Two Types of People | Fintech Inside Edition #55 - 21st Feb, 2022

We're a world with two types of people. This week's edition is about that along with details on LIC's IPO, RBI's cryptocurrency assessment and a round up of the latest in SEA.

Hi Insiders, Osborne here.

Welcome to the 55th edition of Fintech Inside. Fintech Inside is the front page of Fintech in emerging markets.

Today's edition is off-topic. It's not on fintech but I try to highlight two kinds of people and the need for both. However, I've been noticing a declining trend among one kind. Through the edition, I hope to ignite deeper thinking and more

You'll also find details on how all stars are being made to align for LIC's IPO, RBI deputy governors' cryptocurrency assessment and a round up of the fintech events in Southeast Asia.

Aside: This week, I read the best twitter thread ever. The thread is by a Twitter account punk6259 and talks about governments, currency and financial censorship. It's really good. If you don't have time, you can read the summary on Milk Road (and subscribe to it too).

Enjoy another week in fintech!

If you’re an early-stage fintech startup founder raising funding, I'd love to speak to you - reach out to me at connect@osborne.vc

🤔 One Big Thought

Two types of people in the world

Note: today's post is not specific to fintech and is a little philosophical. This is a one-off experiment. Read at your own peril.

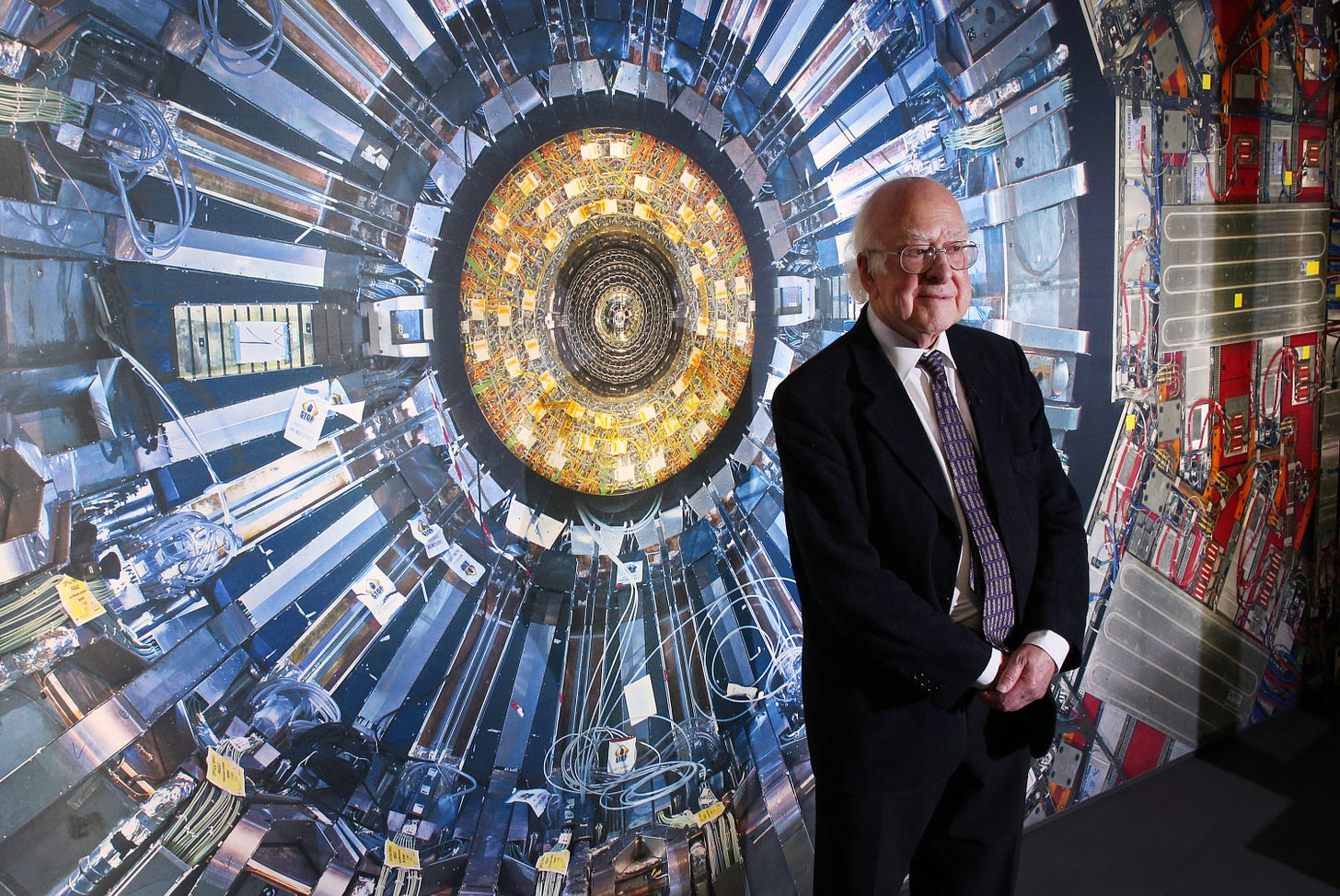

Do you remember the time when the "God Particle" was confirmed by scientists? It was an exciting event for me - I love nerding out about this stuff. The discovery of the Higgs Boson, colloquially known as the God Particle, was an important discovery for the entire physics community (and really our entire species) as it confirmed the existence of a missing piece of the Standard Model in physics. Back in 2015, I stumbled upon Particle Fever, a documentary following the origins, experiments and progress of the Large Hadron Collider (video on how it works) near Geneva, Switzerland.

The Large Hadron Collider (LHC) has been widely heralded as humankind's most ambitious science experiment ever. But the experiment would never have been possible without Mr. Peter Higgs, after whom the particle is named. Mr. Higgs and his teams first theorised the existence of the particle in 1964. Construction of the LHC started in 1998 and the first experiments were conducted in 2008. 48 years after the theory was released and with billions spent on experiment, the particle was confirmed! As this piece of Johns Hopkins magazine puts it, "The shared belief that this supercollider would tell scientists something new about the field of physics loomed large—though no one really knew what, exactly, that something might be. Revolutionary physics data happen so infrequently and come at such extraordinary costs that breakthroughs are rare."

This post is not about the LHC or the Higgs Boson though. This post is about theorists and experimentalists. Theorists and Experimentalists exist in most fields of work. Without theorists, we will never have creative ideas to advance human goals. And without experimentalists, we'll never know if we can realise those ideas. The field of physics, notoriously so, clearly has these two types of people, as illustrated above. The field of construction too has them - just look at famous architect Zaha Hadid (theorist). Zaha brought a unique curves and design to her buildings that engineers (experimentalists) and almost everyone thought it impossible to build. Without George Lucas and his Industrial Light and Magic company, there would be no Star Wars or special effects in movies.

The big question here is, who are the theorists in tech? You can think of Steve Jobs as a theorist - he did push the envelope for a phone, tablet, laptop and others products. Who else? I don't consider Naval Ravikant or Balaji Srinivasan as theorists, though they can pass off as such. Naval is more a philosopher for personal productivity and Balaji, IMO, is a "knowledge-dropper". Listen to this Tim Ferriss interview, you'll know what I'm talking about. We need to do more in the tech sector. We have few real theorists.

This whole post is essentially a call for theorists. Theorists observe events, find patterns, explain why they happen and extrapolate it to the future. Without theorists we're headless chickens hoping to make sense of the direction of tech. Unfortunately, we're evolving to think less - like a "do it for me" mentality, we want others to "think for me". It's no wonder that twitter threads and LinkedIn posts that breakdown concepts and models get so much traction. We need theorists to point us in a direction for the future.

Founders today act as both theorists and experimentalists. They conjure up ideas for what our future should look like and then go out to build it. This isn't an ideal state as being a theorist or experimentalist requires different skills sets. It important for founders to identify which one they are and focus on that. IMO, founders should be "theorists" and hire "experimentalists"/builders around them to execute on their ideas. If a founder is an experimentalist/builder, they need to hire a theorist (not an investor board) on the team to help them think big picture. We have a lot of experimentalists, people who'll execute ideas and get things done and their work is important. We need better thinkers, deeper thinkers and better mentors. People will laugh, validation cycles will be long, breakthroughs will be rare - but we need more theorists.

What do you consider yourself - a theorist or an experimentalist? Who do you consider a great theorist? Thank you for nerding out with me in the first section of this post.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

💼 Work at a Fintech

workatafintech.com: Search from ~180 open positions at 50+ fintech startups in India and South East Asia.

Winvesta, a global investment startup, is hiring for several positions. Apply here.

Velocity, a revenue based finance startup, is hiring Software Engineer. Apply here.

Tartan*, a payroll API startup, is hiring for several positions. Apply here.

Work at a Fintech is a community effort by EMVC. If you’re a Fintech who’s hiring I’d like to help. Write to me and I’ll put your requirement here. 2.5K+ people view these open positions.

3️⃣ Fintech Top Three

1️⃣ For LIC's IPO, the stars are being made to align

Life Insurance Corporation (LIC) of India, India's largest life insurance company, filed its draft IPO prospectus for India's largest IPO in history. Through the IPO, the Indian government hopes to sell 5% of the insurer for $8-10bn. The government has gone through extraordinary lengths over the past couple of years to ensure this IPO is a success: it amended laws to allow a "corporation" to list, it deferred "dividend" payouts of $850mm over the past few years to ensure LIC has adequate capital to meet solvency ratio requirements, it got SEBI to ease listing norms allowing a company of LIC's size to offer only 5% at IPO instead of the minimum 10%, it didn't appoint a Chairman of IRDAI (insurance regulator) for the past year (still vacant position), it amended the LIC Amendment Act, 2021 to allow policyholders a special reservation in the IPO (earlier allowed only for employees), it is seeking exemption from SEBI (securities regulator) on deposit norms (typically 1% of issue size), it is getting banks to increase per-transaction UPI limits and more.

Takeaways: Beautiful feats can be achieved when interests, intent and action are aligned! All of it is coming together wonderfully for this LIC IPO. A lot of these changes are to accommodate for LIC's size, but there's also another reason for this intent: fiscal deficit target. Indian government is targeting a fiscal deficit of 6.8% of GDP for FY22 (ended Mar-22). The $8bn expected IPO proceeds is expected to play a large part of bringing down the fiscal deficit. It was 9.2% in FY21 (ended Mar-21). This is a large reason why the IPO is being rushed to close before end of Mar-22.

This listing is so important, that the government is going ahead with it despite macro-economic fears (US fed rate hike, Ukraine invasion, Chinese economic troubles etc.) and more. Foreign Portfolio and institutional Investors are also trimming their stakes in other listed Indian insurers to make room for LIC allocation. The IPO is great generally for Indian fintech startups as well - increased awareness on insurance products, record number of demat accounts being opened, investors using digital payment methods and more.

Aside, wonder which of the equity research houses will be negative on LIC! 😄

2️⃣ RBI’s deputy governor released a Cryptocurrency Assessment

RBI's Deputy Governor, T Rabi Sankar, made a statement that banning cryptocurrencies is the most advisable choice. The statement was part of his assessment on cryptocurrencies.

Takeaways: The RBI deputy governor made some sound arguments in his assessment, IMO, and the assessment makes for a very good read. He highlighted the four key reasons people give to regulate cryptocurrencies i.e. 1) blockchain is promising and will give India an edge if regulated, 2) most major countries are regulating not banning, 3) many Indians are already invested in crypto and banning it will lead to wealth loss, and 4) banning is unlikely to be effective. He then goes on to counter each of those arguments with examples, analogies and reasons why those arguments don't hold water. It certainly makes for a great debate to Packy.

The deputy governor, IMO, is over-indexing on risks of cryptocurrencies, as he should. But in that process, he is selectively using information and facts to make his point. He cites bitcoin several times initially and even talks of the downsides of bitcoin's energy consumption, but ignores that "proof-of-work" consensus mechanism is not used anymore by modern protocols, including Ethereum which is cited later in the doc. He states that banning private cryptocurrencies is advisable, but ignores the challenges of a Digital Rupee (CBDC). There are more such examples of selective opinions in the document.

The bigger challenge, IMO, is that of the silence of the crypto community. Most proponents of the crypto community had rebuttals to the tune of "what an uncle, he doesn't understand". There're no counter-arguments by anyone in the crypto community. This "lost in translation" situation of the regulator's language and that of crypto community is stark with neither side making an attempt to learn the other's language yet. Coinswitch is the only one, IMO, making that attempt now with the appointment of a Head of Public Policy. We have a long way to go and to need to learn regulator's speak, if we're to make any headway.

3️⃣ SEA Round Up

DBS Digital Exchange surpassed SGD 1bn in trading value in the first year of ops. It is also expected to launch crypto trading for retail users.

FinAccel, the parent company of Indonesian BNPL platform Kredivo, is increasing its stake in Bank BI from 40% to 75%.

Taiwan's central bank is expected to launch it's CBDC.

Funding Societies, a Southeast Asian SMB finance startup, raised $144mm.

Akulaku, an Indonesian personal finance company, raised $100mm.

Cyber Sierra, a cyber insurance startup, raised $4.3mm.

Lummo, an Indonesian SMB accounting SaaS startup, raised an undisclosed amount from Jeff Bezos.

🌏 International

Spain's BBVA Bank invested $300mm in Brazil's digital bank Neon Payments. Moneygram agreed to be acquired by a PE firm for $1.8bn. Flutterwave, a Nigerian payments company, raised $250mm at $3bn valuation. Russia's central bank is piloting the Digital Ruble - it's CBDC, with three banks.

Looking for the news digest? Read all the week’s fintech news and updates in India and SEA over at This Week in Fintech - India and SEA Edition.

🏷️ Other Notable Nuggets

🎵 Song on loop

Fintech updates can get boring, so here's an earworm from the week: The Superbowl’s halftime show was epic! The all star line up of Dr. Dre, Snoop, Eminem, Kendrick, 50Cent all made for serious nostalgia. Also. Dre’s such a bossman. Watch on Youtube.

👋🏾 That's all Folks

If you’ve made it this far - thanks! As always, you can always reach me at connect@osborne.vc. I’d genuinely appreciate any and all feedback. If you liked what you read, please consider sharing or subscribing.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

See you in the next edition.