Fintech Inside #27 - 10th Apr, 2021

This week was intense for Fintech: 2 new unicorns were announced. Also, RBI made big announcements for payments cos., India got it's first NFT marketplace and 6 consortium's applied for NUE licenses

Hi Insiders, Osborne here.

Welcome to the 27th edition of Fintech Inside. Fintech Inside is the front page of Fintech in emerging markets.

This week was a blur to me. So much happened - in India we had 6 Unicorns announced and 29 startups announced fund raises of a total of USD 2.66 Bn! I had a tough time keeping up with startup news this week. If you're in the same boat as me, you know I got your back.

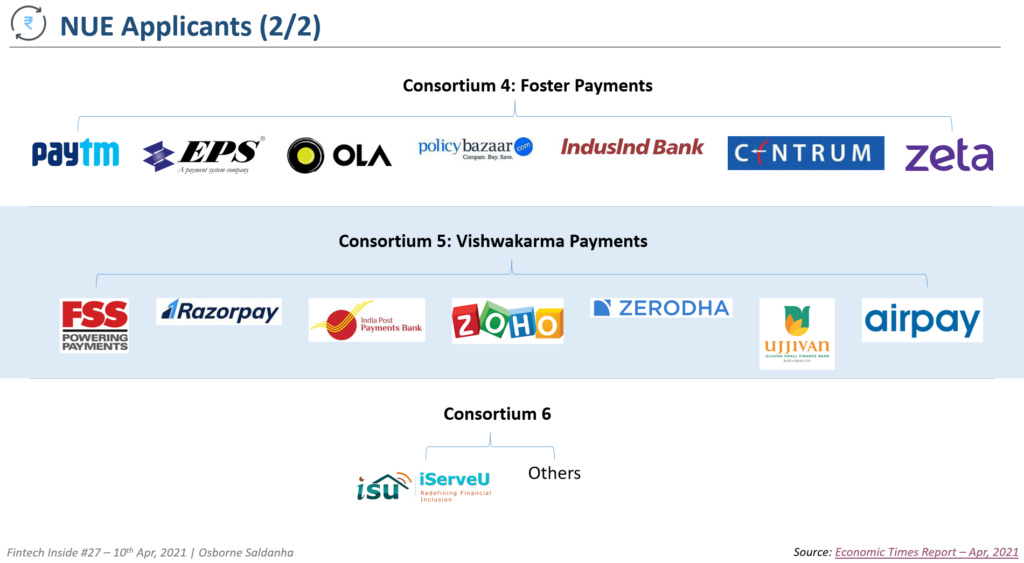

In today's edition, there's updates on RBI's mandates for non-bank payments companies and its opportunities. WazirX launched an NFT marketplace. 6 consortiums came together to apply for NUE licenses in India. Check out who all have applied with whom.

Of course, you've seen the latest viral CRED Ad by now, but have you read my deep dive on CRED's business model?

Global: Ben Evans wrote an insightful post on Shopify's growth and competition with Amazon. Plaid raised USD 425 mn and Clubhouse launched creator payments acceptance with Stripe.

🤔 One Big Thought

Update: Will be making One Big Thought a once-a-fortnight feature. I want to be able to send you quality content on Fintech Inside which takes time to research and structure. Will be posting One Big Thought in the next edition. Appreciate your support, Insider.

💼 Fintech's Hiring

Stack Finance is hiring a Growth Marketing Manager and a Product Manager. You can reach out to the founder Smriti Tomar on LinkedIn for any questions.

Basis* is hiring for 5 positions in Design, Marketing, Sales and Community building. You can reach out to to founders Hena Mehta or Dipika Jaikishan via DM on Twitter.

If you’re a Fintech who’s hiring I’d like to help. Write to me and I’ll put your requirement here.

3️⃣ Fintech Top Three

1️⃣ RBI Mandates Interoperability and Makes Payment Systems Accessible to Non-Bank Entities

India's central bank i.e. the Reserve Bank of India (RBI) announced 4 mega notifications for the payments industry this week. 1 - Non-Bank payments operators will be allowed to integrate with RBI's Real Time Gross Settlements (RTGS) and National Electronic Funds Transfer (NEFT) systems. 2 - Mandatory interoperability for full-KYC Prepaid Payments Instruments. 3 - Account Balance limit on Prepaid accounts and Payment Bank accounts increased to INR 2 lacs (USD 2,700) from INR 1 lac (USD 1,300) 4 - Allowed cash withdrawal from full-KYC non-bank Prepaid accounts.

Takeaways: These are massive updates. It's clear the RBI doesn't want walled gardens in the payments sector. Unfortunately, all bank and non-bank entities want walled gardens to "own" their consumers. You can see this in action from how GooglePay, Amazon and others bury interoperability with dark patterns in their respective apps - though this is changing slowly.

I'm most excited about RTGS and NEFT being opened up to non-bank entities. If you think about it, with UPI, RTGS and NEFT, Indians (retail and business) can transfer amounts as low as INR 1 (USD 0.013) to INR 1 mn (USD 13,380) with 24x7 availability from *any* payments app they choose. This will have massive implications for businesses rather than individuals in my opinion. Lastly, I think this is being done in anticipation of the New Umbrella Entities licenses to be approved in 6 months. Remember: UPI is built on top of IMPS rails.

2️⃣ India's First NFT Exchange Launched by WazirX

Earlier this week, WazirX, Binance-owned Indian cryptocurrency exchange, announced that it launched India's first NFT Exchange. From the little I know, NFT is a non-fungible token for digital assets meaning you can buy digital art and digital assets and you will have full ownership of that digital piece verifiable by the blockchain. Assuming the price of this digital art/asset increases in the future, you can sell it and the original artist will get their cut on sale.

Takeaway: This is great - I believe all artists should get paid well when we consume their art. However I have two main questions here: 1 - resale value of the art itself and 2 - Long term lifespan of the NFT marketplace. On the resale value part, people will buy NFT's to either support their favourite artist (collector's items) or if they see high resale value potential. How many people will really buy it here if they're looking for returns on digital arts?

Secondly, the token verifying one's purchase of the NFT digital art is only good if the platform it was sold on doesn't shut down. In that case, what happens if India's regulators ban cryptocurrency trading? I realise that the rumoured ban is for digital currencies other than the sovereign currency but where does that leave digital assets on the blockchain? Lot's to unfold here and huge props to WazirX and others in the Indian crypto community for their work.

3️⃣ New Umbrella Entity (NUE) Payment Infrastructure Applicants

31st March, 2021 was the last date to apply for RBI's New Umbrella Entity (NUE) for Payments. 6 consortiums applied for the same and saw some huge hitters in the race. For the uninformed, RBI's NUE framework is its way to reduce infrastructure risk of relying on one entity (NPCI) for India's payments networks. It's unlikely that RBI will approve licenses to all 6 consortiums but we will get to know of the same in 6 or so months. The NUE applicants are as below (as per Economic Times)

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

🚀 Featured Fintechs

Featuring 3 Fintech's weekly that have a unique business model, unique product or have recently launched. Let's get you featured here as well.

New: access all the Featured Fintechs from previous editions on AirTable

OfBusiness - India | Series D | SME Lending

OfBusiness is a B2B procurement platform which provides credit to facilitate transactions.

It acts as a marketplace for raw materials bringing suppliers and purchasers on one platform.

Profitable for the past 3 years, OfBusiness has it's own NBFC and raised over USD 200 mn in debt from India's largest banks

OfBusiness has raised over USD 170 mn since inception from Falcon Edge, Matrix Partners, Creation Investments & Norwest. It's latest valuation (Apr 2021) was USD 800 mn

ShopSe - India | Seed | Pay Later

ShopSe provides point-of-sale instant digital "pay later" financing for consumers

ShopSe provides the SaaS infrastructure and brings Lenders, Brands and Consumers on its platform to offer affordability options at offline stores.

It claims to have the largest credit-approved customer base in India and is being used by 10,000+ retail points today.

This week, ShopSe raised USD 5.5 mn in seed funding from Chiratae Ventures and Beenext Ventures along with others.

Stack Finance - India | Seed | Personal Finance

Stack Finance is a personal finance management platform for millenials.

The platform is designed to be a single dashboard for millenials' assets and liabilities with behavioural nudges to make smarter financial decisions.

Stack Finance raised an undisclosed amount from SOSV and several angel investors in Aug 2020.

Let's get your startup featured here. Submit your Fintech startup

🇮🇳 India

- 📰 Market Updates:

Lendingkart raised USD 15 mn debt from Dutch bank FMO. NiyoX claimed to have 30K customers and 10K savings accounts opened within 2 weeks of launch.

PhonePe released its latest design style. Sheroes Money disbursed its first loan this week.

ICICI, SBI Cards and Axisgain market share and increased spends from HDFC Bank freeze.

Zerodha, Razorpay, FSS, Zoho, Ujjivan Small Finance Bank and Cholamandalam Finance partnered to apply for New Payments Entity (NUE) License in India.

- 🚀 Product Launches:

PayPal partnered with FlexiLoans to launch SME loans for its merchant network. FinBox launched CollectX - API for debt collections.

Recko integrated with Razorpay for auto payment data reconciliation. U GRO Capital partnered with SBM Bank India to launch ‘GRO Smart Business’ credit card for SMEs.

WazirX launched India's first marketplace for NFTs. Mobisafar partnered with YES Bank and NPCI to launch Virtual RuPay Prepaid Card.

- 📝 Regulatory Updates:

RBI (Central Bank): Made interoperability mandatory for all wallet, PPI issuers. Directed lenders to refund compound interest to borrowers. Increased Payment Bank account limit to INR 2 lacs (USD 2,700) from INR 1 lac (USD 1,300)

- 💰 Funding Announcements:

- FUND RAISES: Groww (millenial investment app). CRED (credit card rewards). OfBusiness (small business finance). Kudos Finance (embedded lending). Findeed (consumer finance). SafexPay (consumer payments). Shopse (buy now pay later). Avanti Finance (SME lending). OneCard (credit cards).

🌏 Asia

- 📰 Market Updates:

Thailand, Vietnam launched QR code link for cross-border payments. BizBank launched its corporate expense card in Singapore. Atlantis Tech launched MyBizBank, a neo bank for SME's, in Singapore.

- 💰 Funding Announcements:

- FUND RAISES: StashFin (Singapore, neo bank). VISA Accelerator Cohort released.

🌏 International

👋🏾 That's all Folks

If you’ve made it this far - thanks! As always, you can always reach me at connect@osborne.vc. I’d genuinely appreciate any and all feedback. If you liked what you read, please consider sharing or subscribing.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

Found a broken link or incorrect information? Report it.

See you in the next edition.

* - represents a portfolio company of my current place of work.