Fintech Inside # 33 - 15th Aug, 2021 | Finfluencers

Of "Finfluencers" and their rising popularity, cryptocurrency exchanges and networks in the news, US stock trading exchange for the retail users and an institutional crypto exchange.

Hi Insiders, Osborne here.

Welcome to the 33rd edition of Fintech Inside. Fintech Inside is the front page of Fintech in emerging markets.

Happy Independence day to the Indians reading this and Happy Navroze to those celebrating!

We always hope and wish that schools implement basic personal finance in the curriculum, but India's "finfluencers" are filling that void. This week we take a look at those influencers and their rising popularity.

There's also a round up of all the crypto news this week (as there was a bunch of it), along with details of an exchange working on making investing in US stocks easier for Indians and another exchange working on making investing in digital assets easier for institutions.

Please enjoy all the details in today’s edition. If you feel Fintech Inside brings you value, please share it with your friends (and maybe suggest they subscribe too).

If you’re an early-stage fintech startup founder raising equity or debt, I may be able to help - reach out to connect@osborne.vc

🤔 One Big Thought

India's Increasingly Popular "Finfluencers"

This week I'm keeping it light as most of you in India will be taking a break and would want to take it slow.

Most of our parents didn't really get formal financial advise or information. In fact, they relied on relatives, the friendly neighbourhood LIC agent, newspapers and self learning. This for obvious reasons is not the ideal way to learn how to save and invest. Unfortunately, this "lack of information" got passed down to our generation. Us, millennials and GenZ don't have it the same though, we have the opportunity to improve our financial situation by drinking from the firehose that is the internet. But where do we start? blogs? Nah, we've got an entire Avengers line-up for financial education - India's very own Finfluencers.

Keeping up with the video-hungry nation we are, these Finfluencers are building massive audiences on Instagram and Youtube. Their content largely revolves around explaining financial news or concepts. As our attention span continues to reduce, sharpening our financial knowledge and concepts through 15 second reels definitely helps.

Want to learn what's a restoration benefit in your insurance policy? Learn it from "my man FinanceWithSharan". Don't know what an FPO is? Learn it from Neha Nagar. Didn't hear about the economic crisis in Lebanon? Anushka Rathod has you covered. Wondering when to exit your mutual fund? Just ask Fincocktail by Sayali and Niyati. Virtually every weekend you'll see at least one of these influencers do an Instagram Live where they talk directly to subscribers. Video creation is a ton of work especially since it is only 7-15 seconds short and subscribers want new content all the time. However, making sure their videos are accurate is a massive task - I don't know how they do it. Instagram has 180mm active users in India and these financial influencers sure know how to grow their audiences and keep them engaged. Since creating this newsletter I've gained massive respect for these video creators.

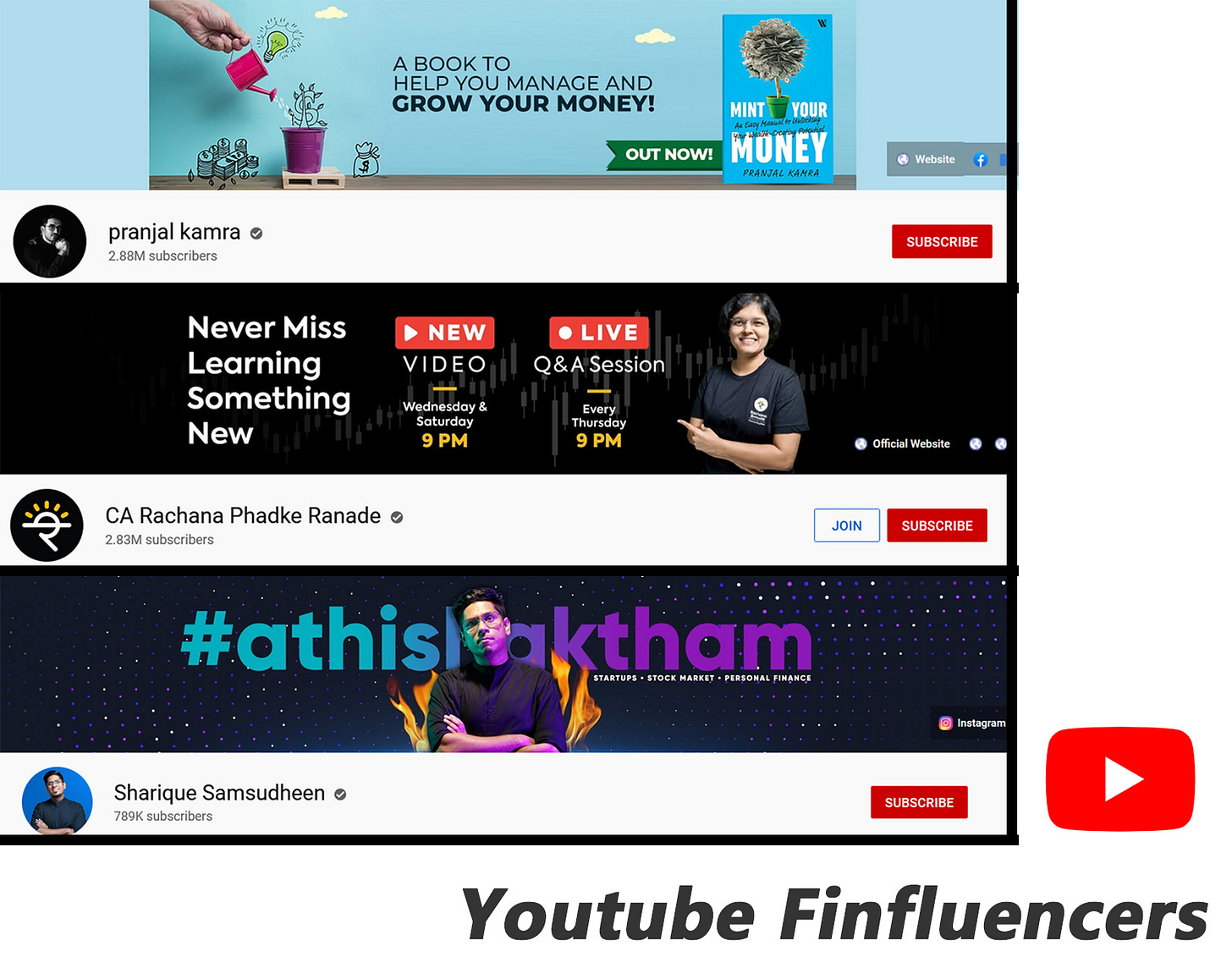

Youtube's financial influencers are on another orbit altogether. Pranjal has 2.9mm subscribers, CA Rachana has 2.8mm subscribers and Sharique has ~800K subscribers. These folks as well put out largely educational content to learn how to invest, how to save, how to create a portfolio and so on. They make it easy to consume but more importantly, the content is in regional languages. I spend less time on Youtube, so I don't know too many financial influencers there.

There's no doubt, these finfluencers are excellent at what they do. They're simplifying financial concepts for our generation and realise their responsibility to be accurate - their subscribers push them to be. The challenge arises when some finfluencers wields enough influence to move markets or results in investors losing their money. SEBI (India's securities regulator) has been proactive to take action if and when things to awry. It banned a TV presenter and his family from the capital markets for fraudulent trading practices and banned a Youtuber from the capital markets for guaranteeing profits through this stock tips. However, in an evermore connected world, social media's financial influencers are going to be inevitable. SEBI, or any regulator for that matter, will not possibly be able to monitor and take action against some random influencer in some obscure corner of the internet. More so, what if a whole community comes together to rally a particular stock to stick it to the hedge funds and the regulators will not be able to do much. Oh wait, that happened already.

Should I start doing fintech reels on Instagram? That's a rhetorical. Don't answer that. :)

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

💼 Work at a Fintech

workatafintech.com: Search from ~170 open positions at ~50 fintech startups in India and South East Asia.

ProgCap, a small business pay later platform, is hiring Product Managers, Collections Managers and Engineers. Apply here.

Clinikk, a health subscription platform, is hiring Engineers and Sales Managers. Apply here.

Simpl, a buy now pay later platform, is across for 12 positions across engineering, sales, product management and collections. Apply here.

If you’re a Fintech who’s hiring I’d like to help. Write to me and I’ll put your requirement here. 2.5K+ people view these open positions.

3️⃣ Fintech Top Three

1️⃣ Cryptocurrency news round up - 3 fund raises, 1 hack

Cryptocurrency startups were the highlight of the week and so I'm combining them here.

CoinDCX, a cryptocurrency exchange, became India's first crypto unicorn after announcing a $ 90mm fund raise led by B Capital.

Pintu, an Indonesian crypto exchange, raised $35 mm from Lightspeed and others, just 2 months after raising $ 6mm.

Mudrex, an Indian crypto wealth platform, raised $2 mm from Nexus Ventures and others.

Poly Network, a cross-crypto currency network, was hacked and tokens worth $ 600m were extracted. Majority of the tokens were returned and Poly Network rewarded the hacker with $500K as a bug bounty reward. (what a roller coaster!)

Takeaways: I'm surprised with the amount of funding being raised by crypto platforms especially because majority of their customers (except Pintu) are in countries that have actively tried banning/blocking/regulating crypto currency platforms. The regulatory environment is uncertain but that's probably where risk-reward ratio is potentially outsized. All these platforms that raised funding, including Vauld which raised $25mm from Valar two weeks back, have seen tremendous growth in the past year. CoinDCX has 3.5mm registered users, Vauld has 100K active users (200x YoY), Pintu is growing 70% MoM and Mudrex has over 25K active portfolio managers with $ 1bn traded since inception. Incredibly, it is estimated that in Indonesia there are 6.5 mm crypto investors vs. 2.2mm public equity investors.

The hack is also an interesting development. The hacker found an exploit, extracted the tokens to prove a point, then returned the tokens. If this hack was done by a black hat hacker (not ethical one) then this would have been the largest hack in DeFi history (yet). Personally, I think we need more security research on our existing financial systems and more importantly on crypto networks. We need to know the unknown threats to crypto networks if we are thinking of it replacing our existing financial systems. Current financial systems are decades old. Crypto as a concept has just barely existing for 2 decades. I think about these hacks in the same way as lending companies need to go through an NPA cycle: expose their books to unknown fraud and fine tune their underwriting models to avoid them in the future. The unfortunate part in a crypto exchange is several investors can be impacted in the event of a hack.

2️⃣ NSE will release a trading platform for Indians to directly invest in select US stocks

India's National Stock Exchange (NSE) announced that it is working on a platform to allow Indians to invest in select US stocks. The system is being built by NSE's subsidiary NSE International Exchange (NSE IFSC) and is part of the regulatory sandbox. The entire trading, clearing, settlement and holding of US Stocks will be under the regulatory structure of IFSC Authority. Investors will be able to hold the depository receipts in their own demat accounts opened in GIFT City.

Takeaways: In the past two years several Indian platforms were launched to enable investing directly in US stock markets - Vested, INDWealth, Winvesta, Groww and several more. Zerodha stayed away from offering US stock investing. These platforms partnered with DriveWealth or Viewtrade Securities in the US and all clearing and settlement took place in the US. That's where the difference lies - all clearing and settlement of this NSE IFSC platform will take place in India's GIFT City. GIFT City is India's experimental finance hub with its own offshore jurisdiction within India's borders and will have special rules and regulations to attract foreign investment. The NSE IFSC platform being built by an exchange is important as it will offer US investing directly to Indian investors. It's unclear if NSE IFSC will have a consumer-facing platform but I wonder what will be the impact on the aforementioned platforms offering the same.

While, geographical diversification is great, the Indian tax regime for overseas investing is brutal and just doesn't justify investing in US stocks. Cost structures are high as well. Nithin, CEO of Zerodha explains the structures really well. The allure of investing in Apple, Microsoft and other platforms that "I use everyday" trumps the tax and cost consideration, I guess.

3️⃣ DBS Bank's brokerage arm received in-principle approval for digital asset token trading from MAS

Vickers, DBS Bank's brokerage arm in Singapore, received an in-principle approval to launch trading services for digital payment tokens. Vickers is a member-only platform for institutional and accredited investors. It "will enhance members' ability to seize opportunities and manage risks arising from changes in cryptocurrency spot prices". Once licensed, DBS will be able to directly support asset managers and companies trading in digital payment tokens through DBS Bank’s cryptocurrency-enabled exchange, DBS Digital Exchange (DDEx).

Takeaways: Surprised this wasn't talked about much. Firstly, I didn't know MAS had such a license. Secondly, a broker getting it makes so much sense. Vickers is one of the first financial firms to get such an approval. MAS issued the first in-principle approval for Australian crypto exchange Independent Reserve last week. DBS is also making the DDEx platform available 24x7 as opposed to operational only during Asian working hours. Launched in late 2020, DDEx supports trading of Bitcoin, Ether, XRP and Bitcoin Cash, targeting only institutional investors. As of the end of June, 400 investors joined the exchange and DBS claimed to have more than $ 130mm in digital assets in its custodian services.

I'm no expert on cryptocurrency and have zero clue about the technicalities but I'm a cursory observer. From what I've seen, this is the first regulatory framework for crypto exchanges that just makes sense. IMO, it's how any crypto exchange should be regulated, if at all - as an exchange, like we have for stocks. Singapore's DBS is also limited to institutional and accredited investors to iron out the kinks before opening up to retail investors. Tons to learn from this structure. If you feel I've misunderstood something, please let me know, I want to learn from your experience.

Looking for the news digest? Read all the week’s fintech news and updates in India and SEA over at This Week in Fintech - India and SEA Edition. You can also find our US, Global and European coverage.

🏷️ Notable Nuggets

Buy Now, Pay Later & Payment Ramifications by John Street Capital

"A Neobank for Creators": why the $ 15bn creator economy is fintech's next battleground

Explained - The General Insurance Business Nationalisation Bill in India

Embedded finance won’t make every firm into a fintech company

Lithic's New Customer by Not Boring

👋🏾 That's all Folks

If you’ve made it this far - thanks! As always, you can always reach me at connect@osborne.vc. I’d genuinely appreciate any and all feedback. If you liked what you read, please consider sharing or subscribing.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

Found a broken link or incorrect information? Report it.

See you in the next edition.