Fintech Inside #15 - 09th Jan, 2021 | Fintech in 2021

Happy New Year, you! What excites you about Fintech in 2021? Also, the latest on CRED, a patent filing and a data breach. Those and more in this first edition of 2021!

Hi Insiders,

Welcome to the fifteenth edition of Fintech Inside. Fintech Inside is the front page of Fintech in emerging markets.

Happy New Year, you! Hope you had a relaxed start to the new year. I wish you more success this year than you've plan for.

This first week of the year saw some big hits in terms of funding, product launches, partnerships and more - especially in Asia. Europe doesn’t seem to be back from the holiday’s. You'll get all the comprehensive coverage in this edition.

This edition’s Big Thought covers Fintech developments I'm excited about in 2021. Fintech Top 3: 1. CRED provided its employees with liquidity through ESOP buyback. 2. A small business lender patented its underwriting algorithm. 3. There was a data breachat a payments company that caught RBI's attention.

In other news, I'd recommend you read this profile on the man who turned credit-card points into an empire (h/t Sandeep). And, RBI added a "Fintech" menu item for direct access to policies and updates.

Feedback: Your feedback helps me improve this newsletter. Appreciate your help in this less than a minute feedback. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

Back to regular programming…

🤔 One Big Thought

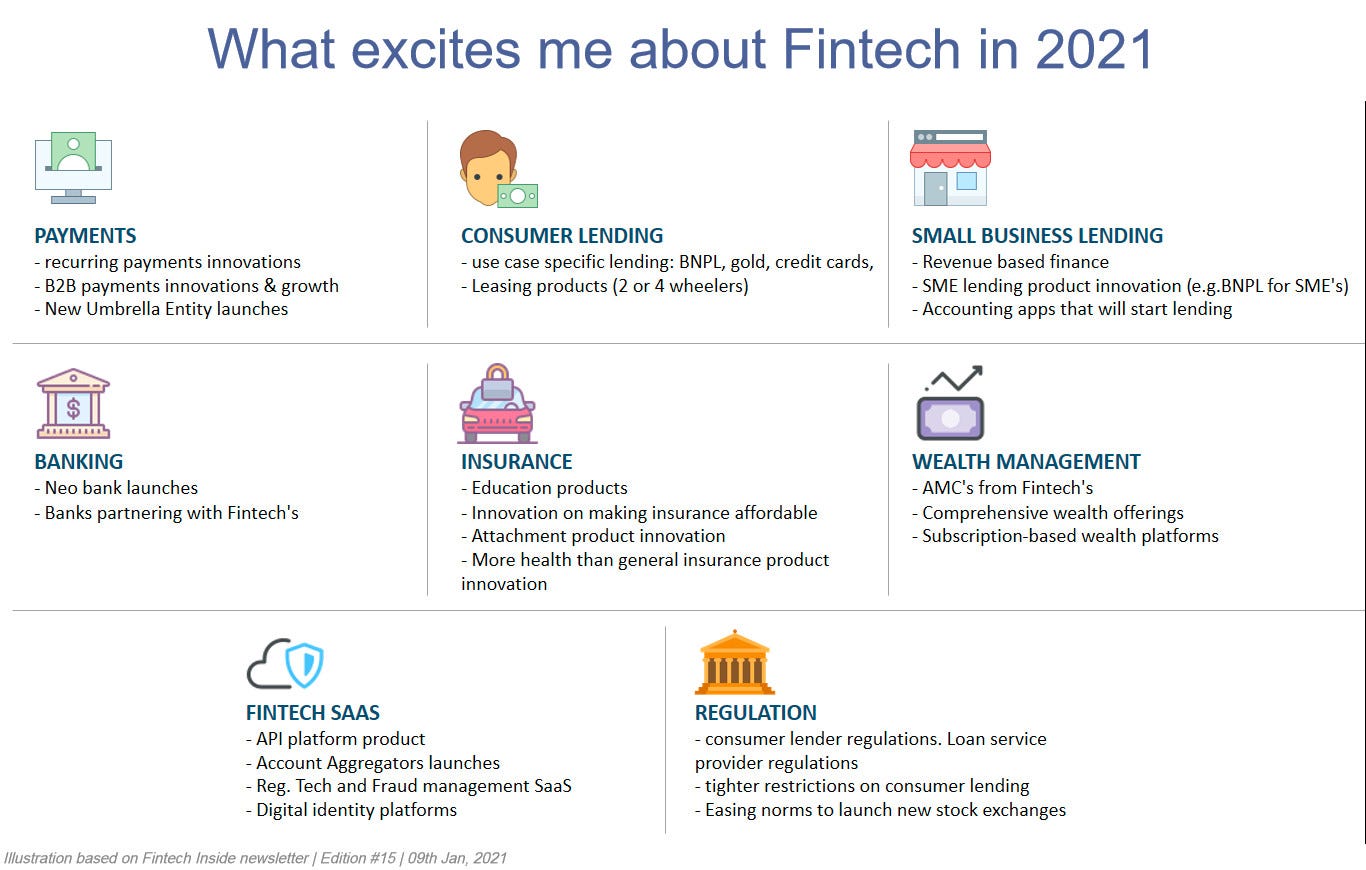

What excites me about Fintech in 2021? (India)

Back in 2014-2016 there was a Fintech wave in payments and wealth tech. This wave got people to trust digital modes and grew distribution capabilities. IMO, that Fintech wave will pale by comparison to the wave we're about to witness this decade in Fintech. 2021 will be just the start of that wave and there's a lot to be excited for Fintech. 2021 will be the year we may see true fintech product innovation.

This post is not a prediction for 2021 neither is it about startup investment areas that I'm keen on. This post is merely a reading of past events from 2019-2020 and what I'm excited for in 2021. If you'd like to add to this list or discuss this post please email me here or schedule a meeting here.

Payments: Looking back, in 2020 WhatsApp Pay launched, several payments cos. raised significant funding, Razorpay became a unicorn, there were rumours of new umbrella entities for payments, RBI launched its payments sandbox and more. 2021 will be the year when the action begins in payments. There's still much to be done for B2B digital payments acceptance - which VC's seem to be ignoring. I'm also keen to see the various product innovations for recurring payments - this has never been done before.

Consumer Lending: 2020 was a tough year for consumer lenders. But I suspect they will come back with a bang in 2021. India is still massively credit starved. I suspect there will further refining in the products and distribution. I feel there will be increased use-case specific lending (think buy now pay later) and customer segment-specific lending. I'm also excited for credit cards to make a comeback this year - a couple of startups were funded in 2020. I feel consumer leasing for automotive might see some traction.

Small business lending: SME Lending is the ignored sector in Fintech. 2020 again was very edgy for SME lenders. To regain lost growth, SME lenders will up the ante and really scale. BharatPe will start lending in a big way. The accounting apps might start lending to generate some revenue. I also suspect we will see some serious product innovation - it's already started with the launch of revenue-based finance startups. But I can assure you there is a lot more product innovation to be seen here. There will also be deeper penetration to cover a wider network of small business categories.

Banking: I mean, is there anything else left to be said about neo banks launching? Will 2021 be their year? I hope so. I'm also really excited to see banks partnering more with startups in 2021.

Insurance: There's SO MUCH innovation that we need in Insurance. This regulator has been a laggard, IMO. But there's no stopping Fintech's from innovating here. I suspect we'll see more innovation on "educating the consumer" and then some innovation on the insurance product itself. There's virtually nothing that can be done in life insurance but we'll mostly see product innovation in health and general insurance. Health might see more traction as general insurance is anyway a tougher sell. "Attachment products" might see some uptake but will be limited.

Wealth management: Fintech's (except you, Zerodha!) in this sector need to be more public about what their building. 2020 was probably the best year for wealth management firms. But other than announcements of them launching stock-broking there were only crickets. Aside from this, I'm hoping there will be a day when wealth Fintech's can make money through subscriptions. INDMoney is one that I've seen do this, but I don't suspect others will follow suit in 2021. Given that SEBI has relaxed norms to launch an AMC, I'm excited to see what Fintech's will do here.

Fintech SaaS: This is the most exciting segment to me that's been largely ignored because we're yet to see how large Fintech's here can become. API platform's are only starting to make their presence felt and they're only going to more more powerful in 2021 as banks start opening up their core banking platforms. Account Aggregators will also see their first launches. Compliance SaaS and fraud management SaaS is going to be in increasing demand. Banks will likely go to international platforms for this, however. Digital Identity as well will see some serious demand. Keeping up with KYC norms is cumbersome and ever changing.

Regulation: I love RBI (Central Bank), like SEBI (Securities regulator) and yet to feel anything for IRDAI (Insurance regulator). I suspect RBI to be even more proactive in 2021 towards regulating payments cos., banks and lenders. I feel we may see some Loan Service Provider (LSP) regulations to regulate all lending entities, even those that don't lend on their balance sheet (FLDG's/marketplaces). RBI will keep a close eye on the launch of neo banks to evaluate how to regulate them. There will be stricter norms around consumer lending and recoveries. I'm also most excited to see what SEBI does with relaxed norms to launch stock exchanges.

What excited you about Fintech in 2021? What do you hope Fintech's launch in 2021? Share your thoughts in the comments or email me here or schedule a meeting here.

💼 Fintech's Hiring

Atlantis, Indian neo bank, is hiring a Head of Product Marketing and Growth. You can apply via email at mycareer@atlantistech.co

ZestMoney*, Indian buy now pay later platform, is hiring for several engineering positions. Here are their open positions

If you’re a Fintech who’s hiring I’d like to help. Write to me and I’ll put your requirement here.

3️⃣ Fintech Top Three

1️⃣ CRED raised USD 81 mn and bought back ESOP worth USD 1.2 mn

CRED, the Indian rewards platform for high credit-worthy individuals, raised USD 81 mn at a valuation of USD 806 mn. It also announced that it provided liquidity to its employees by buying back USD 1.2 mn of ESOP's. It is worth noting that CRED is only a two year old startup.

Takeaway: What fascinated me about the funding announcement was that the funding didn't make waves. The news of the share buy back was a bigger news of the day. That's exactly how it should be. May your tribe grow. More startups should provide that liquidity to early employees sooner. It will really help attract the best talent to work at startups.

If you're a person working at or considering working at an early stage startup - make sure you ask for an ESOP package. Learn all you have to about ESOPs and be curious about the mechanics of ESOPs. If you're a founder, offer equity to early employees, support those who believed in you early on. Here's a very detailed guide on ESOPs and its mechanics (h/t Ulhas). I highly recommend folks in the startup ecosystem to learn about ESOP, benefits, mechanics and taxation.

2️⃣ U Gro Capital filed a patent for its small business underwriting algorithm

In a first for Indian Fintech, small business lender U Gro Capital has filed a patent with the Indian patent office for its underwriting algorithm. The patent covers U Gro's score card-based underwriting model to disburse loans to small businesses.

Takeaway: This is definitely the first for the small business lending sector but its worth noting that this is just an application, not a patent granted. You can learn more about U Gro's risk score underwriting model from this podcast. Another Fintech, CreditVidya, an Indian AI-based consumer underwriting platform, recevied a patent from the US patent office. CreditVidya's patent is for its NLP and AI-based Unstructured Data Processing Framework called “FeatGen”.

I'm generally not one for patents and while I understand the business case for it, I'm not sure what U Gro can protect from with this patent filing. I mean, I'm not sure what's entirely unique about its “sector-focussed, score-based underwriting model”. Several small business lenders have been underwriting in this fashion for a while. Lastly, how will U Gro enforce its patents?

3️⃣ Data breach at Juspay has caught the attention of RBI

Indian payments platform Juspay suffered a data breach in August, 2020 which was only brought to light this week after the data was found on the dark web. The company claimed that only 35 mn records with masked card data and card fingerprint were breached. Juspay facilitates payment of several large ecommerce platforms in India including Amazon, Swiggy, Ola and others.

Takeaway: This is a big deal - even if only non-sensitive data was breached. It's a big deal because 1. Juspay didn't already disclose this leak by itself and only acknowledged it after data was found on the dark web. 2. Just when RBI was beginning to have some trust in payment cos., this happened, despite Juspay being PCI-DSS certified. RBI taking notice of this will bring further stability and structure but will also bring additional scrutiny on Fintech's and could potentially delay other licensing processes.

More importantly, this event has accelerated the need for SaaS products that manage compliance, fraud detection and cyber security. It's imperative to realise that we should focus on building our core platform and integrate with expert platforms, especially on matters as this that are non core.

🇮🇳 India

📰 Market Updates:

- FINTECH's: Digital Instant Loan Apps under the scanner of India's Enforcement Directorate for fraud, coercion and more. UPI volume up 70% YoY. BharatPe is likely to raise USD 200 mn in fresh funds. Amazon Pay India reported total revenue of USD 185 mn (+64% YoY) and loss of USD 252 mn in FY 2020.

- TRADITIONAL BANK’s: Banks claim to have passed on half of RBI rate cut to borrowers. ICICI Bank banking platforms were down on for a day. Fintech Consumer Empowerment, a self-regulatory association, issued Ethical Code for lending.

Kotak Securities launched platform to support Fintechs. Bombay Stock Exchange (BSE) listed companies market cap crossed USD 2.6 Tn.

📝 Regulatory Updates:

- RBI (Central Bank): Introduced Digital Payments Index. Invited candidates to apply for Head of Innovation Hub. Fined Bajaj Finance for coercive loan recoveries. Approved raising FDI in Airtel Payment Bank to 74%. Instructed Banks to align audit function with international best practices.

- SEBI (securities): Proposed easing norms to set up more stock exchanges.

🚀 Product Launches:

- FINTECH's: Paytm launched marketplace for instant personal loans. PhonePe partnered with ICICI Life Insurance to launch life insurance products.

- TRADITIONAL BANKING: ICICI Lombard launched a micro-site for small businesses. Bank of Baroda launched WhatsApp Banking. Axis Bank partnered with Hyundai for digital financial products.

💰 Funding Announcements:

Udaan - B2B commerce and finance (USD 280 mn). CRED - rewards platform credit-worthy individuals (USD 81 mn). Phi Commerce - digital paymentsacceptance (USD 4 mn). Zerone - cloud-based softPOS (USD 1.3 mn). Finsall - insurance financing (USD 330K)

🌏 Asia

📰 Market Updates:

E-wallet transaction volume in Philippines rose 25% post-covid. YouTrip, Singaporean multi-currency wallet, signed a 6-year partnership with VISA. China's Alibaba has planned a USD 5 bn bond sale amid regulatory scrutiny.

Chinese bourses raised USD 119 bn in IPO's in 2020. Singapore's GoBear, financial product comparison, shut down due to Covid. Singapore's DBS Bank launched in house technical training for all staff. Myanmar's Wave Money doubled its payments volume to USD 8.7 bn in 2020.

📝 Regulatory Updates:

Donald Trump banned 8 Chinese apps including Alipay and Wechat Pay. Singapore's MAS announced successful first phase of Veritas - its ethical credit assessment platform.

🚀 Product Launches:

Thailand's Agoda launched buy now pay later with Atome. HSBC launched transaction fraud protection with Silent Eight. Neat, Hong Kong small business Fintech, launched a VISA card program. Pakistan's TAG partnered with i2c to launch a financial super app.

Singapore's wealth mgmt. platform Syfe launched cash management features. Singapore's Grab partnered with Citi Bank to launch personal loans via Grab App. Filippino Boxer Manny Pacquiao to launch payments platform PacPay.

💰 Funding Announcements:

Mynt - Philippines, Fintech arm of Globe telco. (USD 175 mn). BC Group - Hong Kong, crypto exchange (USD 90 mn). Bibit - Indonesia, wealth management (USD 30 mn) Finja - Pakistan, small business SaaS (USD 9 mn).

🇪🇺 Europe

📰 Market Updates:

Banks in UK ask the regulator to increase limit on contactless payments to GBP 100 from GBP 45. SamsungPay will no longer give rewards for payments in 2021. European P2P lender, Robo.cash has crossed EUR 200 mn in cumulative disbursements.

Spain's BBVA is shutting down its US neo bank Simple. UK's FCA says that up to 4,000 UK financial services firms at risk due to Covid.

📝 Regulatory Updates:

UK's HMRC (tax department) announced its largest ever fine of GBP 24 mn to MT Global, a money transfer business. UK Central Bank's Fintech Review suggests new visa and list rule change.

🚀 Product Launches:

UK's VibePay launched a business account dashboard powered by open banking.

💰 Funding Announcements:

- FUNDING: Mambu - German, core banking SaaS (USD 135 mn). Pennylane - France, accounting SaaS (USD 18 mn). TagPay - France, core banking SaaS (EUR 25 mn). Norwegian Block Exchange (NBX) - Norway, crypto exchange (USD 7.2 mn). Conio - Italy, crypto exchange (USD 14 mn)

- ACQUISITION: France's Orange Bank acquired neo bank Anytime. Finland's Paytrail to acquire Checkout Finland.

👋🏾 That's all Folks

If you’ve made it this far - you da real MVP! As always, you can always reach me at connect@osborne.vc. I’d genuinely appreciate any and all feedback. If you liked what you read, please consider sharing or subscribing.

Found a broken link or incorrect information? Report it.

See you in the next edition.

* - represents a portfolio company of my current employer.