Fintech Inside #18 - 30th Jan, 2021 | Personal Finance

Let's talk about Personal Finance! A Payments company launched a softPOS app. Some thoughts on the Gamestop short situation. RBI's Payments booklet and a Cryptocurrency Bill

Hi Insiders, Osborne here.

Welcome to the 18th edition of Fintech Inside. Fintech Inside is the front page of Fintech in emerging markets.

This week, in the "Big Thought" section I discuss a topic that's rarely discussed, lesser discussed outside Fintech circles. I urge you to read it and talk to people in your circles about this taboo topic.

Top 3 Fintech news: a payments company launched an app to convert NFC smartphones to POS devices. GameStop/WallStreetBets/Robinhood and its implications. RBI released a shiny report card on its achievements in Payment systems through 2010-2020.

Folks in India are you ready for Budget 2021? It's expected to be announced on Mon, 1st Feb, 2021. This is our super-bowl! (not)

It's fascinating to see the best and biggest challenger banks coming out of emerging markets as opposed to developed ones. Do read this breakdown of Russian challenger bank, Tinkoff's business. Also, Nubank, Brazil's challenger bank, raised USD 400 mn at a valuation of 25 bn!

In other news: VISA Global published their research on their role in Central Bank Digital Currencies. Turkey launched FAST - it's instant bank transfer system. For those who enjoy market maps, here's one on the crowded Indian Payments Market.

Anonymous Feedback: Your feedback helps me improve this newsletter. Appreciate your help in this less than a minute, anonymous feedback. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

🤔 One Big Thought

Let's talk about ̶S̶E̶X̶ Personal Finance

Not too long ago, a friend of mine tweeted this.

We don't talk about personal finance: Leave aside the fact that men are terrible at explaining investing to women, but we're all largely clueless about personal finance and don't even talk about it. Unfortunately, this situation is all too common and is not limited to women. Most men as well, especially those from non-finance backgrounds, don't understand investing, don't get a straight answer, don't know where to start and more importantly, don't know whom to trust in these matters.

Personal Finance is as much of a taboo topic as Sex, the repercussions of which are far worse. We are all familiar with the situation when one raises the topic of savings or personal finance or investing in our circles - people around us get jittery, wonder what's our agenda, or think why do they want to know about our salary or what do they want to sell to us.

High barrier to entry with a weak leg-up: Post that tweet, I tried asking around and realised that a majority of folks, especially those from non-finance backgrounds, have not invested for their future. Few do their basic budgeting but have no clue what to do with savings or where to start. And therein lies the biggest barrier to entry to personal finance - "Where do I begin?". The answer to this single question is obviously not straight-forward but the most common, dopamine-filled answer to that is "invest in stock markets". That statement, coupled with, "I got XX% return in the past year" is the most common and weakest leg-up to the "Where do I begin" entry barrier.

Are there startups addressing this problem? There are several startups targeting parts of this problem in various ways. It helps to look at the Personal Finance startups in three broad categories: 1. Expense Management/Budgeting apps 2. Wealth Management Apps 3. Consolidated Financial Apps. Obviously, the personal finance market is not limited to these categories but that's a much deeper topic for which I don't have space here.

There are several limitations to the model of each of these categories. Category 1: Expense/Budget management - limited to tracking expenses and budgeting, does not break the "where do I begin" barrier. Category 2: Wealth Management Apps - solves for distribution and execution of mutual funds and stocks, information overload, does not break the "where do I begin" barrier. Category 3: Consolidated financial apps - this gets closest to smashing the barrier. This 3rd category is limited by a SEBI (Indian securities regulator) regulation that does not permit a Registered Investment Advisor (RIA) from offering Advice and Distribution to the same customer. The customer has to choose only one of those services of the RIA. Advice is where most folks need help to shatter the barrier of "Where do I begin".

The reason that regulation is a limitation, is because us Indians do not pay for Advice. Take from us through high, hidden commissions but don't charge us upfront (/s). We'd rather get ill-informed advice from our uncles or friends. INDMoney is the only app, so far, that I've come across that has the best chance to break that barrier. With their free tier, a user can get a consolidated view of their finances and INDMoney has a subscription-based premium tier to access a wealth planner and a tax advisor. I love their app for the consolidated view of my assets, liabilities, expenses, planning, investing and so on. It's a super-comprehensive app. I wonder how many people are paying them subscriptions though - I'd assume its a very small % of overall users.

Through this newsletter, I urge you to speak to family or friends (especially those below 30 years) about their investing habits, help them gain control of their finances by connecting them to experts. Here's a handy list of fee-only investment advisors. Abhishek Aggarwal and a few folks launched Turtle Money Circle. You can and should also evaluate using startups, if not a registered financial advisor, solving for personal finance.

Founders, if you're reading this, as Charanjeev mentioned recently, get yourself a health and/or life insurance. It's the best, bare-minimum investment you can make.

Have something to share about personal finance? Are you a founder in this space? Keen to talk to you - email me here or schedule a meeting here.

3️⃣ Fintech Top Three

1️⃣ PineLabs launched an app to convert NFC smartphones to POS devices

PineLabs, an Indian payments platform that specialises in offline digital payments, launched an Android app - AllTap ePOS, that converts any NFC-enabled smartphone to a POS-device. With this app, any merchant can start accepting tap-and-pay card payments. Users can make payments starting INR 100 (USD 1.4) up to INR 5,000 (USD 67.6). It aims to onboard one million merchants in 2021.

Takeaway: Have said this before, and will say it again, PineLabs has really reinvented itself to stay relevant in 2020's payments race. It was not as innovative as it is today. That said, PineLabs probably sees a future in contact-less card payments, especially given global trends. This app helps reduce the upfront POS device cost for a merchant and updates also can be sent through app updates. Significantly improves the experience especially for smaller merchants.

The important points to note though are: This means that PineLabs is targeting smaller merchants and entering BharatPe's turf. There's also the learning-curve for a merchant to accept contactless payments using this app. Lastly, NFC-enabled smartphones are few and far between, cost of NFC phones are higher than regular ones. These points beg the question, is this a nice to have app for merchants?

2️⃣ Hedge funds were targeted by social media communities in US

WallStreetBets - a Reddit community, ganged up against Hedge Funds that shorted certain stocks, starting with GameStop's stock. This is being seen as a way for retail investors to stick it to the large hedge funds that get bailed out in times of crises. Individual investors of the Reddit community drove the stock price of GameStop up 6.22x from USD 64.85 on Fri, 22nd Jan-2021 to a peak of USD 468.49 on Thu, 28th Jan-2021 before settling at USD 197.44 on 29th Jan-2021.

Takeaway: If you've not understood or read anything about this episode, here's probably the simplest explainer I've found. Also, Zerodha's Nithin posted about shorting stocks, what it means from an Indian context and several other nuances. He explains in plain English what most of us otherwise wouldn't understand, so do read. Also, interestingly Citron Research announced that it would stop publishing short-selling research and will focus only on long investments.

I will not comment whether the actions of this community are right or wrong - there's possibly no right answer here. I don't completely buy into the argument that this is the best way to make the hedge funds pay. However, I do feel that this opens up the debate on social trading, copy trading and price manipulation. Our Indian exchanges are still very nascent and have safeguards against this sort of short squeezing but what happens if a trading community decides "let's ramp up the price of XXX stock"? It's technically price manipulation. Till what point will the regulation restrict this kind of activity? How will it restrict thousands of traders? Who's to bear this risk - platform or traders? I know the likelihood of this happening is low, but it's worth thinking about. At this point, Papa Musk is on his own Bitcoin trip.

3️⃣ Reserve Bank of India released a booklet Indian Payment Systems

The booklet (PDF - 142 pages) gives a detailed look at the various developments in Indian Payment Systems over 2010-2020. This booklet release is an RBI exercise every decade. The previous editions were released in 1998 and 2008.

Takeaways: This booklet is RBI's very shiny report card on its own achievements over the past decade. Obviously, the booklet details the various digital initiatives to make payment systems accessible, transparent and affordable. It's digital achievements truly put India leagues ahead of other countries in this regard.

The three most notable things in this booklet are: 1) RBI is evaluating the viability of a Digital Rupee - Central Bank Digital Currency (Interesting!) 2) RBI has written to other countries' central banks to promote UPI and RuPay and to increase its acceptance globally (why not!) 3) Zero mention of the Payments Bank's developments (curious!). I'm personally very excited about the future of digital payments in India. There's still problems to solve in offline payments acceptance.

🎁 BONUS: Indian government likely to introduce Cryptocurrency and Regulation of Digital Currencies Bill in India

Late Friday (29th Jan, 2021) evening there was news that the government will likely introduce a Cryptocurrency bill to pass in the budget session of the Parliament. The bill - Cryptocurrency and Regulation of Digital Currencies Bill, plans to prohibit all private cryptocurrencies except the official digital currency issued by RBI. The bill plans to make some additional exceptions to "promote the underlying technology of cryptocurrency and its uses".

🇮🇳 India

📰 Market Updates:

- FINTECH's: ZestMoney* claims to have 68% users outside Tier 1 cities and presence in 15,000 offline stores. RedSeer released a report estimating 244 mn online transactors and 140 mn shoppers in India. IndiaGold claimed to have 330K Total Active Users (66% organic) and hit #5 rank on the Google Play Store.

Rupeek's android app was taken down from the Google App Store for a few hours. Google updated its Play Store policy for real money apps, fantasy sports and others - India not included. WhatsApp clarified that Facebook doesn't have access to UPI transaction data.

- TRADITIONAL BANKING: General insurers see premiums rise 10% in Q3FY20. Nandan Nilekani says that NPCI is building an Open Source platform for UPI. New industry body - Atmanirbhar Digital India Foundation, wrote to India's Prime Minister to ban WhatsApp Pay for privacy violations.

SMB's in the auto sector accounted for 91% of loans disbursed during Covid. Aadhar Housing Finance filed for India IPO. India's Axis Bank says that it will classify NPA's at a borrower level, not a facility level as per RBI guidelines. India's gold demand was down 35% to 446.4 tonne in 2020.

📝 Regulatory Updates:

- RBI (Central Bank): Exploring the possibility of a Digital Rupee.

- SEBI (Securities): Banned three companies for providing unauthorised investment advisory services

🚀 Product Launches:

- FINTECH's: PineLabs launched a SoftPOS platform converting android smartphones to POS devices.

💰 Funding Announcements:

Read the funding announcements: Junio (teen banking). GrowFix (alternate investments).

🌏 Asia

📰 Market Updates:

StashAway (Singapore) claims to have reached AuM of USD 1 bn. Indonesia's Stock Exchange added new industrial classification including technology to lure investors.

Ovo, Indonesian e-Wallet unicorn, partnered with Bareksa, mutual fund platform, to launch investing platform starting from USD 1. Ovo also launched instant-redemption mutual fund offering through Manulife partnership.

Thailand's banks posted lowest net profit in 10 years due to pandemic. Alipay, JD Digits, Didi Finance pull out all bank deposit products days after new regulation in China.

💰 Funding Announcements:

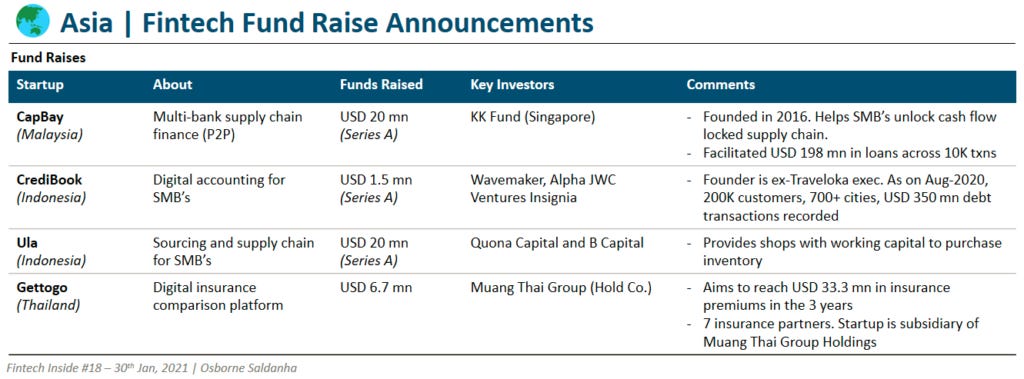

Read all the funding announcements: CapBay (Malaysia). CrediBook (Indonesia). Ula (Indonesia). Gettgo (Thailand).

🇪🇺 Europe

📰 Market Updates:

Ireland's competition commission rejected a plan by four of the country's biggest banks to create a joint payments app. Trustly, Swedish payments firm, is planning an IPO at EUR 9 bn valuation. Mastercard will increase fees on payments from UK purchases in EU.

VISA joined Zone2boost, an startup program (EUR 3 mn fund) created by Caixa Bank (Spain), Global Payments and Worldline. N26, German challenger bank, plans to launch IPO with new CFO hire. BNP Paribas to charge EUR 24 a year for biometric card.

Dozens, UK challenger bank, partnered with Bud to let customers access services without fully signing up.

🚀 Product Launches:

- FINTECH's: PayU partnered with Twisto to launch deferred payments in Poland. TrueLayer, UK Open Banking API provider launched its first payments product.

Mooncard, French corporate payment startup, partnered with Flying Blue to offer Air France miles - first miles reward platform that is not American Express. VISA and TransferWise announced a global partnership and the first use of Visa Cloud Connect.

EverUp, UK-based savings app offering tax-free cash prizes, launched in beta.

- TRADITIONAL BANKING: Citi launched an algorithmic trading platform for listed derivatives. Mastercard debuted its enhanced contactless payment technology.

💰 Funding Announcements:

Remagine (Germany). Kevin. (Lithuania). Alma (France). Nomo (Spain). Token (England). Scalapay (Ireland). INZMO (Germany).

👋🏾 That's all Folks

If you’ve made it this far - thanks! As always, you can always reach me at connect@osborne.vc. I’d genuinely appreciate any and all feedback. If you liked what you read, please consider sharing or subscribing.

Found a broken link or incorrect information? Report it.

See you in the next edition.

* - represents a portfolio company of my current employer

wondering if we could include insurance in the personal finance landscape in India when it is managing maybe Rs 50 trillion of Indian savings/investments!