Fintech Inside #30 - 25th Jul, 2021 | Work at a Fintech

Launching Work at a Fintech! Also, individual investors can't get enough of mutual funds, but the credit industry is seeing increasing defaults and RBI's Digital Rupee

Hi Insiders, Osborne here.

Welcome to the 30th edition of Fintech Inside. Fintech Inside is the front page of Fintech in emerging markets.

This week, fintech news got drowned out because of BharatPe's tech hiring tactics, Zomato's incredible IPO and RBI's CBDC announcement. But you know I've got you covered!

Earlier this week, we launched Work at a Fintech - get all the details here. Plus, the mutual industry is witnessing record investor participation, but the credit industry is also seeing some very high defaults. There's also some more detail on RBI's CBDC.

Globally, Square launched a small business banking platform. Australia's central bank launched its first sustainability-linked agriculture loan. Zip and Quadpay merged in Australia, VISA made a big acquisition and Mastercard rolled out PayPort+, its instant payments interface in UK.

If you’re an early-stage fintech startup founder raising equity or debt, I may be able to help - reach out to connect@osborne.vc

🤔 One Big Thought

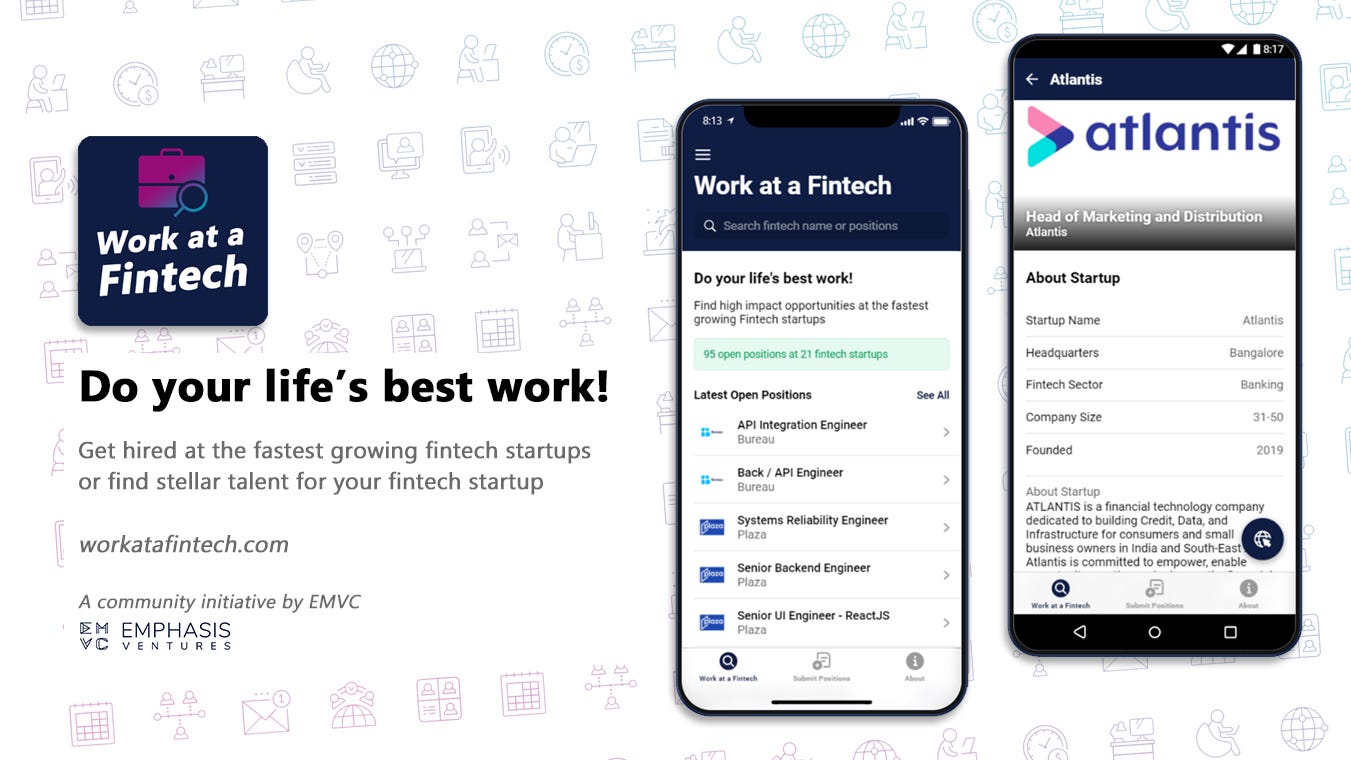

Launching Work at a Fintech (workatafintech.com)

Earlier this week we launched Work at a Fintech - a job board to find high impact opportunities at the fastest growing fintech startups. Build the future of finance together!

We believe that all businesses will be fintech-enabled. To realise this future, the best minds and talent need to be solving the most important challenges in fintech. However, finding the right talent is hard.

We hope Work at a Fintech becomes the single destination for Fintech startups to hire great talent. Moreover, we want to make it easy for anyone wanting to make a career in fintech, including executives from traditional BFSI. The product will evolve to include new features such as easy filtering and search, quicker listing and uploading, better matchmaking, single application to multiple fintech startups and more.

India's fastest growing fintech startups including Slice, Klub, Jai Kisan, Setu, Atlantis, GoKwik, Bureau, ZestMoney, Raise, ProgCap and many more are hiring. Positions on Work at a Fintech have already seen hundreds of applications.

You will find 130+ opportunities at ~40 fintech startups. Positions ranging from entry level to CXO's, across functions (yes, not just tech and engineering!) are all listed on Work at a Fintech.

Not actively looking to switch? Submit your confidential Career Profile and we'll help you find opportunities at the right time. 100+ people have already submitted their profiles.

For now, Work at a Fintech is specifically for fintech startups hiring in India. We started with India because we wanted to stay focused and get it working really well. Once we are ready, we will add support for emerging markets as well.

Work at a Fintech is a community initiative by EMVC, a global early-stage fintech fund investing in India’s breakthrough fintech and insurtech companies.

If you’re a fintech who’s hiring I’d like to help. Write to me and let's get you listed on Work at a Fintech.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

3️⃣ Fintech Top Three

1️⃣ Total number of mutual fund investors doubled in 4 years

This is slightly dated news but needed to be highlighted. Total unique mutual fund investors in India doubled to 23.9mm as on Jun, 2021 from 11.9mm as on Mar, 2017. Moreover, total unique mutual fund investors added in the quarter ended Jun, 2021 was 1.2mm whereas those added in all of FY21 was 2mm! Unique Investor is defined by unique PAN and includes both retail and corporates.

Takeaway: The number of mutual fund investors increasing is definitely reason to cheer. 1.2 mm new investors added in just one quarter vs. 2mm added in a whole year! Incredible growth. This growth is clearly driven by the bull market we're currently experiencing, despite India's Covid situation. Individual investors hold more than 72% of assets in equity schemes. However, it doesn't seem like this growth will be sustainable - especially if the bull market doesn't continue. SIP (systematic investment plan) contribution stood at only $ 1.23bn in Jun 2021.

What's even more fascinating is that retail mutual fund participation is driven almost entirely by distributors - 80% of individual (including HNI) AuM came through distributors - 58% from Top30 cities and 22% from Bottom30 cities. 20% of individual (incl. HNI) AuM is coming from either directly or from platforms like PaytmMoney, Groww and others. Portion of retail investors (excl. HNI's) directly investing (through apps like PaytmMoney, Groww etc.) has been growing over the years - 12% in Mar, 2019, 14% in May, 2020 and 16% in Jun, 2021. Here you'll find more data points on individual investors.

This bull market is doing much more for "investor education and participation" than the "Mutual fund sahi hai" campaign.

Thanks to Abhishek Murarka for helping me understand certain terms from AMFI's data.

2️⃣ Large NBFC's witness increasing NPA's

While total outstanding credit to micro and small businesses dipped by 3.6% YoY as on Jun, 2021, HDFC Bank's small business NBFC arm reported 2x QoQ growth in GNPA from 3.89% to 7.75% in Jun-21 quarter. Bajaj Finance as well reported 19% GNPA in its auto finance vertical for the quarter ended Jun-21. RBI itself expects banking sector NPA to rise to 9.8% by Mar, 2022 whereas S&P thinks it may be as high as 11-12%.

Takeaway: This bit of news is so contradictory to the section above - markets are seeing record retail investor participation but at the same time, we're witnessing high credit defaults. I know the two aren't directly correlated but it seems so unintuitive. HDB Finance (HDFC Bank's small business finance arm) is probably the largest small business lender in India, has a full machinery in place to collect loan repayments and is yet witnessing 7.75% gross NPA. Bajaj as well is known to have a superior loan book given its scale and even it is witnessing 19% gross NPA.

During Covid's 2nd wave in India (Apr, 2021 onward), fintech startups had it tough - liquidity was tight and the race was on to minimise defaults. Now they have to switch gears and grow their book size while maintaining low defaults. I wonder if fintech startups in this space have seen similar deterioration in book quality. I would imagine lending startups have performed better because of alternate data based underwriting, better contactability and direct debit access, add to the fact that there is much more scrutiny on their books from lenders and learnings from the instant loan app implosion.

3️⃣ RBI announced plans to roll out a "Digital Rupee" in a phased manner

India's central bank announced via speech by the deputy governor, that it plans to introduce a central bank digital currency (CBDC) i.e. a Digital Rupee. It will roll out this Digital Rupee in a phased manner because of legal changes it will warrant. This Digital Rupee will also be tested across retail and wholesale applications "with no disruptions". RBI says the main considerations for the roll out will be: 1. ledger technology - distributed or centralised, 2. validation mechanism - token based or account based, 3. distribution architecture - distributed by banks or RBI and, 4. degree of anonymity.

Takeaways: Impressive announcement, RBI. It's only been days since EU's ECB announced its approval for investigation phase of the Digital Euro. If you read the speech it comes across that RBI is primarily thinking of and rolling out its CBDC out of peer pressure - "other central banks are doing so we should not be left behind". There's no real "need" other than benefits of reduced dependency on cash, lower transaction cost and reduced settlement risk - all of which are to some extent being solved by India's famous and robust digital payments backbone.

One interesting thing from the speech was RBI's note on anonymity. "There is thus a unique scenario of increasing proliferation of digital payments in the country coupled with sustained interest in cash usage, especially for small value transactions. To the extent the preference for cash represents a discomfort for digital modes of payment, CBDC is unlikely to replace such cash usage. But preference for cash for its anonymity, for instance, can be redirected to acceptance of CBDC, as long as anonymity is assured". Even RBI recognises Indian's use of cash for anonymity and a consumer's behaviour when using digital modes. It will be interesting to see how RBI bakes anonymity in CBDC's roll out.

Looking for the news digest? Read all the week’s fintech news and updates in India and SEA over at This Week in Fintech - India and SEA Edition.

👋🏾 That's all Folks

If you’ve made it this far - thanks! As always, you can always reach me at connect@osborne.vc. I’d genuinely appreciate any and all feedback. If you liked what you read, please consider sharing or subscribing.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

Found a broken link or incorrect information? Report it.

See you in the next edition.