Efficiency & Convenience | Fintech Inside - Edition #59 - 18th April, 2022

A framework to evaluate if an idea's time has come. Also details on RBI's digital banking units, crypto startups and UPI and lastly, Apple's fintech ambitions.

Hi Insiders, Osborne here.

Welcome to the 59th edition of Fintech Inside. Fintech Inside is the front page of Fintech in emerging markets.

Been a minute since the last newsletter, thanks for your patience.

When you get an idea to build a company or launch a product, how do you know whether the idea will “click”? As an investor, how do we evaluate if an idea’s time has come? In the early days, it’s very difficult to say for sure - it’s all very subjective. That’s where I use the Efficiency-Convenience Framework.

Today’s edition discusses a framework to evaluate if an idea’s time has come. The post covers how to apply the framework, features of the framework and more. It’s a work in progress and I’d appreciate your feedback and comments to improve on it.

There’s also details on RBI’s Digital Banking Units, crypto startups and the albatross on their neck that is UPI and finally, Apple’s fintech ambitions.

Request: Been getting comments that Gmail and other email platforms are throwing my newsletter in Spam. Request you to whitelist this newsletter. Please?

If you're building in fintech or have an idea that you'd like to riff on, I'd love to speak with you. Write to me at connect@osborne.vc.

Enjoy another week in fintech!

✨ Fintech Happy Hour

After a successful first fintech happy hour in Bangalore, I’m excited to host the next Fintech Happy Hour! This time we meet in Delhi NCR.

Delhi NCR is home to several fintech unicorns, including the two public fintech startups - Paytm and Policybazaar. The region has a thriving fintech ecosystem and I can’t wait to get everyone in the same room!

Save the date for Wednesday, 27th April, 2022.

If you’d like to sponsor the happy hour, please email me at connect@osborne.vc

🤔 One Big Thought

Framework to evaluate investment opportunities: Efficiency & Convenience

Now's a good time as any to introduce you to what I do. I am Osborne (LinkedIn) and I work at Emphasis Ventures, a US-based VC fund. I help invest largely in fintech startups in India but increasingly in commerce and SaaS startups. This newsletter is not my main gig - in fact I don't earn anything from this. Have been investing for close to nine years now. Some of the founders we've invested in and I've had the privilege of working with includes Khatabook, M2P Fintech, Jar, Slice and many others (see full portfolio here). In the past, I've also invested/managed companies including ZestMoney, KreditBee, LoanTap and others.

You would have heard this before - a VC's job is to say NO. We evaluate thousands of startups a year and invest in only about 10-12 (in a good year). Among the several questions I end up asking the founder, one that's constant is - "what gives you conviction that now is the right time to build this?". While founders usually fumble when asked this, I think deeply about this, especially when investing in category creating companies.

History is littered with examples of ideas that didn't find PMF initially but launched years later with skyrocketing adoption. Vine, acquired by Twitter and launched in 2013, couldn't find PMF and was eventually shut. Then came TikTok in 2017 and now we cannot live without short video platforms. Flipkart launched Flyte, a music streaming service, in 2013 and had to eventually shut it - India was just not ready back then. I'm sure you'll be able to think of many more such examples.

How to evaluate if an idea's time has come?

When looking to invest in an early stage startup there are typically two things investors look at - quantitative metrics and qualitative aspects, duh. The challenge is, with early stage startups, there is no quantitative data to evaluate. The investment decision is largely qualitative in nature - what's the founders pedigree, do they have any unique insight, what's the market like, and so on. Very subjective with no right answers. The same startup will work for some investors and will not for others.

Usually when a founder comes up with an idea, it's to bring some innovation to the market they want to build in. I believe that there's nothing we can do to bring a sea change to a market - the market has a certain constant flow, the idea will either float and flow with the current or the idea will drown. How do we anticipate whether an idea will float or drown?

This is where the Efficiency-Convenience Framework comes into action. Excuse the long-syllable name, so let's refer to it as ECF.

At any point in time a market is either in a state of increasing Efficiency or increasing Convenience. This framework is simply a method for me to categorise the various markets in a country/state/city. Once categorised, I'm able to better evaluate an idea for its potential to create value in the future.

For example is payments efficient in India? If yes, is it convenient? If not efficient, the opportunity is to invest in solutions that make payments efficient. If efficient, the opportunity is to invest in solutions that make payments convenient. Simple.

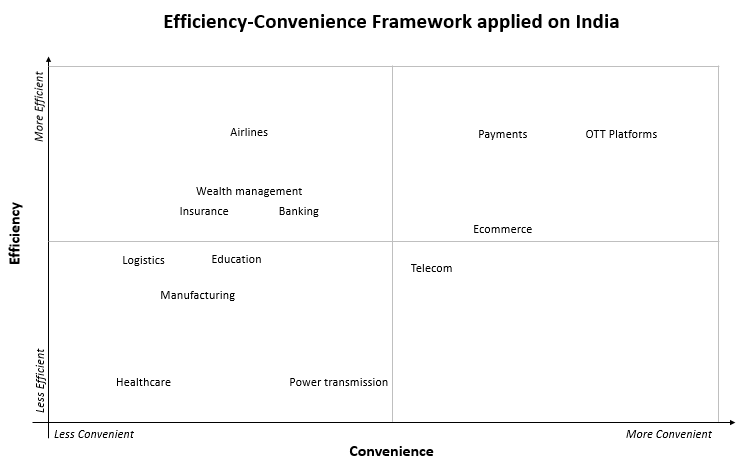

In the image above where would you place "Credit Cards"? What about "Logistics" or "Ecommerce"? And "OTT Platforms"? "Game Streaming"? "Payments"? Think about it, all of these markets are solving for Efficiency or Convenience. And hence each of these sectors have achieved different levels of maturity with varying levels of opportunity.

Startups looking to solve for either Efficiency or Convenience have their own features. While I don't mean to generalise, it's uncanny how similar startups are when solving for Efficiency or Convenience. These features have their own pros and cons. Knowing where a startup falls in the Efficiency-Convenience Framework helps me evaluate a startup accordingly.

Within a certain country, various markets have varying levels of maturity. The market will first start solving for efficiency and gradually, as the sector sees mass adoption, it solves for convenience. You'd effectively want to see a market evolving as below: "Less Efficient-Less Convenient" to "More Efficient-More Convenient". Obviously, the reality of it will see a sector go from "Less Efficient-Less Convenient" to "More Efficient-Less Convenient" and then to "More Efficient-More Convenient". Very unlikely that a sector will go to "Less Efficient-More Convenient" - that would be odd.

All this probably sounds great as a concept so I thought of applying this framework to Indian markets. Interestingly, the markets when mapped on the framework follow what I just talked about. Think about the brands you know of in these various sectors and correlate them with the features mentioned above. For example, the ecommerce sector: we have large marketplaces like Flipkart and Amazon and a long tail of ecommerce players, the experience is fairly convenient and efficient, they're all fighting for the same wallet share and so on. They broadly fit in the framework.

Now, the mapping is completely my own subjective application, and you may disagree with the mapping. But I'm reasonably sure your mapping would look broadly similar, if not, I'd be keen to see what yours would look like.

The fascinating part about this framework is that it applies to a varying resolutions - pick a market and zoom in to analyse various products and its applicability, or pick a geography and zoom in or out to analyse a country, state, city, town etc. It applies across these use cases. Oh, and this framework can also be used by founders to evaluate starting up in a market or launching a new product.

How this framework helps in my thinking: For illustration, I will use an obvious example. Let's say a founder comes to me saying they have an idea to build a driverless taxi service for India. In my view, driverless taxi service is a convenience. Is the market efficient enough to now seek convenient options? I don't think so. Many moving parts to that. Is the market at least at an inflection point in efficiency that in a few years time it will look for convenience? I'm not sure when that inflection point will come, if at all. Maybe I'll pass on this investment opportunity. Investment decisions are not as simple, but you get the point.

As an exercise closer to home, where do you think the 10-min grocery delivery market falls in the ECF? Will this market fall in different quadrants in the ECF for different cities or towns? What do you think?

The most important aspect of this framework, is that markets, once mapped, will be never static in ECF. It's going to be constantly fluid - moving from Efficient to Convenient and back to Efficient all the time. Regulation or other "acts of god" may accelerate or decelerate this process. It's all about constantly taking in the signals and applying it to this framework.

This framework has been helpful to me several times over the past few years. It's helped me bring structure to evaluating a startup. As mentioned, it's not the only framework I rely on to arrive at investment decisions.

What do you think about this framework? Does it make sense to you? What do you think as utter nonsense in this? Are there other frameworks you've referred to reliably? I genuinely look to hear from you.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

3️⃣ Fintech Top Three

1️⃣ RBI's Digital Banking Unit (DBU) plan is not so digital

RBI released guidelines for scheduled banks to establish digital banking units (DBU). Per RBI, for accounting purposes, business conducted under this unit will be a separate line item, for example, 1. Other Retail Banking and 2. Digital Banking. For front end, DBU's will need to have "interactive" systems, and for back end, the Core Banking System could be part of existing CBS with "logical separation" or "core-independent digital-native technologies". RBI also notes, "Banks are free to adopt an in-sourced or out-sourced model for operations of the digital banking segment including DBUs. The outsourced model should specifically comply with the relevant regulatory guidelines on outsourcing." You should definitely read the guidelines, it's not very long.

Takeaways:

Digital Banking Units are Digital but also Physical: Basically, RBI wants DBU's to be a "DIY Branch". This is my interpretation, correct me if I'm wrong, but it seems RBI wants DBU's to be physical locations with self-serve or assisted "interactive facilities". These "Banking Outlets" can be opened in Tier 1 to 6 locations and operated 24x7. What's the point of this?

Is this a precursor to a green field digital banking license?: Most definitely not. Far from it actually. When these guidelines were released, most folks thought this is a step in the direction of eventually releasing digital banking licenses. But it's clearly not that. RBI still believes in India accessing financial services only from a physical location. Given the state of India's ATM's and bank branches in most locations, I honestly don't think DBU's have a bright future.

2️⃣ The albatross around Indian crypto startups' neck - payments

Coinbase temporarily disabled UPI as a payment option to buy cryptocurrencies in India after NPCI, India's retail payments quasi-regulatory body, released a statement that it is "not aware of the integration". Post this, most other crypto exchanges disabled UPI and some went even further and disabled other major payment methods as well. Aside from UPI issues, crypto trading volumes in India collapsed ten days after new tax regime came into effect: WazirX -72%, ZebPay -59%, CoinDCX -52%, and BitBns -41%.

Takeaways:

Are payment methods merchant agnostic?: Here's the thing - technically, payment methods are agnostic to the use case or merchant. They can be used by anyone for anything. RTGS, NEFT and IMPS are built and maintained by RBI and UPI is this beautiful unicorn birthed by NPCI, a retail payments industry body that acts as a quasi-regulatory body. However, there are certain categories of merchants that pose "high risk" and so regulators and banks typically do not like to process their payments or be associated with such merchants. In fact, the banking partner has to approve every merchant on boarded by a payment gateway. These "high risk" categories could be the adult industry, the cannabis industry, gambling industry and so on. Crypto industry is none of that fortunately. It is a high risk industry, so is the stock market, but let the user decide that.

This is deja vu: The crypto industry in 2022, is exactly where it was in 2018. In 2018, the RBI released a circular instructing all regulated financial entities to exit all crypto-related relationships. Several crypto startups shut down, some pivoted and so on. Four years on, and we're back to square one. India is taking a regressive stance on this industry. The worst part is that it's not from a lack of understanding - the government and RBI have studied the market and have displayed better knowledge about the subject matter than 90% of NFT buyers and crypto traders.

3️⃣ Apple's fintech ambitions

Apple acquired Credit Kudos, a UK-based credit scoring startup, for $150mm. Sometime back,it was reported that Apple was working on a BNPL product with its banking partner Goldman Sachs. It integrated with Metamask to allow users to buy cryptocurrencies. Apple is also working on a feature for merchants to use their iPhones to accept payments via Tap and Pay. It partnered with Stripe and Adyen for this Tap and Pay feature.

Takeaways:

(This section is a round up of news from the last year, not the last week)

The Apple Ecosystem for your financial life starting with Payments: Payments was obvious for Apple to launch as a wedge in the fintech sector. It's a "low hanging fruit" which finds easiest adoption with high frequency usage. Apple's approach though has been markedly different compared to other OEM's with payment apps (i.e. Samsung, Xiaomi etc.). Apple created a meta layer above the payments layer, combined it with an identity layer and elevated the user experience to a one-click one. This experience alone allows Apple (apart from the size of the company) to command a 15bps margin on the payment volume - very difficult for anyone else to command. Others do payments for free as an acquisition tool. And now that Apple has users on Apple Pay, it's opening it up to Merchants to accept payments via Tap and Pay. Nice strategy. Aside: I wonder what are the stats of fraud on iOS devices.

Credit: By virtue of users owning iOS devices, Apple has a ton of data on its users. Couple that with the payment data and Apple can create a fairly rich profile of users. It's acquisition of Credit Kudos (I'm invested in a similar business - Monnai) in UK came as a surprise to me. The fact that it was acquired for $150mm was a shock. See, Credit Kudos is a "new age" credit bureau - it not only uses credit data for credit decisioning, it used device data and other alternate data. CK brought credit bureaus to the 21st century. Surprising because Apple thought this important enough to in house it, surprising because Apple has usually taken the approach to build rather than buy. CK's capabilities now gives Apple supercharged capabilities for its own Apple Card product and soon to launch BNPL product. I'm sure Apple is thinking of BNPL as a way to further simplify its one-click checkout and then it will force all merchants as well to have Apple Checkout not just Apple log in.

Full stack financial products except license and book: Apple has enough cash in bank to acquire several banks across the world. But it will not do that. The same way that Amazon, Google and other companies have avoided licenses - too much regulatory overhead. Besides, they already own the customer and are large enough that any bank in the world will work with them. In each of their products, Apple has partnered with a license holder that brought their own credit book but Apple owned the customer, the data and the experience.

India plans: It's unclear what plans Apple has for India to launch its fintech products. I suspect, given it's strategy of partnering, Apple could potentially create a large business for itself in India. It's Apple Pay and Apple Card products are eagerly awaited. However, India is a complicated regulatory geography, and most global companies haven't done too well in India without acquisitions - Amazon acquired Emvantage way back in 2016 to launch Amazon Pay though Amazon's strategy is different from that of Apple's.

If you want to read more on Apple's payments/fintech strategy, do read Michael's substack - Part 1, Part 2.

🌏 International

Looking for the news digest? Read all the week’s fintech news and updates in India and SEA over at This Week in Fintech - India and SEA Edition.

🏷️ Other Notable Nuggets

👋🏾 That's all Folks

If you’ve made it this far - thanks! As always, you can always reach me at connect@osborne.vc. I’d genuinely appreciate any and all feedback. If you liked what you read, please consider sharing or subscribing.

1-min Anonymous Feedback: Your feedback helps me improve this newsletter. Click UPVOTE 👍🏽 or DOWNVOTE 👎🏽

See you in the next edition.