DeFi Investing | Fintech Inside Edition #52 - 30th Jan, 2022

Covering the enigmatic and fluid world of DeFi along with details on fintech funds raised, SEA regulators and El Salvador

gm Insiders, Osborne here.

Welcome to the 52nd edition of Fintech Inside. Fintech Inside is the front page of Fintech in emerging markets.

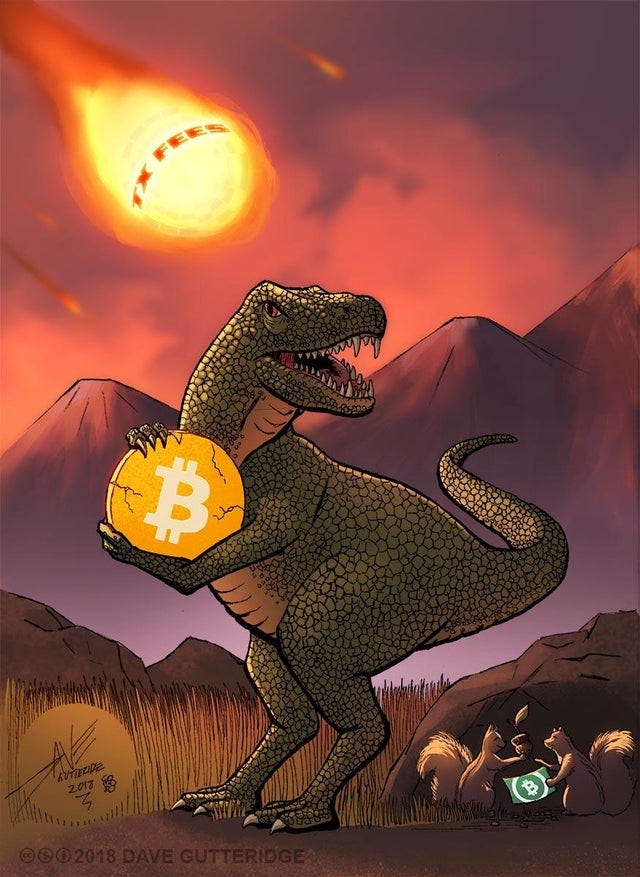

Recently, I was made to feel like a dinosaur for being in the fintech sector, so today's edition is my attempt at not being alone in that feeling. Today's edition covers the enigmatic and fluid DeFi sector. DeFi encompasses everything finance, so today I focused only on the investing side of DeFi.

There's also details on SMB, credit and wealth startups in India announcing fund raises, South East Asian regulators and El Salvador.

Enjoy another week in fintech.

If you’re an early-stage fintech startup founder raising equity, I may be able to help - reach out to connect@osborne.vc

🤔 One Big Thought

DeFi 101 | Investing

Today's post is written with help from Pillow - a crypto investing startup. You'll find a nice surprise at the end of this post. This is not a sponsored post and neither am I nor EMVC an investor in Pillow.

Fintech has been a fast growing sector for as long as I can remember. I've been investing in fintech startups for a long time now and I still feel that fintech startups have barely scratched the surface of the larger financial services industry. Then came along this 18-year old founder in the crypto space, who was talking to me about DeFi and towards the end of the conversation called me a TradFi guy. TradFi, for almost everyone reading this, is Traditional Finance. Yes, TradFi includes those of us building in Fintech as well. I've never felt so outdated, while being in a sector I thought was at the bleeding edge.

Hi, fellow dinosaurs, join me in this quest of learning more about DeFi. There are a lot of pieces to cover about DeFi but for this Edition, I will only be covering DeFi investing, or ways in DeFi to generate a return on your investment.

Disclaimers:

Fintech Inside is only meant for entertainment purposes and any content here should not be construed as education or investing advice. Please do your own research before investing in what you read in a newsletter.

This is a very high level, non-exhaustive, 101-style post. If you know your DeFi, this post is probably not for you. But I urge you to poke holes in it and let me know what I got wrong.

Yes, there's been a lot of editions about crypto recently. Will be covering a lot of it in the weeks to come. This is a complex, nuanced topic which I'm learning about, myself and hopefully helping you make sense of as well.

What is DeFi? DeFi is short for Decentralised Finance. It's a financial sector reimagined, designed and built on blockchain technology. IMO, Blockchain technology is a system where there is no concentration of trust, trust (consensus mechanisms) is converted to a mathematical and computational construct. Our current TradFi systems place a lot of trust in institutions - central banks, banks, financial firms and more. DeFi aims to not have any of those centralised dependencies. DeFi is that promise of building new financial systems, inspired by the existing ones, but without the inefficiencies, exclusion, opacity and centralisation.

How big is DeFi? DeFi is still a drop in the financial ocean. But…

There are ~200-300mm crypto users globally. Of these, only ~4mm unique addresses have ever used a DeFi protocol. That's a sub-2% penetration.

As of end Jan-2022, a total 150 DeFi apps held $107bn in user funds, $30bn down from the start of 2022. In the past week, nearly $300mm was liquidated from these apps.

These numbers tell you that DeFi is still in its early stages but there's a lot of traction with real billions of dollars being managed by these startups and projects.

Get to the good part already, how do I make money in DeFi? Hold your dinosaur paws! First, let's understand the ways to invest. There are several products you can invest in DeFi and start making a return. These products go from simple to very complex very quickly. They have the same concepts of TradFi e.g. P2P lending, mutual funds, derivatives, options, futures and more but the fudamental blocks of building the products are drastically different. For the purpose of this post, I'm not going to cover how these products function under the hood because honestly, I don't understand it yet.

The few DeFi product types where you can earn a return are:

Crypto Portfolios: This is a mutual fund/smallcase style basket investing. You can create your own basket and invest or you can invest in existing thematic baskets. These platforms automatically analyse your strategy and build your portfolios and trades on your behalf. Mudrex, an Indian startup, enables this style of investing.

Lending to Institutional Borrowers: As an individual investor, you can lend to an institution or another individual even with smaller sums. Startups that facilitate this, typically pool funds from many investors and lend to individuals against crypto collaterals or companies like Coinbase that use the funds for their trading businesses. There are many startups/protocols/projects that facilitate this. These loans are short term ones with attractive interest rates. You can access this avenue through platforms like Aave, Compound, Markets.xyz and more.

Staking: As you've read above, blockchains replace centralised trust based structures. There are several methods in blockchain to replace this trust - here's a simple explainer on all those methods (consensus mechanisms) by venture fund Eximius. Staking is one such method where block validator locks in their coins to gain the right to validate transactions. As a reward, the validator gains coins. Staking also thus provides a return. Ethereum, in its second version, popularised this method and is a popular smart contract, layer one protocol. This topic can get complex real quick and there's a lot of detail I didn't mention. There are too many platforms that facilitate investing and getting a return by staking.

Derivatives: DeFi derivatives are *highly* technical. To be honest, I don't understand a lot of it. I'm not going to pretend I understand it. You can instead read about DeFi derivatives from this *excellent* report or this *excellent* rambling. Platforms like squeeth, zeta, invariant, and 01protocol can help you get invested in DeFi derivatives.

Money managers: This is the exciting type. These money manager platforms are those that make investing in DeFi easy for us TradFi dinosaurs. You don't need metamask wallets, you don't need to analyse crypto coin performance, you don't need to understand derivatives or any of that hairy crypto stuff. These platforms "manage" your money for you, without any lock ins and give you a relatively secure return. These platforms pool user funds and automatically invest it in various protocols to your stabilise returns. Pillow and Flint are two Indian startups building such products.

If you plan to deploy your funds in DeFi, just remember, it comes with its own challenges. First, you need to have money to make money. Gas fees on Ethereum are prohibitively high, which means you need to invest larger amounts for the returns to make any sense. Secondly, a lot of the DeFi hype grew in a year where even a fool could have made money. One market correction, and who's to say how much DeFi will be impacted. In just the past week, Bitcoin plummeted 50% from its November peak. Lastly, don't think we can expect regulations for these products anytime soon.

There's a long way to go for DeFi to become just Fi. We're only just starting to see some directional use cases that have become large enough. As a generation, will we leapfrog fintech and directly implement DeFi? I guess, there's still some time to be able to say that with conviction. However we cannot ignore the opportunity in front of us. Slowly at first and then all at once.

Pillow is invite-only currently. FinTech Inside readers can sign up using this exclusive link to skip the queue and get access to Pillow.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

💼 Work at a Fintech

workatafintech.com: Search from ~180 open positions at 50+ fintech startups in India and South East Asia.

Zeta, a fintech infrastructure startup, is hiring a Solutions Architect. Apply here.

FlexiLoans, a SMB finance startup, is hiring an AVP for Supply Chain Finance. Apply here.

Raise, a fintech startup, is hiring several positions. Apply here.

Work at a Fintech is a community effort by EMVC. If you’re a Fintech who’s hiring I’d like to help. Write to me and I’ll put your requirement here. 2.5K+ people view these open positions.

3️⃣ Fintech Top Three

1️⃣ Indian SMB, credit and wealth startups announced $80mm in funding

Vyapar, a SMB accounting startup, raised $30mm.

Raise Financial Services, a fintech startup with its first product in stock trading, raised $22mm.

Kissht, a small ticket, instant SMB and retail finance startup, raised $13.5mm.

Flint, a crypto investment startup, raised $5.1mm.

Reevoy, an invoice factoring startup, raised $4mm.

Pillow, a crypto investment startup, raised $3mm.

Minko, a retailer finance startup, raised $1.5mm.

WintWealth, a debt investment aggregator startup, raised an undisclosed amount.

Takeaway: Impressive to see Vyapar crushing it in a crowded SMB accounting market. Vyapar is the only startup which has firmly stuck with charging SMB's a subscription fee for the SaaS product as opposed to everyone else who gives it away for free. Today, it claims to have 100K+ paying SMB's - whoever said that Indian SMB's don't pay! The IndiaMart investment and partnership could have helped but I wouldn't give IndiaMart too much credit for this.

The stock broking business has long been touted as Zerodha's game to win and rightly so. Zerodha changed the game and gave us that "delta 4" experience in stock investing. Few thought that any business could challenge Zerodha's dominance, no one thought that there's any more innovation possible in the sector - not even Nithin Kamath. Then came Pravin Jadhav who conceptualised the stock brokerage business at PaytmMoney and then went on to start Raise which launched its stock broking product Dhan. With 100K+ registered users, Dhan is far from toppling Zerodha (7+mm registered users), but it has created a mark for itself among traders with its blazing fast app, several new industry-first features and much more. Dhan seems to be focused on traders and not the masses, which is also great as we know that majority of the revenue for brokerages come from trading. Excited to see how this plays out.

Special mention of the DeFi investment startups - Pillow and Flint, that announced their fund raises. Both function in slightly different ways at the backend, but give returns of 13-18% on invested capital. Do try them out!

2️⃣ South East Asian regulators getting busy

OJK, Indonesia's financial services authority, has banned financial firms from facilitating cryptocurrency sales.

Bank Indonesia, Indonesia's central bank, launched its first real time payments infrastructure BI-FAST.

Thailand's regulator is planning to introduce regulations for crypto payments.

BSP, the Philippine central bank, reported 53% adult Philippinos owned e-Money accounts in 2021, compared to 29% in 2019 and expects 70% adults to have bank accounts by 2023.

Takeaway: Regulators the world over seem to be struggling to regulate cryptocurrencies. They're not alone though, not many people understand the benefits and challenges of this new industry. As per Reuters, $~60bn of crypto assets were traded in Indonesia in 2021 up from $4bn in 2020. From my very brief reading of the situation, it's a little confusing - the OJK has banned financial firms from facilitating crypto trade, but crypto asset trade is allowed in Indonesia on the commodities exchange and trading is supervised by the trade ministry and the Commodity Futures Trading Regulatory Agency. This ministry is currently working on a separate digital asset bourse called the Digital Futures Exchange, expected to be launched this quarter. All this while, Indonesia's top religious council said that crypto payments and trade is unlawful for Muslims. Indonesia seems to be as confused as us in India. (if I've got some aspect of Indonesia's crypto regulation wrong, please write to me)

Indonesia's long awaited real time payments platform - BI FAST was launched this week. Indonesian payments platforms have been studying the impact of this platform on their businesses for some time. They've been taking a leaf from India's payments ecosystem reaction to UPI's launch to prepare their own businesses from becoming obsolete. Except, BI FAST is not built like UPI. BI FAST is built on ACI Worldwide's payment backend allowing it UPI-like capability. Currently 20 banks are live on BI FAST. All this while Thailand announced that it will introduce regulations for crypto-based payments. Thailand will be the only (that I can think of) Asian country to say that it's cool with crypto-based payments. Thailand's progressive view of cryptocurrencies is a fascinating topic that is seldom written about. I'm unable to put my finger on why the financial industry of this little country is obsessed with digital assets. If you have access to any report on the topic, I'd love to read it.

The week was not as eventful as the weekend (Ashneer Grover saga continues) so there're only two top news for the week.

🎁 BONUS: About El Salvador, the IMF and Incentives

In September, 2021, El Salvador became the first country to recognise Bitcoin as legal tender. This meant that Bitcoin could officially be used to pay for goods and services across the country. The tiny Latin American country with a population of ~7mm suddenly became centre of attention in the global cryptocurrency debate. The President then announced that the country will issue a billion dollar bitcoin-backed bond to raise funds for the country and trade in bitcoin. This drew a lot of attention especially from central banks worldwide.

The International Monetary Fund (IMF), seemed to have had a serious problem with this. After making some comments that the volatility of bitcoin will adversely impact the stability of the country, the IMF seems fed up and is now resorting to arm twisting. IMF in its recent statement, said it "urged the authorities to narrow the scope of the Bitcoin law by removing Bitcoin's legal tender status..." "...stressing that it would be difficult to get a loan from the institution.". El Salvador has a pending loan disbursal of $1.3bn from the IMF.

Very curious to see how the President of El Salvador reacts to this notification and if the IMF will get its way.

If you're interested, here's an interesting take (15mins, audio) by CoinDesk about the entire situation where it says that Bitcoin's influence on El Salvador in the media is overstated and Bitcoin reserves are only 2% of the total reserves of the country and hence the IMF is being unreasonable.

🌏 International

The IMF's board has urged El Salvador to strip Bitcoin off legal currency status. The IMF request is a major obstacle to El Salvadors loan request of $1.5bn from IMF. Walmart's fintech platform acquired Even, an earned wage access startup and ONE, a neo bank. Meta is selling off assets of Diem, its crypto platform on the back of regulatory scrutiny. UBS is acquiring Wealthfront for $1.4bn.

Looking for the news digest? Read all the week’s fintech news and updates in India and SEA over at This Week in Fintech - India and SEA Edition.

🏷️ Other Notable Nuggets

🎵 Song on loop

Discovered this beautiful band called London Grammar. Their songs mellow with some intense vocals. This song especially is beautiful - Wasting my young years (Youtube / Spotify).

👋🏾 That's all Folks

If you’ve made it this far - thanks! As always, you can always reach me at connect@osborne.vc. I’d genuinely appreciate any and all feedback. If you liked what you read, please consider sharing or subscribing.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

See you in the next edition.