raise from Insight Partners. October claims to have disbursed USD 521 mn since inception Read More

Capify, US-based small business lender operating in UK and Australia, raised USD 10 mn from Goldman Sachs Read More

Knoma, UK-based lender for educational courses, has raised USD 21 mn in debt and equity from Global Founders Capital, Rocket Internet and others including angel investor Christian Faes, LendInvest’s chairman Read More

QUIN, a German investment advisory platform, has raised EUR 1 mn from sino AG, Runa Capital and others Read More

Other Notable Nuggets

Bank Mandiri, Indonesia’s largest bank, reflects on the future of Banking

AliPay has launched Trusple, a blockchain based cross border money transfer platform

Greenlight, US-based kids payments platform, raised USD 215 mn

Stripe’s VC Activities - An Overview

Mobile Payments On Smartphones Soar 26 Pct YOY In Japan

Australian Fintech unicorn Airwallex raises an additional $40m in an extended series D round

Amazon launches palm scanning for payments, checkouts and other use cases

Slightly late to the party, Square launches QR-code based payments

Goldman Sachs Acquired General Motors’ Credit Card Business for USD 2.5 bn

Tokyo’s Stock Exchange had to be shutdown for a full day after a hardware glitch

That’s all folks

If you’ve made it this far - thanks! As always, you can always reach me at connect@osborne.vc. I’d genuinely appreciate any and all feedback. If you liked what you read, please consider sharing or subscribing.

See you in the next edition.