Fintech Inside #16 - 16th Jan, 2021 | Digital Instant Loan Apps

India's instant loan problem, a global retail co. partnered with a Fintech VC, market manipulation and credit card aggregation. Fintech's this week raised USD ~2 bn! Read all about it!

Hi Insiders,

Welcome to the sixteenth edition of Fintech Inside. Fintech Inside is the front page of Fintech in emerging markets.

This week I discuss the the instant loan app situation in India. There's also coverage on a global retail co. partnering with a Fintech VC, market manipulation and credit card aggregation.

This past week was probably the craziest yet for funding: 9 SEA Fintechs raised USD ~470 mn (USD 300 mn was announced by Grab) and 11 European Fintechs raised USD 1.3 bn (USD 545 mn was announced by Checkout.com). We're only in the third week of Jan!

In other news: VISA opened up their accelerator program for SEA - apply here. Here's an Ecommerce Payment Trends in SEA. Some kind soul compared the features of global neo banks. And Affirm's IPO was a huge success.

Request: If you're subscribed but do not find this newsletter helpful, please clear the clutter and unsubscribe. I'd rather have a smaller, more engaged reader-base. No love lost. ✌🏽

Feedback: Your feedback helps me improve this newsletter. Appreciate your help in this less than a minute, anonymous feedback. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

🤔 One Big Thought

The Instant Loan App Problem Plaguing India

What's an Instant Loan Platform? There are several hundred digital, instant loan apps in the wild. Each of these have been vying to lend to the Indian consumer since 2016/2017 with the promise of short term, small-ticket, digital KYC and instant disbursal. Now, these loan apps operate via 3 main models - own Balance Sheet (full risk to lender), First Loss Default Guarantee (partial risk to lender) and Marketplace (no risk to lender). The only model that's regulated by India's central bank is the own Balance Sheet model where the entity is required to have an NBFC license with minimum capital of INR 20 mn (USD 270K). Most digital instant loan apps have a marketplace model, some have a FLDG model and even fewer have their own NBFC to lend off their own balance sheet.

So what's the situation and why is it happening? The situation is that borrowers are being harassed to repay their delayed outstanding loans. Some borrowers even took their own lives. A few, unregulated loan apps have been using forceful methods to collect outstanding loan amounts. Media reports claimed that 60-70+ apps operated by Chinese individuals/companies which operated under the marketplace model (unregulated) are to blame for these. It's also said that these loan apps applied prohibitively high interest rates and unnecessary fees making the repayment very tough for borrowers. Because of low principal amount, borrowers borrowed from several platforms - some borrowed from 72 loan apps! Further, most of these apps are unregulated and hence are not required to comply with any RBI mandates. It's worth noting that these apps would have had some regulated lenders provide them with capital for further on-lending, did these regulated entities do any diligence on these platforms? This has made it difficult for the legit lenders.

Who bears the onus and what's being done about it? I wish this answer was simple. It seems the reported app platforms that were unregulated have shut and are not lending. All the genuine lenders are on tenterhooks. India's RBI went into overdrive and has been working with legit Founders to ensure strict compliance. In Jun-2020, RBI mandated that these loan platforms clearly disclose the NBFC/Bank through which a borrower is getting a loan. In Dec-2020, RBI also released an unusual caution to borrowers regarding borrowing from unauthorised digital loan platforms. In Jan-2021, RBI constituted a Working Group to put in place an appropriate regulatory framework for regulated and unregulated digital lenders. Aside from RBI, Google's PlayStore at it's end made all app providers to provide some proof/evidence of being authorised lenders. On 14th Jan, 2021 some 30+ unauthorised lending apps were removed from the PlayStore. Then we have self-regulated, Fintech lenders' associations - Digital Lenders Association of India (DLAI) and Fintech Association for Consumer Empowerment (FACE) who are doing their own fire-fighting.

Where do we go from here? India is still credit-hungry. Those that have been running a structurally strong business will only get fortified from here on. Consumer education will be paramount. It will be interesting to see what RBI's Working Group comes up with in its recommendation. I'm hoping (and so is Sandeep, Founder of Red Carpet) for RBI to bring about some regulation for Loan Service Providers (those that operate the FLDG, marketplace or other models). However, I'm also hoping that this incident doesn't bring too much regulation that it limits the potential to innovate and grow genuine businesses. Also, obviously rooting for humane collection startups.

Keen to discuss this story in the digital lending sector? please email me here or schedule a meeting here.

💼 Fintech's Hiring

IndiaGold, a gold monetisation platform, is hiring for several engineering positions. Apply here or share with your network.

Plum, a corporate health insurance platform, is hiring for several engineering and design positions. Apply here or share with your network.

If you’re a Fintech who’s hiring I’d like to help. Write to me and I’ll put your requirement here.

3️⃣ Fintech Top Three

1️⃣ Walmart partnered with Ribbit Capital to launch a Fintech company

Walmart, US announced that it was partnering with Fintech VC Fund - Ribbit Capital to launch a Fintech company. The partnership hopes to "bring together Walmart’s retail knowledge and scale with Ribbit’s FinTech expertise to deliver tech-driven financial experiences tailored to Walmart’s customers and associates."

Takeaway: While this announcement was met with a lot of excitement, unfortunately, there's very little detail on the actual strategy. At first I thought Walmart will give Ribbit Capital's portfolio, access to Walmart's global ecosystem - customers and vendors. But the press release doesn't say so.

To me, this seems like a very audacious and mutually beneficial partnership. I'm hoping this boldness is replicated by several other non-financial services conglomerates. Fintech, by its very nature, crosses over across industries and cannot be looked at in isolation.

2️⃣ India's securities regulator banned host of stock-based TV show

SEBI, India's securities regulator, banned Hemant Ghai, host of CNBC Awaz show Stocks 20-20. The regulator has banned Hemant, his wife and his mother from the securities market, directed him to refrain from giving investment advice and impounded INR 29.5 mn (USD 400K) profit made from fraudulent transactions. Apparently, Hemant, through his wife or mother, would buy a stock on a day, recommend the same stock on his show the next morning and sell the stock later on the day of recommendation.

Takeaway: This is a first for India's securities market (at least AFAIK) and I would think the regulator views this as market manipulation. This then obviously raises the question of stock games, stock portfolio copying or even "influencers" in the stock market. Is it allowed? It will take a lot to convince the regulator that this can be done in a regulated manner.

I don't know a lot on this topic and so here's a link to Zerodha's post addressing it. Basically, regulation doesn't allow it and anyone worth their salt will not risk their brand/reputation on these grey areas. Pravin Jadhav puts it succinctly here:

3️⃣ London-based Curve raised USD 95 mn, Expands to US

Curve, a fintech that combines multiple cards and accounts into one smart card and an app, raised USD 95 mn from by IDC Ventures, Fuel Venture Capital and Vulcan Capital, the investment house of late Microsoft co-founder Paul Allen. The company has raised a total of USD 169 mn (per Crunchbase) and has 2 mn registered users.

Takeaway: I've highlighted this company because several Indian startups are building exactly this solution and are in early stages. Unfortunately, one even shut down in 2020. While I love this concept and I will be a user, I feel it will be an uphill task to be successful in India. Credit card penetration in India is low, debit card is a little more widely used. The number folks that have both and know how to use them is small. Sure, spends of this limited base is very high.

Then obviously there's the challenge of actually executing this unless you have a large user base of credit card users (👀 CRED). There are several entities that need to come together - issuer, network, payment switches etc. The platforms need to tokenise the cards to enable aggregation and payments - banks aren't ready here yet. Pricing in payments is as it is low, these platforms would earn less than 10 basis points on transaction volumes, which then requires billions in throughput. I'm keen to see how this innovation gets executed in India.

🇮🇳 India

📰 Market Updates:

- FITNECH's: Practo, healthcare startup, is expected to launch financial services products. VISA proposed common protocol for offline payments. PwC released a report on Indian payments, expects payments volume to rise to USD 3.2 Tn by 2025.

DOTPe, a payments co., is expected to raise USD 25 mn from PayU. Drip Capital, Y-Combinator backed small business lender, claims to have disbursed USD 1 bn in trade finance.

Paytm expects to turn profitable in 2021, is raising USD 400 mn from UBS. Paytm Money raised USD 68 mn from parent co., expects to turn profitable in 18 months.

- TRADITIONAL BANKING: Axis Bank removed penalty on premature close of term deposits. India's Insolvency and Bankruptcy Code (IBC) resolutions took average 433 days.

📝 Regulatory Updates:

- RBI (central bank): Canceled the license of a regional bank, 99% depositors to get back deposits. Expects Bank NPA to rise to 13.5% by Sept-2021. Told a high court that NPCI is responsible for Tech Giants' compliance with UPI rules. Imposed penalty of USD 270K on Deutsche Bank AG.

- SEBI (securities): Banned news anchor from securities market for Buy-Today-Sell-Tomorrow trades.

🚀 Product Launches:

- FINTECH's: Paytm Money launched F&O Trading. Paytm is testing its chat-based payments feature (again). CreditVidya partnered with TrueCaller to launch embedded loans for small businesses.

- TRADITIONAL BANKING: IDFC Bank launched an invite-only credit card with 9% interest p.a. YES Bank launched wellness-themed credit cards.

💰 Funding Announcements:

- FUND RAISE: CoinSwitch Kuber. Samunnati. Siply. Digit Insurance.

- ACQUISITIONS: TechMahindra + Payment Tech Sol. WishFin + Ladders

🌏 South East Asia

📰 Market Updates:

Pintek, education finance platform, raised USD 21 mn debt. PayPal becomes first foreign firm in China with full ownership of its payment entity. Report on SEA's Fintech sector and investments.

🚀 Product Launches:

Pakistan's central bank launched its instant bank-to-bank payment platform - Raast in collaboration with the Gates Foundation. China's Agriculture Bank equipped its ATM's to accept deposits and withdrawal of the country's digital currency.

Standard Chartered Bank formed a strategic partnership with Bukalapak for digital banking. Nium and Cebuana Lhuillier launched a mobile remittance app in Singapore. Ripple launched wallet-to-wallet remittance between Malaysia (Mobile Money) and Bangladesh (bKash). Be Group, Vietnamese ride-hailing co., partnered with VP Bank to launch a digital bank - Cake.

💰 Funding Announcements:

- FUND RAISE: Grab (Singapore). MoMo (Vietnam). Ajaib (Indonesia). Alami (Indonesia). BukuKas (Indonesia). Zipmex (Singapore). MicroSec (Singapore). MicroLeap (Malaysia).

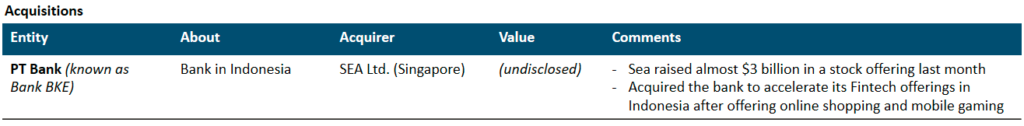

- ACQUISITION: SEA + Indonesian Bank.

🇪🇺 Europe

📰 Market Updates:

Revolut, UK-based neobank applied for a banking license.

🚀 Product Launches:

Mastercard launched cloud-POS platform with NMI and Global Payments. Four of Ireland's largest banks partnered to launch a multi-bank payments app. Moven added cryptocurrency features in its Bank-in-a-Box SaaS platform.

Birmingham Bank launched in UK for SMB's after acquisition of Bira Bank. NALA, a Tanzanian fintech co., launched its money transfer app in UK.

💰 Funding Announcements:

- FUND RAISE: Checkout.com (UK). Rapyd (UK). Carne Group (Ireland). Curve (UK). Clark (Germany). b.Fine (Belgium). Biconomy (UK). Jedox (Germany). Minna (Sweden). Quantile (UK). Sweep (UK).

👋🏾 That's all Folks

If you’ve made it this far - thanks! As always, you can always reach me at connect@osborne.vc. I’d genuinely appreciate any and all feedback. If you liked what you read, please consider sharing or subscribing.

See you in the next edition.