Fintech Inside #26 - 27th Mar, 2021 | Central Banks

This edition discusses Central Banking and the lack of women representation. Also, NPCI's market cap, digital payments are popular in India and RBI's thinking of new banking licenses

Hi Insiders, Osborne here.

Welcome to the 26th edition of Fintech Inside. Fintech Inside is the front page of Fintech in emerging markets.

Happy Holi and Happy Easter to those who celebrate. Hope you enjoy your festivities while being close to your loved ones. Next week there will not be an edition of Fintech Inside.

Today's edition looks at female central bankers globally and in India. NPCI's plan on market cap for UPI Apps, Digital debit methods are most popular in India and RBI is thinking of new banking licenses.

India and Asia had a massive week for funding announcements. 7 funding announcements and 1 acquisition in India. While in Asia there were 5 fund raises and 1 acquisition.

Globally: Revolut applied for US Banking license. US' SEC launched a probe on the country's recent SPAC craze and Stripe launched a "one-click checkout" feature.

🤔 One Big Thought

Women Central Bankers

This week, RBI's former Deputy Governor Kamalesh Chandra Chakrabarty passed away. His passing away got me thinking about RBI governors and women in central banking - don't know how the two connect but still, hear me out.

Since RBI's inception in 1935, India has had 25 governors including the current governor Mr. Shantikanta Das. However, in all these years India has never had a female governor of the central bank. US' Treasury Department is not exactly it's central bank but it appointed its first female secretary, Janet Yellen, in Jan-2021. Female central bank governorship is actually uncommon globally. In fact, only 15 out of 173 central banks globally have a female as its governor. Vietnam was the latest to induct Nguyen Thi Hong as its first female central bank governor on 12th Nov-2020. Here's a nice full list of all female central bank governors.

Now, you must be thinking - what's the point of all this? Why does the gender of the central bank governor matter? Does having a female governor actually result in a better, stable economy? Valid questions. Let's discuss.

Firstly, the gender matters because 1. it's high time to break the glass ceiling in economics and central banking. 2. Financial institutions have all but excluded women participation in financial products and services. Economics, as with most other fields, has low women representation especially at higher positions. This has inherently made the industry and its products and services gender specific. The European Central Bank has a really good report on why women in central banks matter. Also, this week, Japan's central bank set a new, two-year, diversity target which is expected to increase the ratio of women managers in the central bank.

Secondly, having women central bank governors is also a great thing for the economy. This study, by Bocconi University shows that central bank boards with a higher proportion of women set higher interest rates for the same level of inflation. Basically suggesting that women board members have a more hawkish approach to monetary policy. Then there's this study which shows that a financial system is stable during the tenure of a female central bank governor that has high social capital or high cognitive abilities while the financial system is relatively less stable during the tenure of a male central bank governor that has high social capital or high cognitive abilities. There is some evidence supporting the impact female central bank governors can have on an economy but we need to do more.

As this study further states, "women have been found to hold statistically different views on economic questions, which have important implications for policymaking and real economic outcomes. On average the study published by the IMF found women to be less confident in market solutions, and more positive to government intervention, government spending, taxation, and redistribution. The same study found that women are more conscious of both diversity and equality of opportunity than their male counterparts"

Random trivia: RBI's first governor in 1935 was my namesake - Sir Osborne Smith.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

💼 Fintech's Hiring

Coinbase is hiring in India.

India's Ministry of Finance is hiring a Director (Digital Economy and Fin Tech). I cannot verify if the post is still vacant but it's interesting that the Ministry of Finance is even thinking on these lines. (h/t @logic)

If you’re a Fintech who’s hiring I’d like to help. Write to me and I’ll put your requirement here.

3️⃣ Fintech Top Three

1️⃣ NPCI's plan on market share cap for third party UPI Apps

This week National Payments Council of India (NPCI), which operates the Unified Payments Interface (UPI) payment rails, laid out its plan to cap the market share of Third Party Application Providers (TPAP). Earlier, NPCI said that it will impose a market share cap of 30% on TPAP's like GooglePay, PhonePe, WhatsApp Pay and other UPI apps. The NPCI now said that it will have 3 levels of alerts to notify the App provider regarding the breach of its market share threshold. Level-1, alert when market share is between 25-27%. Level-2, alert when market share is up to 30%. Level-3 when market share crosses 30%. At Level-3 breach, the TPAP will have to stop onboarding new customers.

Takeaway: This market share cap, to me, seems like not such a great move. In the #9th Edition of Fintech Inside on 07th Nov, 2020, I posted my views on this UPI market share which is important to re-post, as below:

Let’s for a minute try and see the arguments from NPCI’s perspective – maybe it feels WhatsApp pay may become really large and hence monopolistic. But there’s already a cap of 20 mn users. Maybe NPCI feels there is a risk of system failure – the cap is put on the TPAP’s not the Payment service providers (PSP’s) which actually face the problem of system failures.

My issue with this doesn’t stop there. How is a TPAP going to limit a consumer from paying using their app if the cap is breached? Putting a cap means failure rates might increase – if I prefer using PhonePe but PhonePe has to limit to 30% of total volume how will PhonePe stop me from using it?

Lastly, if the New Umbrella Entities have their way and licenses are doled out, then these entities which have built on UPI may not need UPI/NPCI and will switch to their own payment rails.

2️⃣ Digital methods emerged second-most popular in-store payment method

A Global Payments report published by WorldPay highlighted that digital payments and wallets was the second most popular method of payment in India, after cash. Cash accounted for 34%, digital accounted for 22% market share, followed by Debit Cards, Credit Cards, POS Financing and finally Charge Cards.

Takeaway: If this report is to be believed, it's interesting that debit payments account for 76% of the overall POS payments in India and over 80% of overall ecommerce payments. The top 3 modes of payment at POS all being debit modes. Obviously, UPI's popularity, has driven digital payments to be most used at POS and ecommerce outlets. Credit still has a long way to go in India - will this be an opportunity or a loss?

Further, it's also interesting to see VISA account for 42% of payments on Ecommerce and POS, while Mastercard accounted 31%. VISA has been optically more proactive in partnering with Fintech's, financial institutions and every one else - so it's not that surprising. Nonetheless, good headline stats in this report.

3️⃣ RBI formed an External Panel to evaluate bank license applications

The Reserve Bank of India (RBI), formed a Standing External Advisory Committee (SEAC) to evaluate license applications for Universal Banks and Small Finance Banks. This SEAC is a 5-member team headed by former RBI Deputy Governor Shymala Gopinath and will have a term of 3 years. All applications will be initially vetted by the RBI and then shortlisted and sent to SEAC for its evaluation.

Takeaway: The last time RBI gave out licenses was in 2015 when two entities were given licenses to float Universal Banks and 10 entities to float Small Finance Banks. This is an interesting development if more entities are given banking licenses. Our market is large enough for more banks to offer services. That said, the counter to that is the existing banks can beef up their operations and improve access to Banking. RBI has usually been very conservative with doling out licenses but will we see it being more disruptive with this batch?

Also, will a tech-first approach be rewarded? Hint: Sachin Bansal. Unlikely, in my view. If you see the Fintech's that are part of RBI's Retail Payments Sandbox first cohort, you'll notice a pattern: RBI chose solutions that use offline capabilities or those that can be used even on feature phones.

🚀 Featured Fintechs

Featuring 3 Fintech's weekly that have a unique business model, unique product or have recently launched.

This week, I feature the lesser known Fintech's of YC's latest batch. Here's the full list of Indian startups as part of this batch.

Splitsub (India | group buying | Seed)

Splitsub is a subscription sharing platform that graduated from YC's W21 batch this week.

Launched in Aug-2020, Splitsub plans to be a marketplace for group buying in the future.

When it launched its Beta, Splitsub saw 10,000+ sign ups in the first two months

Today, it claims to have 7,000+ active users. Read a full profile here.

Kodo (India | corporate credit card | Seed)

Kodo has built a corporate credit card product, similar to Brex in US.

It has built a "Privileges" section for small businesses and startups to access with their spends on Kodo.

The premise is to target a userbase that is ignored by traditional Banks and NBFC's.

Bueno Finance (India | blue collar finance | Seed)

Bueno Finance helps blue collar workers build and improve their credit score by providing short term credit over UPI

This credit access program helps blue collar workers get access to formal credit in the future

Bueno partners with brands/companies that have large blue collar workforce and gives revolving credit to this workforce. Repayments of loans is done by deducting directly from salary.

Bueno claims to have 12 corporate partners with access to ~10,000 blue collar workers and has disbursed loans to ~3,100 of them.

Let's get your startup featured here. Submit your Fintech startup

🇮🇳 India

- 📰 Market Updates:

RuPay’s market share by volumes is 34%. Digital wallets emerge second-most popular in-store payment method.

Finance Ministry asked SEBI to address issues that led to NSE outage. 85% of Indian consumers believe that robots can help them with managing their finances according to a report.

True Balance, short term loan platform, raised USD 10 mn in debt funding led by Northern Arc. Digital financing startup Drip Capital raised USD 40 mn warehouse credit line from US bank.

Govt. might block IP addresses of cryptocurrency exchanges. Outward remittances from India under LRS scheme hit USD 1.2 bn in Jan-2021, up 34% since Oct-2020.

Policybazaar joined Paytm-Ola-IndusInd Bank New Umbrella Entity for payments. TATA Group is working on a universal consumer payments ID.

Tiger Global may lead ClearTax funding at USD 750-850 mn valuation.

NPCI's plans to cap market share of UPI players in India. Stripe updated its data storage capability to store data within India (h/t @anmolm_).

14 NBFCs have moved various high courts against the RBI's norms on current account opening. Former RBI deputy governor Kamalesh Chandra Chakrabarty passed away.

- 🚀 Product Launches:

OneCard launched OneCard EMI payment facility. Yap, a banking API platform, launched a programmable card API platform.

Niyo launched NiyoX - a neo bank in partnership with Equitas Small Finance Bank and VISA.

YES Bank and SHEROES launched an accelerator to support women entrepreneurs.

- 📝 Regulatory Updates:

- RBI (central bank): Formed an external panel to evaluate Universal Bank and Small Finance Bank applications.

- 💰 Funding Announcements:

- FUND RAISES: FloBiz (SME accounting). Velocity (revenue based finance). KreditBee (digital instant loans). RupiFi (embedded SME Finance). DotPe (payments and commerce platform). IndiaLends (financial products aggregator). FinOne / muvin (neo banking)

- YC Companies in India: Full List here. ~13 Fintech companies from India in this batch.

- ACQUISITIONS: Khatabook acquired BizAnalyst.

🌏 Asia

- 📰 Market Updates:

Ant’s Alipay launched an advisory platform for asset managers. China proposed worldwide CBDC rules. Thai insurers sell policies for COVID vaccine side effects.

Traveloka, Indonesian travel OTA, and SCB 10x, Thailand's SCB Bank's tech innovation arm, partnered to create a JV to offer digital financial services in Thailand.

Hoolah partnered with Visa to support local businesses in Malaysia. China bans microlenders from granting consumer loans to university students. Tencent-backed mutual aid platform Qingsong Huzhu abruptly shuts down.

- 💰 Funding Announcements:

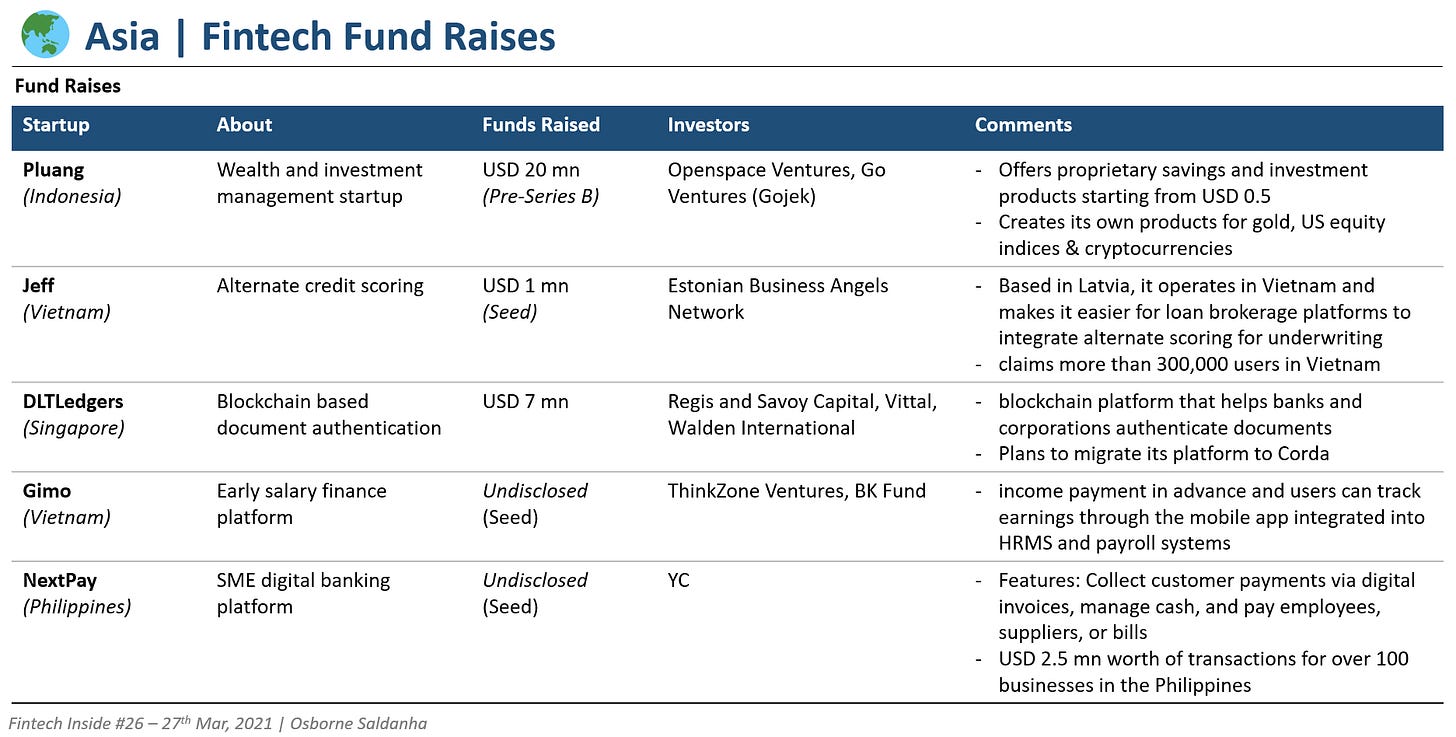

- FUND RAISES: Pluang (Indonesia, wealth mgmt.). Jeff (Vietnam, alternate credit scoring). DLTLeders (blockchain document authentication). Gimo (payday lending platform). NextPay (SME digital banking)

- ACQUISITIONS: Qoala acquired FairDee

👋🏾 That's all Folks

If you’ve made it this far - thanks! As always, you can always reach me at connect@osborne.vc. I’d genuinely appreciate any and all feedback. If you liked what you read, please consider sharing or subscribing.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

Found a broken link or incorrect information? Report it.

See you in the next edition.